Transfer On Death Designation Within 2 Years

Description

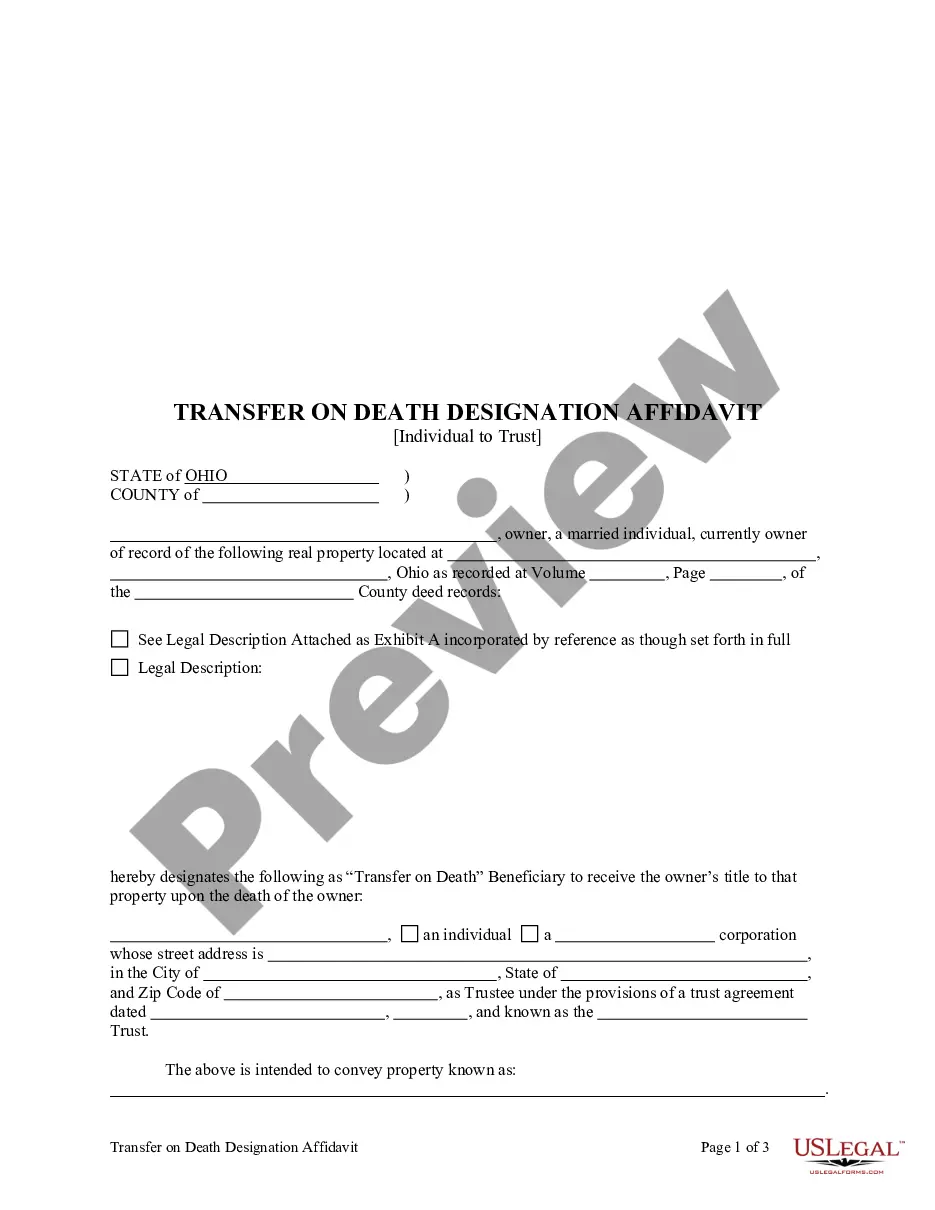

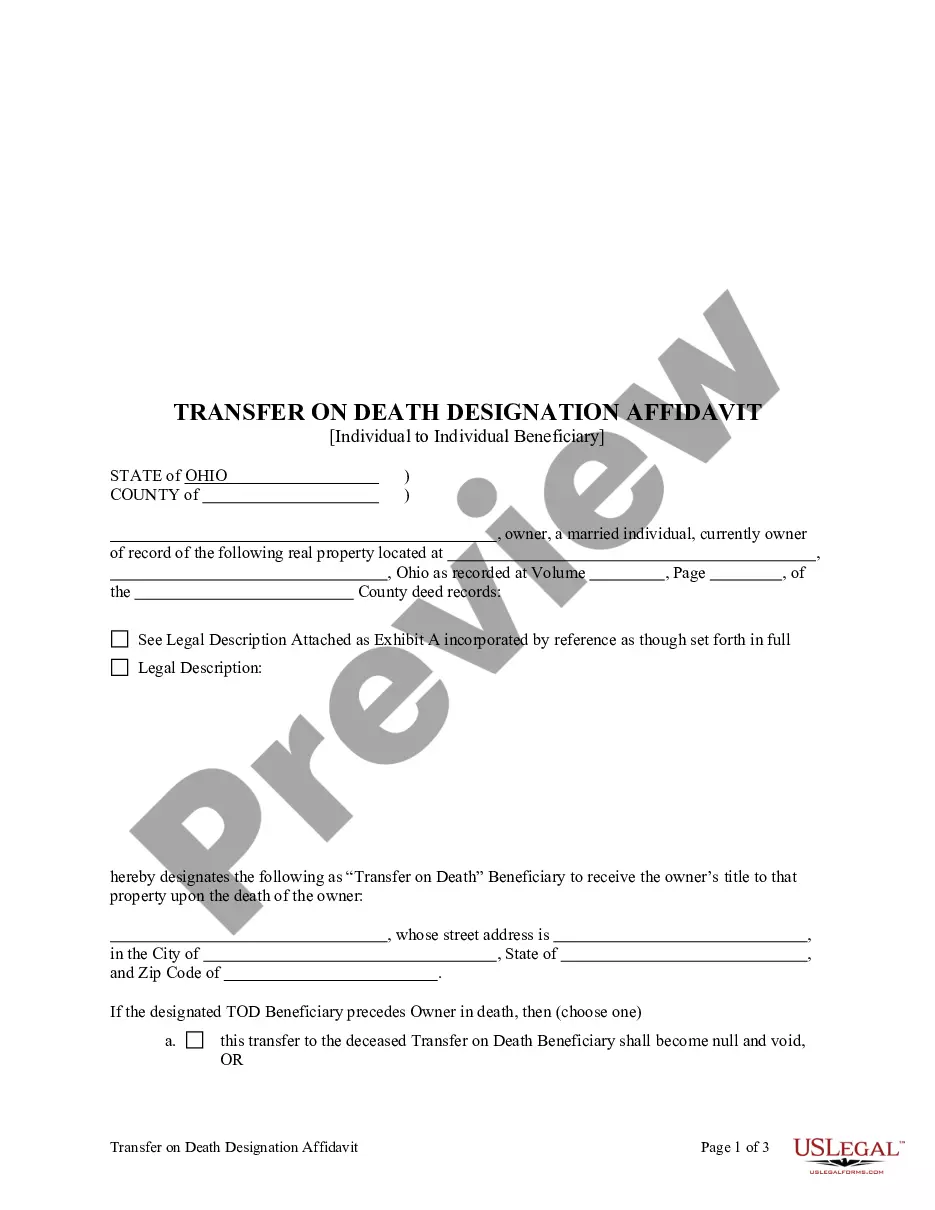

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To A Trust?

The Transfer On Death Designation Within 2 Years displayed on this page is a versatile formal template created by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any professional and personal event. It’s the quickest, easiest, and most dependable way to acquire the necessary paperwork, as the service guarantees bank-grade data security and anti-malware safeguards.

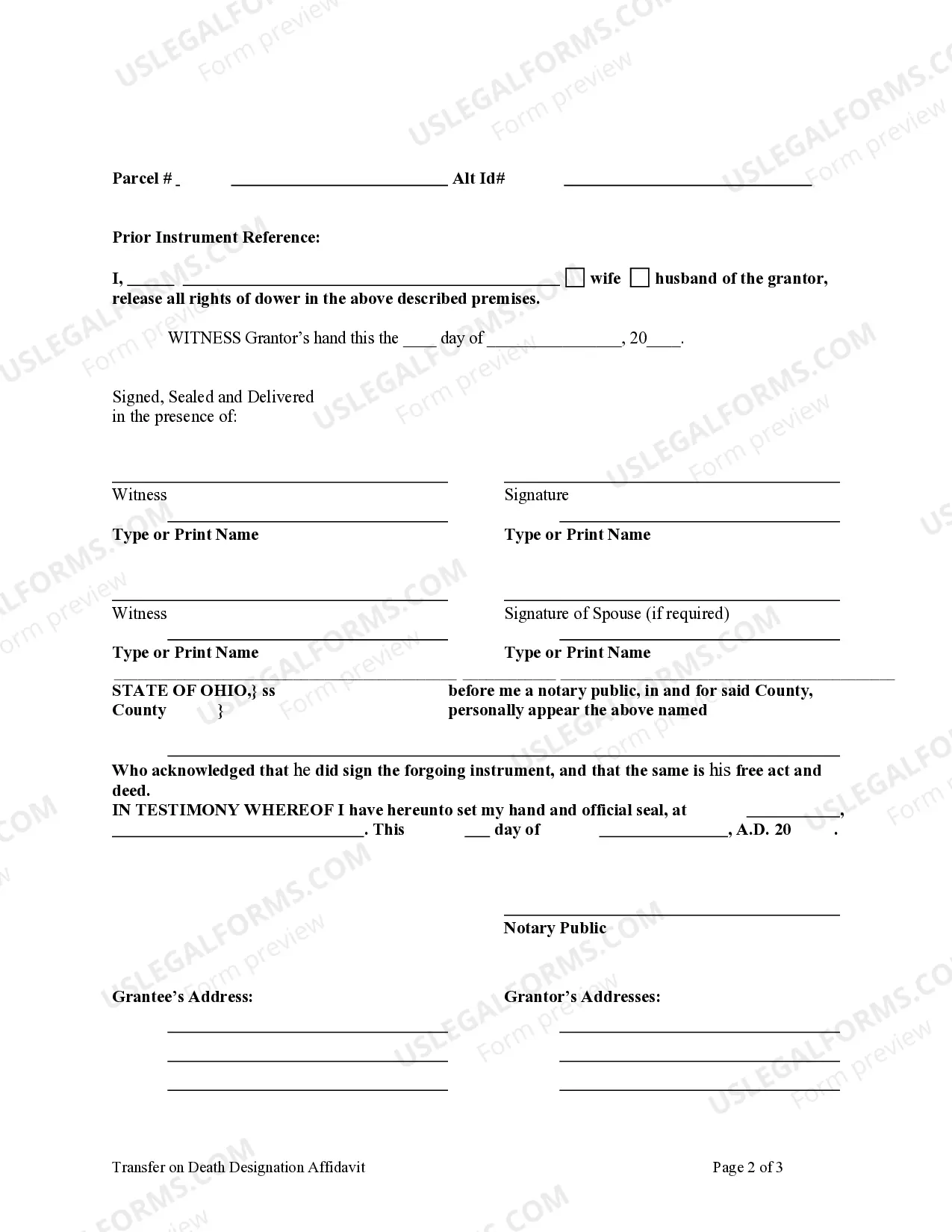

Complete and sign the document. Print the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a valid signature.

- Search for the document you require and review it.

- Browse through the sample you searched and preview it or check the form description to ensure it meets your needs. If it doesn't, use the search bar to find the correct one. Click Buy Now once you have located the template you want.

- Register and Log In.

- Select the pricing option that fits you and set up an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

- Choose the format you prefer for your Transfer On Death Designation Within 2 Years (PDF, Word, RTF) and store the sample on your device.

Form popularity

FAQ

To fill out a transfer on death form effectively, start by downloading the appropriate template from a trusted source, such as US Legal Forms. Enter the required information, including the asset description and the beneficiary's name and address. Make sure to review the form for accuracy before signing it. Remember, the transfer on death designation within 2 years can simplify the transfer process and ensure your wishes are honored.

Filling out a transfer on death designation within 2 years requires careful attention to detail. First, gather all necessary information about the asset you want to transfer, including its legal description and current owner details. Next, complete the required form, ensuring you include the beneficiary's information accurately. Finally, sign and date the form, and consider consulting a professional or using a reliable platform like US Legal Forms for guidance.

The 2 year rule after death can refer to various legal and tax considerations that affect how an estate is managed and taxed. For instance, some tax benefits may only apply if the estate is settled within this period. By using a transfer on death designation within 2 years, you can simplify the distribution of your assets, potentially avoiding complications that arise later.

An estate can remain open for varying lengths of time, often depending on the complexity of the estate and the requirements of probate court. Generally, an estate should be settled within a year, but some cases may take longer due to disputes or asset valuation. Utilizing a transfer on death designation within 2 years can help expedite this process by ensuring a straightforward transfer of assets.

The 2 year rule typically refers to the time frame in which certain tax implications can arise after a person's death. Specifically, it may pertain to how long an estate can be open for tax assessments and the potential claims against it. Understanding the 2 year rule is crucial, especially when planning to use a transfer on death designation to streamline the estate process.

In the United States, the federal estate tax exemption allows individuals to inherit up to a certain amount without incurring taxes. As of 2023, this exemption is over $12 million per individual. However, it’s important to consider state laws, as some states have their own inheritance taxes which may apply even with a transfer on death designation within 2 years.

Yes, a transfer on death designation allows assets to pass directly to your beneficiaries without going through probate. This can significantly speed up the inheritance process, as the assets are transferred immediately upon death. Utilizing a transfer on death designation within 2 years can help ensure your loved ones receive their inheritance without the delays often associated with probate.

Filing a transfer on death deed does not require a lawyer, but having one can be beneficial for clarity and compliance. You can complete the filing process on your own by following state guidelines, especially with the transfer on death designation within 2 years. However, if you have any concerns or complexities, consulting a lawyer can help you navigate the process effectively. Platforms like US Legal Forms can also assist you in understanding the requirements.

Yes, you can create a transfer on death deed in Washington state. This option allows you to designate a beneficiary to receive your property without going through probate, as long as the transfer on death designation within 2 years is properly recorded. It simplifies the inheritance process for your heirs. Make sure to check the specific requirements or use resources from US Legal Forms to assist you.

Transferring property after death typically involves settling the estate and following the instructions of the transfer on death designation within 2 years. The beneficiary must present the necessary documentation, such as the death certificate and the transfer on death deed, to the local authorities. This process usually avoids probate, making it simpler and faster for your loved ones. Using a reliable platform like US Legal Forms can help you with the required paperwork.