Affidavit For Transfer Without Probate Ohio Withholding

Description

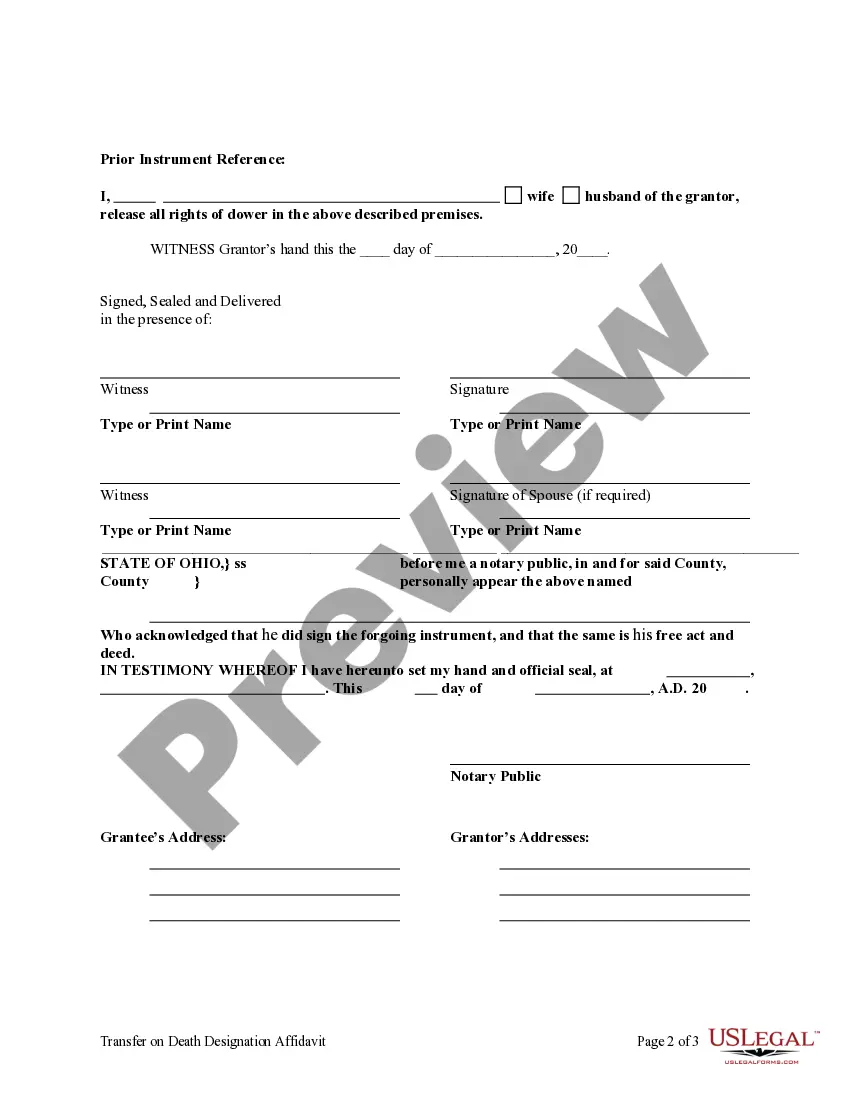

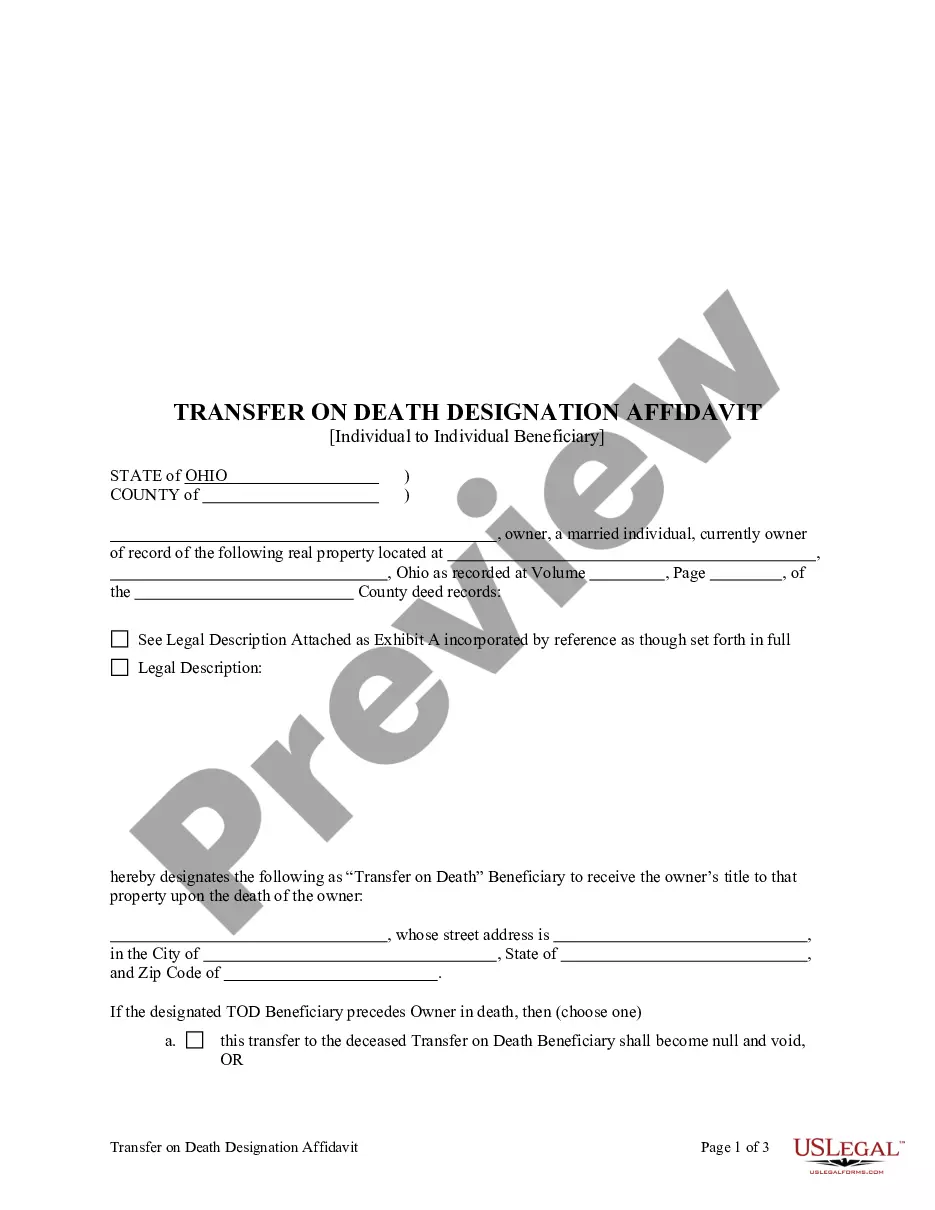

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual Without Contingent Beneficiary?

It’s clear that you cannot become a legal authority instantly, nor can you determine how to swiftly create an Affidavit For Transfer Without Probate Ohio Withholding without possessing a specialized skill set.

Drafting legal documents is a labor-intensive task that demands a specific education and expertise. So why not entrust the creation of the Affidavit For Transfer Without Probate Ohio Withholding to the professionals.

With US Legal Forms, one of the most extensive libraries for legal documents, you can find everything from court filings to templates for in-office communications. We recognize the significance of compliance and adherence to federal and local statutes and regulations. That’s why all templates on our platform are location-specific and current.

You can regain access to your documents from the My documents section at any time. If you are an existing client, you can simply Log In, and find and download the template from the same section.

Regardless of the purpose of your documentation—whether it is financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Find the document you require using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain whether Affidavit For Transfer Without Probate Ohio Withholding is what you need.

- Start your search again if you require any other form.

- Create a free account and choose a subscription plan to acquire the form.

- Select Buy now. After the payment has been processed, you can download the Affidavit For Transfer Without Probate Ohio Withholding, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

Identity Theft: A charge of standard identity theft in Arizona is classified as a class 4 felony. If convicted, the offender can face a minimum jail time of 1.5 years and a maximum jail time of 3 years, along with a fine of up to $150,000.

File a report with your local county or city law enforcement agency. You do not need to know the name of the person who used your identity. You can show the police the information you have such as debt collection letters or other indications that you are the victim of this crime.

The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Identity Theft Affidavit Complete this form if you think you are a victim of identity theft which may impact your Arizona tax return.

Identity Theft ? A charge of identity theft is a class 4 felony and comes with a minimum jail time of 1.5 years and a maximum jail time of 3 years. If convicted, you could also face a fine of up to $150,000.

Credit Card Offers, Bank Statements, Canceled Checks, and More Documents Containing Financial Information. An identity thief could potentially use anything that comes from a financial institution. ... Documents Containing Personal Information. ... Documents Containing Account Information. ... Junk Mail. ... Child- and School-Related Mail.

Report your identity theft and get a personal recovery plan online at or by calling 1-877-IDTHEFT (438-4338).