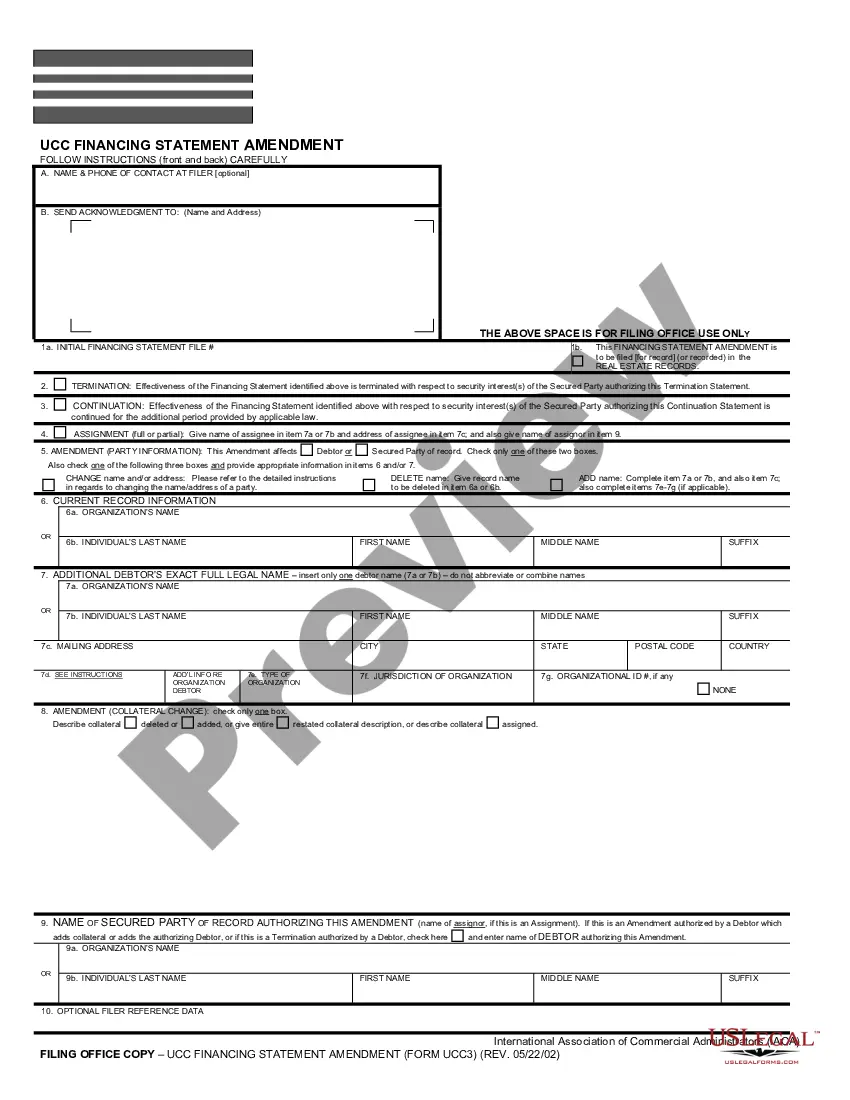

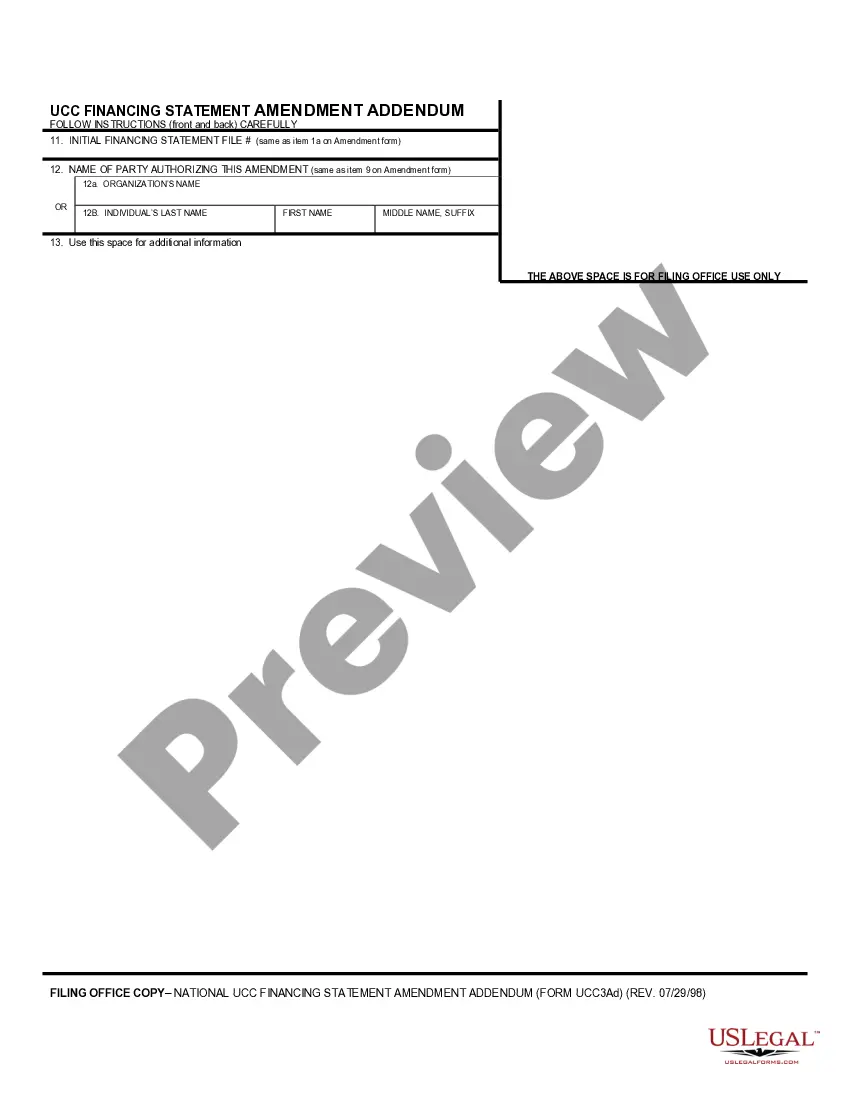

Financing Statement Amendment Additional Party form for adding additional Debtors or Secured Parties to Financing Statement Amendment (Form UCC3) filed with the New York filing office.

New York Additional Without Power

Description

How to fill out New York UCC3 Financing Statement Amendment Additional Party?

Administrative procedures demand exactness and correctness.

If you are not accustomed to completing forms like New York Additional Without Power on a daily basis, it could lead to some misunderstandings.

Choosing the proper template from the outset will guarantee that your form submission proceeds smoothly and avert any hassles of resending a document or repeating the same task from the beginning.

If you are not a registered user, finding the needed template may involve a few extra actions: Locate the template using the search bar, ensure the New York Additional Without Power you found applies to your jurisdiction, review the preview or inspect the description that includes the details regarding the template's applicability, if the result aligns with your search, click the Buy Now button, select the suitable option from the suggested subscription plans, Log In to your account or sign up for a new one, complete the purchase via credit card or PayPal, and receive the form in your desired format. Locating the correct and current samples for your documentation takes just a few minutes with a US Legal Forms account. Eliminate the uncertainties of administration and simplify your paperwork tasks.

- You can consistently locate the appropriate template for your documentation on US Legal Forms.

- US Legal Forms is the largest online forms repository featuring over 85 thousand templates covering various topics.

- You can effortlessly find the latest and most suitable version of the New York Additional Without Power by simply navigating the platform.

- Store and save templates in your profile or review the description to ensure you have the right one available.

- With an account at US Legal Forms, you can gather, store centrally, and peruse the templates you save for easy access.

- Once on the site, click the Log In button to authenticate.

- Next, visit the My documents page where your document history is archived.

- Browse through the forms' descriptions and keep those you require at any time available.

Form popularity

FAQ

And is it required to fill out, before a tax return can be received? Yes, the NY Form IT-558 is required to report any New York State addition and subtraction adjustments required to re-compute federal amounts using the rules in place prior to any changes made to the Internal Revenue Code after March 1, 2020.

New York additions and subtractions that relate to intangible items of income, such as interest or ordinary dividends, are only required to the extent the property that generates the income is employed in a business, trade, profession, or occupation carried on in New York State.

Complete Form IT-558 and submit it with your return to report any New York State addition and subtraction adjustments required to recompute federal amounts using the rules in place prior to any changes made to the IRC after March 1, 2020.

Instructions for Form IT-215 Claim for Earned Income Credit Tax Year 2021.

Yes, the NY Form IT-558 is required to report any New York State addition and subtraction adjustments required to re-compute federal amounts using the rules in place prior to any changes made to the Internal Revenue Code after March 1, 2020.