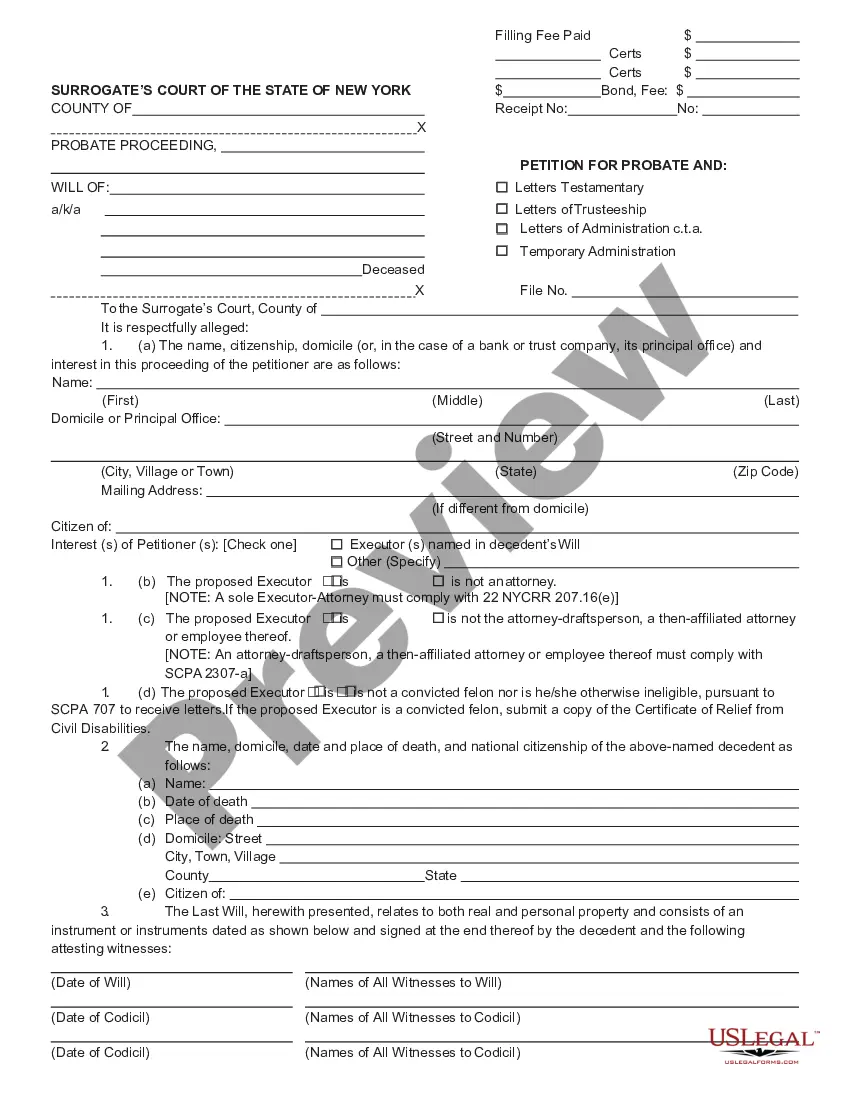

This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

Nys Surrogate Court Forms Receipt And Release Form To Beneficiaries

Description

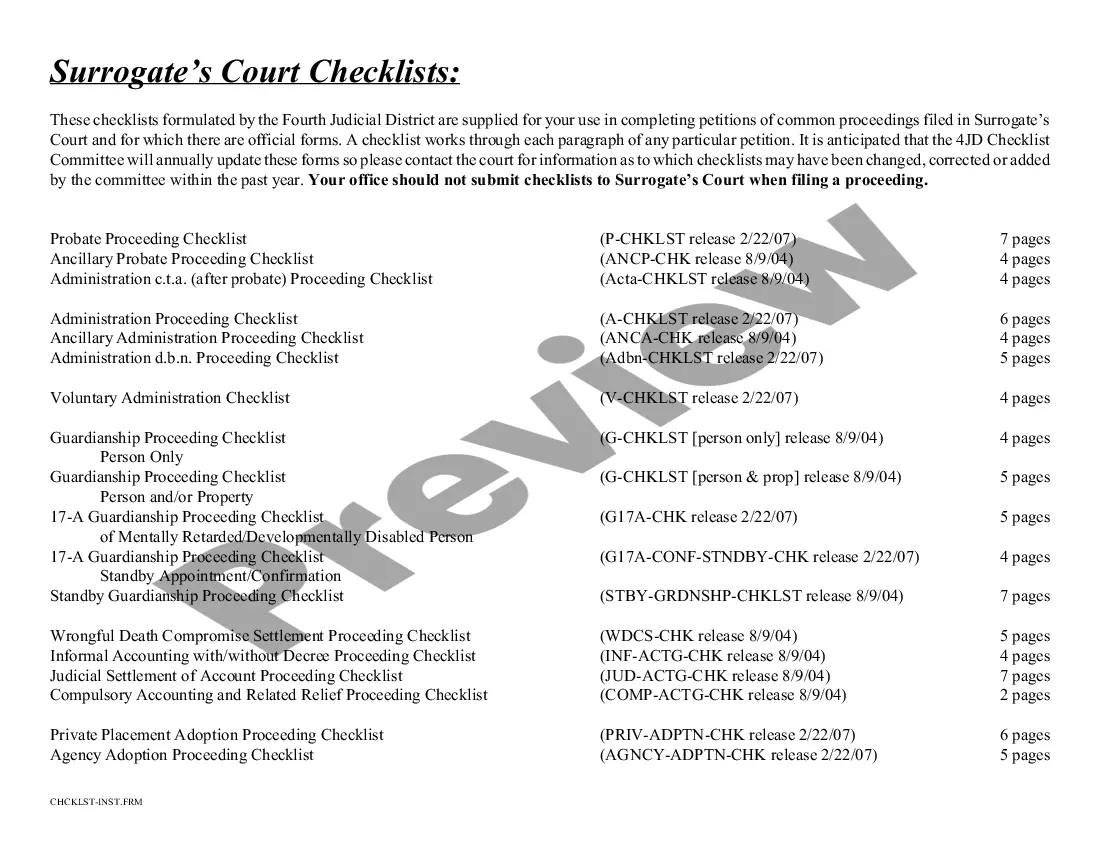

How to fill out New York Surrogate's Court Information?

Creating legal documents from the ground up can often be intimidating. Some situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more cost-effective method of producing Nys Surrogate Court Forms Receipt And Release Form To Beneficiaries or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-specific templates carefully crafted for you by our legal professionals.

Utilize our platform whenever you need dependable and trustworthy services through which you can swiftly locate and download the Nys Surrogate Court Forms Receipt And Release Form To Beneficiaries. If you're already familiar with our site and have previously registered an account, simply Log In to your account, find the form and download it or re-download it anytime later in the My documents section.

Choose the most appropriate subscription plan to acquire the Nys Surrogate Court Forms Receipt And Release Form To Beneficiaries. Download the document, then complete, validate, and print it out. US Legal Forms has an impeccable track record and over 25 years of expertise. Join us now and make document execution a straightforward and efficient process!

- Not registered yet? No worries. It requires minimal time to set it up and browse the library.

- Before rushing to download Nys Surrogate Court Forms Receipt And Release Form To Beneficiaries, consider these tips.

- Examine the form preview and descriptions to ensure you are on the correct document.

- Ensure the template you select meets the standards of your state and county.

Form popularity

FAQ

Under New York Surrogate's Court Procedure Act § 1409, Notice of probate, before the Surrogate's Court will issue letters, a notice must be filed with the following information: Name of the testator. Name and address of the proponent. That the will has been offered for probate.

The Receipt And Release will state that the beneficiary releases the Trustee from any and all claims, damages, legal causes of action, et cetera, known or unknown, regarding the administration of the Trust. Third, there may be unknown liabilities at the time of the distribution, most commonly income tax.

An executor of a deceased person's estate typically has to show an accounting of the estate to the beneficiaries and heirs unless the beneficiaries and heirs waive their privilege. The accounting is a way to prove the executor settled the estate legally and as the deceased intended.

The Waiver and Consent is used to speed up the process when everybody agrees that the Will is valid and that the Will should be admitted to probate. If every distributee signs this Waiver and Consent it can save the estate significant time and expense.

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements.