Fiduciary Deed Example With Explanation

Description

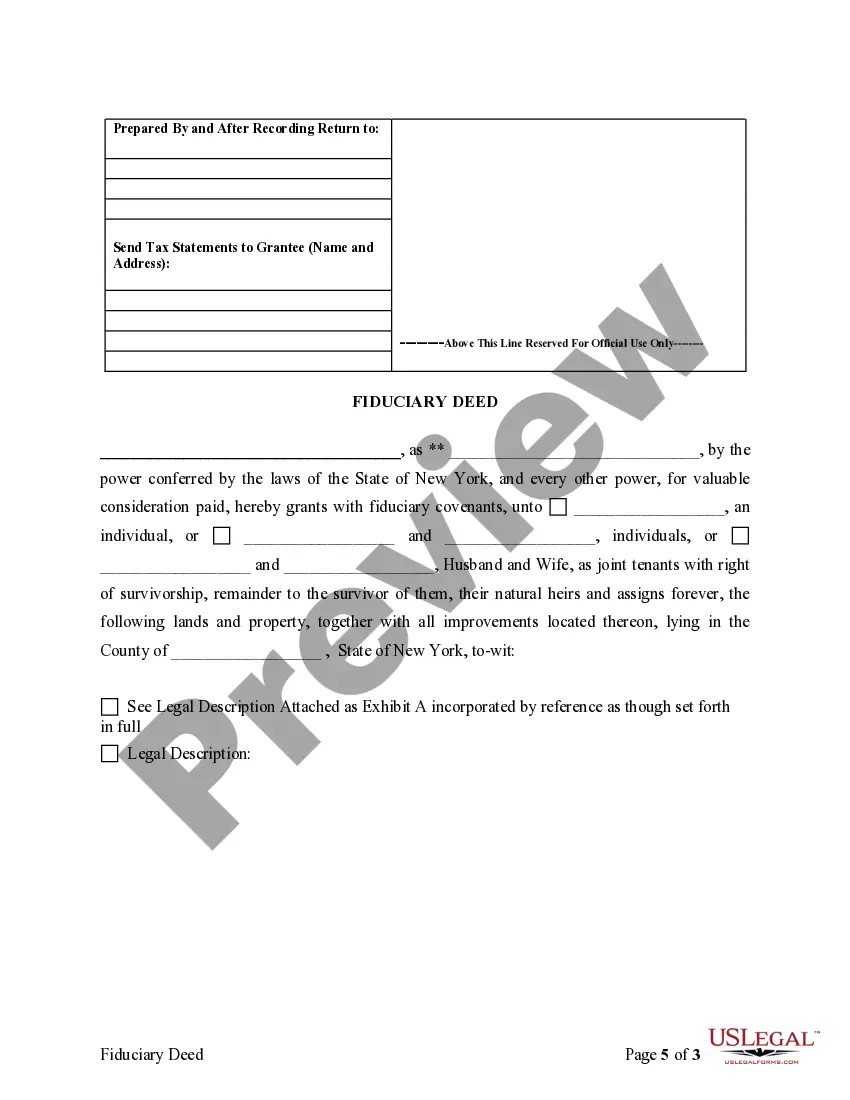

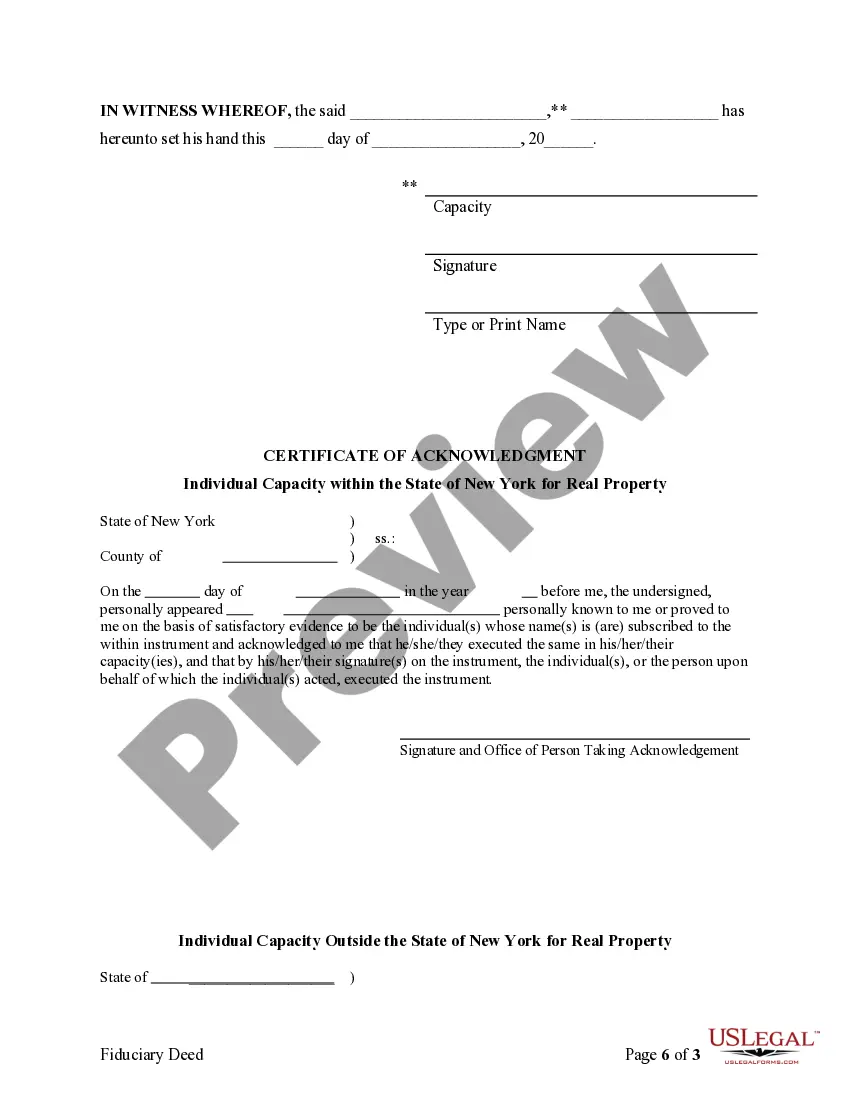

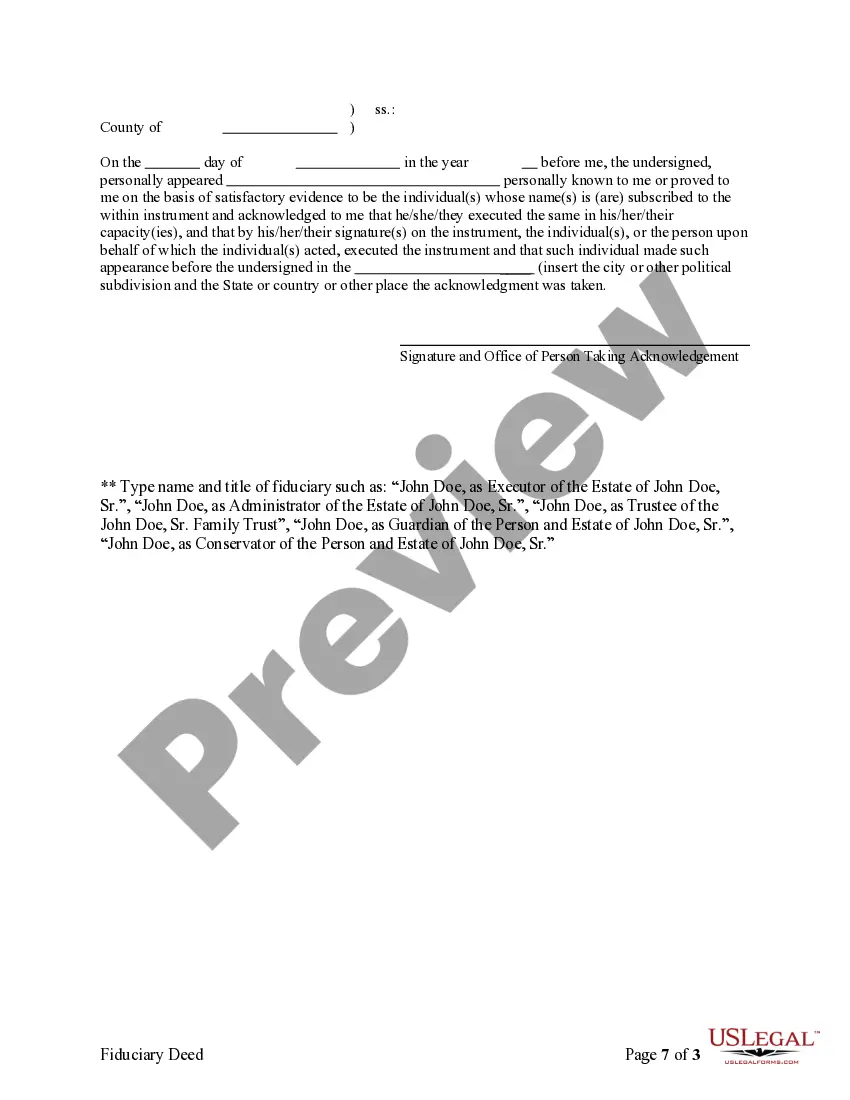

How to fill out New York Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Drafting legal documents from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of creating Fiduciary Deed Example With Explanation or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-specific templates diligently put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can easily find and download the Fiduciary Deed Example With Explanation. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to set it up and explore the catalog. But before jumping straight to downloading Fiduciary Deed Example With Explanation, follow these recommendations:

- Check the document preview and descriptions to make sure you have found the document you are searching for.

- Check if form you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Fiduciary Deed Example With Explanation.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and turn form completion into something easy and streamlined!

Form popularity

FAQ

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

Deeds by executors and administrators contain fiduciary covenants signifying that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property.

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons. Fiduciary deeds are commonly employed when settling estates and the original owner of the property is deceased.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.