Ny Small With Sale

Description

How to fill out New York Small Business Startup Package?

Creating legal documents from the ground up can often be daunting.

Some situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more economical method to prepare Ny Small With Sale or other documents without unnecessary complications, US Legal Forms is readily available.

Our online library of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs.

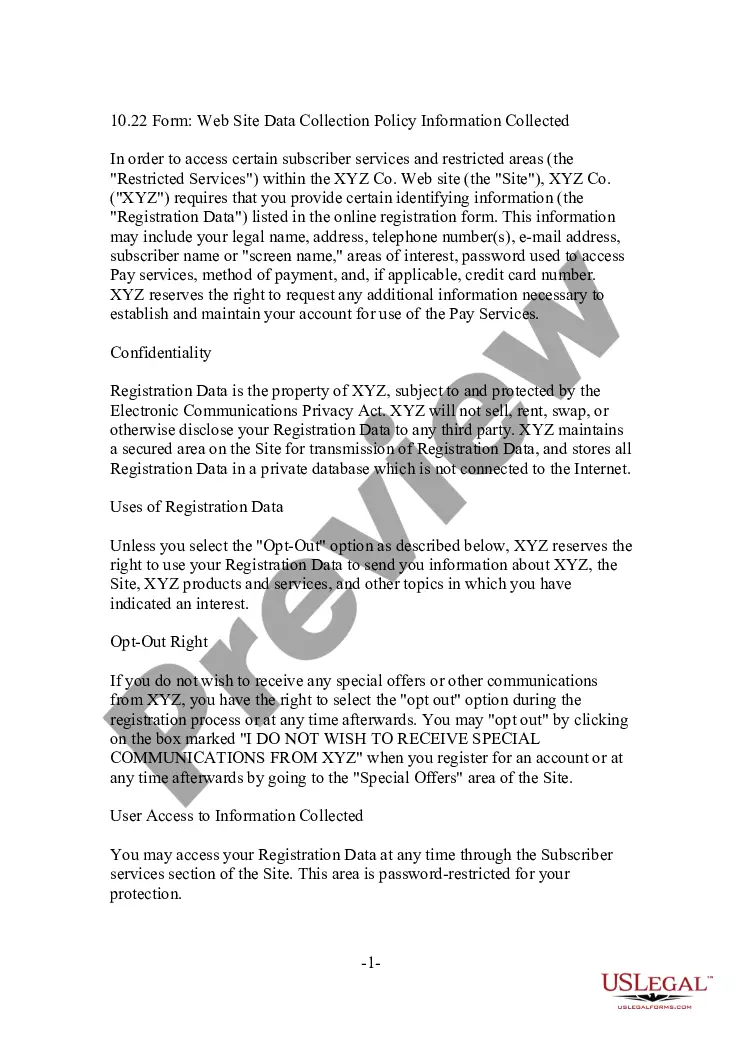

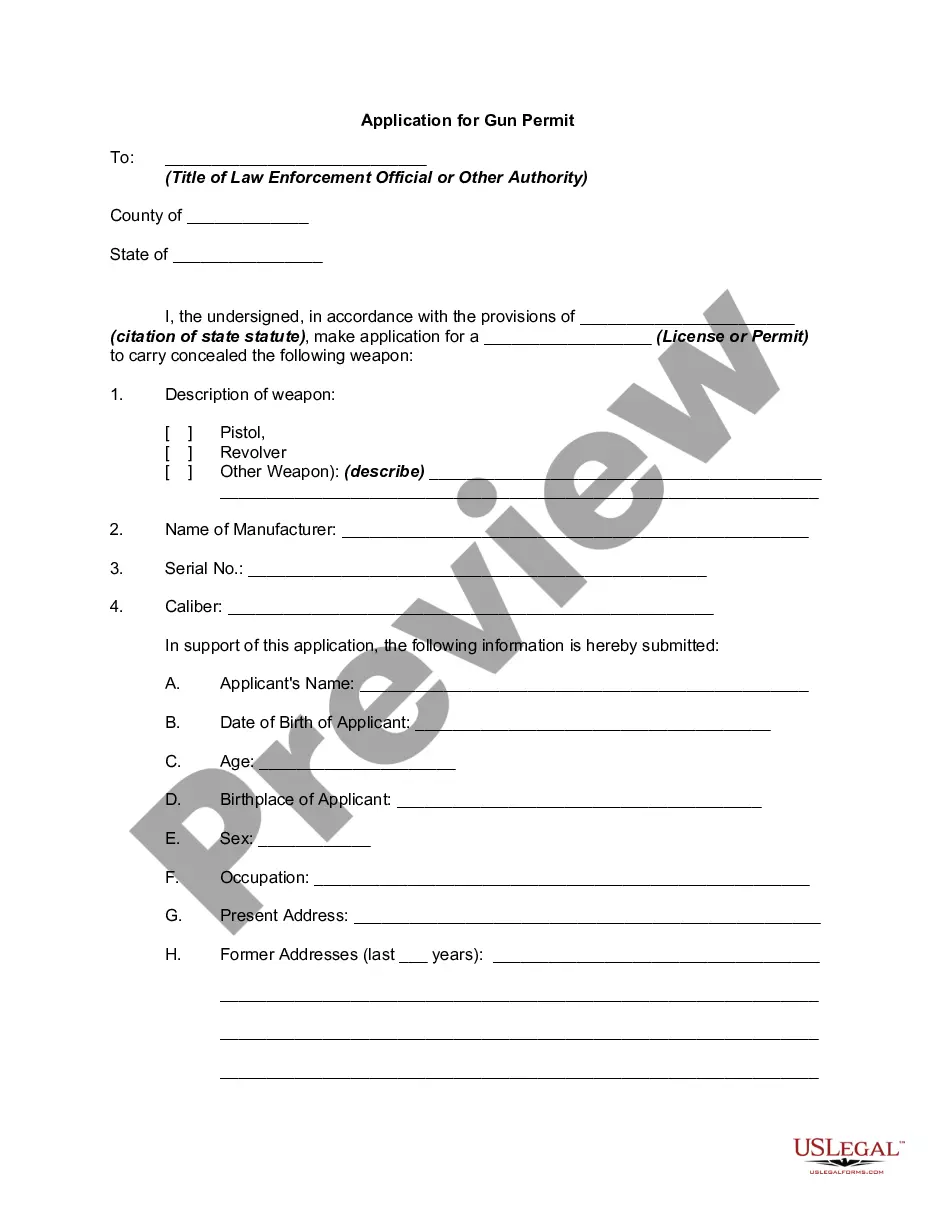

Review the document's preview and descriptions to ensure you have the correct document. Ensure that the selected form adheres to your state and county's regulations and laws. Choose the most appropriate subscription plan to acquire the Ny Small With Sale. Download the file, then complete, validate, and print it out. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us now and make form execution straightforward and efficient!

- With just a few clicks, you can easily obtain state- and county-specific forms meticulously crafted by our legal professionals.

- Utilize our platform whenever you require reliable services to swiftly locate and access the Ny Small With Sale.

- If you're already familiar with our site and have set up an account, simply Log In, choose the template, and download it, or re-download it anytime from the My documents section.

- Don't have an account? No worries, registering takes just a few minutes and allows you to peruse our catalog.

- Before diving into the download of Ny Small With Sale, consider these suggestions.

Form popularity

FAQ

Filing a small claim in New York involves several straightforward steps. First, you need to determine the correct court where your claim should be filed, typically a small claims court in your county. Next, gather all necessary documents, including evidence and any relevant information regarding your claim. Finally, you can file your claim either in person or through online platforms like US Legal Forms, which provide user-friendly resources to help you navigate the process. This ensures you understand the requirements and increases your chances of a successful outcome.

Calculating NYS small business modifications involves determining your federal taxable income first. Next, you will make specific adjustments according to New York State regulations. These adjustments may include deductible expenses and allowable credits. By using resources like US Legal Forms, you can streamline the process of ensuring your NY small with sale calculations are accurate and compliant.

To write off sales tax effectively, begin by keeping accurate records of your sales transactions. Gather all necessary documentation, such as receipts and invoices, showing the sales tax charged. You can then report this tax on your business's sales tax return. Utilizing the US Legal Forms platform can simplify this process, helping you understand the specific forms needed for your NY small with sale activities.

To find short sale home listings, utilize real estate websites, local listings, and tools designed for buyers searching for Ny small with sale opportunities. Many online platforms allow you to filter properties specifically designated as short sales. Connecting with a real estate agent who specializes in short sales can also provide insider access to newly listed properties, making your search more efficient.

The $1 property in NYC typically refers to homes sold through short sales or auctions, where properties are significantly undervalued. These sales allow buyers to acquire homes at a fraction of their market value, often appealing to investors and first-time homebuyers. Engaging with a platform like UsLegalForms can help you navigate the complexities of the Ny small with sale process to find these hidden gems.

The seven steps of a sales strategy include defining your target market, establishing your value proposition, setting clear sales objectives, determining your sales process, training your sales team, optimizing your sales tools, and monitoring your performance. This structured approach can increase your chances of success in the NY small with sale sector. By following these steps, you can create a focused strategy that drives results.

The 2 2 2 rule in sales recommends contacting a lead twice the first day, twice the next day, and twice the following day. This approach maintains momentum and shows potential customers your commitment. When working within the NY small with sale framework, consistent follow-up can make a significant difference in conversion rates.

The 10-3-1 rule in sales suggests that you should aim to reach ten potential customers, engage in three meaningful conversations, and ultimately close one sale. This rule emphasizes the importance of quality over quantity in your approach. In the context of NY small with sale, this method helps you streamline your efforts and effectively convert leads into buyers.

To boost sales quickly in the NY small with sale market, focus on targeted marketing campaigns. Identify your ideal customers and use social media platforms to reach them. Additionally, utilize promotions or discounts to entice potential buyers, and consider leveraging your existing customer base for referrals.