Nys Employment Requirements

Description

How to fill out New York Employment Hiring Process Package?

Accessing legal templates that meet the federal and local regulations is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the correctly drafted Nys Employment Requirements sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and personal scenario. They are easy to browse with all papers collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a Nys Employment Requirements from our website.

Obtaining a Nys Employment Requirements is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

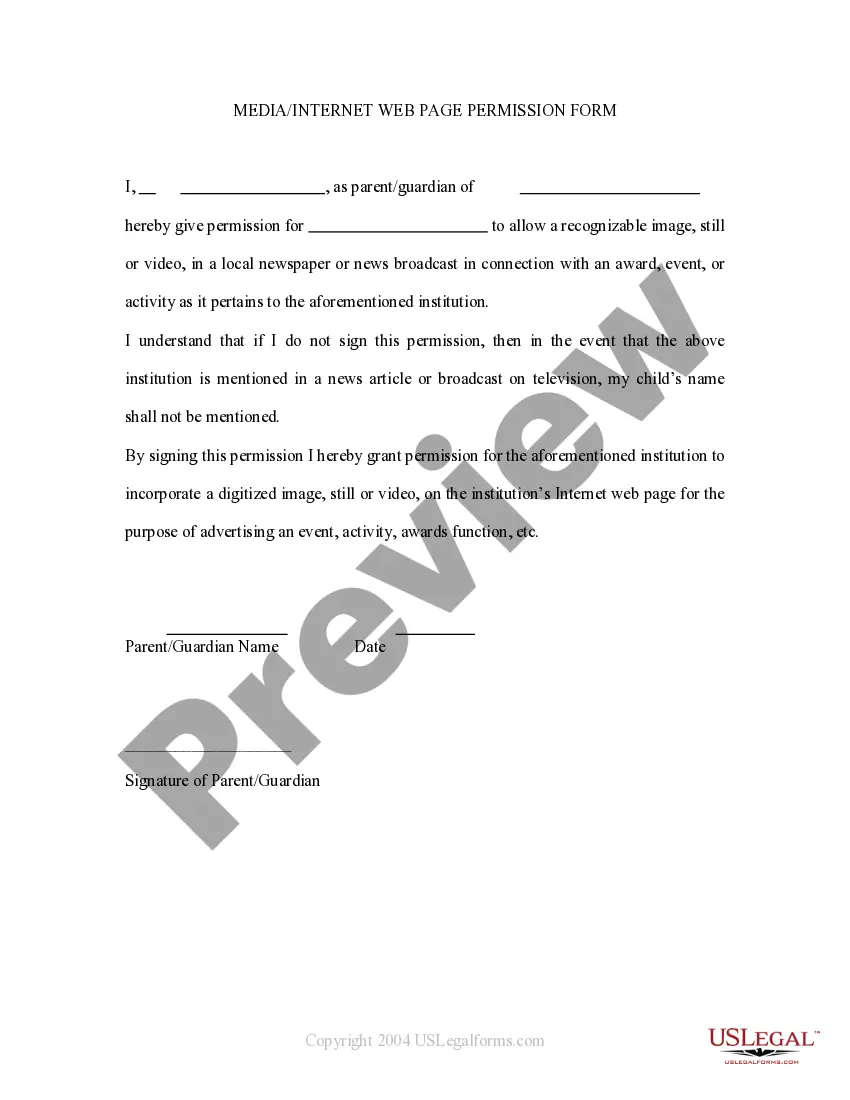

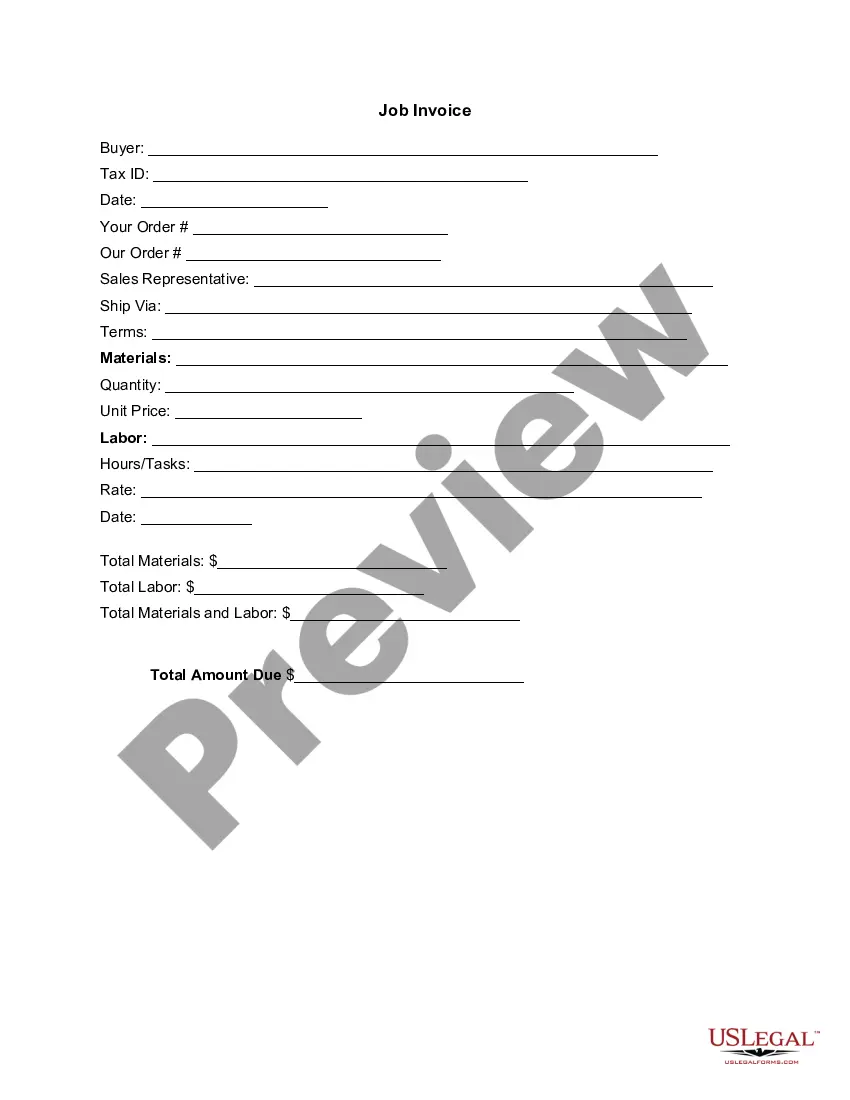

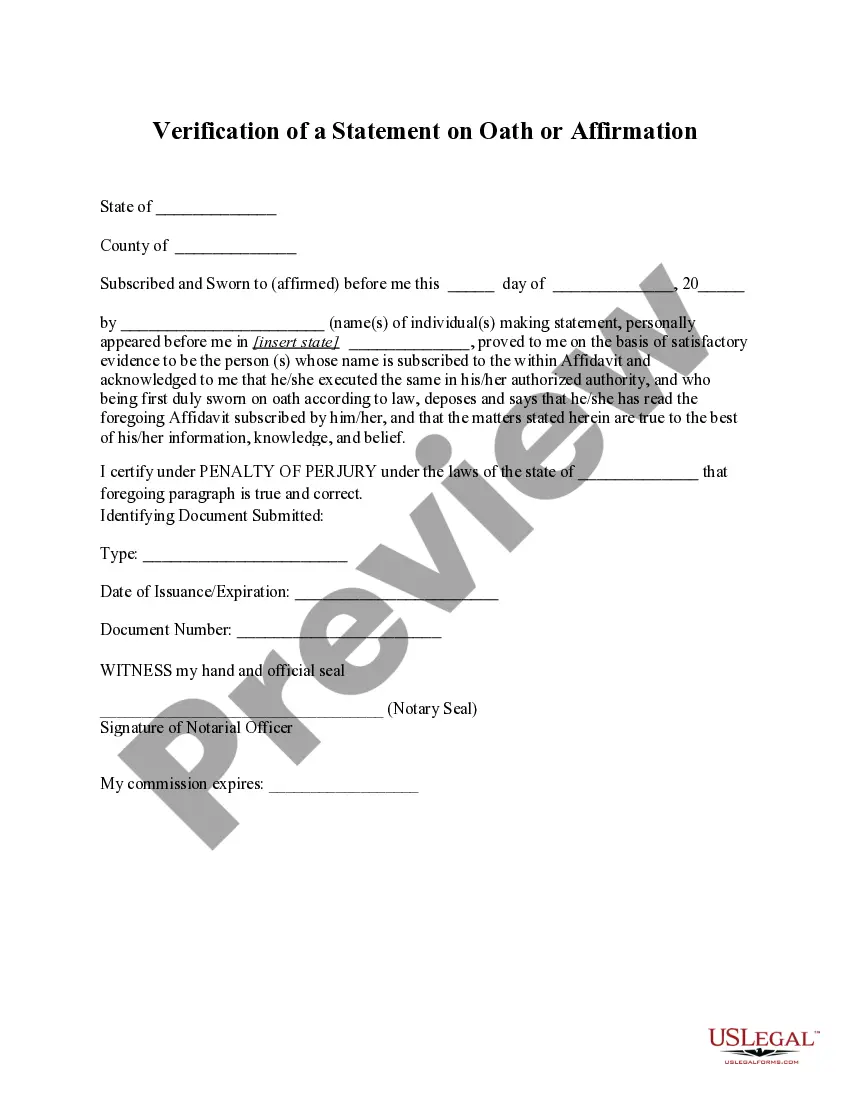

- Analyze the template utilizing the Preview option or through the text outline to make certain it meets your requirements.

- Browse for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Nys Employment Requirements and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Please refer to the clock and chart below for a visual on how each block of time is rounded. 00 :53 ? :07 Punch In a.m. Punch Out a.m. Rounded to a.m. Rounded to a.m. 15 :08 ? :22 Punch In a.m. Punch Out p.m. Rounded to a.m. Rounded to p.m.

If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

New York State law requires each employee to fill out an IT-2104 form, so employers can withhold the correct amount of taxes from their paychecks. The IT-2104 form is an essential document for New York employers when it comes to payroll administration.

The seven-minute rule allows employers to round employee time to the nearest quarter-hour. The seven-minute rule is a payroll rule that allows employers to round down employee time of 1-7 minutes. However, employee work time of 8-14 minutes must be rounded up and counted as a quarter-hour of work.

The Checklist to give you a quick snapshot on one page. I-9 Form for verifying an employee's eligibility to work in the United States. W-4 Form to set up federal income tax withholding. IT-2104 Form to set up New York State income tax withholding. Direct Deposit Form to set up direct deposit payments.