Custodia Hijo Withdrawal

Description

How to fill out New York General Power Of Attorney For Care And Custody Of Child Or Children?

Creating legal documents from the ground up can occasionally feel quite daunting.

Certain situations may require extensive investigation and significant financial expenditure.

If you seek a simpler and more budget-friendly method of preparing Custodia Hijo Withdrawal or any other forms without unnecessary obstacles, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

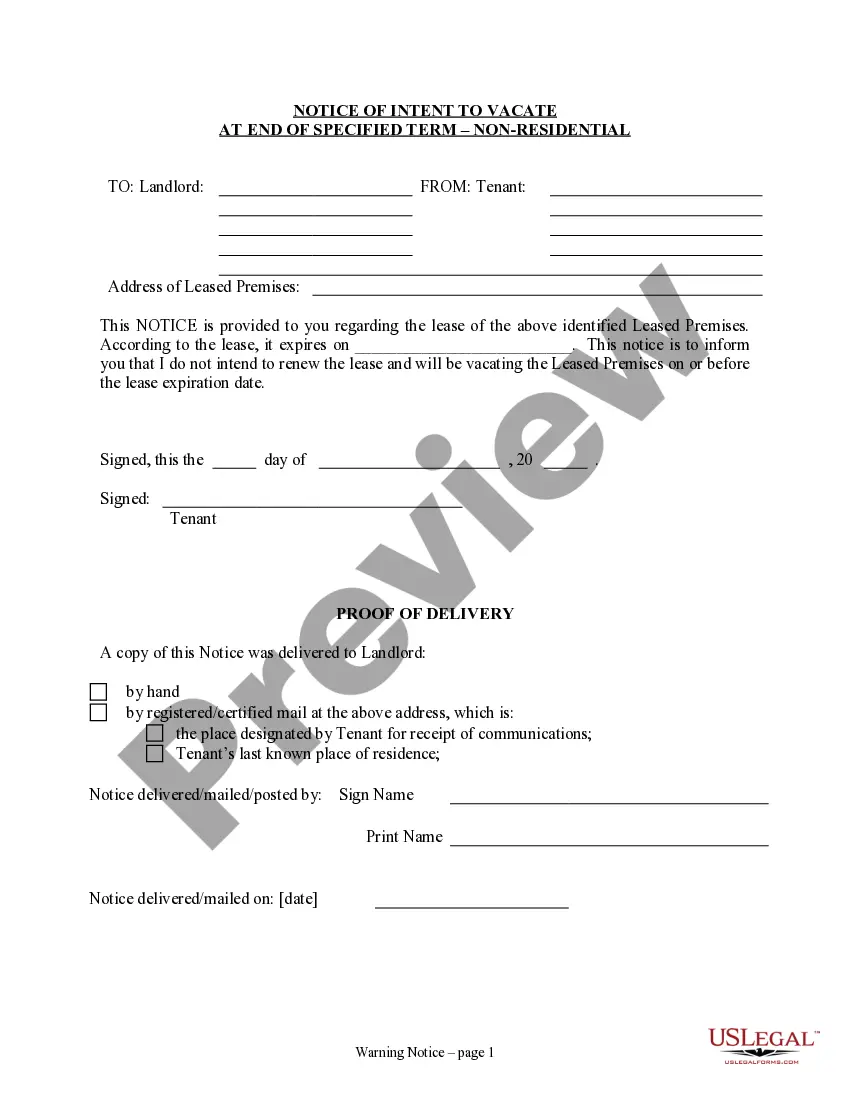

However, before diving straight into downloading Custodia Hijo Withdrawal, consider these suggestions: Review the document preview and descriptions to confirm that you have located the document you need. Verify if the form you select aligns with the regulations and laws of your state and county. Select the appropriate subscription choice to purchase the Custodia Hijo Withdrawal. Download the form. Then complete, authenticate, and print it out. US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and simplify the form execution process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms carefully crafted for you by our legal experts.

- Utilize our site whenever you require dependable and trustworthy services through which you can easily find and download the Custodia Hijo Withdrawal.

- If you’re a returning user and have already established an account with us, just Log In to your account, find the template and download it quickly or re-download it anytime in the My documents section.

- Don't yet have an account? No problem. It only takes a few minutes to register and browse the catalog.

Form popularity

FAQ

As the custodian, you can withdraw money from a custodial account if you need to use it to pay for something that will benefit the minor. You can't take the money back yourself, or give it to someone else.

No, a parent cannot take money out of a UTMA account. The assets remain under the control of the custodian until the minor reaches the majority age. At that time, all remaining funds in the account are turned over to the beneficiary, free from further court supervision or management.

At what age does a child take control of the assets in the account? In some states a custodian can specify the age?18, 21, or even older?when the child will take control of the account (also called the "age of majority"). It is important to do this when you open the account, since you cannot make any changes later.

Gifts are irrevocable: Contributions to a custodial account are considered irrevocable?meaning you can't get that money back?and funds can be withdrawn by the custodian only to pay for expenses that would directly benefit the child before the age of majority.

As the legal owner of the custodial account, your child is technically on the hook to file a tax return and pay any taxes or penalties owed on unearned income.