New York Department Of Corporations Forms

Description

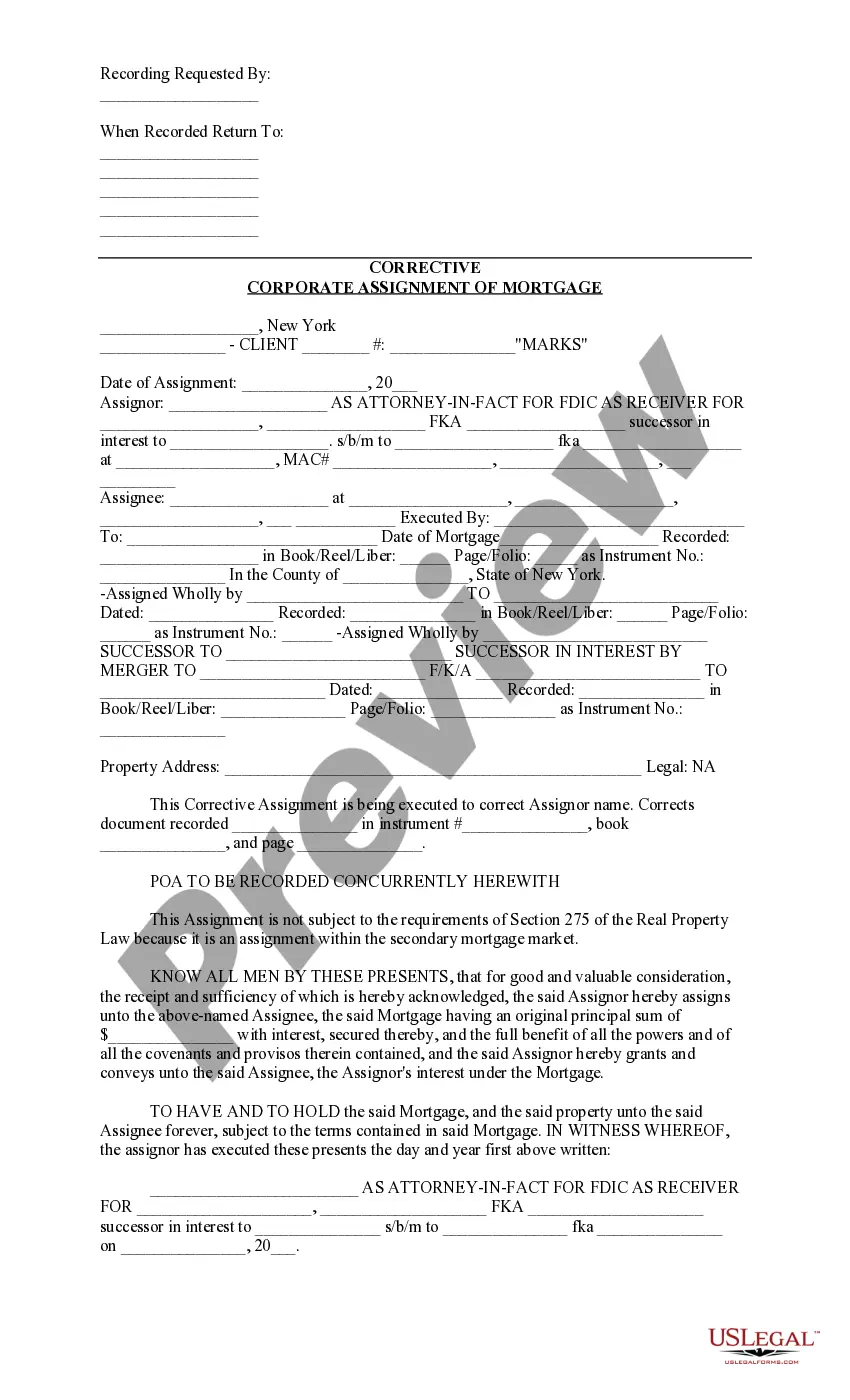

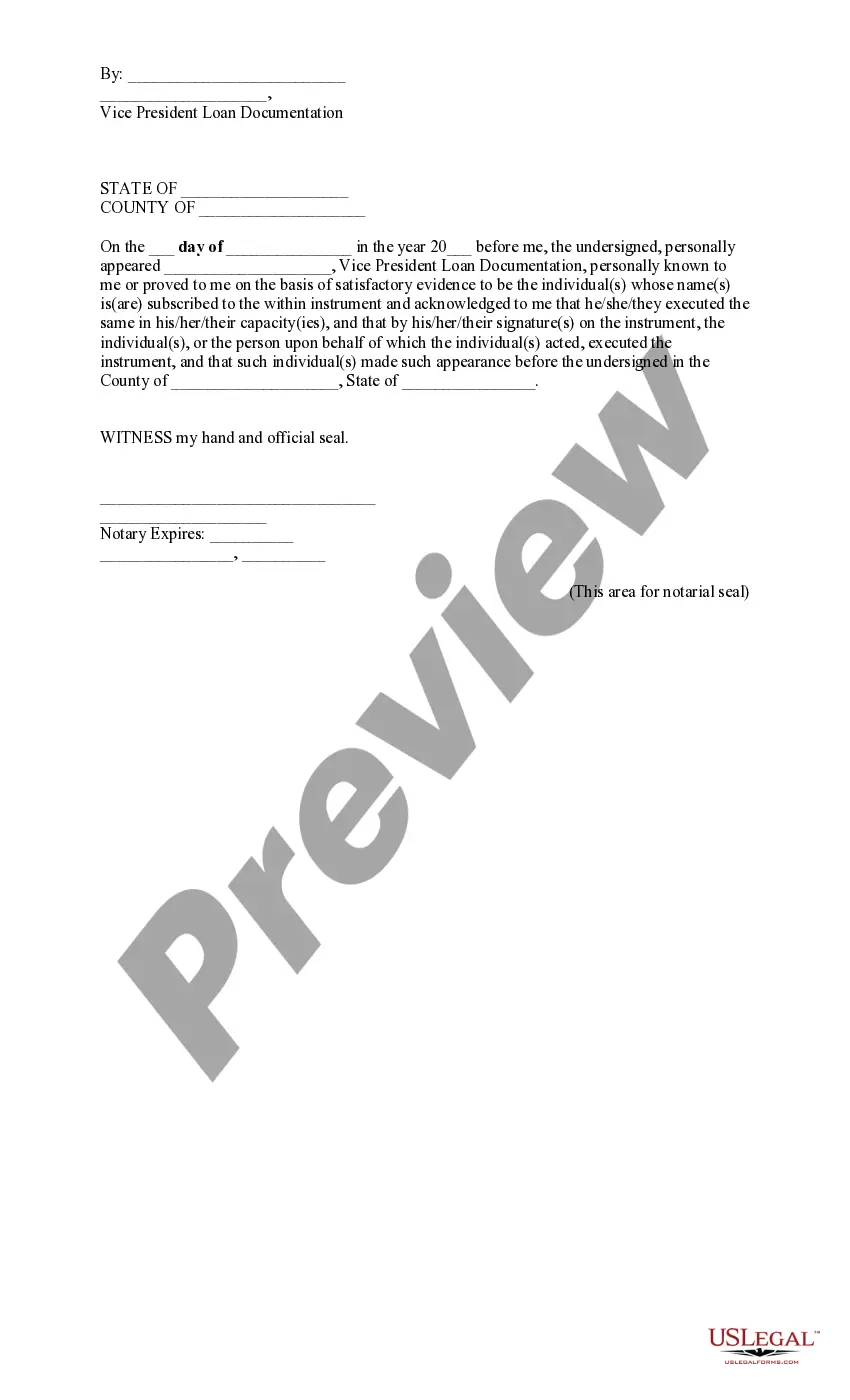

How to fill out New York Corrective Corporate Assignment Of Mortgage?

There's no longer a requirement to waste time hunting for legal documents that comply with your local state regulations.

US Legal Forms has compiled all of them into a single location and made them easier to access.

Our website offers over 85k templates for any business and personal legal matters categorized by state and area of use.

Utilize the search bar above to look for another sample if the previous one did not meet your needs.

- All forms are professionally crafted and validated, so you can have confidence in receiving the latest New York Department Of Corporations Forms.

- If you are acquainted with our platform and already possess an account, it is essential to verify that your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained paperwork whenever necessary by navigating to the My documents section in your profile.

- If you have not interacted with our platform previously, the procedure will require additional steps to complete.

- Here's how new users can access the New York Department Of Corporations Forms in our collection.

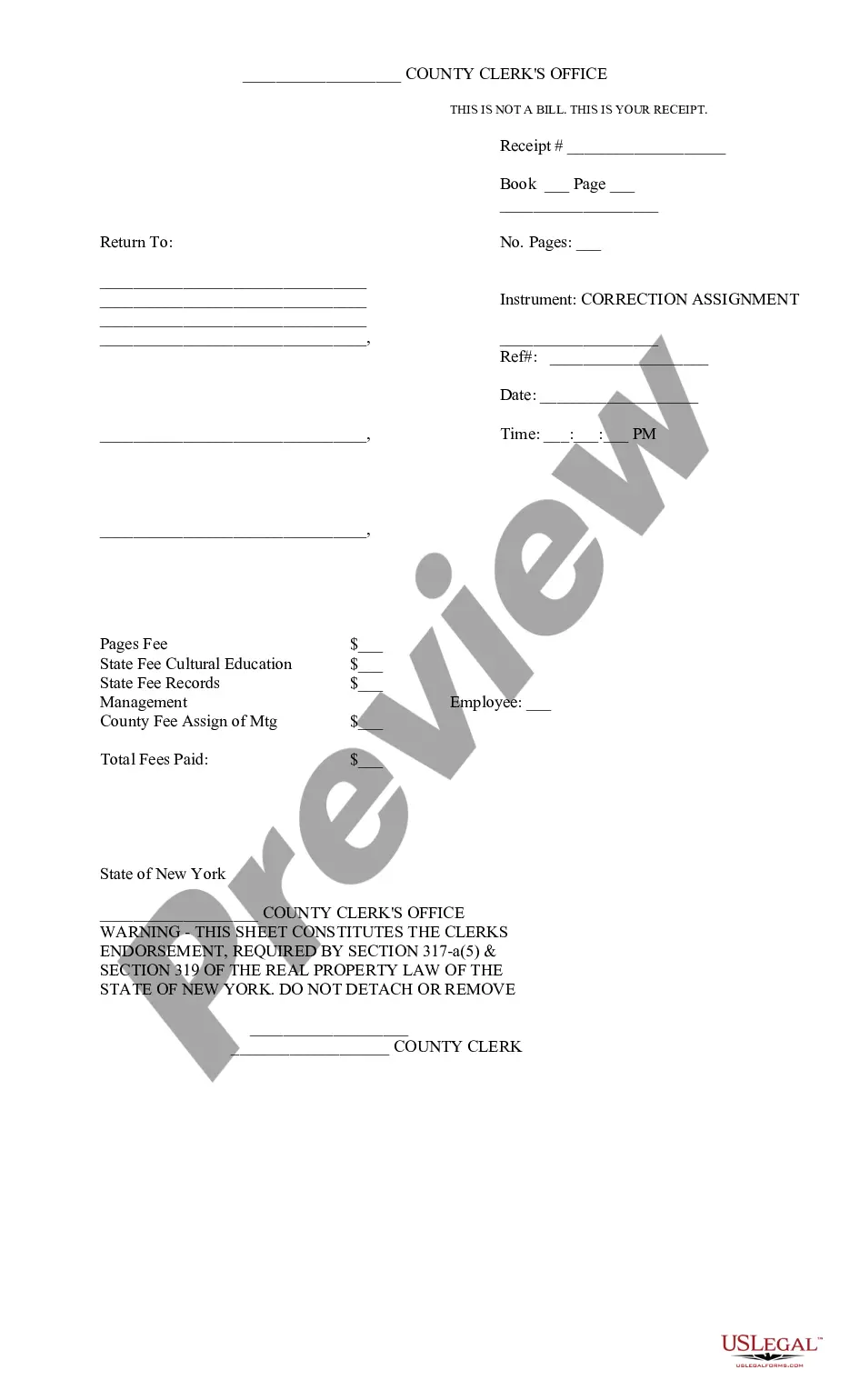

- Review the page content meticulously to confirm it includes the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

To obtain a certified copy of an original document, you must request it from the office that issued the original. This often involves completing a request form, providing the necessary details about the original document, and paying any required fees. It's crucial to supply accurate information to avoid delays. USLegalForms offers comprehensive resources and forms to help streamline your request for certified copies from the New York Department of Corporations.

A certified copy is not the same as a notarized copy; they serve different purposes. A certified copy confirms that a document is a true and accurate reproduction of the original, while a notarized copy involves a notary public verifying the identity of the signer and authenticating the signing process. Understanding this distinction is vital when dealing with official documents required by the New York Department of Corporations. USLegalForms can help you discern when each type of document is appropriate.

To certify a document in New York, you must produce an original document and submit it to the relevant authority, usually the New York Department of Corporations. The office will review your document and verify its authenticity before issuing a certified copy. Completing the correct forms and paying the associated fees are necessary steps. USLegalForms provides templates that guide you through the certification process, ensuring you have everything needed.

Your New York State Department of State (NYS DOS) number can often be found on official documents related to your business entity, such as the formation certificate. Additionally, you can search for your business through the NYS Department of State's online database. This number is crucial for accessing various services, including filing forms related to New York Department of Corporations. USLegalForms can assist you in locating and processing necessary forms pertaining to your NYS DOS number.

The process of obtaining a certified copy involves requesting a reproduction of an original document that reflects its authenticity. You typically need to submit a request to the appropriate office, such as the New York Department of Corporations, along with any necessary forms and fees. Ensure you provide accurate details of the document you need to be certified. This process is essential for official matters, and using USLegalForms can simplify it by providing the correct forms.

Yes, New York State imposes a corporate income tax on businesses that operate within its jurisdiction. The tax is based on the corporation’s income, which may include revenue from various sources. Businesses registered with the New York Department of Corporations should stay informed about current tax rates and regulations to ensure proper compliance.

Generally, corporations must file a tax return annually, even if they have no income or expenses. This requirement applies to firms registered with the New York Department of Corporations. In some cases, certain types of corporations might be exempt, so it’s crucial to investigate your corporation's specific obligations.

Yes, you typically need to file a corporate tax return in New York if your corporation is registered with the New York Department of Corporations or if it conducts business in the state. Even if your corporation does not owe taxes, filing a return is essential to remain compliant with state regulations. Always check your specific situation or consult a tax professional to confirm requirements.

Filing an S Corporation in New York requires completing the necessary forms through the New York Department of Corporations. Start by ensuring that your business meets all eligibility requirements for S treatment, including filing Form 2553 with the IRS. Afterward, complete the New York S Corporation Election form and submit it along with any required documentation to the appropriate state agency.

In New York City, individuals and businesses that meet certain income thresholds must file a tax return. This includes residents and part-year residents who earn income from various sources. If you operate a business and are registered with the New York Department of Corporations, you may also need to file specific forms related to your business taxes.