New York Trustee Withdrawal

Description

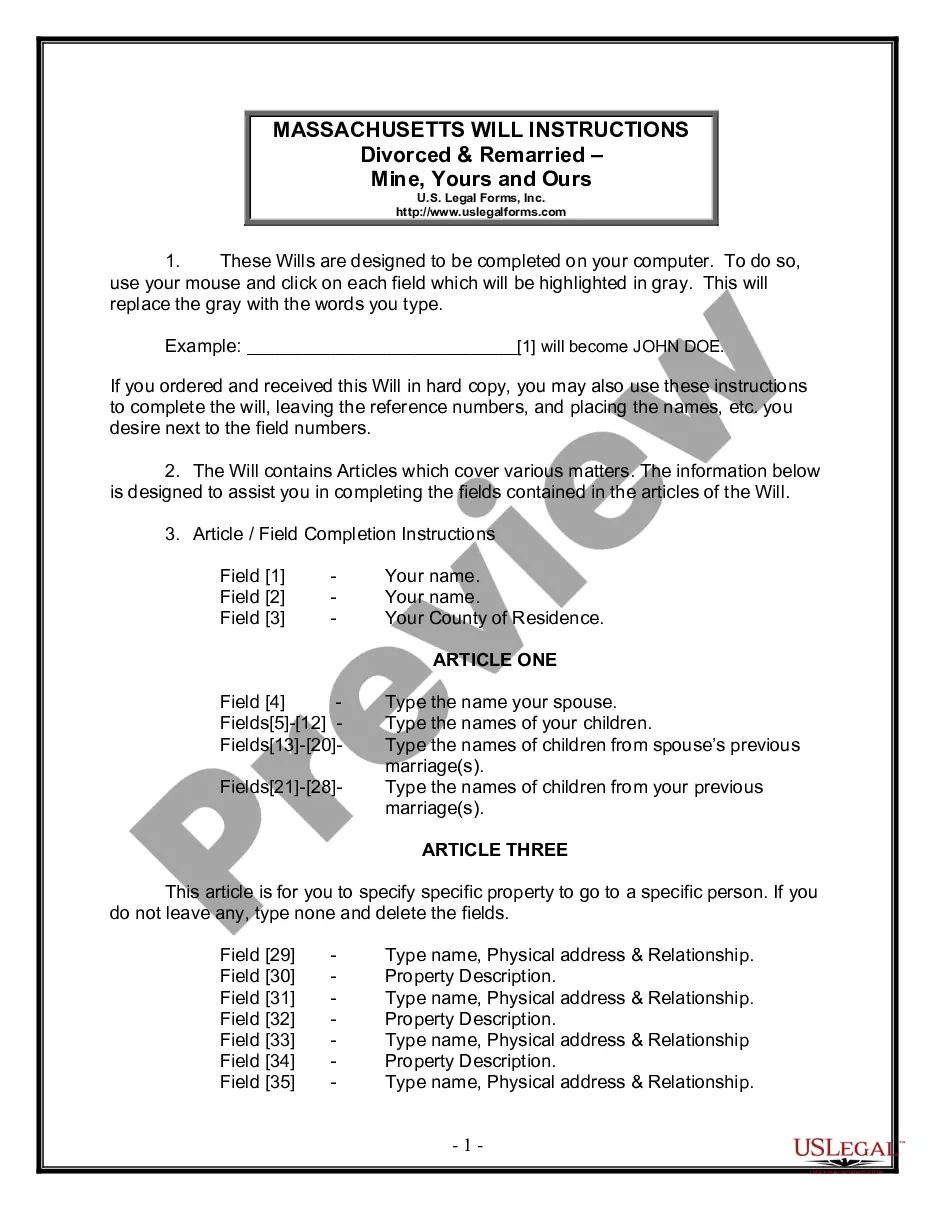

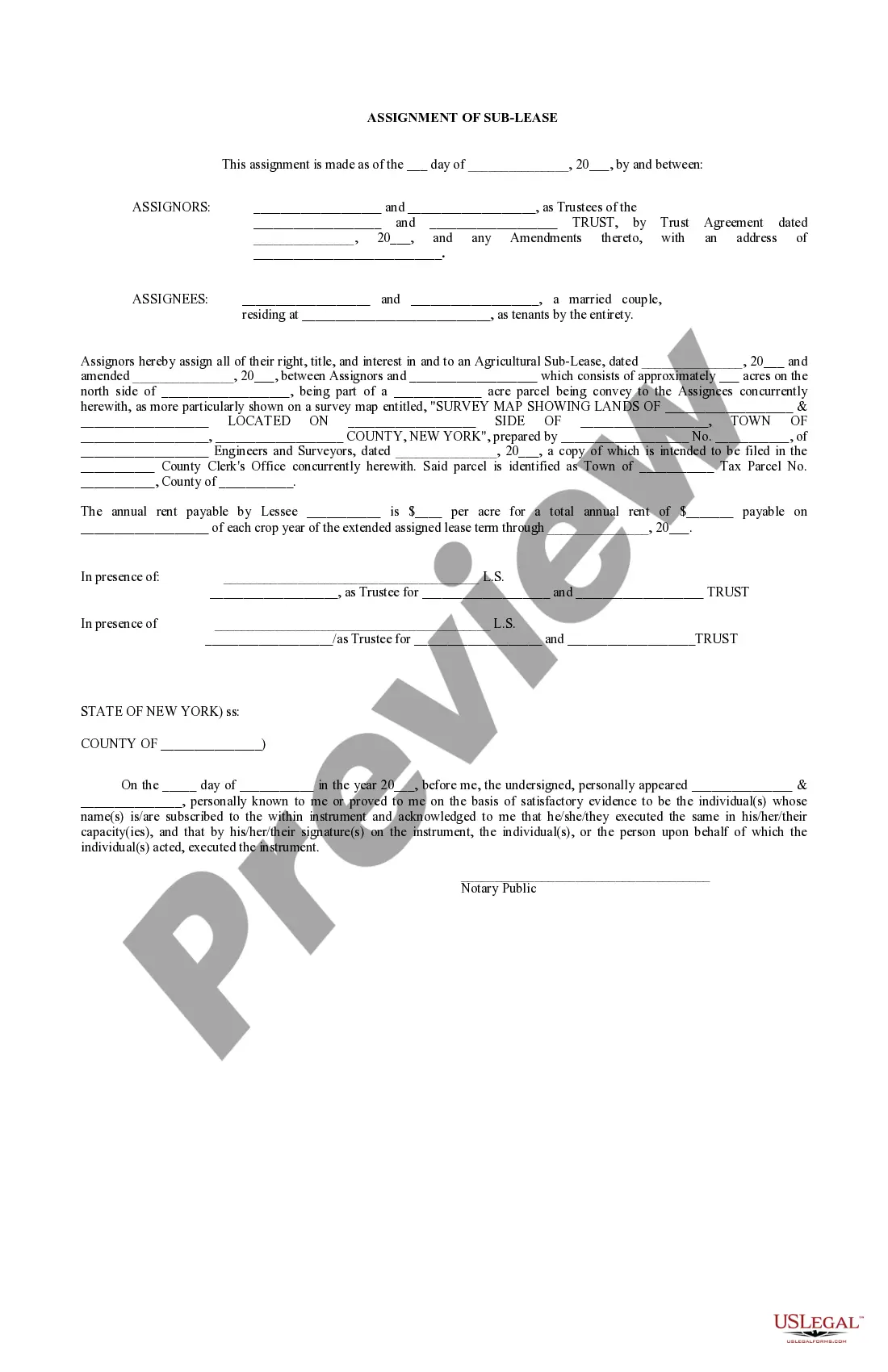

This assignment of an agricultural sublease is the transfer of the a party's entire interest in a lease. When a tenant assigns its lease, the assignee takes over the tenant's obligations under the lease and deals directly with the landlord.

Form popularity

FAQ

Trusts in New York are seen as separate entities and are subject to state income tax on any income they generate. This includes income that may influence capital gains from investments, which can be complicated if you're navigating New York trustee withdrawals. To address these complexities, reach out to services like US Legal Forms that specialize in trust matters and tax forms.

Yes, New York State does tax 403 B distributions when you withdraw funds during retirement. This taxation can influence your overall retirement income, particularly if you have significant funds in a 403 B account. To manage this tax burden effectively, consider exploring options that allow more favorable tax treatment. For assistance with forms or financial strategies, US Legal Forms can help.

You can mail NY Form IT-205 to the appropriate address based on the type of trust or estate you are filing for. Typically, this information is provided on the form or through the New York State Department of Taxation and Finance's website. If you face difficulties, using US Legal Forms can guide you in ensuring that all paperwork is submitted correctly and on time.

Form IT-205 is typically required for the fiduciaries of estates and trusts in New York. If you hold a trust that earns income, it's essential to file this form to report the income. Additionally, the income generated from the trust may affect the tax implications of any New York trustee withdrawal. To simplify the filing process, consider visiting US Legal Forms for personalized support.

Yes, 403b contributions in New York are generally subject to state tax once you withdraw them. When you make withdrawals, especially in retirement, these funds may be taxed by New York State. However, if you’re making contributions, the impact on your state tax will depend on your overall income and tax situation. For guidance tailored to your specific circumstances, consider using platforms like US Legal Forms.

If you want to remove yourself from being a trustee, you need to formally resign. You should draft a resignation letter that outlines your intention and provide any necessary notice to the beneficiaries or co-trustees as required. This ensures a smooth transition and contributes to a successful New York trustee withdrawal.

To revoke a trust in New York, you must create a written revocation document that clearly states your intention to revoke it. This document should be signed and notarized according to New York laws. Utilizing platforms like uslegalforms can provide templates and guidance, making the New York trustee withdrawal process simpler and more effective.

The difficulty in removing a trustee largely depends on the reason for removal and the specific provisions in the trust agreement. If backed by solid evidence and legal grounds, the process can be straightforward. Seeking assistance from a legal professional can streamline the New York trustee withdrawal process, making it easier for you.

To get rid of a trustee, you should start by reviewing the trust document to identify the grounds for removal. You may need to petition the court if the trustee does not voluntarily resign. It’s essential to provide evidence of poor performance or wrongful actions, which can lead to a smooth New York trustee withdrawal.

Removing a trustee from a trust involves legal procedures, and its complexity can vary based on the circumstances involved. Generally, you must show a valid reason, such as misconduct or incapacity. Consulting with a legal expert knowledgeable in New York trustee withdrawal can simplify this process and ensure you follow all necessary steps.