Will Vs Trust In Ny

Description

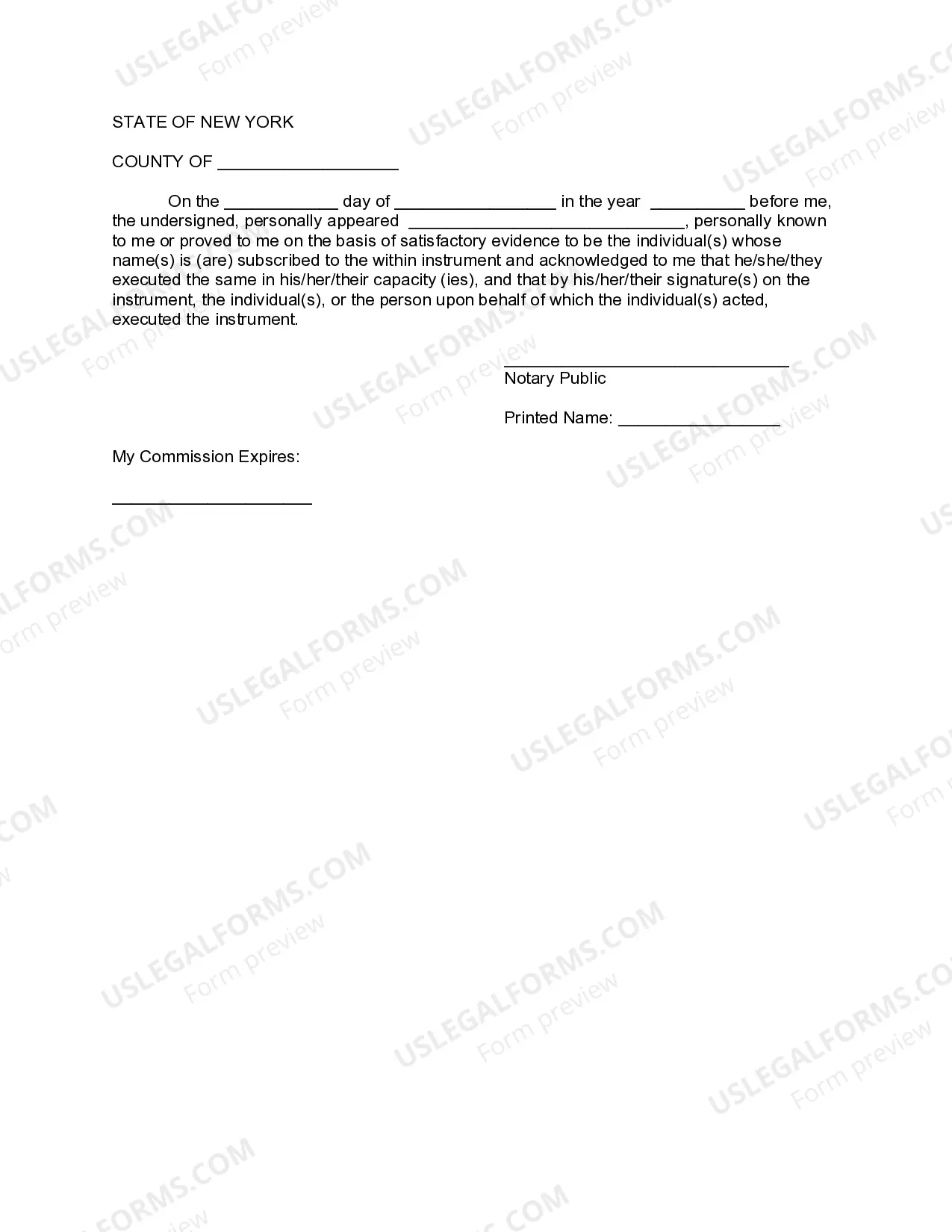

How to fill out New York Amendment To Living Trust?

Using legal templates that comply with federal and state laws is essential, and the internet offers many options to pick from. But what’s the point in wasting time looking for the appropriate Will Vs Trust In Ny sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any business and life case. They are simple to browse with all files collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Will Vs Trust In Ny from our website.

Getting a Will Vs Trust In Ny is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Analyze the template utilizing the Preview option or via the text outline to ensure it meets your requirements.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Will Vs Trust In Ny and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Importantly, trusts provide more privacy than a will, which becomes a matter of public record. A trust is more expensive to set up and is typically used by wealthier individuals to avoid estate taxes, or by people who want more control over how their heirs access and use the assets they're being left.

DISADVANTAGES OF A TRUST Most importantly, a trust will cost more than a last will at the initial stage of planning and you have to provide more information up front.

A living trust can avoid probate and help maintain privacy while preserving your assets by avoiding unnecessary fees. A trust gives you control, even after you pass away. A will gives you control of who you leave your assets to, but not how or when they get those assets.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.