Dissolution Dissolve Company With The Eu

Description

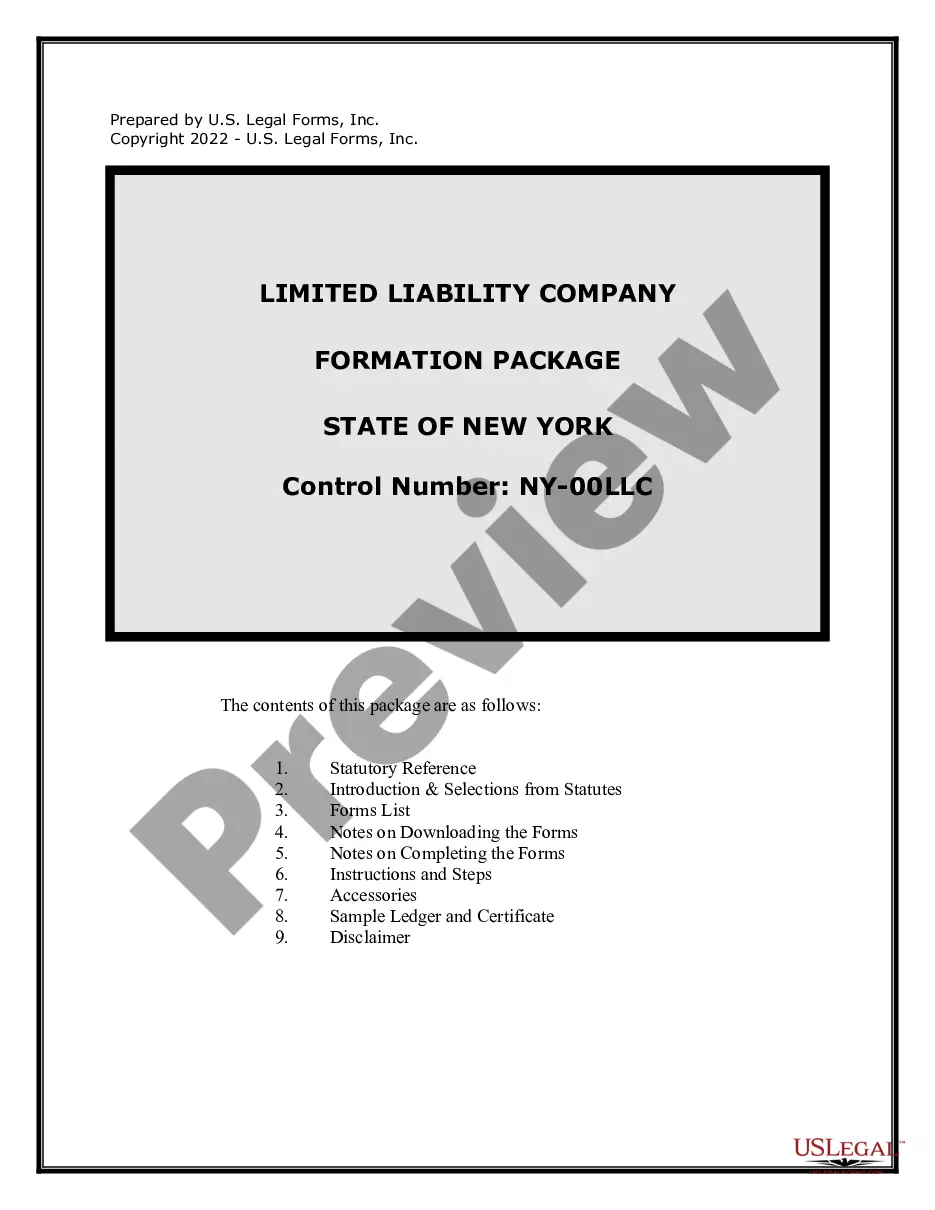

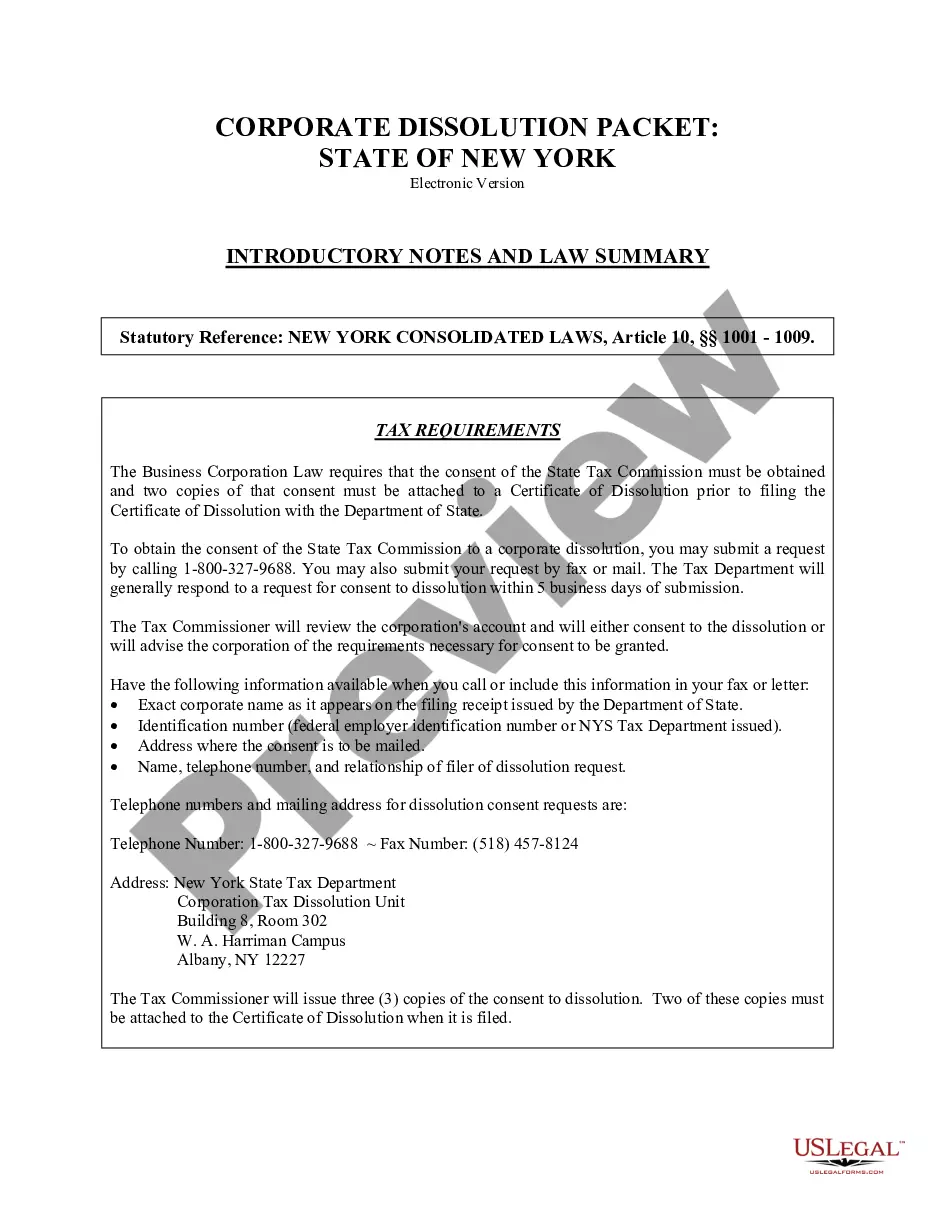

How to fill out New York Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, simply log in to your account. Download the required form template by clicking on the Download button, making sure your subscription is active. If not, renew it according to your selected payment plan.

- For first-time users, start by exploring the Preview mode and form description. Verify you've selected the right document that aligns with your needs and adheres to your local jurisdiction’s requirements.

- If the chosen form isn’t suitable, utilize the Search tab to locate another template that fits your criteria. Proceed once you find the correct document.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan, and create an account to gain access to the extensive library of resources.

- Complete your transaction by entering your credit card details or opting for PayPal. Finish the payment process.

- Download and save your form on your device. Access it anytime from the My Forms menu within your profile.

In summary, utilizing US Legal Forms simplifies the process of dissolving your company in the EU. Their extensive library of over 85,000 legal forms ensures you have access to the right documents, and premium expert assistance is available for detailed support.

Don't hesitate; start your dissolution process today by visiting US Legal Forms for all your legal document needs!

Form popularity

FAQ

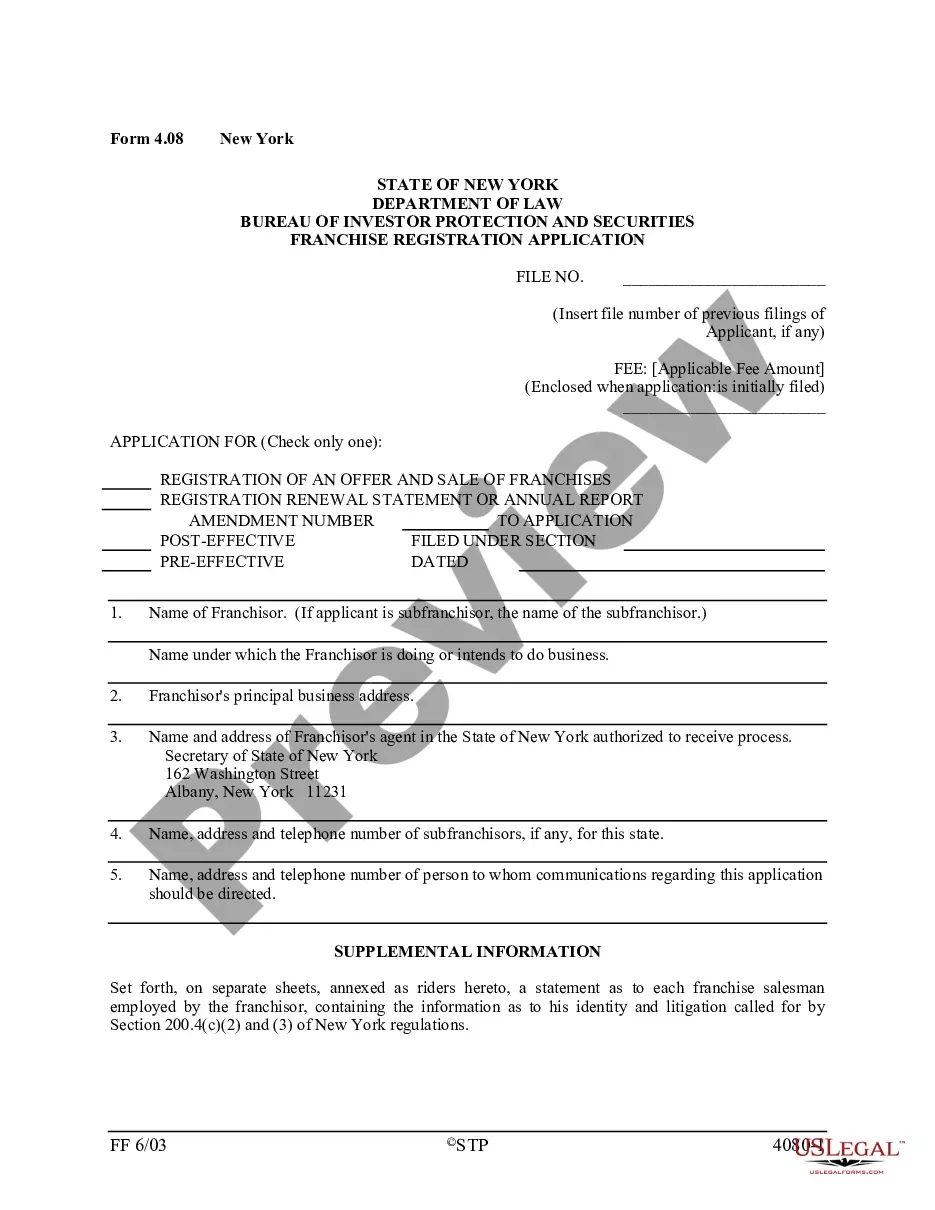

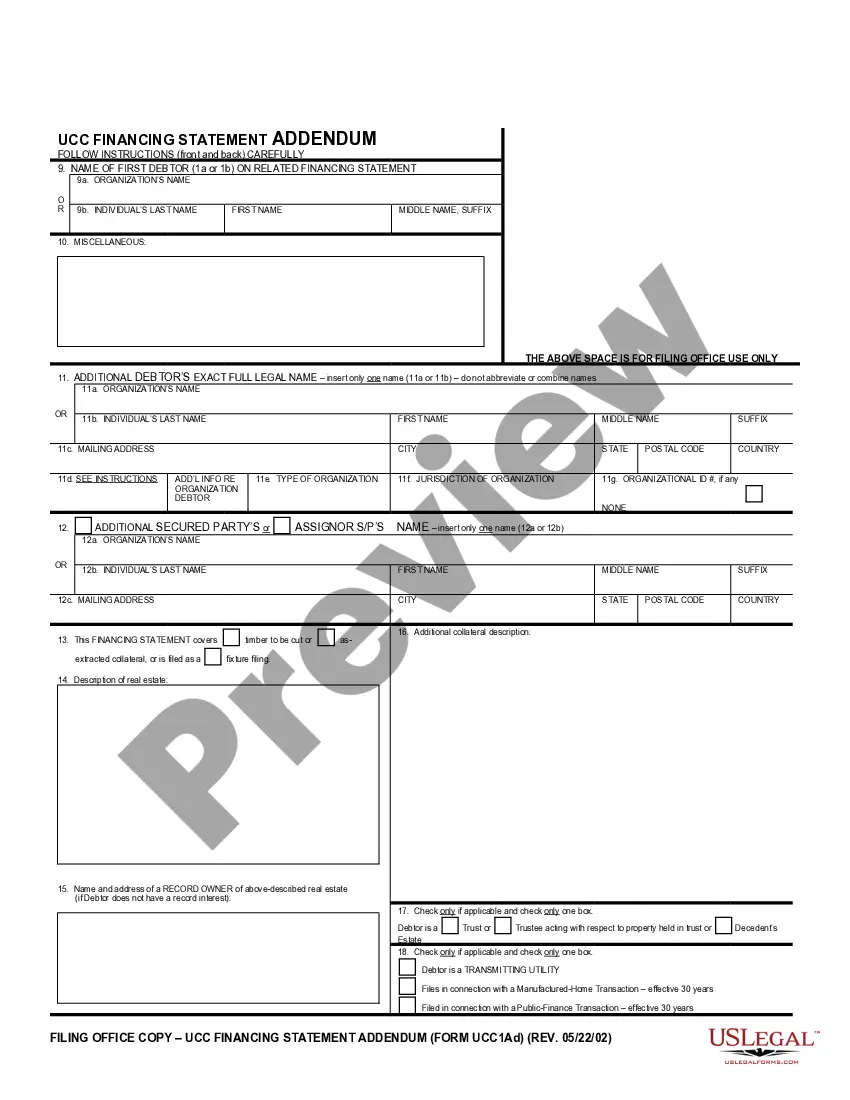

The two types of dissolution for a corporation are voluntary and involuntary dissolution. Voluntary dissolution occurs when the owners decide to close the business, often for strategic reasons. Involuntary dissolution, on the other hand, can happen due to state actions, typically for noncompliance or legal issues. Understanding these types can help you navigate the complexities of dissolving a company with the EU.

Dissolving a corporation with the IRS involves filing specific forms, such as Form 966, which is a corporate dissolution or liquidation form. You will also need to file your final tax return, indicating that it’s the last one for the corporation. Make sure to account for any taxes owed so that you comply with federal laws. Utilizing resources like US Legal Forms can simplify this process and ensure you meet all legal requirements.

When a company enters dissolution, it initiates a formal process to cease its business activities. This means the company will settle debts, liquidate assets, and distribute any remaining resources among shareholders. The dissolution process helps to legally terminate the business and mitigate any potential liabilities. It’s important to follow legal guidelines to ensure a proper resolution, especially when you consider the implications of dissolving a company with the EU.

When you dissolve a corporation, it's important to understand the tax implications. The IRS requires that you report any gains or losses from the sale of corporate assets, which may lead to tax liabilities. Additionally, if your corporation has shareholders, distributed assets could also trigger taxable events. Consulting with a tax professional can guide you through the dissolution process while addressing any tax concerns.

To dissolve a US corporation, you typically begin by holding a meeting with your board of directors to approve the dissolution. Following this, you need to file the necessary paperwork with your state’s Secretary of State and ensure that you resolve all outstanding debts and obligations. It's essential to inform relevant stakeholders and follow local laws to smoothly dissolve your company and avoid complications.

You can dissolve a corporation in three primary ways: voluntary dissolution, administrative dissolution, and judicial dissolution. Voluntary dissolution occurs when the owners choose to close the business. Administrative dissolution happens when a state authority dissolves a company for failing to comply with regulations. Judicial dissolution involves a court's intervention to dissolve a corporation typically due to legal disputes.

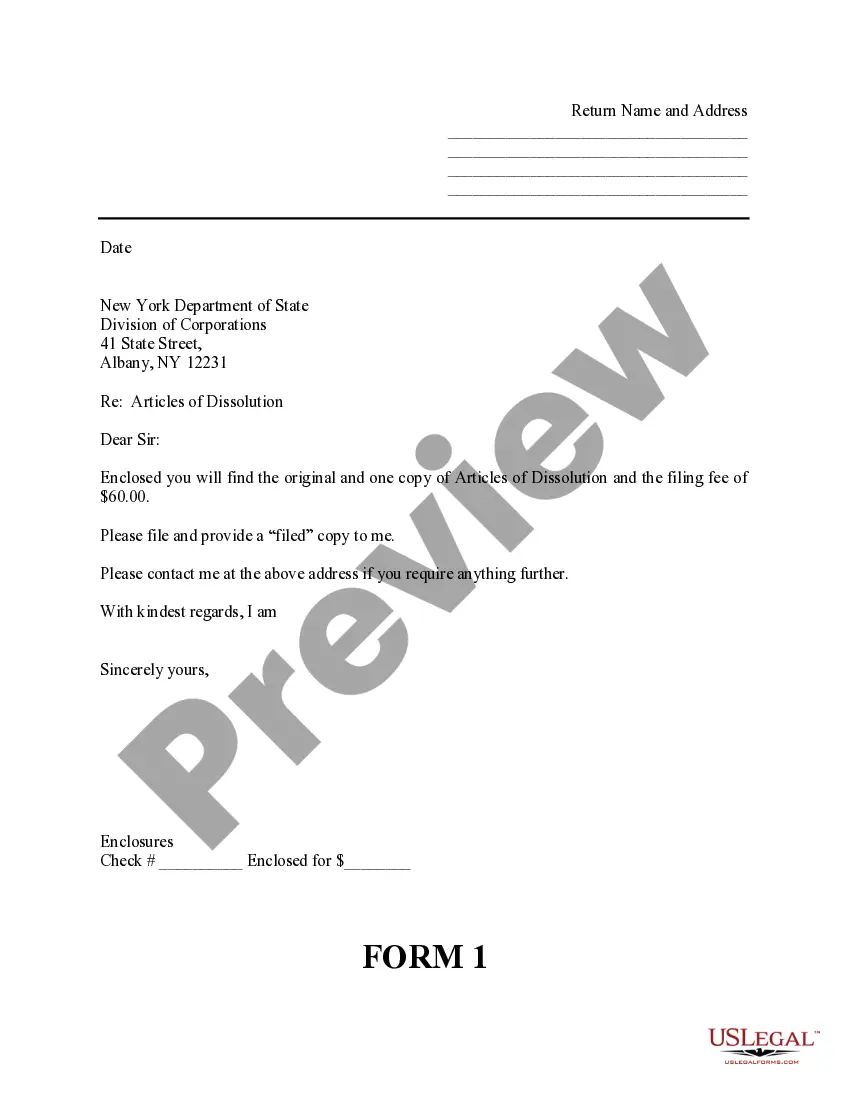

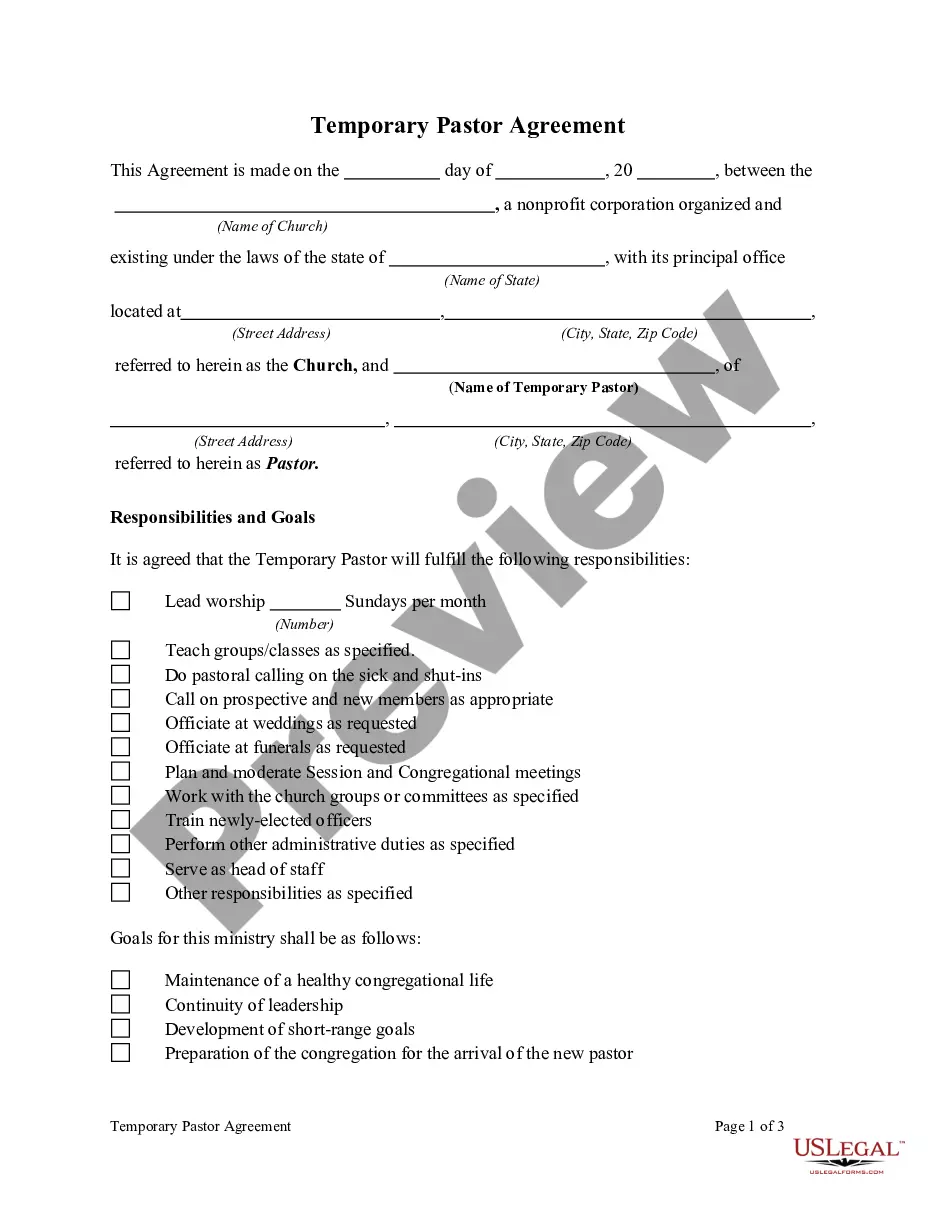

A dissolution letter should clearly state the company's name, the decision to dissolve, and the effective date of dissolution. Include any relevant information, such as the distribution of assets and handling of liabilities. This letter acts as a formal notification to stakeholders like employees, creditors, and partners. The USLegalForms platform can help you craft a professional dissolution letter that fulfills your needs when you plan to dissolution dissolve company with the EU.

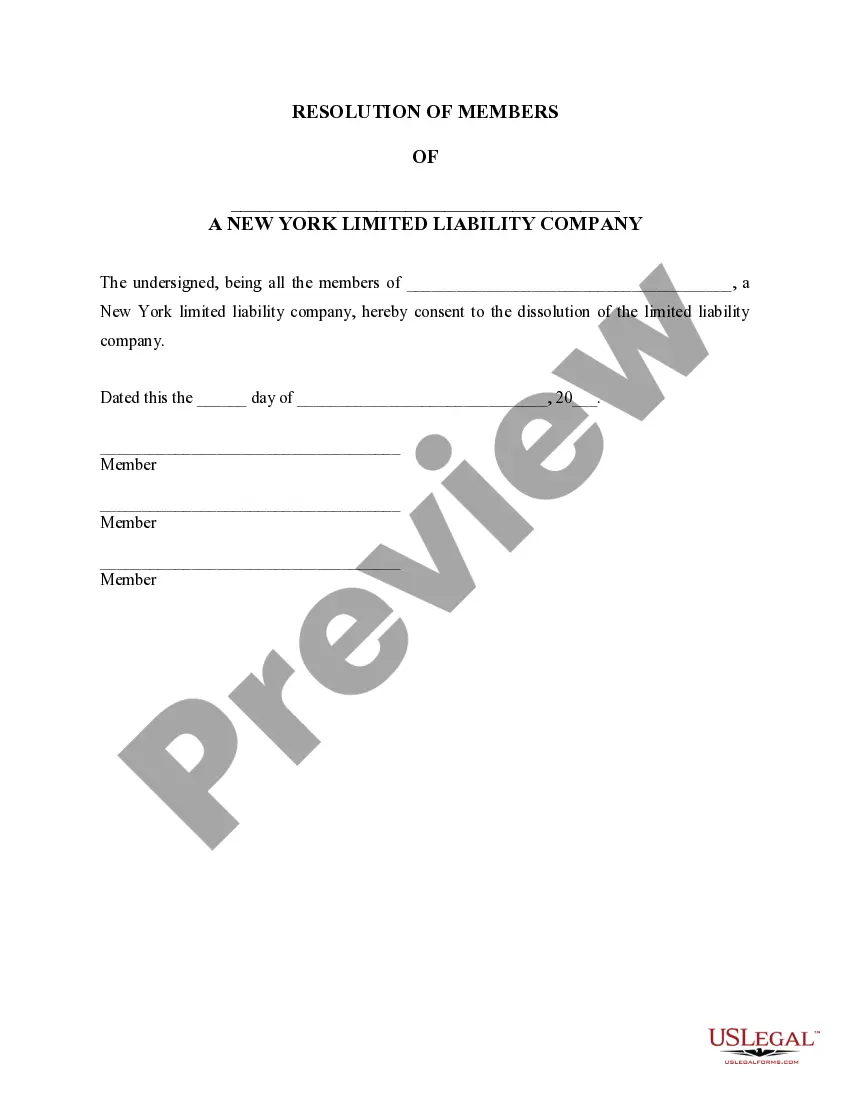

Filling out articles of dissolution requires you to provide specific information about your business, including its name, registration details, and dissolution reason. Review your state’s requirements to ensure you include any necessary signatures or documentation. It's essential to follow the correct procedures to avoid complications during the dissolution process. Utilizing USLegalForms can ensure precision when you dissolution dissolve company with the EU.

Writing a dissolution generally involves preparing a formal document that outlines your intent to end the business. This document should include important details like the company’s name, the reason for dissolution, and the effective date. Be sure to also address how the company’s remaining assets will be distributed, if applicable. Using the templates available on the USLegalForms platform can help you write a clear and concise dissolution when you dissolution dissolve company with the EU.

An example of a dissolution is when a limited liability company (LLC) decides to legally cease operations due to financial hardship. The owners may agree to dissolve the company by filing articles of dissolution with the appropriate state agency. This formal action demonstrates that they are meeting legal obligations while winding down their business affairs. If you need assistance in understanding dissolution processes to dissolve your company with the EU, consider resources offered by USLegalForms.