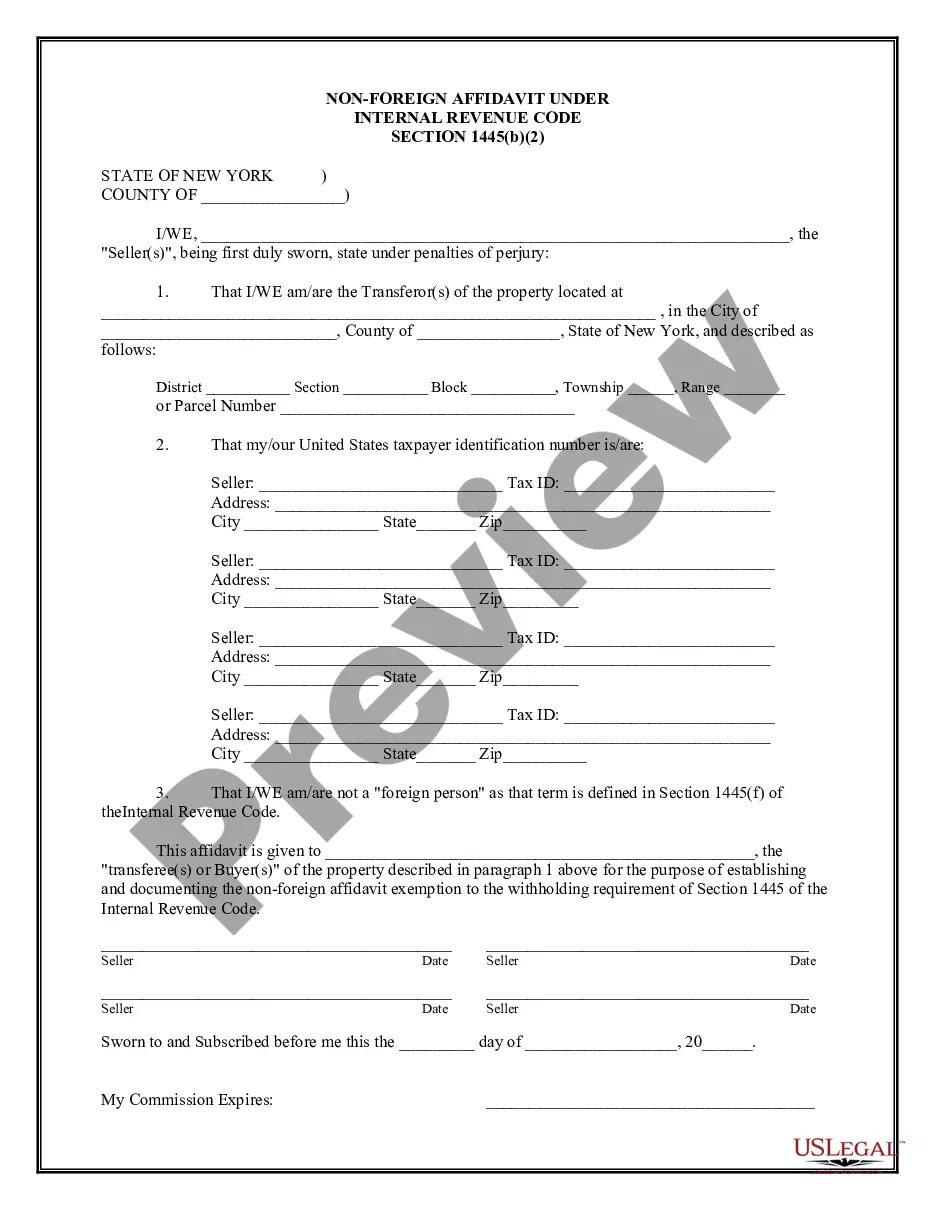

Firpta Affidavit Ny Withdrawal

Description

How to fill out New York Non-Foreign Affidavit Under IRC 1445?

The Firpta Affidavit Ny Withdrawal displayed on this page is a reusable official template created by skilled attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and lawyers more than 85,000 validated, state-specific forms for any business and personal situation. It’s the fastest, simplest, and most trustworthy way to acquire the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you desire for your Firpta Affidavit Ny Withdrawal (PDF, DOCX, RTF) and download the sample onto your device. Complete the paperwork by printing the template for manual completion. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with a legally-binding electronic signature. Download your documents again whenever needed. Access the My documents tab in your profile to redownload any previously acquired forms. Subscribe to US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Search for the document you need and examine it.

- Review the sample you searched for and preview it or read the form description to ensure it meets your needs. If it doesn’t, use the search bar to find the correct one. Click Buy Now when you have found the template you require.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

Typically, the buyer of the property is responsible for filing the FIRPTA certificate, specifically Form 8288, at the time of closing. However, if the seller wishes to obtain a withholding certificate, they must file Form 8288-B themselves. Accurate completion of these forms is vital to ensure compliance with IRS regulations. US Legal Forms offers helpful resources to guide you through the filing process and ensure you meet all requirements.

A withholding certificate is an official document issued by the IRS that allows a seller to reduce or eliminate the withholding tax required under FIRPTA. This certificate is essential for foreign sellers to ensure they are not overtaxed on the sale of their U.S. property. To obtain this certificate, it is important to follow the proper procedures outlined in IRS guidelines. US Legal Forms can provide you with the necessary templates to help you with this process.

Getting a FIRPTA withholding certificate involves submitting Form 8288-B to the IRS along with supporting documents that justify your request. This certificate allows you to either reduce or eliminate the withholding amount on the sale of U.S. property by foreign persons. Make sure to file this form as early as possible to avoid delays. US Legal Forms can assist you in preparing and filing this important document correctly.

To obtain a withholding certificate under FIRPTA, you must file Form 8288-B with the IRS. This form requests a reduction or exemption from the withholding amount based on your situation. It is crucial to provide all necessary documentation to support your request. For a seamless experience, you can utilize US Legal Forms, which provides easy access to the appropriate forms and instructions.

Yes, you can get FIRPTA withholding back if you qualify for a withholding certificate or if your actual tax liability is lower than the withheld amount. To initiate this process, you will need to file a tax return and include the relevant forms to claim a refund. Make sure to keep accurate records of your transactions related to the FIRPTA affidavit NY withdrawal. For detailed assistance, US Legal Forms offers resources that can help you navigate the refund process.

To obtain a copy of your federal tax ID certificate, also known as an Employer Identification Number (EIN), you can contact the IRS directly. They can send you a replacement letter that confirms your EIN. Additionally, if you used a tax professional to obtain your EIN, they may have a copy on file. Utilizing US Legal Forms can streamline this process and provide you with the necessary templates and guidance.

Processing Form 8288-B, which is related to the FIRPTA affidavit NY withdrawal, typically takes about 90 days. However, this timeframe can vary depending on the IRS workload and specific circumstances surrounding your case. It's essential to ensure that you complete the form accurately and submit all required documentation to avoid delays. If you need assistance with this process, consider using the services available on US Legal Forms.

Form 8288-B is typically filled out by the buyer or transferee of the real property when applying for a withholding certificate. This form is crucial for requesting a reduction or exemption from FIRPTA withholding. When you prepare the Firpta affidavit for NY withdrawal, it is essential to ensure that all information is accurate and complete to avoid delays. Utilizing USLegalForms can help you navigate this process efficiently, offering the necessary forms and guidance tailored to your situation.

Filing for a FIRPTA refund involves submitting Form 843, along with supporting documents that justify your claim. You will also need to include a copy of the FIRPTA withholding certificate and any tax returns relevant to the transaction. Ensure that you mention the Firpta affidavit for NY withdrawal in your documentation, as it can help clarify your situation to the IRS. Consider using USLegalForms to access straightforward templates and instructions that can aid in your refund process.

To file FIRPTA withholding, you'll need to submit the appropriate forms to the IRS. Start by completing Form 8288, which is required for withholding tax on the sale of U.S. real property by foreign persons. Additionally, prepare a Firpta affidavit for NY withdrawal if applicable, as it helps clarify the tax situation and ensures compliance. You can simplify this process by using USLegalForms, which offers resources and templates to guide you through each step.