New York Closing Without A License

Description

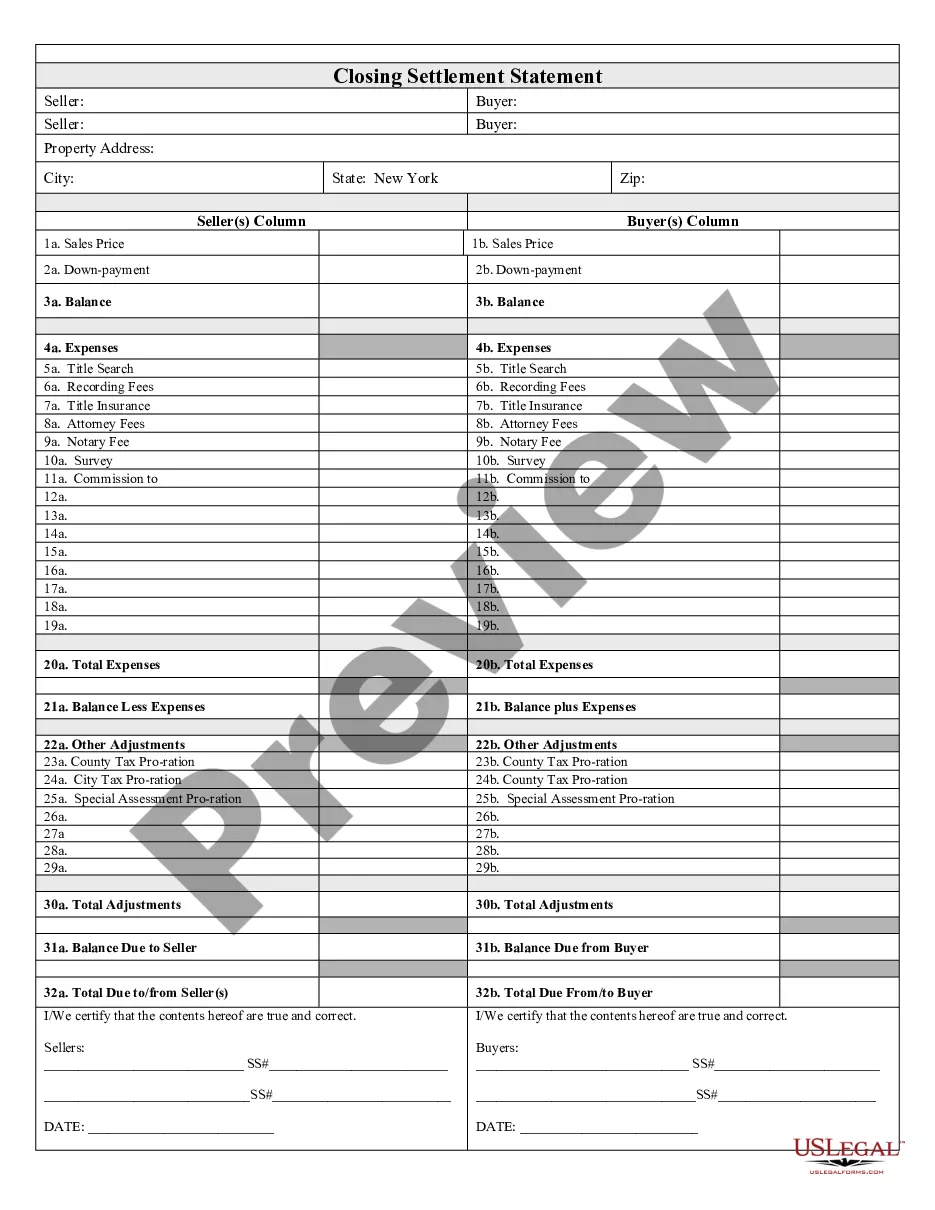

How to fill out New York Closing Statement?

Legal documents handling can be daunting, even for the most experienced professionals.

When you are searching for a New York Closing Without A License and lack the opportunity to spend time finding the accurate and current version, the processes can be challenging.

US Legal Forms addresses all requirements you may have, ranging from personal to business paperwork, all in one location.

Employ advanced tools to complete and manage your New York Closing Without A License.

Here are the steps to follow after acquiring the form you desire: Confirm this is the correct document by previewing it and reviewing its details. Ensure that the template is accepted in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Select the file format you want, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Streamline your routine document management into a seamless and user-friendly process today.

- Access a valuable resource library of articles, guides, and materials pertinent to your situation and needs.

- Save time and energy hunting for the documents you require, and utilize US Legal Forms’ sophisticated search and Review tool to find New York Closing Without A License and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to view the documents you have previously saved and organize your folders as you see fit.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- A robust online form library could be transformative for anyone aiming to manage these scenarios effectively.

- US Legal Forms is a frontrunner in online legal documents, with over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Complete the process by filing with the New York Department of State written consent from the Tax Department (Form TR-960, Consent to Dissolution of a Corporation); one Certificate of Dissolution; and. a check for $60 payable to the New York Department of State.

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada).

Must use Form IT-2663, Nonresident Real Property Estimated. Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT?2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

Duplicate Certificate of Authority If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

A final return must be filed within 20 days after you cease business operations or the sale, transfer, or change occurs. After we process your final return, we will inactivate your sales tax account.