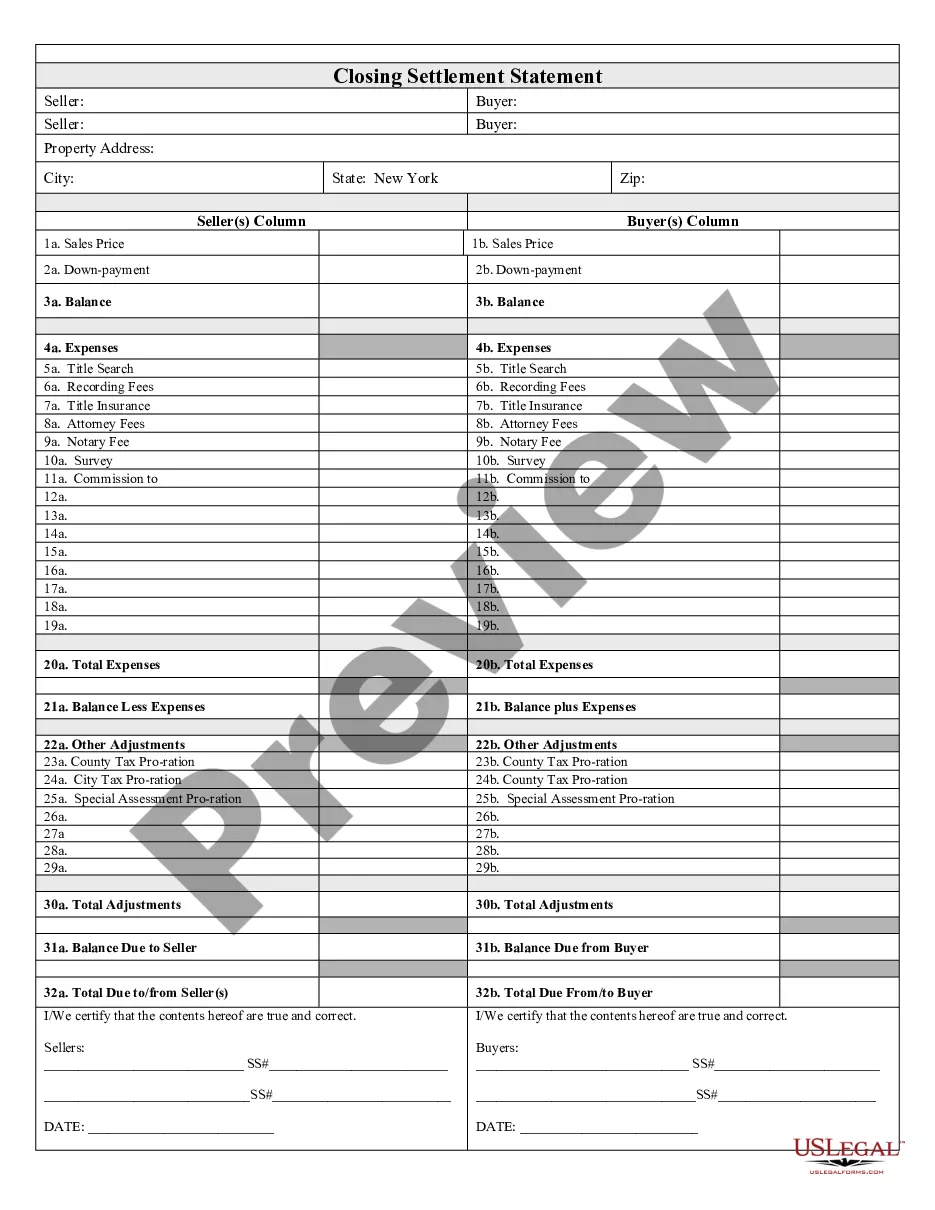

New York Closing For Good

Description

How to fill out New York Closing Statement?

Drafting legal documents from scratch can sometimes be intimidating. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more cost-effective way of preparing New York Closing For Good or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of over 85,000 up-to-date legal forms covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-compliant forms diligently put together for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can quickly find and download the New York Closing For Good. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and explore the catalog. But before jumping straight to downloading New York Closing For Good, follow these recommendations:

- Review the document preview and descriptions to ensure that you have found the document you are searching for.

- Check if form you select conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the New York Closing For Good.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and turn form execution into something simple and streamlined!

Form popularity

FAQ

A final return must be filed within 20 days after you cease business operations or the sale, transfer, or change occurs. After we process your final return, we will inactivate your sales tax account.

Closing/Dissolving a Business Notify government agencies that you are dissolving your business; Notify all lenders and creditors and settle any remaining debts; Collect all the money the business is owed (accounts receivables) or sell off any outstanding judgments, claims, and debts owed to the business;

Must use Form IT-2663, Nonresident Real Property Estimated. Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT?2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

There are some basic steps to dissolving an LLC in New York. Step 1: Vote to dissolve the LLC. Review your company's operating agreement. ... Step 2: File articles of dissolution. You must file the articles of dissolution within 90 days after performing step 1. ... Step 3: Winding up. ... Step 4: File the final tax return.

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada).