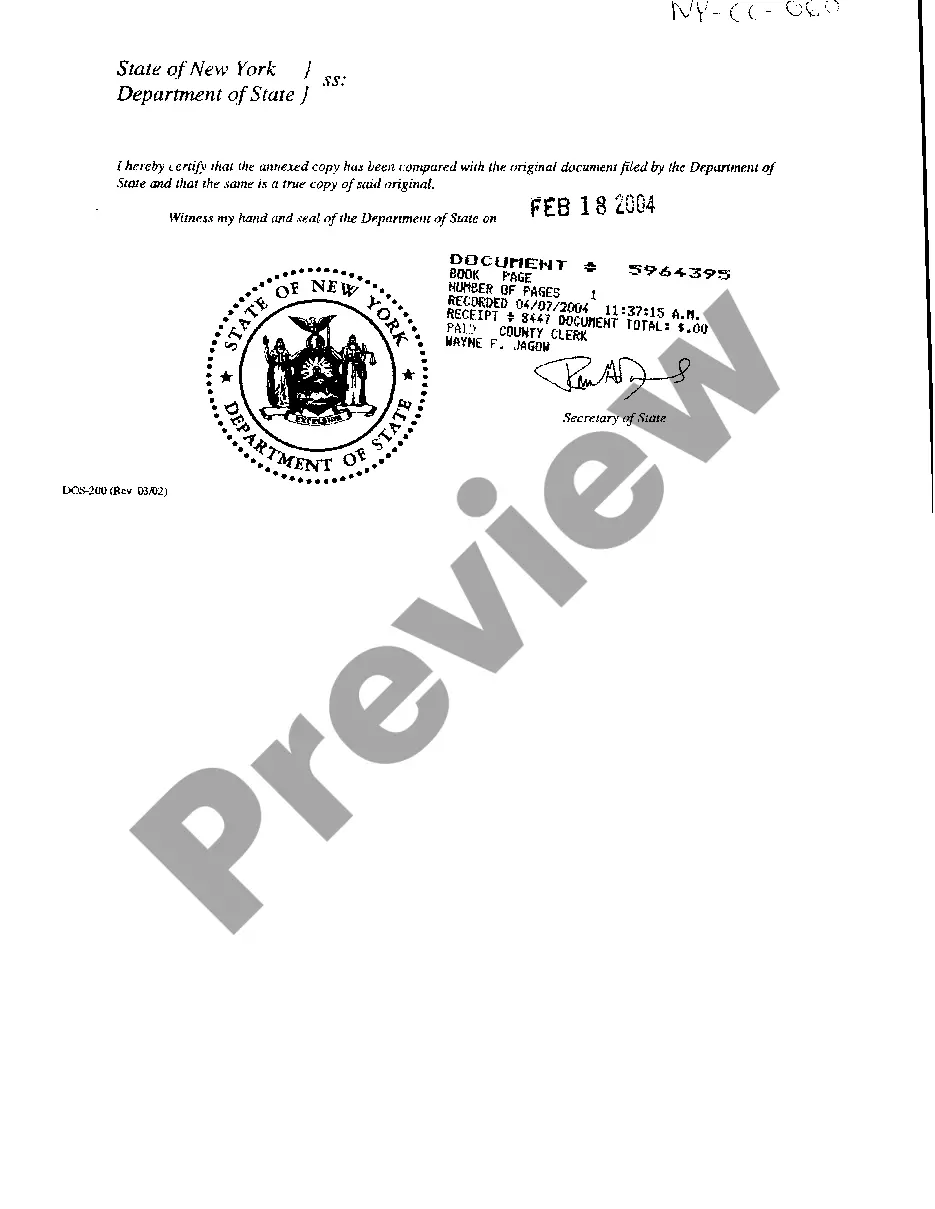

Certificate Of Assumed Name Nyc Without Llc

Description

How to fill out New York Sample Certificate Of Assumed Name?

Accessing legal templates that adhere to federal and state regulations is essential, and the internet provides numerous options to select from.

However, what's the use in spending time searching for the appropriate Certificate Of Assumed Name Nyc Without Llc example online when the US Legal Forms digital library already has such templates curated in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by legal professionals for various business and life scenarios.

Review the template using the Preview feature or through the written description to ensure it fulfills your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legislative changes, ensuring your form is current and compliant when obtaining a Certificate Of Assumed Name Nyc Without Llc from our site.

- Acquiring a Certificate Of Assumed Name Nyc Without Llc is quick and easy for both existing and new users.

- If you already have an account with an active subscription, Log In to download the document sample you need in the correct format.

- If you are new to our platform, follow the steps outlined below.

Form popularity

FAQ

Convert your DBA to an LLC in 5 Steps Step 1: Verify your DBA name is available for an LLC. Make sure your DBA name is available to register as an LLC. ... Step 2: Determine what needs to happen next with your DBA. ... Step 3: Form an LLC. ... Step 4: Obtain an EIN. ... Step 5: Dissolve your DBA, if necessary.

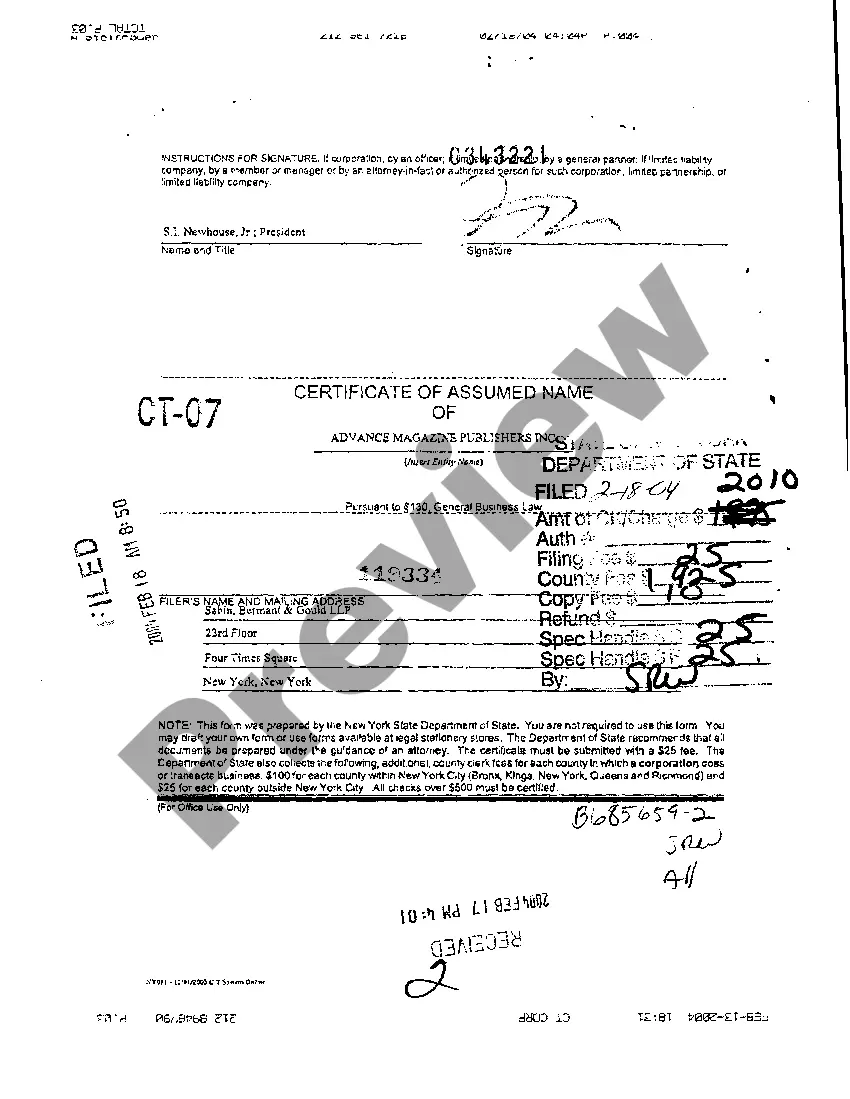

LLCs, LLPs, corporations and foreign entities: Previously incorporated businesses must register their DBA through the New York Department of State by filing a Certificate of Assumed Name form. LLCs and LLPs get charged a $25 fee. Corporations must pay the state $25 for every non-NYC county.

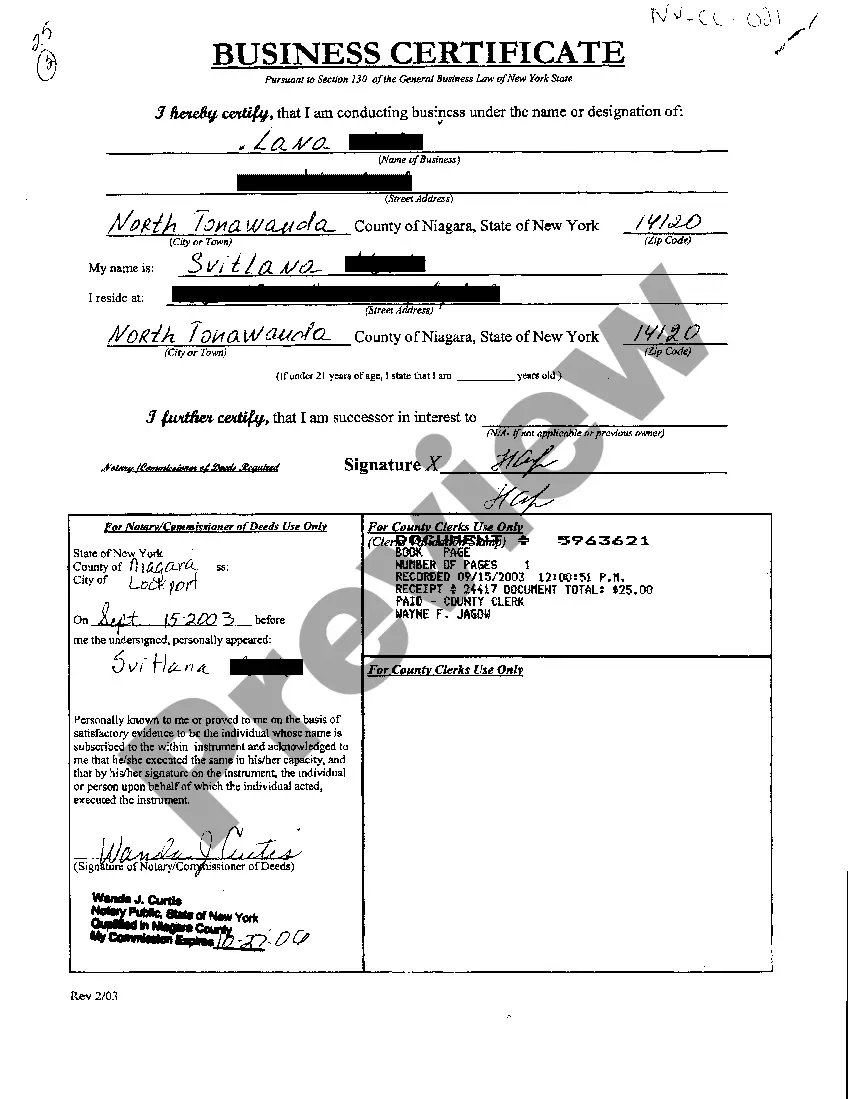

This certificate is also called the "doing business as (DBA) certificate." Businesses must file the certificate with the New York State Department of State (NYSDOS). Without this certificate, a business must operate under its legal name, and use its legal name everywhere.

How much does a DBA filing cost in New York? For sole proprietors, the filing fee for a DBA in New York is $100. Certified copies of the business certificate are an additional $10 each. Sole proprietors file a DBA with the county clerk they plan on doing business with.

Step 1 ? New York business entity search. A DBA name must be unique and meet New York state requirements. ... Step 2 ? Filing a certificate of the assumed name New York. If your business is incorporated, you must file a DBA with the NYS Department of State. ... Step 3 ? Pay New York filing fees.