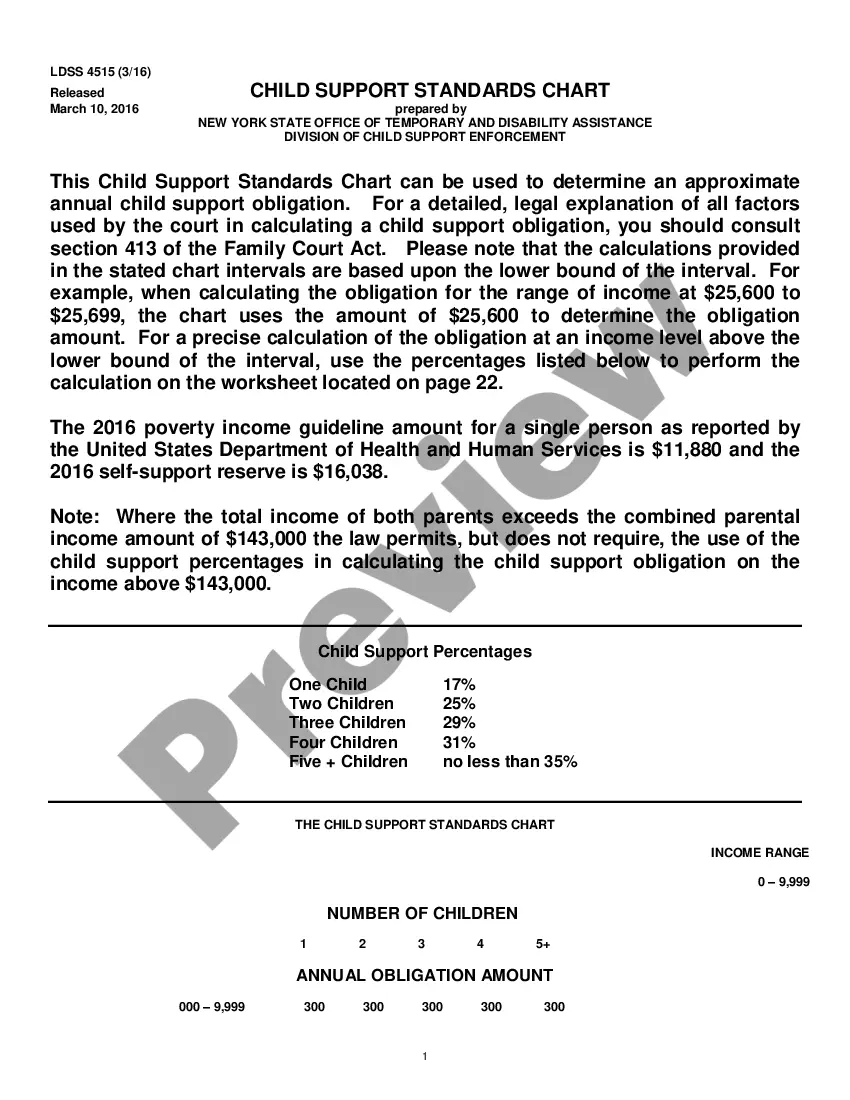

Child Support Arrears Forgiveness Program Ny Withholding

Description

How to fill out New York Stipulation For Child Support - 9-99?

Creating legal documents from the ground up can frequently be daunting.

Certain situations might require extensive research and significant financial investment.

If you’re looking for a simpler and more economical method of preparing Child Support Arrears Forgiveness Program Ny Withholding or any other documents without navigating through complications, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

However, before directly proceeding to download the Child Support Arrears Forgiveness Program Ny Withholding, adhere to these guidelines: Check the document preview and descriptions to ensure you have the correct document. Verify if the form you select complies with the regulations and laws of your state and county. Choose the most appropriate subscription option to purchase the Child Support Arrears Forgiveness Program Ny Withholding. Download the form, then complete, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make document execution easy and efficient!

- With just a few clicks, you can swiftly access state- and county-specific templates meticulously created by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can easily locate and download the Child Support Arrears Forgiveness Program Ny Withholding.

- If you're already familiar with our website and have set up an account with us, simply Log In to your account, select the form, and download it or re-download it at any time later in the My documents section.

- Don't have an account? No issue. Registration takes little to no time, allowing you to explore the library.

Form popularity

FAQ

Yes. The legal formation of an entity ? not an entity's treatment for federal income tax purposes ? determines filing responsibility for Texas franchise tax.

A Texas foreign LLC does business in Texas but was organized in another state or jurisdiction. To register as a Texas Foreign LLC, you'll need to submit an Application for Registration to the Texas Secretary of State and pay the state a filing fee of $750 (add 2.7% for all credit card transactions).

Yes. Non-U.S. corporations, LLCs, LPs and financial institutions must register with the secretary of state before transacting business in Texas. Such entities are subject to state franchise tax and federal income tax on certain income.

To register a foreign corporation in Texas, you must file a Texas Application for Registration with the Texas Secretary of State. You can submit this document by mail, by fax, in person, or online. The Application for Registration for a foreign Texas corporation costs $750 to file.

A Texas foreign LLC does business in Texas but was organized in another state or jurisdiction. To register as a Texas Foreign LLC, you'll need to submit an Application for Registration to the Texas Secretary of State and pay the state a filing fee of $750 (add 2.7% for all credit card transactions).

To register a foreign corporation in Texas, you must file a Texas Application for Registration with the Texas Secretary of State. You can submit this document by mail, by fax, in person, or online. The Application for Registration for a foreign Texas corporation costs $750 to file.

A general business license is not required in Texas. However, it is important to determine necessary licenses, permits, certifications, registrations or authorizations for a specific business activity, at the federal, state and local level.

Provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist. To transact business in Texas, a foreign entity must register with the secretary of state under chapter 9 of the Texas Business Organizations Code (BOC).