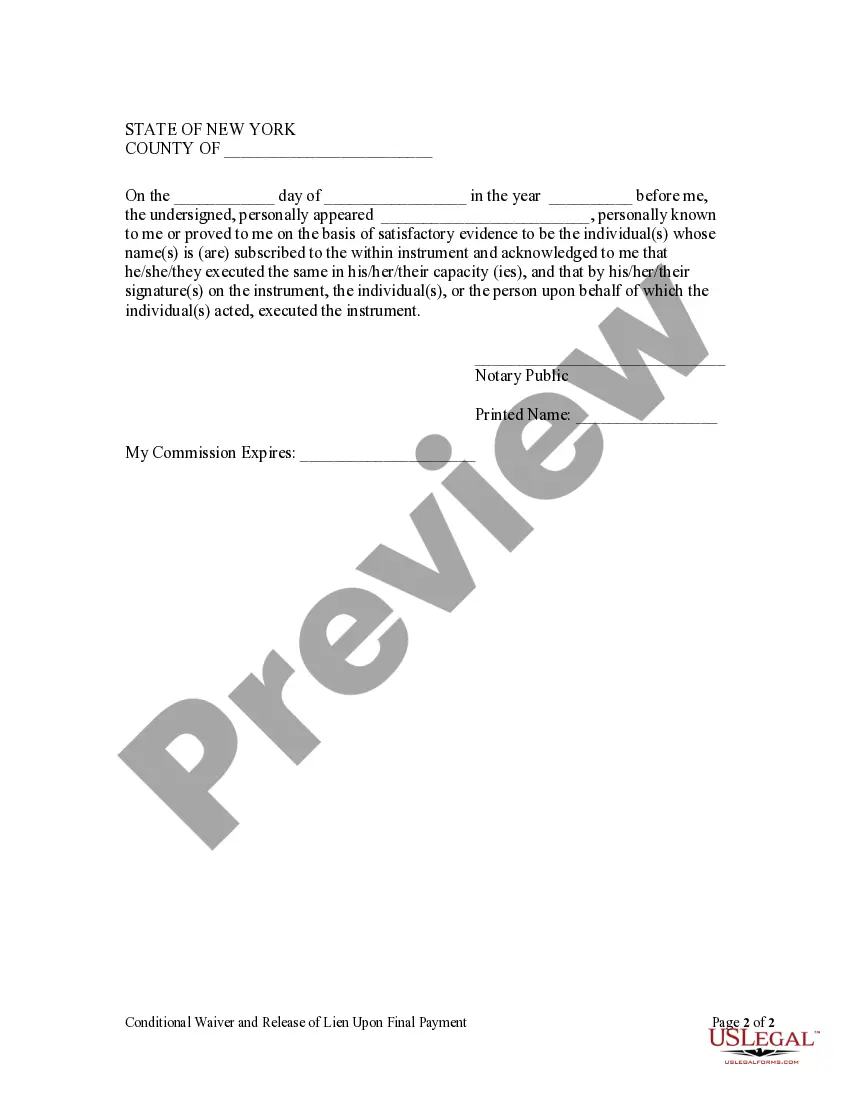

This Conditional Waiver and Release of Lien Upon Final Payment form is for use by a lienor, in consideration of final payment to waive and release his or her lien and right to claim a lien for labor, services or materials furnished through a certain date to a customer on the job of an owner of property. This Conditional Waiver and Release of Lien Upon Final Payment is conditioned upon the lienor receiving collected funds for the work described, and if such funds are not received within a specific number of days of the date of this waiver, this Conditional Waiver and Release of Lien is void.

Lien Waiver For Homeowner

Description

How to fill out New York Conditional Waiver And Release Of Lien Upon Final Payment?

- If you're already a US Legal Forms user, log into your account and access the 'My Forms' section to download your lien waiver. Ensure your subscription remains active, renewing if necessary.

- If you're new to the platform, start by previewing the available forms. Check the descriptions to ensure the lien waiver aligns with your specific jurisdiction's requirements.

- Utilize the search feature to find alternative templates if your initial choice does not meet your criteria.

- Once you've found the appropriate lien waiver, click the 'Buy Now' button and select the subscription plan that works best for you. Create an account to unlock full access to the library.

- Proceed to payment by entering your card details or using a PayPal account to complete your purchase.

- After payment, download your lien waiver form and save it to your device. You can revisit this document anytime from the 'My Forms' section in your profile.

Once you have your lien waiver, ensure that it's completed accurately to avoid any potential legal issues. US Legal Forms not only provides a robust collection of forms but also connects you with legal experts for additional assistance.

Take the first step towards safeguarding your investment by exploring US Legal Forms today. With thousands of forms at your fingertips, you can ensure your legal needs are met efficiently.

Form popularity

FAQ

The safest type of lien waiver for potential claimants is the unconditional waiver upon payment. This waiver prevents the claimant from later asserting any lien claims once they have received payment. For homeowners, using this waiver can provide peace of mind when working with contractors, ensuring that all debts are cleared and your property remains secure. It's wise to consult resources at US Legal Forms to navigate these waivers effectively.

A lien affidavit is a legal document that affirms a creditor's right to claim against a debtor's property if debts remain unpaid. This document provides information about the debt specifics, the debtor’s details, and the property involved. For homeowners, understanding lien affidavits is crucial, and using a lien waiver for homeowner can provide a safeguard against unauthorized claims.

When writing a letter of intent for a lien, clearly state your intent to file a lien, including the property details and the amount owed. Make sure to include relevant dates and any supporting documentation, as this adds validity to your claim. You may want to mention that you are using a lien waiver for homeowner as part of your process in addressing this matter. This shows you are taking necessary steps to protect your rights.

Filling out a lien affidavit involves specifying the details of the debt, including the amount owed, the debtor’s information, and a description of the property. Be sure to provide accurate documentation to support your claim. If you find this process overwhelming, you can utilize platforms like US Legal Forms which offer templates and guidance to help you effectively complete the lien affidavit without confusion.

Yes, it is possible for someone to place a lien on your property without your knowledge. This typically occurs when a creditor feels they have valid grounds for securing a debt against your property. To prevent such situations, consider implementing a lien waiver for homeowner when dealing with contractors and service providers. This proactive measure can help protect your property from unwarranted claims.

A lien waiver is a legal document that relinquishes a contractor's or supplier's right to file a lien against a property. Essentially, it protects the homeowner from future claims for unpaid work or materials. Understanding the meaning of lien waivers is vital for any homeowner looking to engage in renovations or improvements.

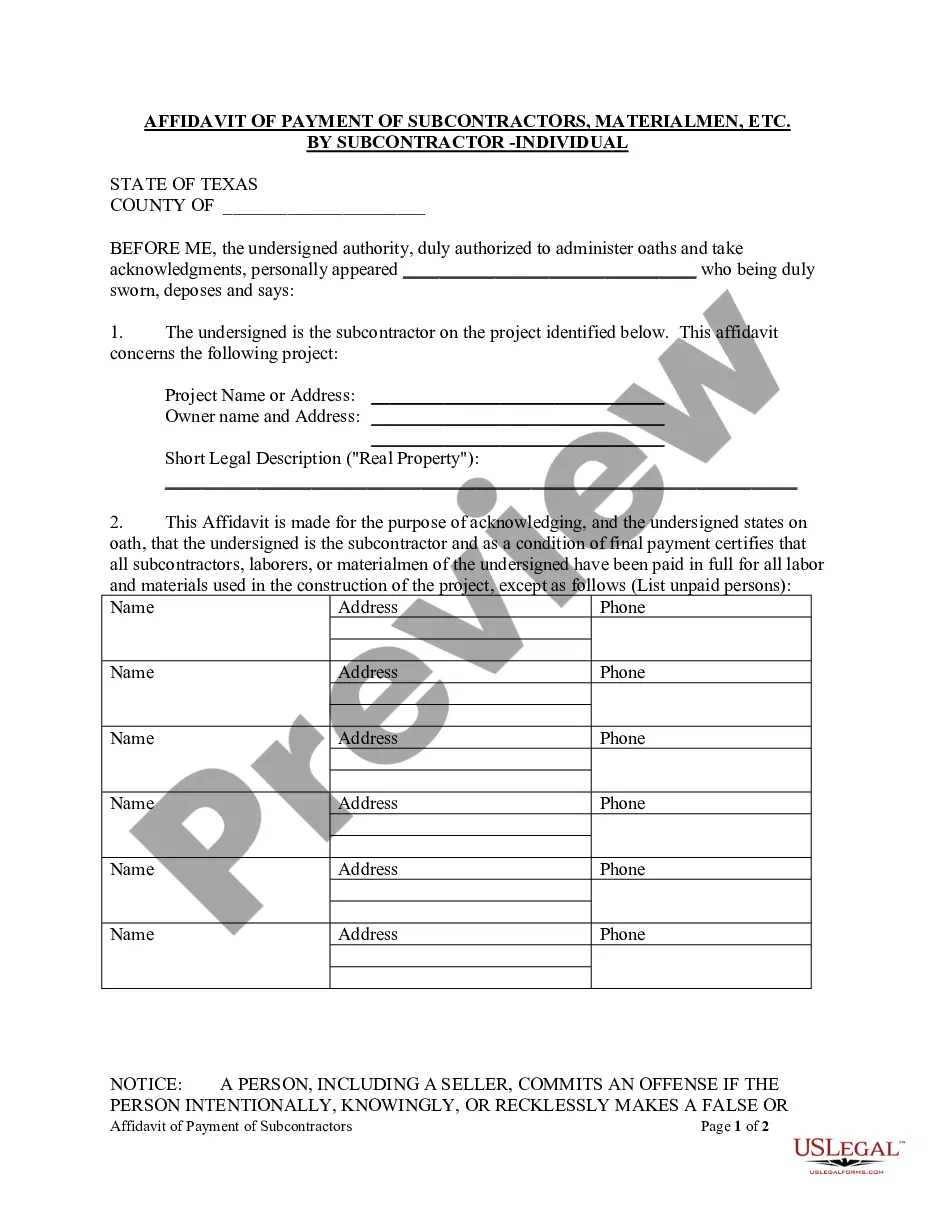

Generally, a release of lien does not need to be notarized in Texas, but it can add protection to the document. It is essential to follow any specific instructions provided in the original lien agreement. A notarized release can make it more credible and may be preferred by some parties involved in a transaction.

In Texas, the requirements for a lien include a valid debt, the identification of the property in question, and a written document or filing in the county clerk's office. Homeowners should ensure the lien is properly filed to protect their interests. Understanding these requirements helps homeowners navigate property transactions more effectively.

A landlord lien waiver is a document that protects a landlord from financial loss while allowing a tenant to have temporary possession of property. Essentially, it ensures that a landlord cannot claim a lien on the premises due to unpaid rent or other charges. This type of waiver can provide peace of mind for both parties involved in a rental agreement.

In Texas, lien waivers for homeowner do not always require notarization. However, circumstances may vary based on the specific agreement or arrangement with the contractor or supplier. While notarization can add an extra layer of security, it is not a strict requirement for all lien waivers.