Warning Letter To Tenant For Trash

Description

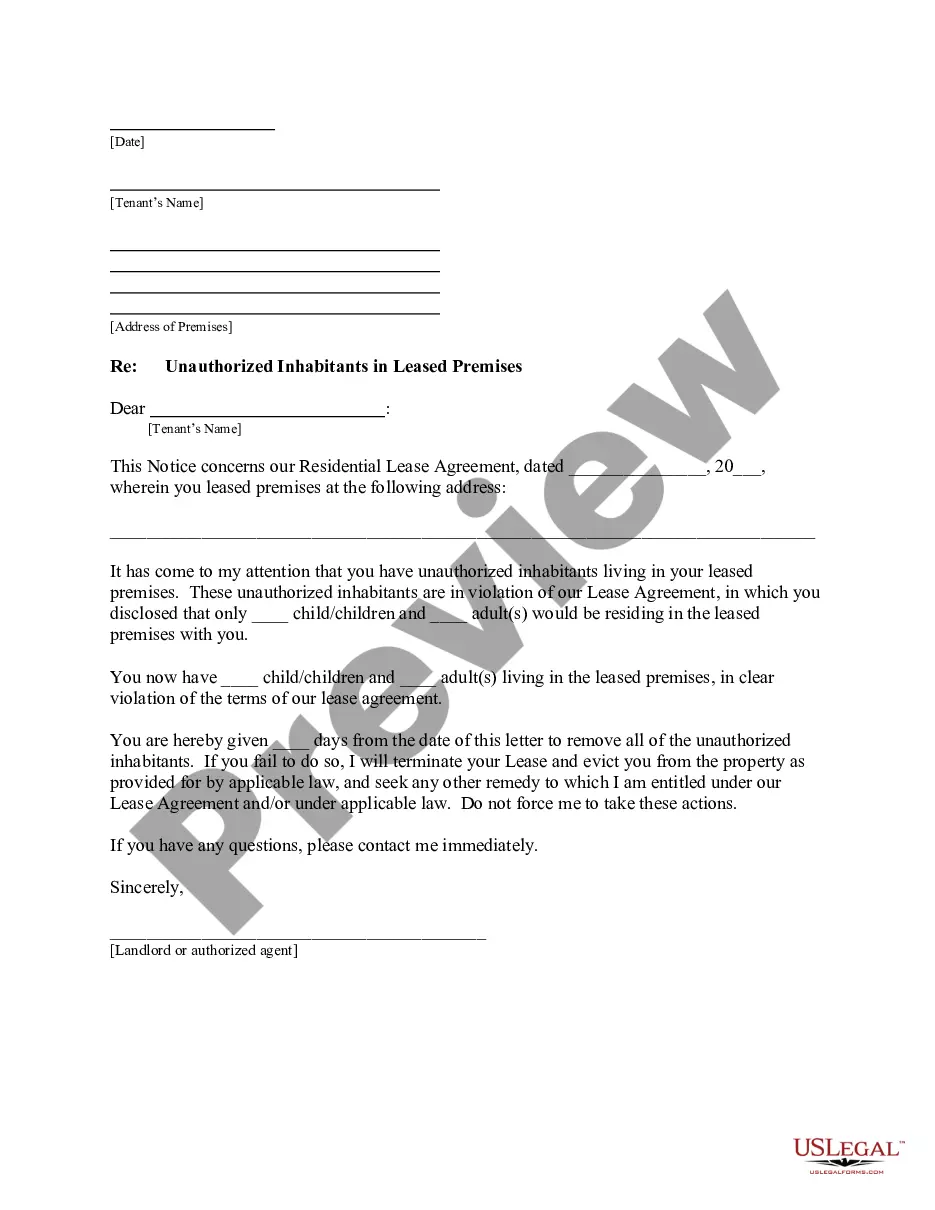

How to fill out New York Letter From Landlord To Tenant As Notice To Remove Unauthorized Inhabitants?

Managing legal documents can be daunting, even for seasoned professionals.

If you are looking for a Warning Letter To Tenant For Trash and lack the time to find the appropriate and current version, the process can become anxiety-inducing.

Access state- or county-specific legal and business documents.

US Legal Forms accommodates every requirement you may encounter, ranging from personal to corporate documentation, all consolidated in one location.

If this is your first encounter with US Legal Forms, create a free account to gain unrestricted access to all platform benefits. Follow these steps after finding the desired form.

- Utilize advanced tools to complete and oversee your Warning Letter To Tenant For Trash.

- Benefit from a collection of articles, guidelines, and references tailored to your circumstances and requirements.

- Save time and effort seeking the documents you require, and make the most of US Legal Forms’ enhanced search and Preview feature to locate and download Warning Letter To Tenant For Trash.

- If you hold a subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents section to review previously saved documents and organize your files as desired.

- A comprehensive online form repository could be transformative for anyone aiming to handle these matters efficiently.

- US Legal Forms stands as an industry leader in digital legal documentation, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you have the following advantages.

Form popularity

FAQ

Oklahoma does not have provisions for a composite return. The S corporation must provide nonresident shareholders a Form 500-B. By the due date (including extensions) of its income tax return. Showing their respective amount of income and tax withheld.

All resident partners must file individual income tax returns with Oklahoma if they are required to file individual Federal Income Tax Returns. All nonresident partners that have gross income of $1,000.00 must file an Oklahoma Return even though their net may actually be a loss.

Form 586 is used to report to the Oklahoma Tax Commission (OTC) that the below named entity is electing, or revoking an election, to become an electing pass-through entity (PTE).

Each individual taxpayer may deduct up to Ten Thousand Dollars ($10,000.00) of retirement benefits paid by the State of Oklahoma or by the federal government. This deduction cannot exceed the amount included in the taxpayer's federal adjusted gross income.

Pass-through entities are treated as reporting, but not taxable, entities for Oklahoma income tax purposes unless they elect to pay the pass-through entity (PTE) tax. The income of the entity is passed through to the owners and each owner is taxed on his or her distributive share.

Form 514-PT must be completed for nonresidents electing to be included in a composite return. Form 587-PTE must be completed for an electing PTE. If the Oklahoma capital gain deduction (Form 561-P or 561-PTE) is included in Column C or F of Form 514-PT, or Column C of Form 587-PTE, place an ?X? in the box.

Every corporation organized under the laws of this state or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma.