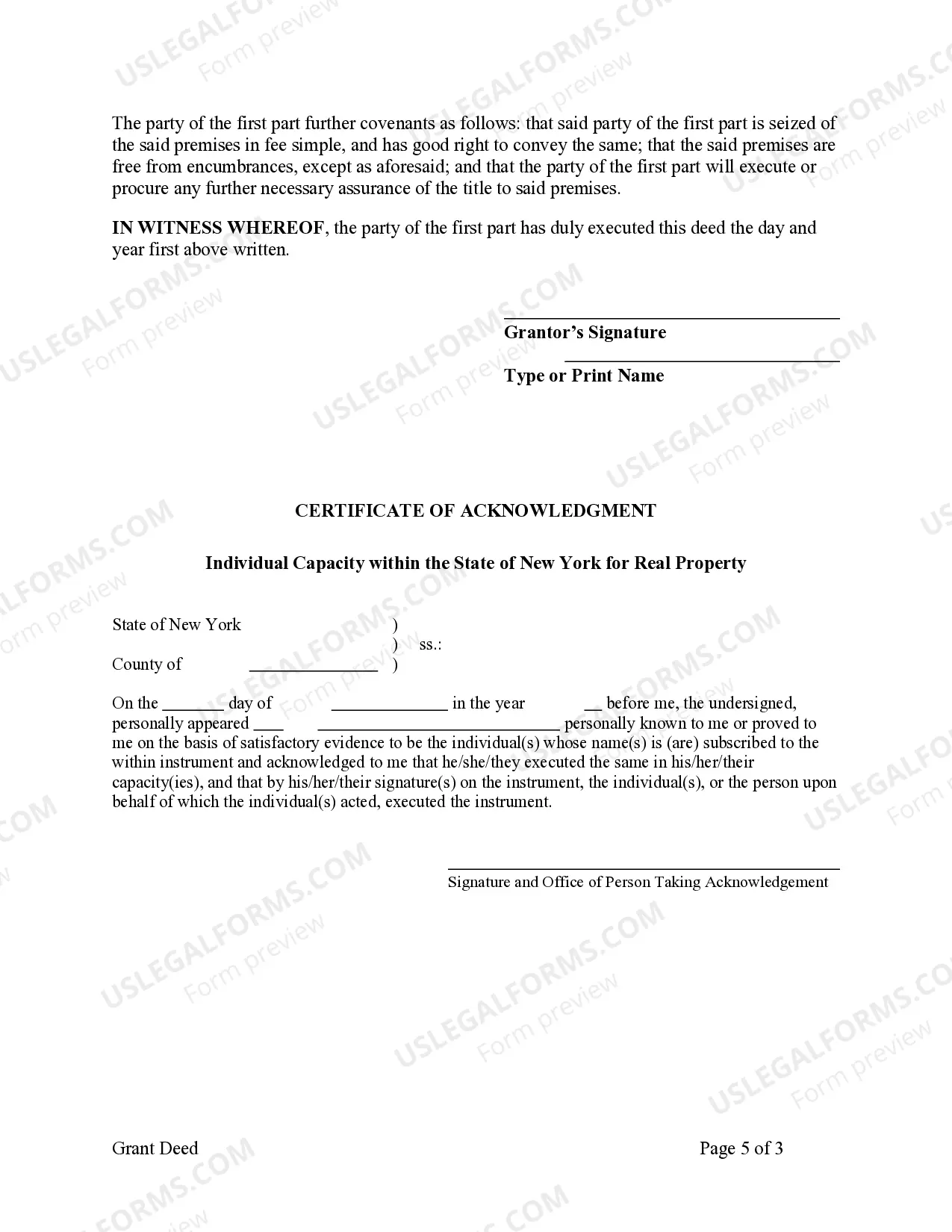

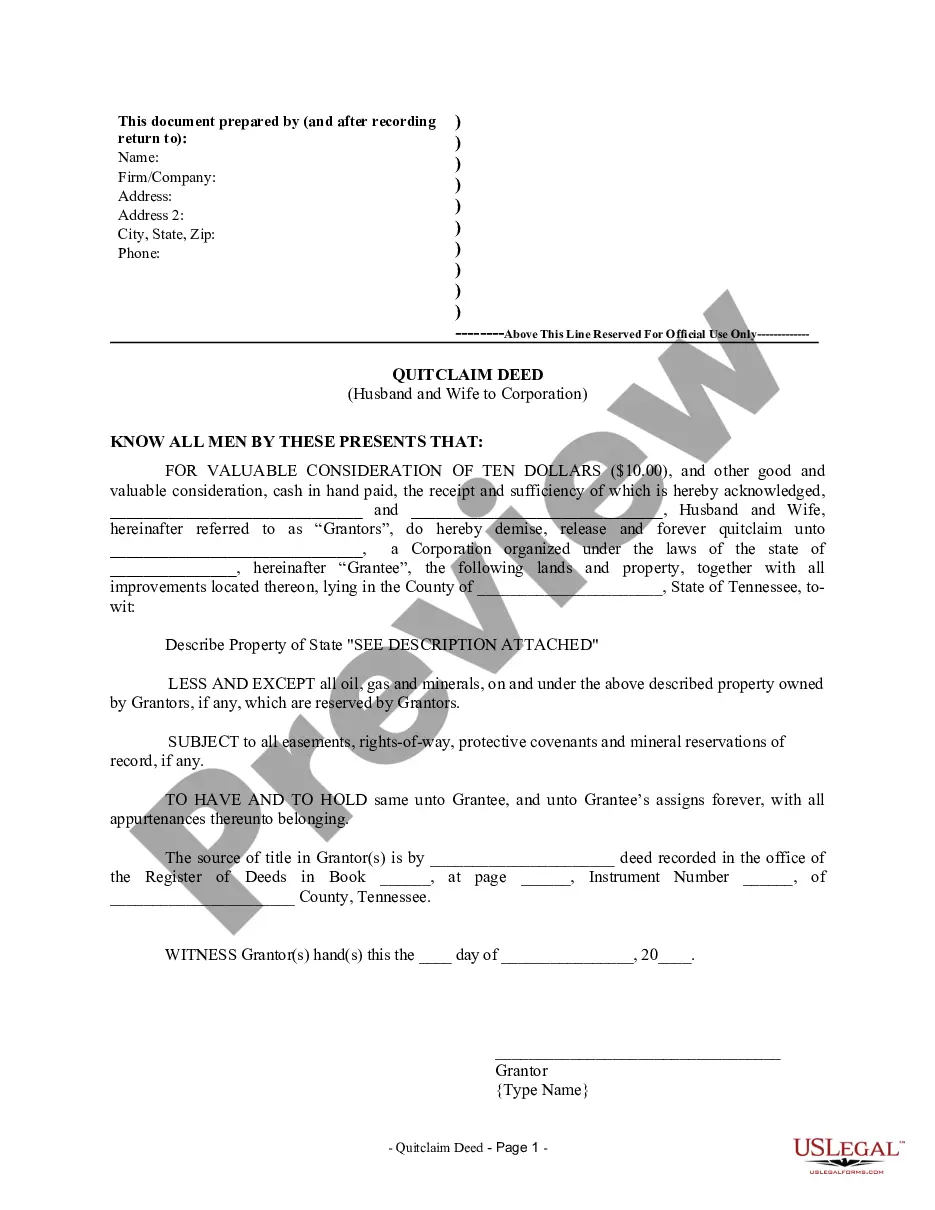

This form is a Grant Deed where the Grantor is an individual and the Grantees are two individuals or husband and wife. This deed complies with all state statutory laws.

Individual Grant Deed With Right Of Survivorship

Description

How to fill out Individual Grant Deed With Right Of Survivorship?

Red tape necessitates exactness and correctness.

Unless you engage in completing documentation such as Individual Grant Deed With Right Of Survivorship daily, it might lead to some misinterpretations.

Choosing the appropriate template initially will guarantee that your document submission proceeds seamlessly and avert any troubles of resubmitting a file or recreating the same work entirely from the beginning.

If you are not a registered user, finding the required template will involve a few extra steps.

- Acquire the correct template for your documents in US Legal Forms.

- US Legal Forms is the largest online forms library that provides over 85 thousand templates for various fields.

- You can secure the latest and most pertinent version of the Individual Grant Deed With Right Of Survivorship by simply searching it on the site.

- Find, store, and save templates in your account or consult the description to ensure you possess the correct one available.

- With an account at US Legal Forms, you can effortlessly gather, keep in one location, and navigate the templates you save for quick access.

- While on the website, click the Log In button to sign in.

- Subsequently, proceed to the My documents page, where the inventory of your documents is stored.

- Review the descriptions of the forms and save those you need at any time.

Form popularity

FAQ

While the right of survivorship offers many benefits, it can also present disadvantages. One significant drawback is that it may not align with an individual's estate planning goals, especially if the property owner wishes to distribute assets differently upon their death. Moreover, the automatic transfer can prevent certain family members from inheriting. Therefore, consider using platforms like USLegalForms for tailored documents that address these complexities.

In Canada, if a property is held with an individual grant deed with right of survivorship, the surviving owner typically supersedes the terms of any will. This means that the property automatically transfers to the survivor, bypassing the will's instructions. Beneficiaries designated in a will may not have claim over assets with a right of survivorship. Understanding this distinction can simplify estate planning and clarify your intentions.

Survivorship differs from inheritance due to its automatic nature. With an individual grant deed with right of survivorship, the survivor directly receives the property without going through probate, unlike traditional inheritance processes. Inheritance often requires legal documentation and can result in disputes or delays. Thus, survivorship offers a smoother transition of assets between property owners.

The right of survivorship in Canada allows joint property owners to inherit the entire property upon the death of one owner. This legal concept operates under an individual grant deed with right of survivorship, ensuring that the remaining owner automatically assumes ownership. It simplifies the transfer process and avoids delays related to probate. Overall, this arrangement provides clarity and security for property ownership.

An example of the right of survivorship occurs when two individuals own a home together as joint tenants. If one owner dies, the surviving owner immediately receives full ownership of the property, eliminating the need for probate. This arrangement not only simplifies the transfer of property but also offers peace of mind, knowing the surviving owner will retain the asset without legal complications.

Yes, the right of survivorship generally takes precedence over a will in Canada. This means that if a property is held in joint tenancy with right of survivorship, the property will automatically transfer to the surviving owner, bypassing the terms of a will. It’s crucial to structure property ownership carefully to ensure it aligns with your estate planning intentions.

To create a joint tenancy with right of survivorship, you typically need an individual grant deed that specifies all owners as joint tenants. Each co-owner must agree to this arrangement and can sign the deed. It is wise to consult a legal professional or use resources like US Legal Forms, which can provide templates and guidance to ensure that the deed meets all legal requirements.

The common abbreviation for joint tenancy with right of survivorship is JTWROS, which stands for Joint Tenants With Right Of Survivorship. This term is often used in legal documents and discussions related to property ownership. Understanding this abbreviation can help you navigate property agreements and documentation more effectively.

A joint tenant with the right of survivorship is an individual who co-owns property with one or more persons. When one joint tenant passes away, their share of the property automatically transfers to the surviving co-owner(s) rather than being passed through a will or trust. This means that the ownership remains intact without the need for probate, providing a smooth transition of property ownership.

For a married couple, joint tenancy with right of survivorship is often deemed the best form of ownership. This arrangement ensures that if one spouse passes away, the surviving spouse automatically inherits the entire property without probate issues. Additionally, establishing this through an individual grant deed with right of survivorship can ease the legal process. It is key to consult with legal professionals to ensure the right choice for your situation.