Ny Tax Lien Foreclosure

Description

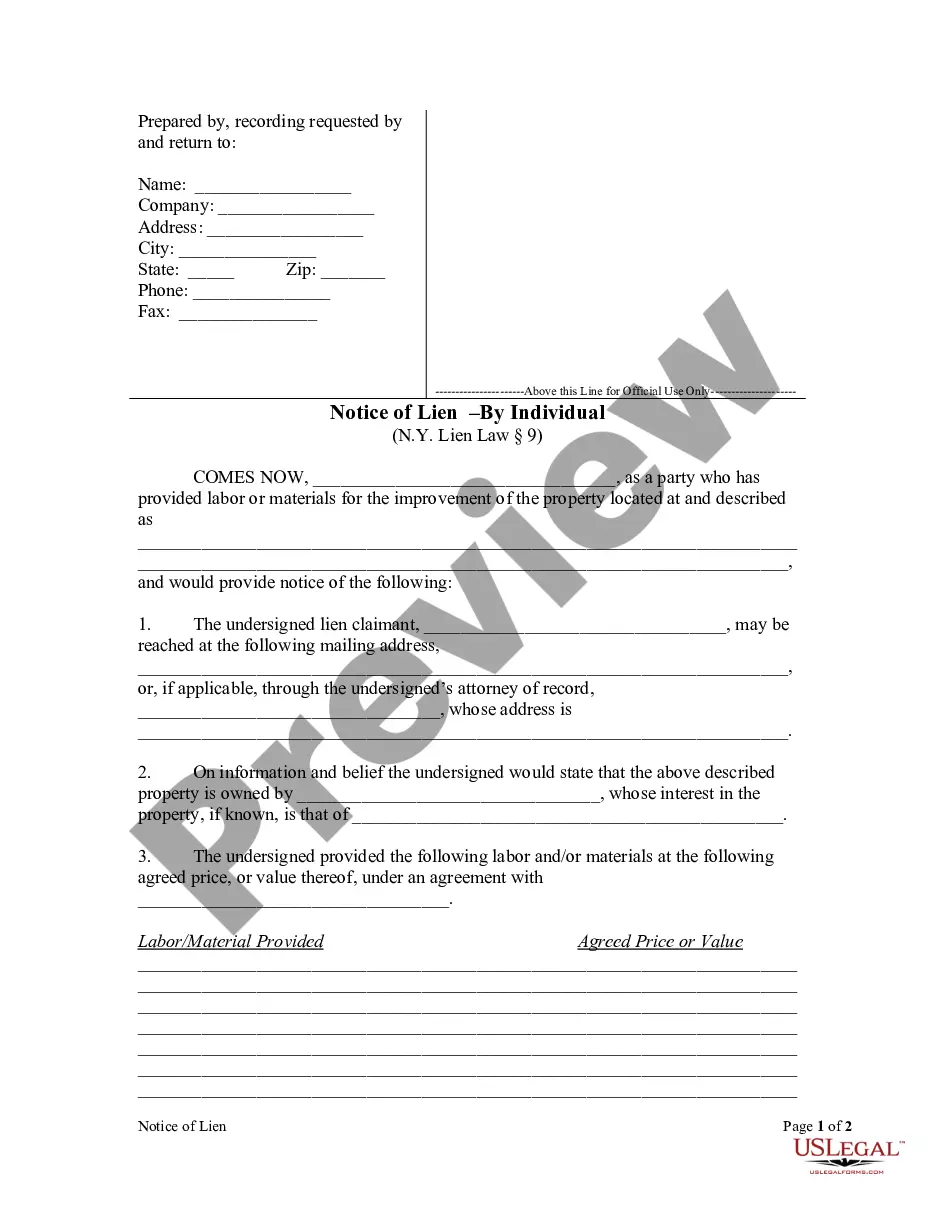

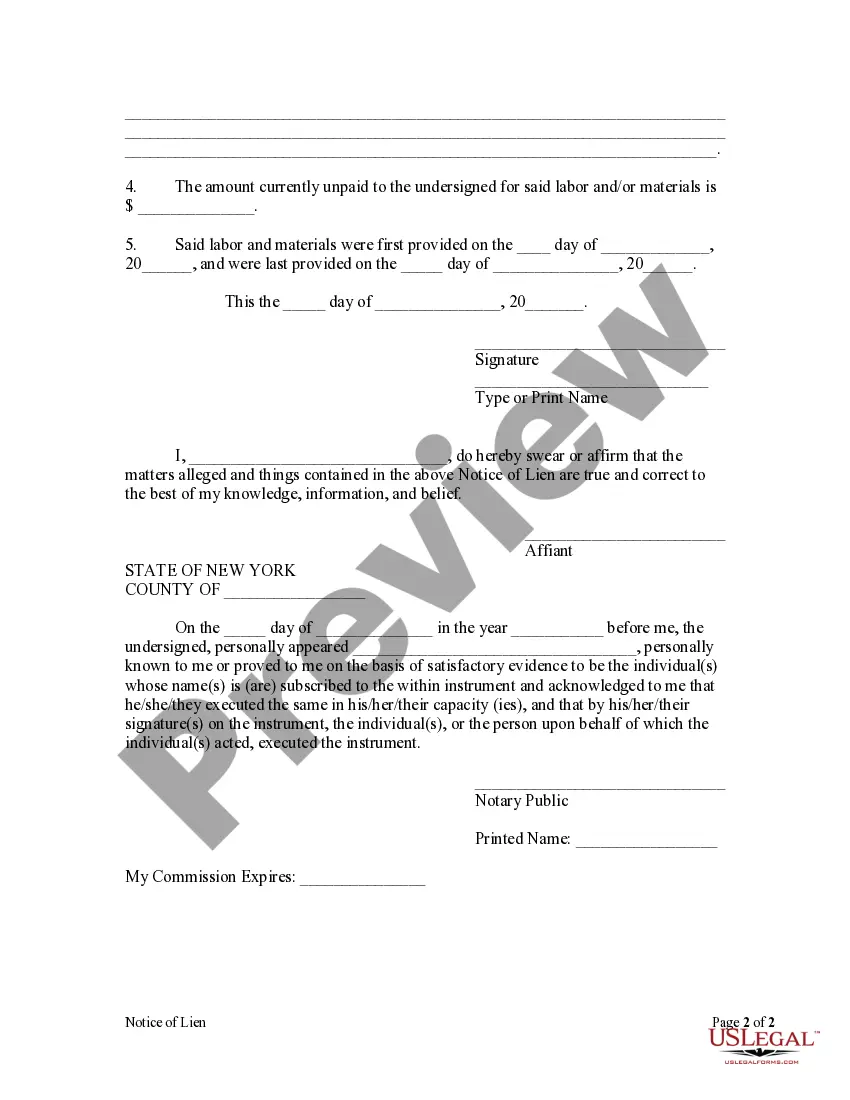

How to fill out New York Notice Of Lien By Individual?

Managing legal documentation and processes can be a lengthy addition to your schedule. New York Tax Lien Foreclosure and similar forms frequently require you to search for them and figure out how to fill them out correctly.

Consequently, whether you are addressing financial, legal, or personal issues, having a comprehensive and user-friendly online collection of forms readily available will significantly help.

US Legal Forms is the premier online service for legal templates, featuring over 85,000 state-specific forms and a variety of resources to help you complete your paperwork efficiently.

Browse the collection of relevant documents available to you with just one click.

After that, follow the steps outlined below to complete your form: Ensure you have located the correct form by using the Review option and examining the form details. Select Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download then fill out, eSign, and print the form. US Legal Forms has 25 years of experience helping users manage their legal documentation. Obtain the form you require now and simplify any process effortlessly.

- US Legal Forms offers you state- and county-specific forms accessible at any time for download.

- Protect your document management processes using a high-quality service that enables you to create any form within minutes without any additional or hidden costs.

- Simply Log In to your account, locate New York Tax Lien Foreclosure, and download it directly from the My documents section.

- You can also access previously stored forms.

- Is this your first time using US Legal Forms? Register and create an account in just a few minutes to gain access to the form collection and New York Tax Lien Foreclosure.

Form popularity

FAQ

To foreclose on a tax lien property, you must follow the legal procedures set by your state. This often involves obtaining a tax lien certificate, notifying the property owner, and then proceeding to auction the property if the taxes remain unpaid. Understanding the process of NY tax lien foreclosure can help you make informed decisions. US Legal Forms provides resources that can simplify this complex process and ensure compliance with local laws.

In Arkansas, property owners can be delinquent on property taxes for up to three years. After this period, the government can initiate a tax lien foreclosure. It is crucial to stay informed about your tax status to avoid losing your property. For assistance in managing tax liens, consider using US Legal Forms to access various resources.

Recently, New York introduced updated laws regarding foreclosure procedures to enhance homeowner protections. These changes aim to provide borrowers with more time to respond and access assistance. As you explore the landscape of NY tax lien foreclosure, it’s important to stay informed about these legal adjustments. US Legal Forms offers straightforward resources that can guide you through understanding these new regulations.

In New York, tax liens typically survive the foreclosure process. This means that if a property goes through foreclosure, the tax lien remains attached to the property. Consequently, the new owner may still be responsible for paying off the tax lien. To navigate the complexities of NY tax lien foreclosure, consider using the resources provided by US Legal Forms, which can help you understand your obligations.

Removing an NYS Tax Lien requires a resolution Pay in full ? Pay the debt off and the liens come off. Payment Plan ? Once paid in full, the liens will be released. Offer In Compromise ? Debt is settled for less than you owe. Hard to get if you have valuable property though.

A tax lien is a legal claim against real property for unpaid municipal charges, such as property taxes, housing maintenance, water, sewer, demolition, etc. An owner whose property is subject to a tax lien sale will receive a lien sale notice and the lien sale list will be published publicly.

If the taxes are not paid, after being awarded a foreclosure judgment in court, the city can convey the tax delinquent property to a qualified third party. The new owner is selected based on the history and qualifications in property management that are submitted to the city.

In New York, the tax foreclosure procedure is similar to the mortgage foreclosure process. A petition (lawsuit) is filed in court. If you don't respond to the lawsuit by filing an answer that lists your objections to the case, the court will enter a default judgment against the property.

In NYS under Article 11 of the Real Property Tax Law Foreclosure may begin after two years of delinquency on the taxes. However counties and cities have different policies and can extend that period to three to four years from the date of the delinquency.