Foreclosure Meaning

Description

How to fill out New York Referee's Deed In Foreclosure?

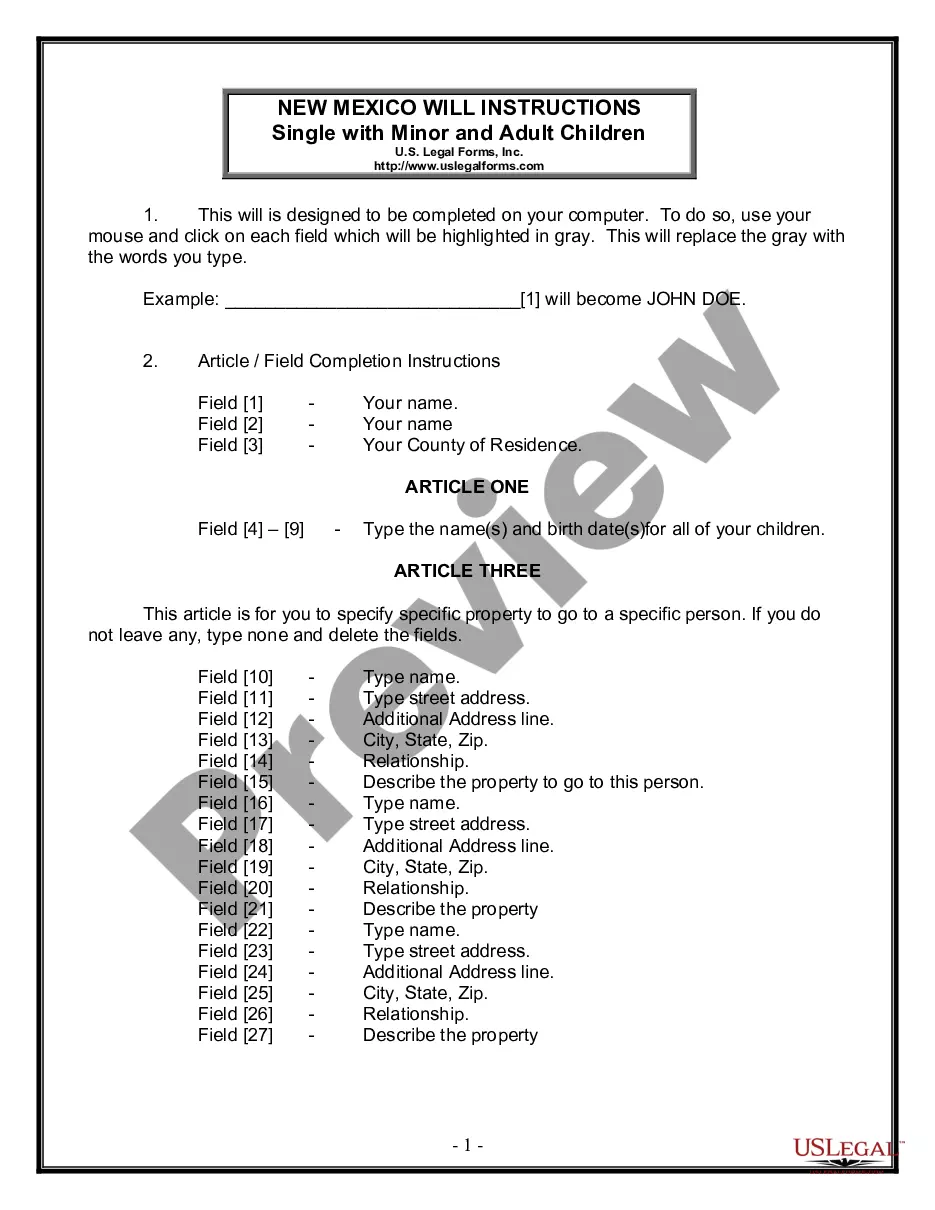

- If you are a returning user, log in to your account and access your preferred form template. Ensure your subscription remains valid, or renew it if necessary.

- For first-time users, begin by checking the Preview mode and the description of legal forms. This guarantees that you select the template that aligns with your legal requirements.

- If the template does not match your needs, use the Search tab to find an alternative form appropriate for your jurisdiction.

- Once you locate a suitable document, click the Buy Now button and select your desired subscription plan. You'll need to create an account to access the full library.

- Proceed to checkout by entering your payment details through credit card or PayPal to finalize your subscription.

- Download your chosen form and save it on your device, making it easily accessible in the My Forms section of your profile whenever needed.

By utilizing US Legal Forms, users can efficiently create important legal documents with confidence. Their extensive library exceeds that of competitors, offering over 85,000 customizable forms.

Take charge of your legal needs today and see how US Legal Forms can empower you to create precise documents with ease!

Form popularity

FAQ

One major downside of foreclosure is its negative impact on your credit score, which can take years to repair. Additionally, homeowners lose their property, leading to instability and emotional distress. Exploring the foreclosure meaning helps highlight the importance of preventive measures. Consider using US Legal Forms to find ways to handle potential foreclosure scenarios effectively.

In New Mexico, foreclosure typically follows a judicial process, meaning it involves court proceedings. The lender must file a lawsuit to initiate the foreclosure, and the borrower gets a chance to respond. Understanding the foreclosure meaning in this context can clarify your rights and options. US Legal Forms provides useful resources to navigate these legal intricacies.

Writing the term foreclosure is straightforward; it is spelled F-O-R-E-C-L-O-S-U-R-E. In any legal document or discussion, clear usage of this term helps convey important information about property repossession. Grasping the foreclosure meaning can enhance your understanding of related documents or discussions.

Typically, it is the borrower who suffers the most in a foreclosure situation. They lose their home and face damage to their credit history, which can take years to recover. Moreover, family dynamics can strain under such financial stress. Knowing the foreclosure meaning is vital for anyone facing this challenge.

Foreclosure does not entirely wipe out debt. Instead, it allows a lender to reclaim a property when the borrower defaults on their mortgage payments. Remaining debts may transfer to collections, impacting your credit score. Therefore, understanding foreclosure meaning can help you navigate the potential financial consequences.

In simple terms, foreclosure is the legal process through which a lender takes possession of a property due to unpaid mortgage payments. The lender files a claim, and if the borrower cannot settle the debt, the property may be sold. Foreclosure meaning highlights how important it is for homeowners to communicate with their lenders to explore alternatives. Early intervention can sometimes prevent foreclosure entirely.

When you allow a house foreclosure, you are ultimately losing ownership of the property. The lender initiates legal proceedings, and the house may be sold at auction. This affects your credit score significantly, making it challenging to secure loans in the future. Understanding foreclosure meaning helps you grasp the implications and prepare for better financial decisions.

Foreclosures in Maryland typically follow a judicial process, meaning they go through the court system for resolution. After missed payments, the lender must file a lawsuit to begin the process. Knowing foreclosure meaning here indicates that the process aims to protect the lender's investment while also allowing for homeowner rights. If you're facing foreclosure, seeking guidance can help you understand your options and potentially save your home.

To buy a foreclosed home in Maryland, start by researching available properties through real estate listings or auctions. Often, banks or government entities will sell these homes. Understanding foreclosure meaning helps you to recognize the unique buying process and potential risks involved. Make sure to consult with real estate professionals or platforms like uslegalforms to ensure you handle the paperwork correctly and secure a beneficial deal.

In Maryland, you can typically miss three to six mortgage payments before the foreclosure process starts. However, the exact timeline may vary based on your lender's policies. Understanding foreclosure meaning is essential; it refers to the legal process by which a lender takes possession of a property due to unpaid mortgage debt. Staying informed can help you navigate this situation effectively.