New York Form Application Withholding Tax Rate

Description

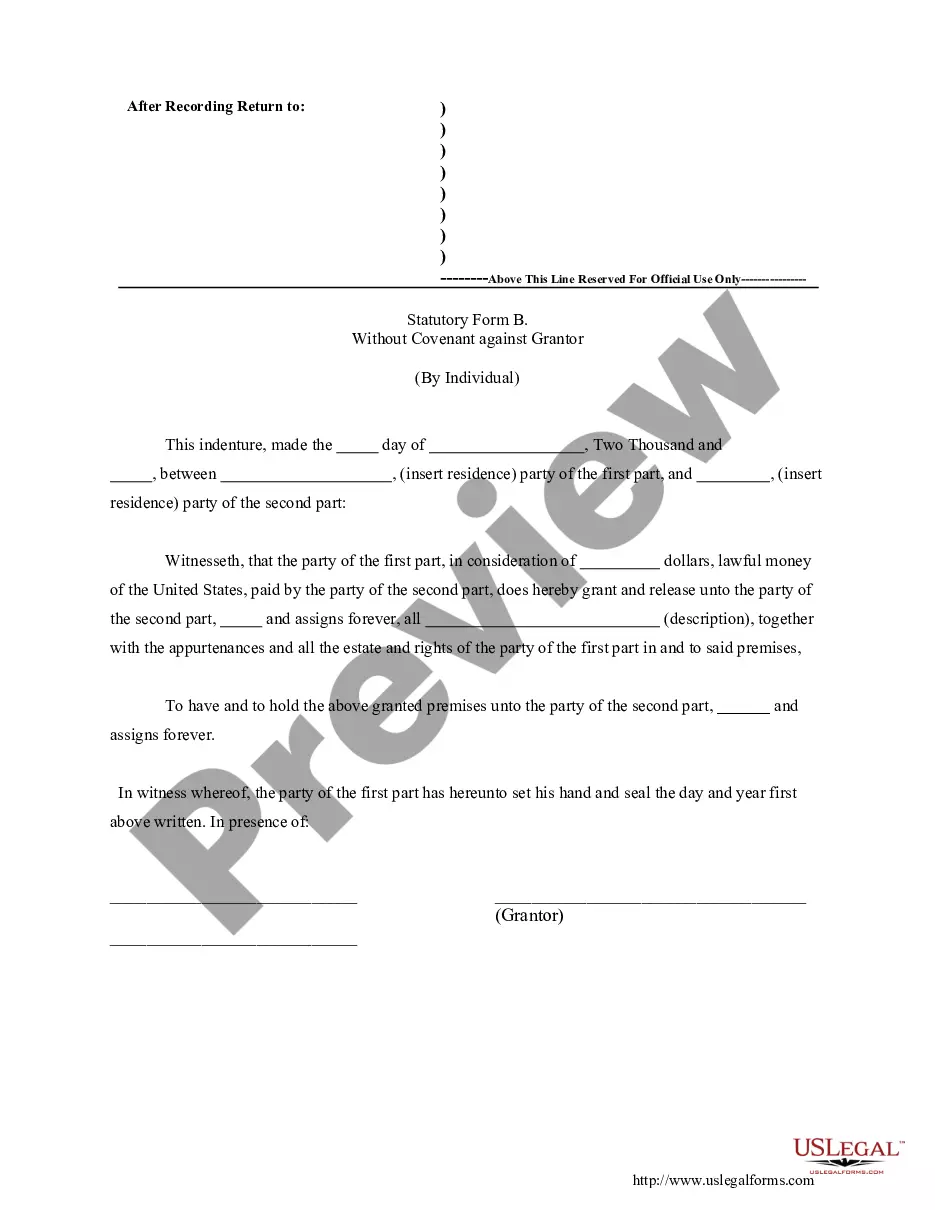

How to fill out New York Form Application Withholding Tax Rate?

How to obtain professional legal documents that comply with your state regulations and formulate the New York Form Application Withholding Tax Rate without hiring a lawyer.

Numerous online services provide templates for a variety of legal situations and formalities.

However, it may require time to identify which of the readily available samples satisfy both practical and legal standards for your needs.

Download the New York Form Application Withholding Tax Rate via the button next to the file name. If you don't have a US Legal Forms account, follow the instructions below: Browse the webpage you've opened and verify if the form meets your requirements. To do this, use the form description and preview options if available. Search for another template in the header specifying your state if necessary. Click the Buy Now button upon finding the appropriate document. Select the most suitable pricing plan, then Log In or pre-register for an account. Choose your payment method (by credit card or via PayPal). Adjust the file format for your New York Form Application Withholding Tax Rate and click Download. The acquired documents will remain in your possession: you can always access them in the My documents tab of your profile. Join our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is a reliable platform that assists you in finding official documents drafted according to the latest updates in state law and allows you to save money on legal help.

- US Legal Forms is not an ordinary web catalog.

- It is a repository of over 85,000 verified templates suitable for various business and personal scenarios.

- All documents are organized by area and state to streamline your search process.

- Additionally, it includes robust solutions for PDF editing and electronic signatures, enabling users with a Premium subscription to effortlessly complete their documents online.

- It requires minimal time and effort to acquire the necessary paperwork.

- If you already have an account, Log In and confirm the validity of your subscription.

Form popularity

FAQ

Yes, New York does have a state withholding form, known as the IT-2104, which you can use to determine your withholding status and allowances. This form is essential for both employees and employers to ensure compliance with state tax laws. For convenient access and guidance on the New York form application withholding tax rate, check the resources available at US Legal Forms.

The amount of New York state tax withheld should be based on your income level and personal exemptions. Generally, you can refer to the withholding tables available through the New York state Department of Taxation and Finance for precise amounts. Utilizing the New York form application withholding tax rate can help ensure you meet your tax obligations and avoid surprises during tax season.

Calculating your state tax withholding in New York requires knowing your income, allowable deductions, and the applicable tax rate. You can use tools such as state tax calculators or the resources provided on the US Legal Forms platform to simplify this process. Understanding the New York form application withholding tax rate is crucial for accurate calculations.

New York taxes can take a significant portion of your paycheck depending on your income and allowances. On average, you might see around 6-8% withheld for state taxes, but factors like local taxes and deductions can influence this. To ensure you're withholding the correct amount, refer to the New York form application withholding tax rate details available on our US Legal Forms site.

The New York state withholding tax rate varies based on your income level and filing status. Typically, it ranges from 4% to 8.82%, depending on your taxable income. You can find specific rates on the official state tax website or through our platform at US Legal Forms, which provides detailed resources on the New York form application withholding tax rate.

To adjust your tax withholding, start by reviewing your current withholding amount on your paycheck. If it doesn't match your expectations, complete a new Form W-4 for federal tax or Form IT-2104 for New York taxes. Submitting these updated forms to your employer enables them to modify your upcoming paychecks, ensuring that you align with the New York form application withholding tax rate. Utilizing the services of US Legal Forms can simplify this process and help you understand the requirements better.

Adjusting your New York state tax withholding requires you to fill out a new Form IT-2104, which allows you to update your withholding allowances. You can submit this form to your employer at any time, and they will adjust your withholdings accordingly. This is key to ensuring you meet the New York form application withholding tax rate as per your latest financial situation. Regular adjustments can help prevent unexpected tax liabilities.

To register for withholding tax in New York, you will need to complete the New York State Department of Taxation and Finance's registration process. You can submit your application online, via mail, or in person. Make sure you have your business information handy, including your Employer Identification Number (EIN). Following this process will help you navigate the New York form application withholding tax rate effectively.

When filing your New York form application withholding tax rate, it's essential to determine the right number of withholding allowances that accurately reflect your circumstances. Typically, you can claim one allowance for yourself, plus additional allowances for dependents or other qualifying factors. To ensure you don’t owe taxes come filing season, consider using the IRS Form W-4 and New York's Form IT-2104 as guides. If you're unsure, consulting a tax professional can provide clarity.

Filling out your tax withholding form accurately is essential for ensuring the right amount of taxes are deducted. Start by referencing the New York form application withholding tax rate and gather necessary personal information. Ensure you correctly indicate your allowances and the income level, being cautious about future changes. Platforms like US Legal Forms offer detailed instructions and support to help streamline this process, making it much simpler for you.