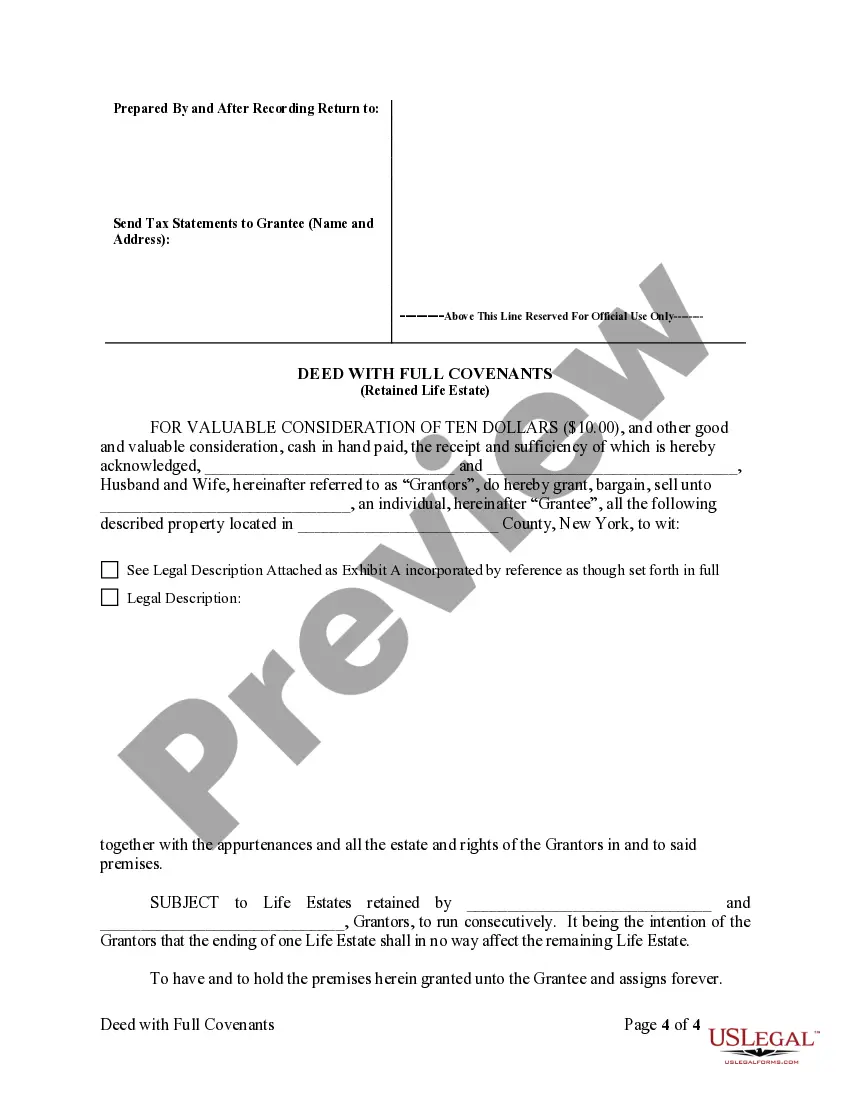

Deed With Life Estate Sample With Deed

Description

How to fill out New York Warranty Deed To Child Reserving A Life Estate In The Parents?

The Deed With Life Estate Sample With Deed you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Deed With Life Estate Sample With Deed will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it fits your needs. If it does not, use the search option to find the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Deed With Life Estate Sample With Deed (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a valid.

- Download your paperwork one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

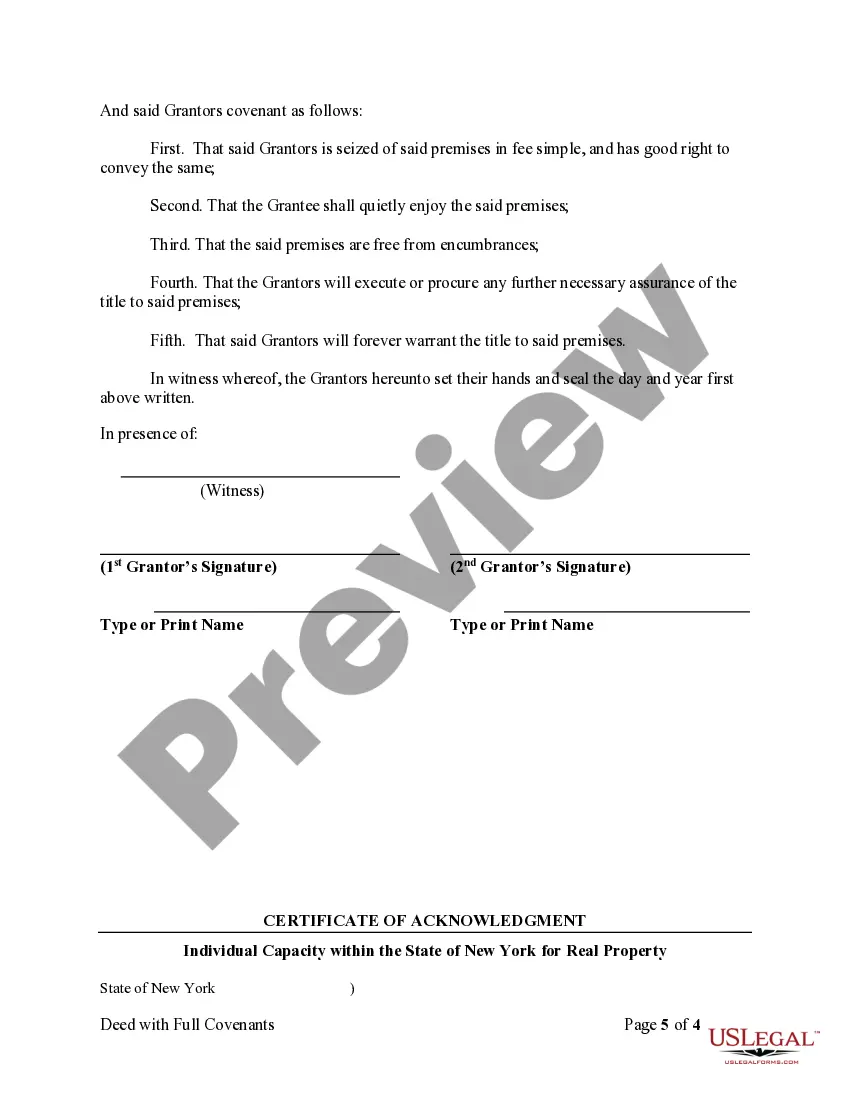

An example of a life estate with Jane Smith as the remainderman is "to John Smith for life, then to Jane Smith." Jane Smith is the remainderman in this example because she is the person inheriting title to the property following the death of John Smith.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

A: A life estate deed is an irrevocable transfer of your property to remainder beneficiaries (?remainderman?) while reserving the ownership and right of use of the property for your lifetime. This transfer avoids probate upon death while retaining ownership interest for your lifetime.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

A remainder interest in property is the value or portion of the property inherited by an individual after the death of another heir. The remainder interest can be created by a will, a trust agreement, or a deed. In turn, a remainderman is a person who holds a remainder interest in property.