Deed With Life Estate Sample Form Florida

Description

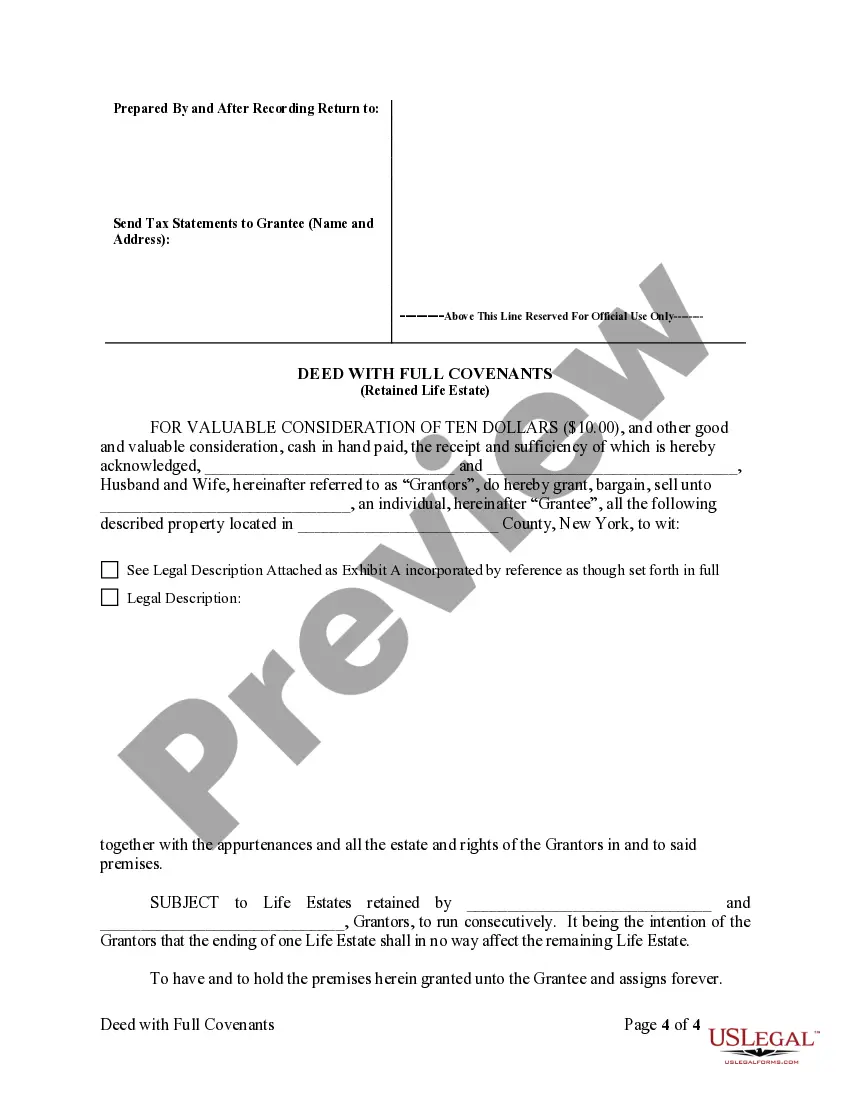

How to fill out New York Warranty Deed To Child Reserving A Life Estate In The Parents?

Finding a go-to place to access the most recent and appropriate legal samples is half the struggle of working with bureaucracy. Finding the right legal documents requirements accuracy and attention to detail, which is the reason it is very important to take samples of Deed With Life Estate Sample Form Florida only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and view all the details regarding the document’s use and relevance for the circumstances and in your state or region.

Consider the following steps to complete your Deed With Life Estate Sample Form Florida:

- Make use of the library navigation or search field to find your template.

- Open the form’s description to see if it fits the requirements of your state and area.

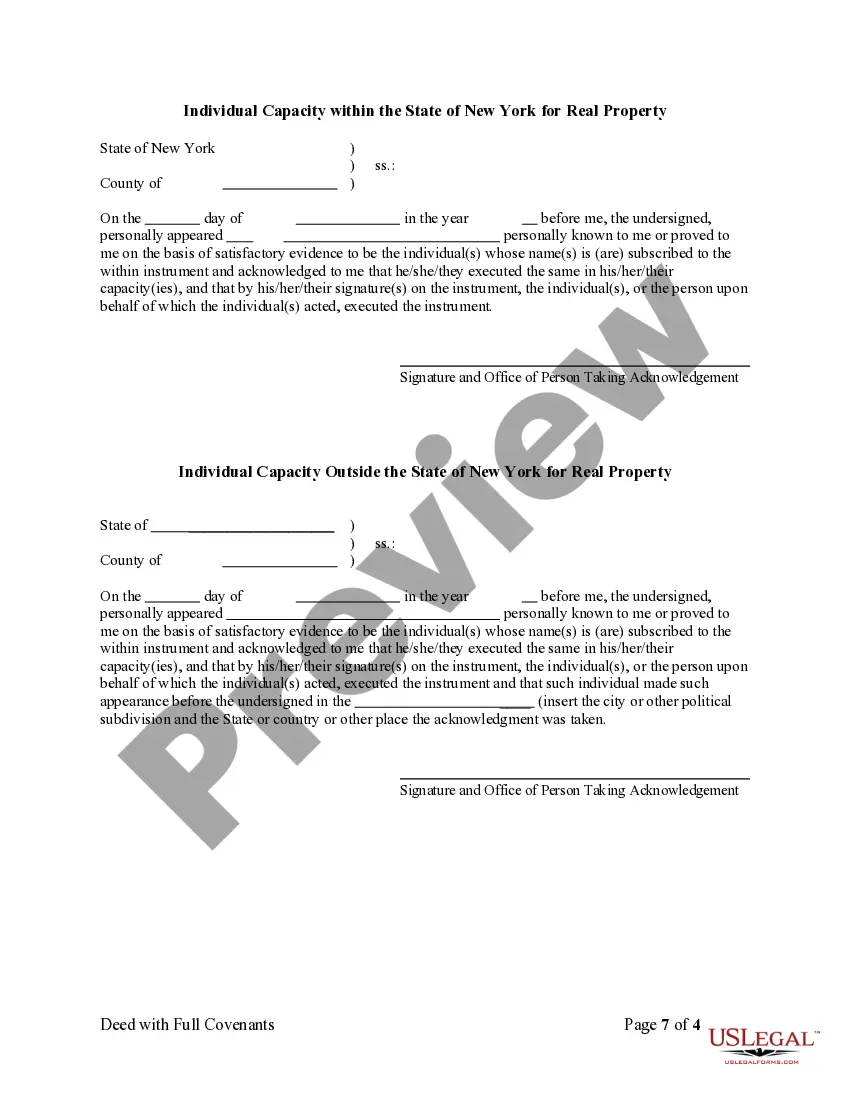

- Open the form preview, if there is one, to make sure the form is the one you are looking for.

- Go back to the search and locate the right template if the Deed With Life Estate Sample Form Florida does not match your requirements.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Choose the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Finalize your purchase by selecting a transaction method (bank card or PayPal).

- Choose the document format for downloading Deed With Life Estate Sample Form Florida.

- When you have the form on your gadget, you can alter it with the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal paperwork. Discover the comprehensive US Legal Forms catalog to find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

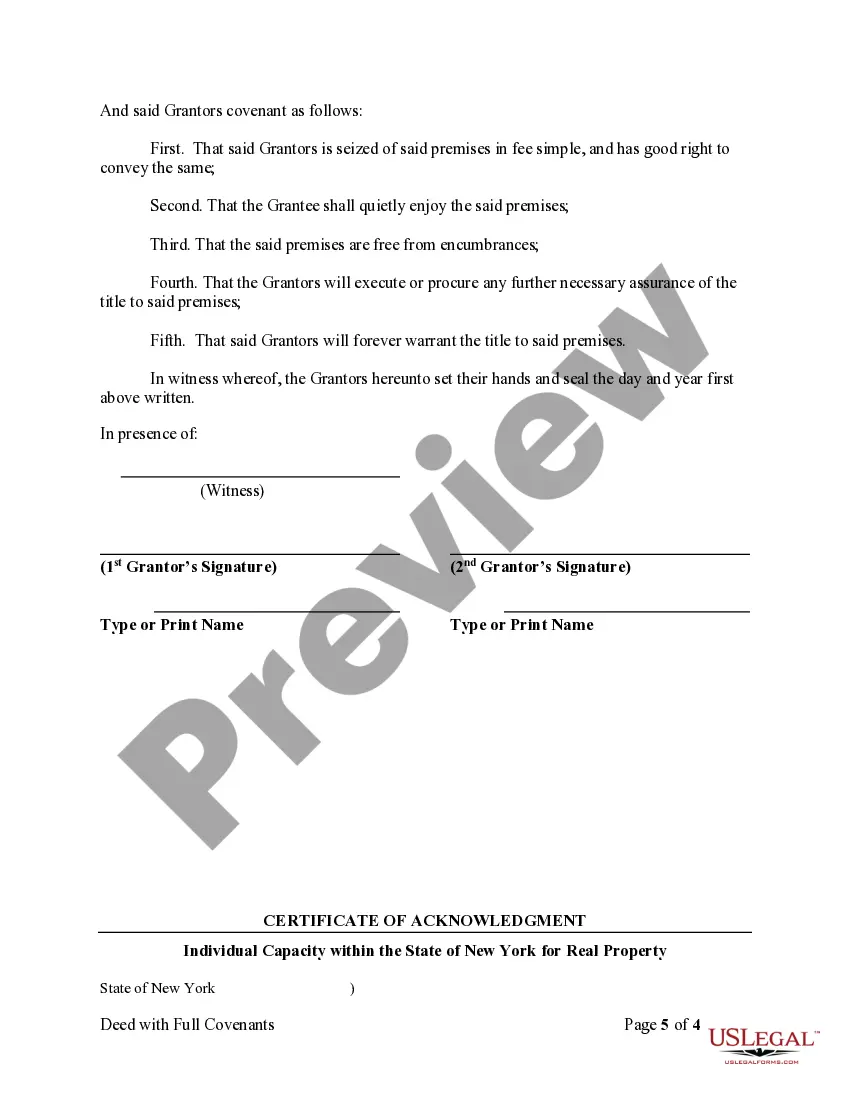

Life estate interests can be created by deed, by conveyance through last will and testament or as we commonly see as the default distribution of homestead to a spouse who is not on title and choses not to elect to take a one-half ownership interest in Property within six months from the date of death of their spouse.

The person holding the life estate ? the life tenant ? possesses the property during his or her life. The other owner ? the remainderman ? has a current ownership interest but cannot take possession until the death of the life estate holder.

A: A life estate deed is an irrevocable transfer of your property to remainder beneficiaries (?remainderman?) while reserving the ownership and right of use of the property for your lifetime. This transfer avoids probate upon death while retaining ownership interest for your lifetime.

The Florida Enhanced Life Estate Deed is a great estate planning tool because it allows a person to qualify for Medicaid and keep the homestead. Often using a regular life estate deed can disqualify a person from long-term government assistance.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.