New York Professional Llc Forms

Description

Form popularity

FAQ

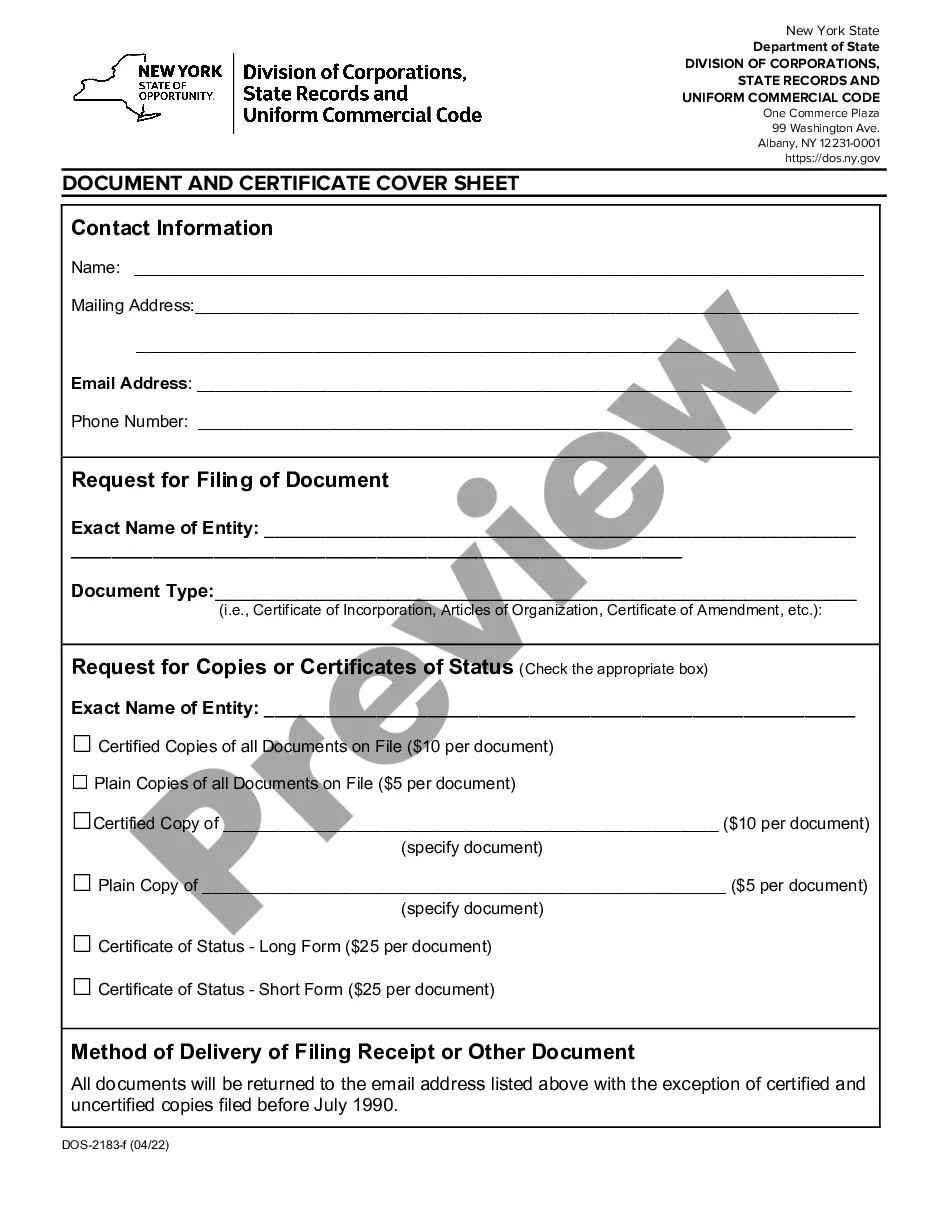

To establish a PLLC name in New York, the name must include ‘Professional Limited Liability Company’ or its abbreviations like ‘PLLC’. Additionally, the name must be distinguishable from existing business names and cannot imply a profession not licensed in New York. When selecting a name, be sure to review the specifics and prepare the necessary New York professional LLC forms to finalize your registration.

Yes, having an LLC in New York State may still require you to obtain specific business licenses, depending on your profession and location. While forming an LLC offers liability protection, it does not inherently grant you the right to operate without all necessary permits and licenses. Ensure you review the relevant regulations and prepare the appropriate New York professional LLC forms to stay compliant.

Doing business in New York includes maintaining a physical presence, such as a storefront or office. It can also involve regular interactions with clients or conducting significant sales transactions within the state. If your activities meet these criteria, you may need to file specific New York professional LLC forms to comply with state regulations and properly register your business.

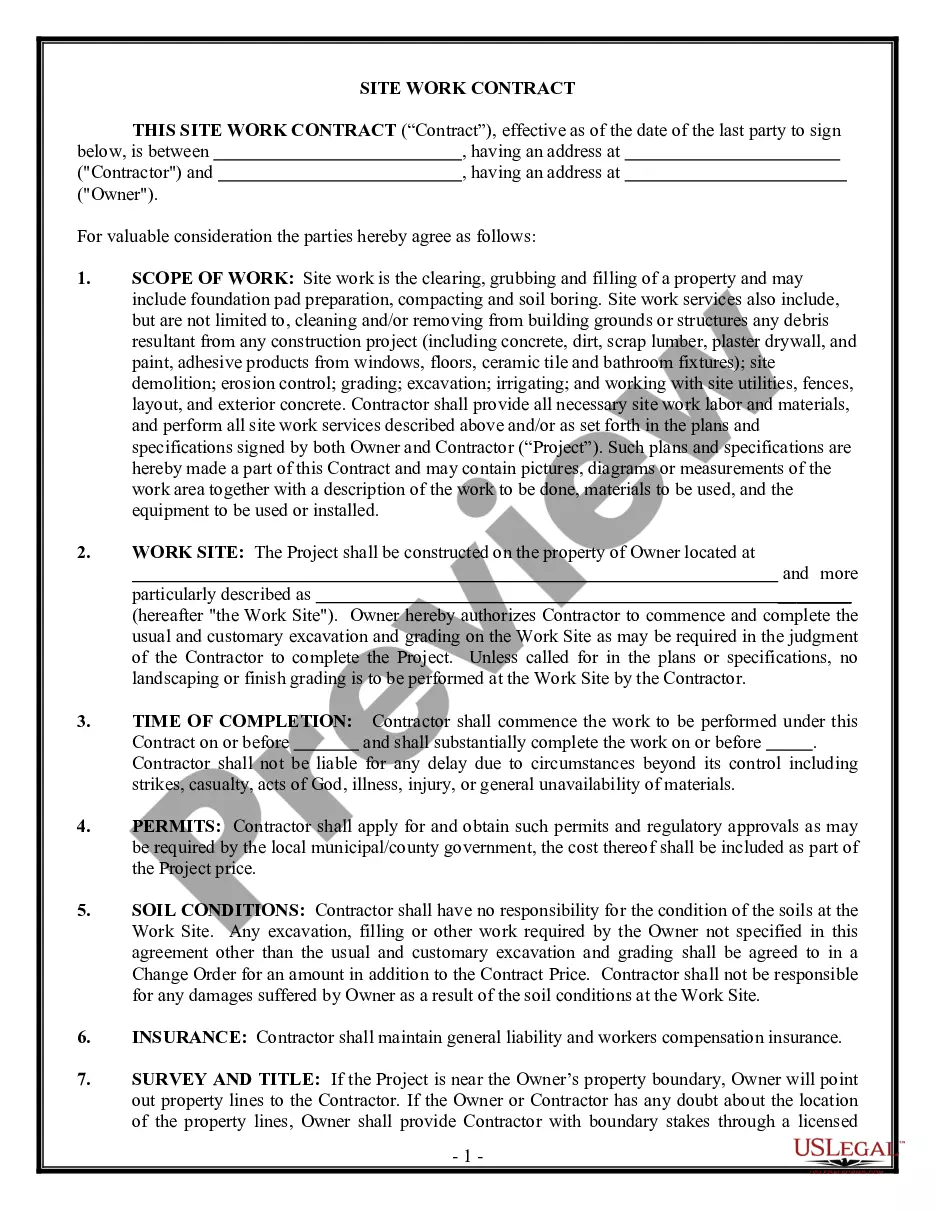

The cheapest way to form an LLC in New York typically involves filing the required documents yourself rather than hiring legal aid. This way, you save on attorney fees while ensuring that you understand the New York professional LLC forms you need to submit. Additionally, utilizing online platforms such as uslegalforms can provide affordable access to necessary templates and guidance to streamline your filing process.

In New York, a standard LLC cannot provide professional services unless it is structured as a PLLC. A PLLC is specifically designed for licensed professionals, allowing them to limit personal liability while working in regulated fields. If you are looking to provide professional services, it is crucial to complete the appropriate New York professional LLC forms to ensure compliance with state laws.

A PC, or Professional Corporation, is a business structure specifically designed for licensed professionals, such as doctors or lawyers. In contrast, a PLLC, or Professional Limited Liability Company, combines the benefits of limited liability protection with the structure of a traditional LLC. When choosing between these forms, it's important to consider your professional needs and how New York professional LLC forms can accommodate your business plan.

Section 206 of the New York State limited liability company law outlines the regulations governing the formation and operation of LLCs in New York. This section includes provisions that define the necessary filings and requirements for establishing a professional limited liability company, or PLLC. Understanding these regulations is essential when preparing New York professional LLC forms, as they guide compliance and effective business operation.

The account adjustment notice for NYS is a formal communication from the state regarding changes or corrections to your tax account. This notice can impact your professional LLC's financial records and obligations, so it is important to address any discrepancies promptly. Keeping your records accurate and up-to-date is crucial for compliance and avoiding penalties. For tailored assistance with your New York professional LLC forms, uslegalforms can help you through the process with ease.

The NYS sales tax certificate of authority allows businesses in New York to collect sales tax from customers. This certificate is a requirement for most vendors and ensures compliance with state tax laws. By obtaining this certificate, your professional LLC can engage in sales without facing penalties or legal issues. If you're unsure about how to access this document along with other New York professional LLC forms, uslegalforms offers valuable guidance.

NYS Form TR 570 is a crucial document for businesses in New York, particularly those looking to establish a professional LLC. This form is utilized to apply for a tax identification number, which is essential for tax reporting and compliance. By filling out NYS Form TR 570 accurately, you ensure your professional LLC can operate smoothly and meet its obligations. For assistance with New York professional LLC forms, consider exploring resources provided by uslegalforms.