Ny Business Corporation Form 2553 Instructions

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

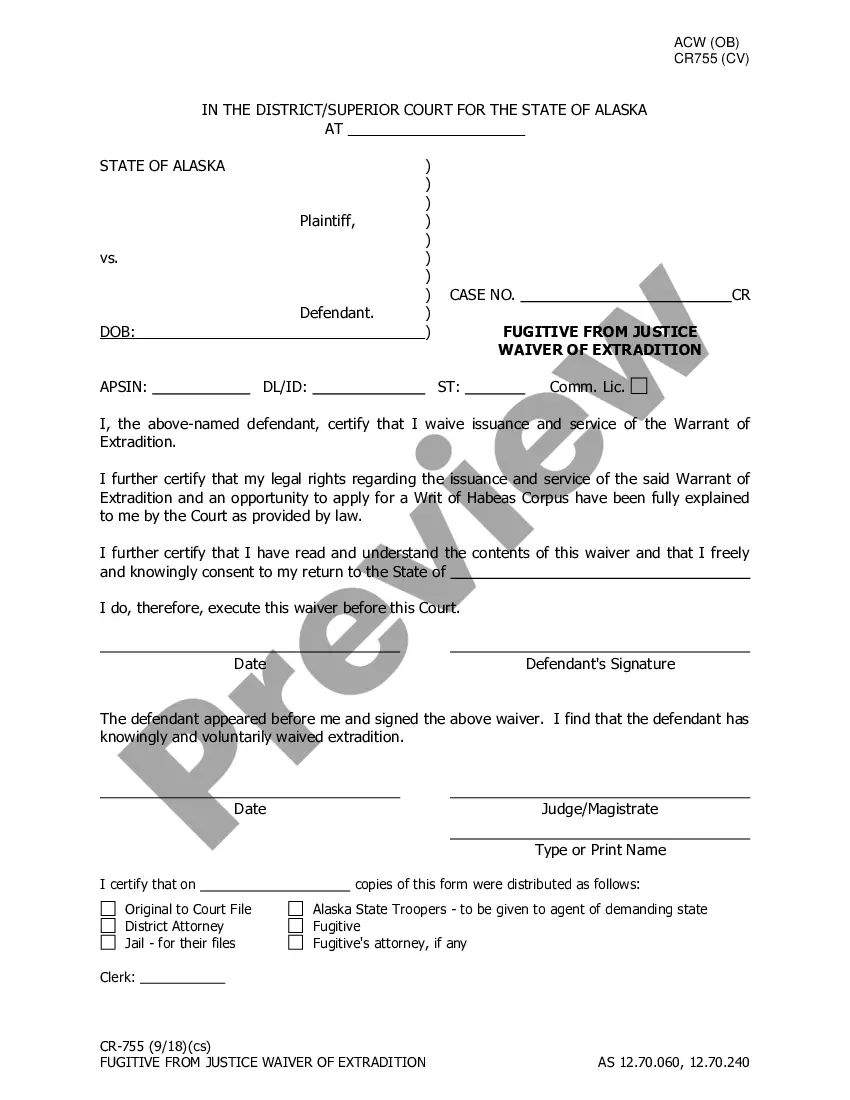

Regardless of whether it's for professional reasons or personal matters, everyone must navigate legal situations at some stage in their lives. Finalizing legal documents requires meticulous attention, starting with selecting the appropriate form template. For example, if you choose an incorrect version of a Ny Business Corporation Form 2553 Instructions, it will be rejected upon submission. Thus, it's vital to have a reliable source of legal documents like US Legal Forms.

If you need to acquire a Ny Business Corporation Form 2553 Instructions template, follow these straightforward steps.

With an extensive US Legal Forms collection available, you won’t have to waste time searching for the correct template online. Utilize the library’s easy navigation to find the suitable template for any occasion.

- Locate the sample you require using the search box or catalog navigation.

- Review the form’s description to confirm it fits your needs, state, and county.

- Click on the form’s preview to inspect it.

- If it’s the incorrect form, return to the search feature to find the Ny Business Corporation Form 2553 Instructions template you need.

- Download the template when it aligns with your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you haven't created an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you prefer and download the Ny Business Corporation Form 2553 Instructions.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Form CT-3-S ? Use the following address: NYS CORPORATION TAX. PO BOX 15182. ALBANY NY 12212-5182. Private delivery services.

You must file the Articles of Incorporation with the New York Department of State, Division of Corporations. The filing fee is $125.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

There are ten steps you'll complete to start an S Corp in New York. Step 1: Choose a Business Name. ... Step 2: Obtain EIN. ... Step 3: Certificate of Incorporation. ... Step 4: Registered Agent. ... Step 5: Corporate Bylaws. ... Step 6: Directors and Meeting Requirements. ... Step 7: Stock Requirements. ... Step 8: Biennial Statement.

A business can register as an "S corporation" for filing New York State taxes. The filing allows individual shareholders to report corporate income on their own tax returns. All shareholders must agree to file. Businesses must also be registered as a S corporation with the federal government.