New York Corporation Ny Fort Plain

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

It’s well-known that you cannot become a legal expert right away, nor can you understand how to swiftly prepare New York Corporation Ny Fort Plain without a specific educational background.

Drafting legal documents is a lengthy process demanding particular training and abilities. So why not delegate the creation of the New York Corporation Ny Fort Plain to the experts.

With US Legal Forms, which is one of the most extensive legal template libraries, you can find everything from court documents to templates for office communication. We recognize the importance of compliance and adherence to federal and local regulations. That’s why, on our platform, all templates are specific to locations and current.

Select Buy now. Once the purchase is completed, you can download the New York Corporation Ny Fort Plain, complete it, print it, and send or mail it to the necessary individuals or organizations.

You can regain access to your forms from the My documents tab at any time. If you are a returning client, you can just Log In and find and download the template from the same tab.

- Begin by visiting our website and obtain the document you need in just a few minutes.

- Use the search bar at the top of the page to find the form you require.

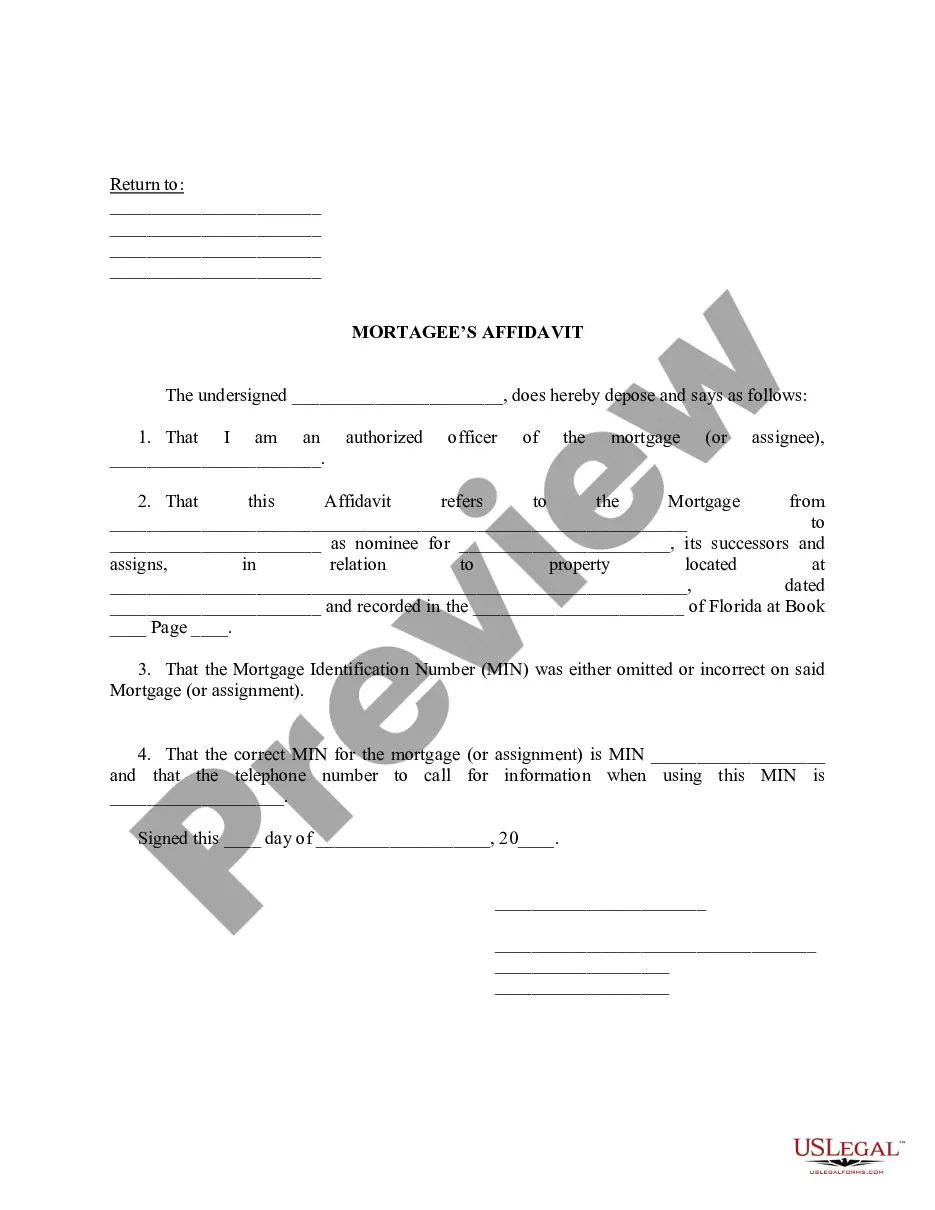

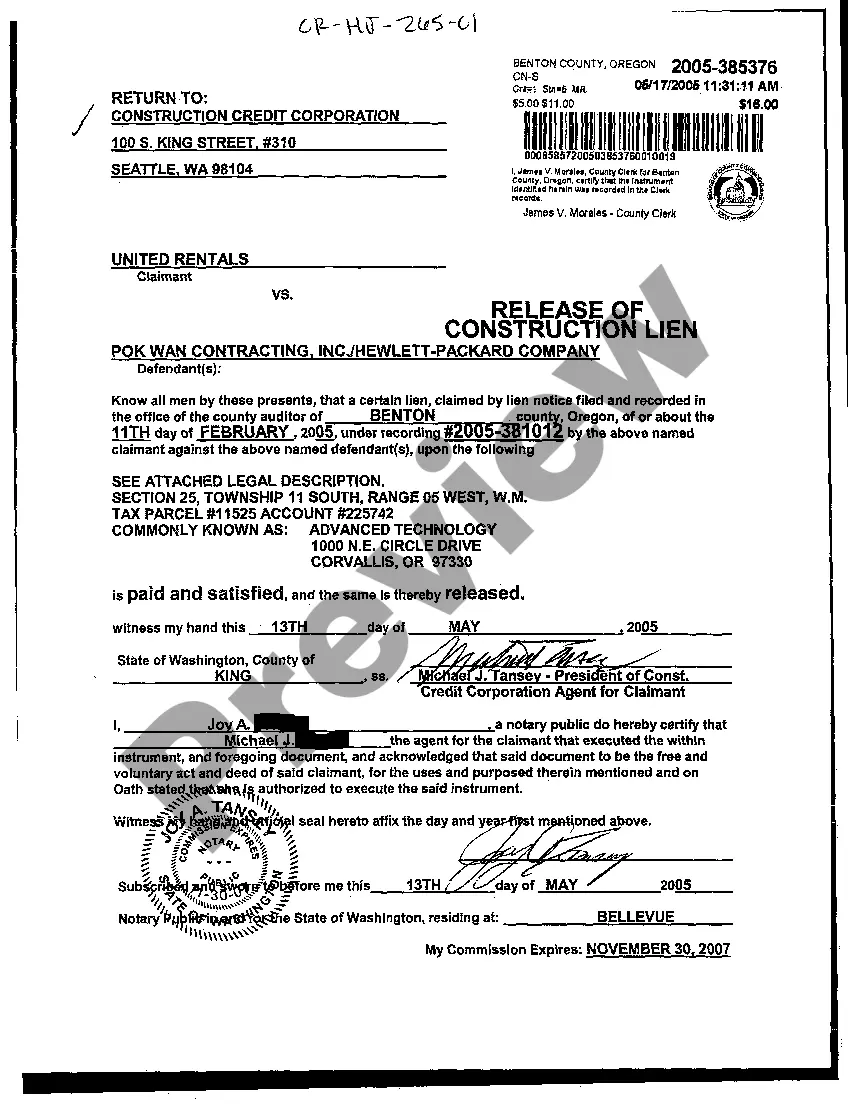

- Preview it (if this option is available) and review the supporting description to ascertain if New York Corporation Ny Fort Plain is what you're looking for.

- If you require another form, initiate your search again.

- Create a free account and select a subscription option to purchase the form.

Form popularity

FAQ

If you do not file your report within the one-month filing period, the Department of State will determine your company to be delinquent. There are no penalties for filing a late New York biennial report to remove your delinquent status.

The mailing address is New York State Department of State, Division of Corporations, Statement Unit, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231-0002.

How to Form a Corporation in New York Choose a Corporate Name. ... File Certificate of Incorporation. ... Appoint a Registered Agent. ... Prepare Corporate Bylaws. ... Appoint Directors and Hold First Board Meeting. ... Issue Stock. ... File New York Biennial Statement. ... Comply With Other Tax and Regulatory Requirements.

The biggest difference is that corporations have ?shareholders? and LLCs have ?members.? Corporations tend to have many owners, while LLCs are now the most common small business entity type.

If you fail to file your New York biennial statement, you won't be charged any late fees and New York will not administratively dissolve your LLC. Instead, the New York Department of State will change your LLC's status to ?past due,? meaning you'll lose your good standing.