New York Business Corporation Withholding Tax

Description

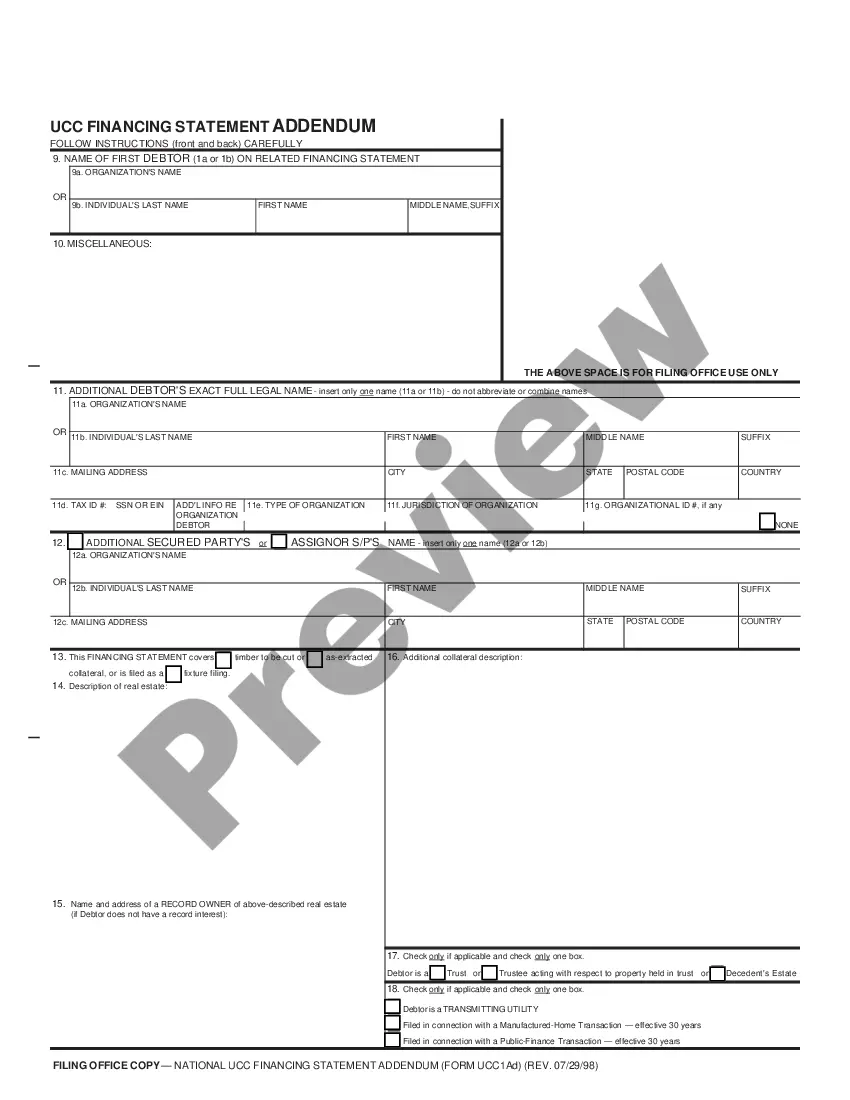

How to fill out New York Business Incorporation Package To Incorporate Corporation?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial investment.

If you're looking for a simpler and more cost-effective method to produce the New York Business Corporation Withholding Tax or any other document without unnecessary obstacles, US Legal Forms is always here for you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters.

Before diving straight into downloading the New York Business Corporation Withholding Tax, adhere to these suggestions: Review the document preview and details to confirm you are on the correct document, ensure the template you select meets the standards of your state and county, choose the appropriate subscription plan to obtain the New York Business Corporation Withholding Tax, download the form, and then complete, sign, and print it. US Legal Forms boasts a strong reputation and more than 25 years of experience. Join us now and make document handling simple and efficient!

- With just a few clicks, you can immediately access forms that comply with state and county regulations, crafted for you by our legal professionals.

- Use our website whenever you need a dependable service that helps you quickly locate and download the New York Business Corporation Withholding Tax.

- If you’re already familiar with our services and have set up an account, simply Log In to your account, choose the form, and download it right away or re-download it anytime later in the My documents section.

- Don't have an account? No worries. It takes hardly any time to create one and start browsing the library.

Form popularity

FAQ

The NY state tax rate varies based on the structure of the business and the amount of net income. For corporations, rates may include various tiers and adjustments. Being aware of the current rates, including those applicable to New York business corporation withholding tax, is vital for accurate financial planning.

Be sure you have downloaded the MyODFW app on your phone (which lets you tag when out of cell reception). Login to the app before fishing or hunting and be sure your licenses and tags are in your portfolio. Buy your big game tag or redeem your SportsPac voucher by the tag sale deadline.

Intentionally hitting a deer or elk in order to salvage it remains unlawful. Animals with missing and/or removed antlers are NOT available for salvage. This includes situations where antlers were detached as a result of the vehicle collision and cannot be recovered at the scene.

How to buy a license online: 1. Log into the ODFW electronic licensing system from the MyODFW.com website. Click on the green "Buy a license" button.

Once the tag has been purchased, you will be able to see it in your Recreational Portfolio online or in the MyODFW app. Note: You will be able to see that you purchased a tag, but you won't be able to validate it until just before your hunt.

A Roadkill Salvage Permit allows a person to recover, possess, transport, and use the carcass of a deer or elk killed as a result of an accidental collision with a vehicle for the purpose of salvaging the meat for human consumption.

How to check your results online. If you have an ODFW account, you can check your results online (you cannot check your results through the MyODFW app). Go to your profile and under Recreational Portfolio click ?Controlled Hunt."

Purchase your licenses and tags via the MyODFW.com licensing page. Follow the screen prompts to print, or if you choose electronic documents, verify the documents you bought are listed in the MyODFW app. Learn how to use electronic licenses and tagging. See the FAQs for this information.

Fishing: $29. Hunting: $22. Combination fishing and hunting: $47.50.