Real Estate Contract To Purchase A Home In Nys Withholding

Description

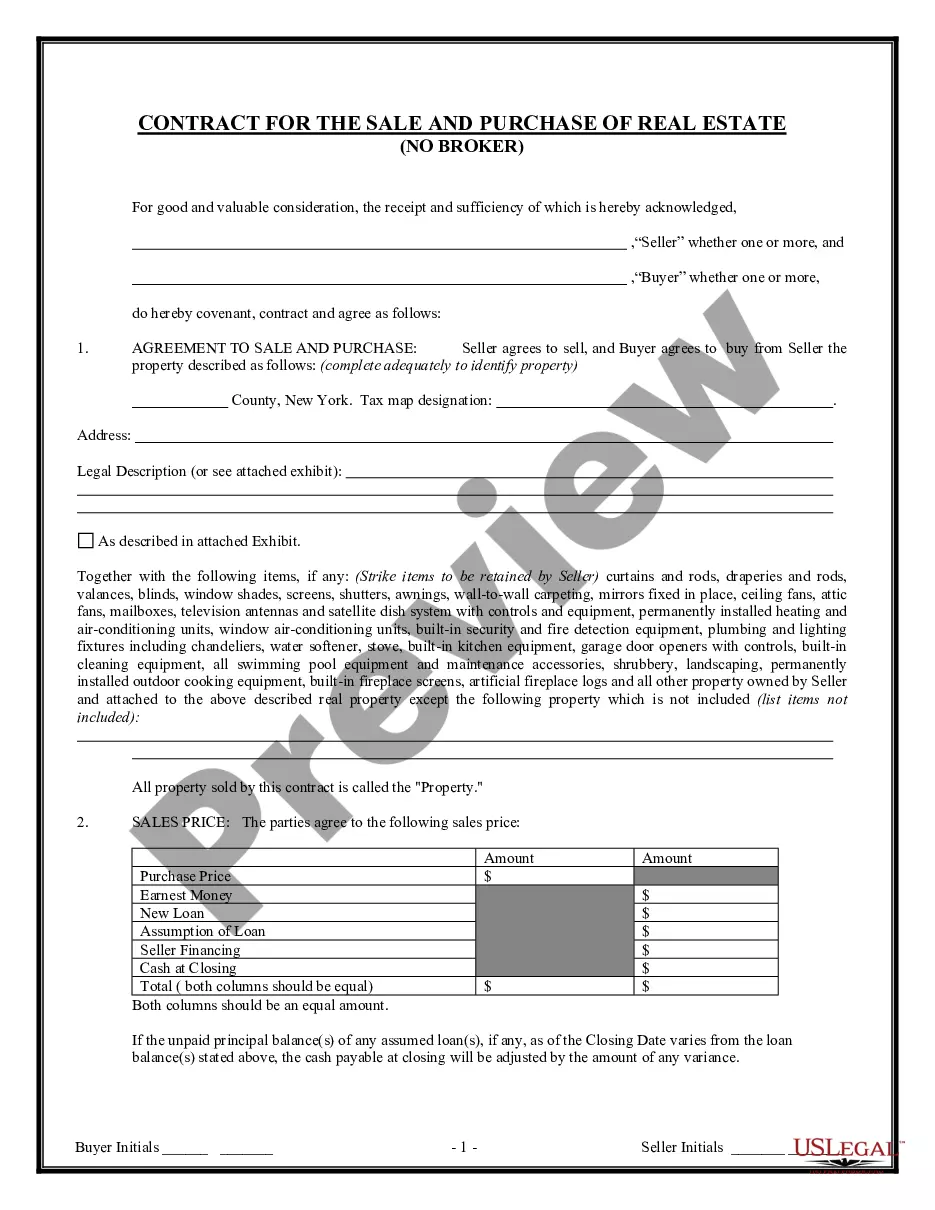

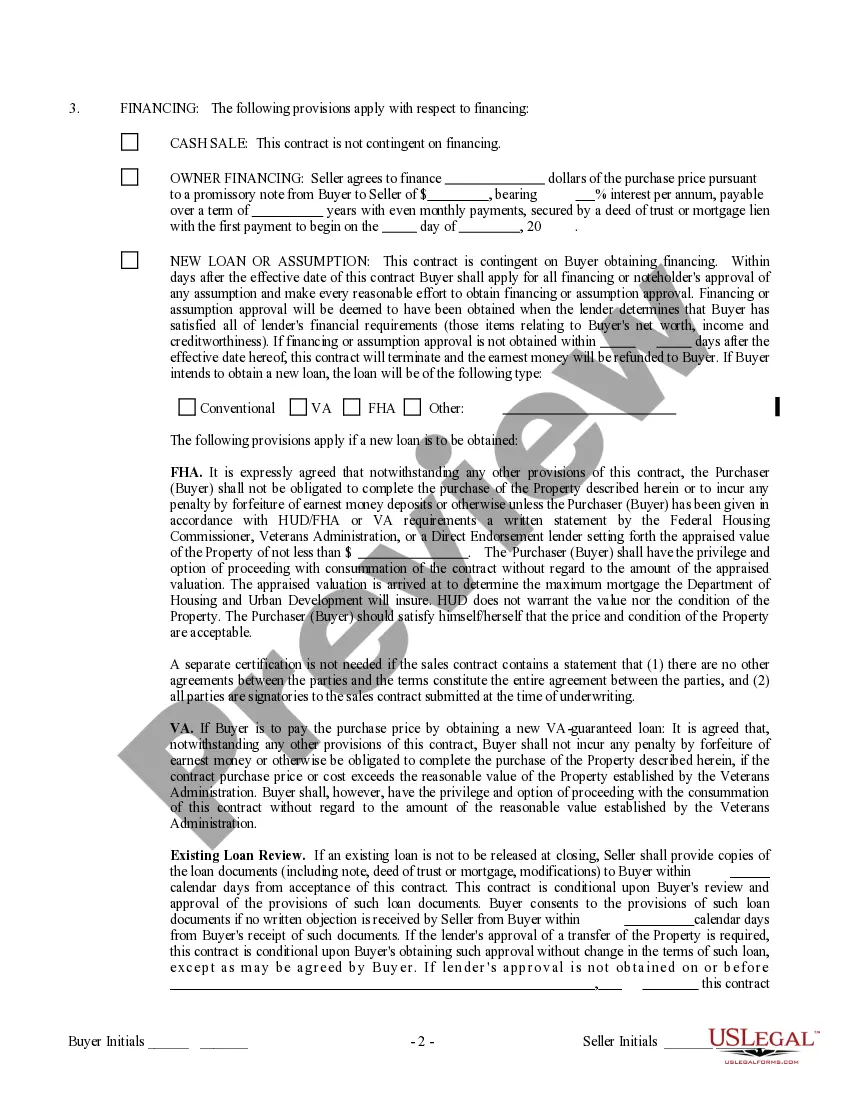

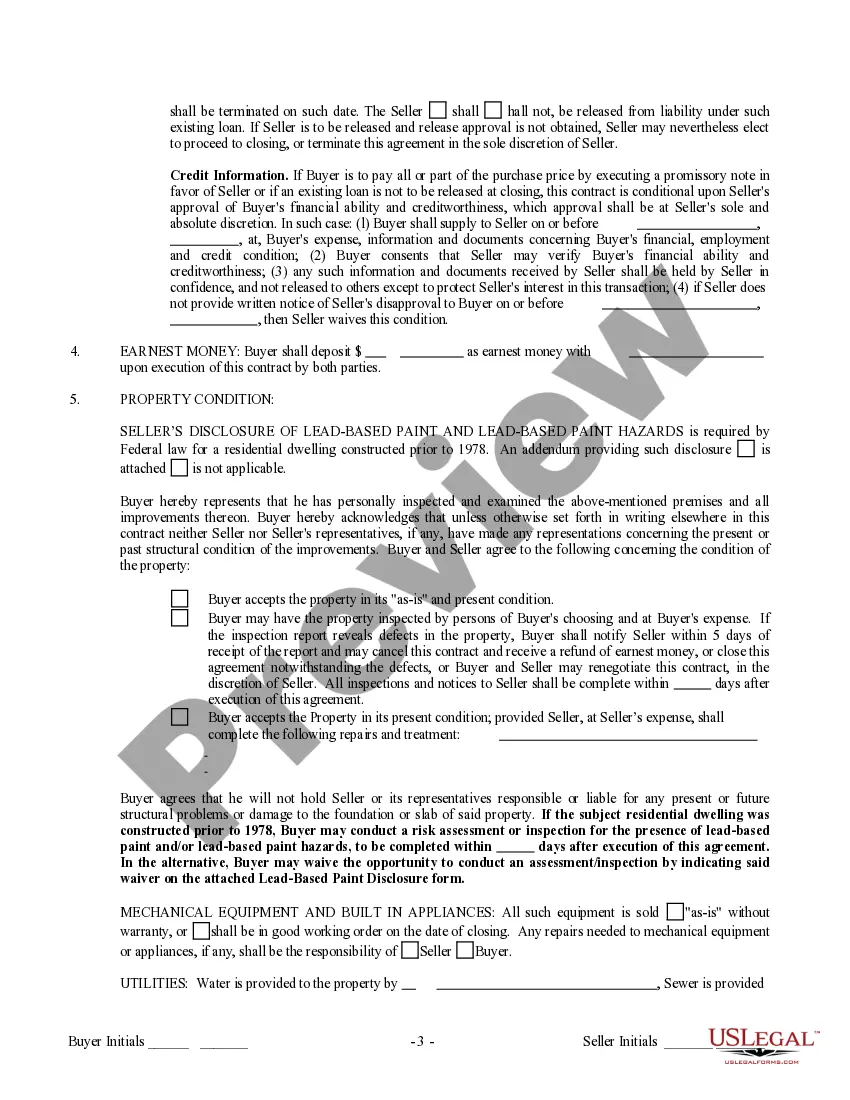

How to fill out New York Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

There's no longer a requirement to invest hours searching for legal documents to adhere to your local state guidelines.

US Legal Forms has gathered all of them in one location and made them easily accessible.

Our site provides over 85k templates for various business and personal legal situations curated by state and area of application. All forms are expertly prepared and verified for accuracy, so you can be confident in obtaining an updated Real Estate Contract To Purchase A Home In Nys Withholding.

Select your preferred pricing plan and create an account or Log In. Complete payment for your subscription via card or PayPal to proceed. Select the file format for your Real Estate Contract To Purchase A Home In Nys Withholding and download it to your device. Print out your form to fill it manually or upload the document if you prefer using an online editor. Assembling legal documents under federal and state regulations is quick and straightforward with our library. Experience US Legal Forms now to keep your paperwork organized!

- If you are familiar with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and hit Download.

- You can also revisit all saved documents whenever needed by opening the My documents tab in your profile.

- For first-time users, the process will involve a few additional steps to complete.

- Here’s how newcomers can locate the Real Estate Contract To Purchase A Home In Nys Withholding in our library.

- Examine the page content closely to verify it contains the sample you need.

- Utilize the form description and preview options, if available.

- Use the search field above to look for another template if the previous one didn't meet your needs.

- Click Buy Now next to the template title once you identify the correct one.

Form popularity

FAQ

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

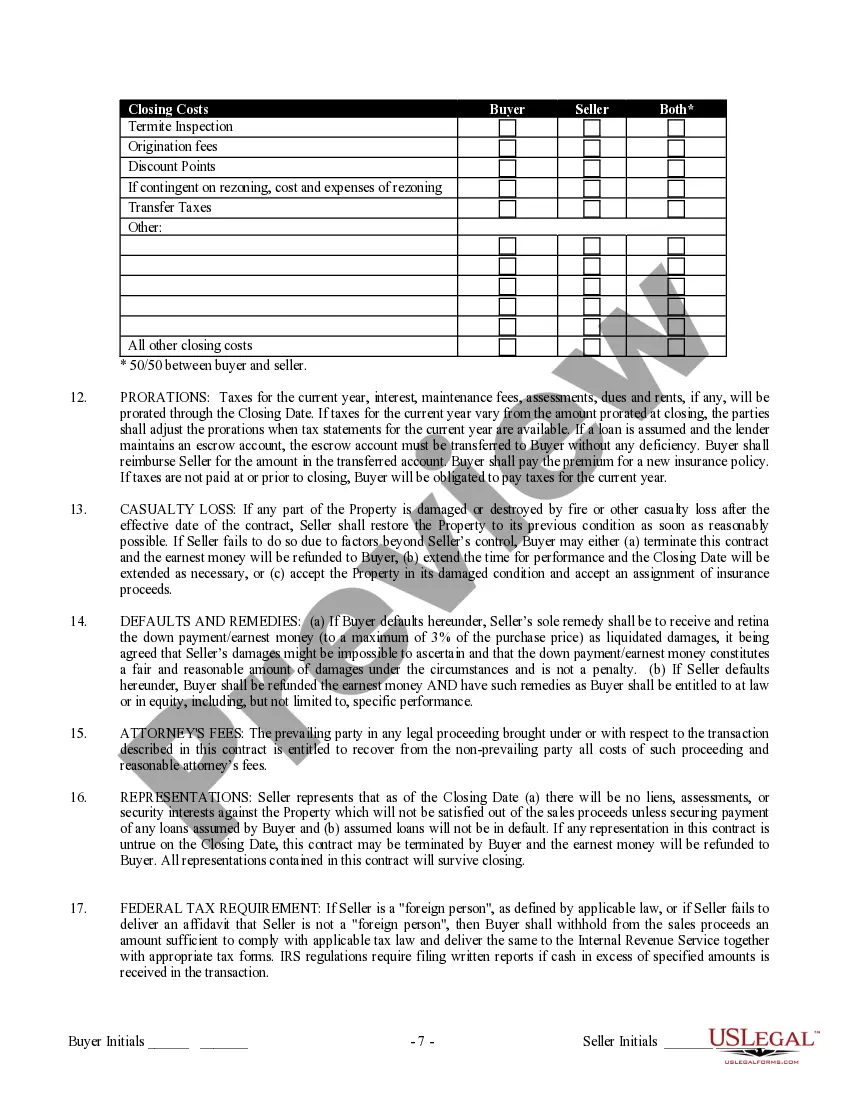

What Are The New York Transfer Tax Rates? The NYS transfer tax is 0.4% for properties below $3,000,000 and 0.65% for those $3,000,000 and up. The New York City transfer tax goes from 1% to 1.425% when over $500,000. The transfer tax is based on the purchase price of the property.

Form IT-2663 must be signed by the nonresident transferor/seller (an individual, a trustee, an executor, or other fiduciary of an estate or trust).

Estimated Income Tax Payment Form. For use on sale or transfer of real property by a nonresident of New York State.

In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.