Home Buyers Checklist For Buying A Home

Description

How to fill out Home Buyers Checklist For Buying A Home?

What is the most reliable service to obtain the Home Buyers Checklist For Purchasing A Home and other recent iterations of legal documents? US Legal Forms is the solution!

It's the largest assortment of legal forms for any purpose. Each template is meticulously crafted and verified for adherence to federal and local laws. They are categorized by field and jurisdiction, making it easy to locate what you require.

US Legal Forms is an excellent option for anyone needing to manage legal documents. Premium subscribers can enjoy additional benefits as they can complete and authorize their previously saved documents digitally at any time using the integrated PDF editing feature. Explore it today!

- Experienced users of the website simply need to Log In to the platform, confirm their subscription status, and click the Download button next to the Home Buyers Checklist For Purchasing A Home to obtain it.

- Once saved, the document remains accessible for future use within the My documents section of your account.

- If you have yet to create an account with us, here are the steps to follow to obtain one.

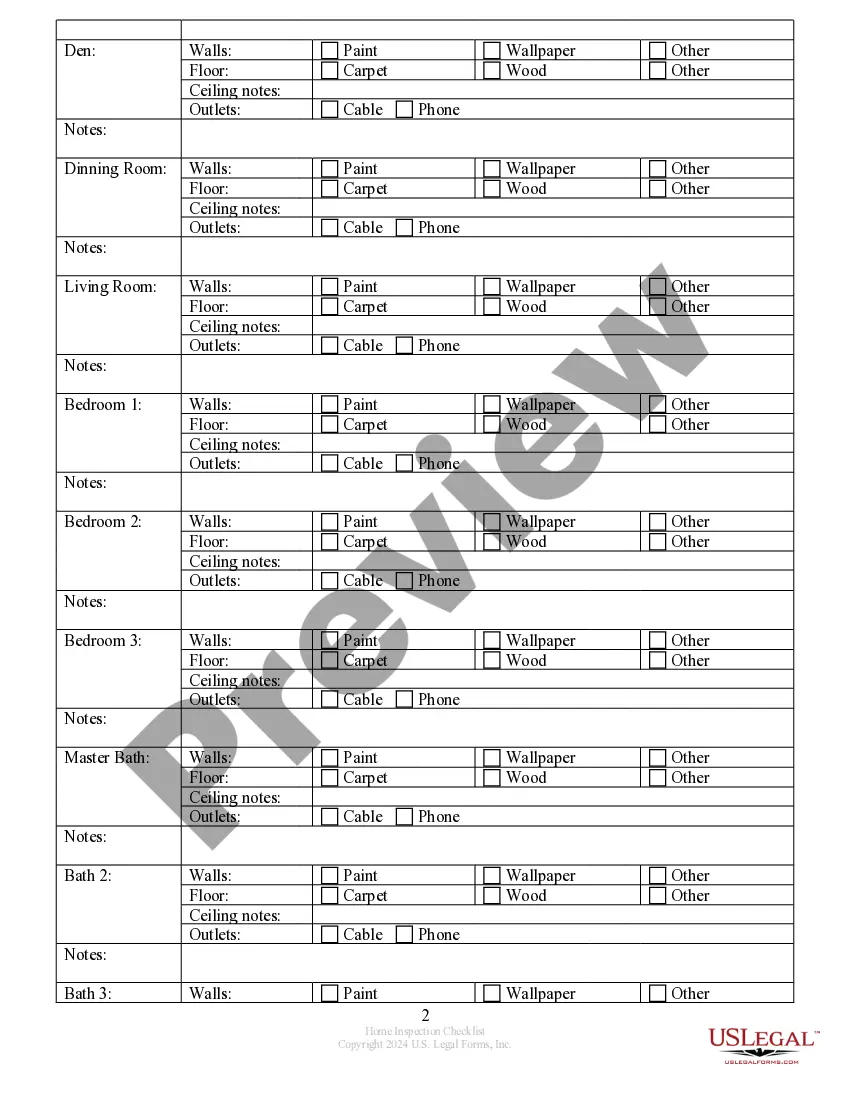

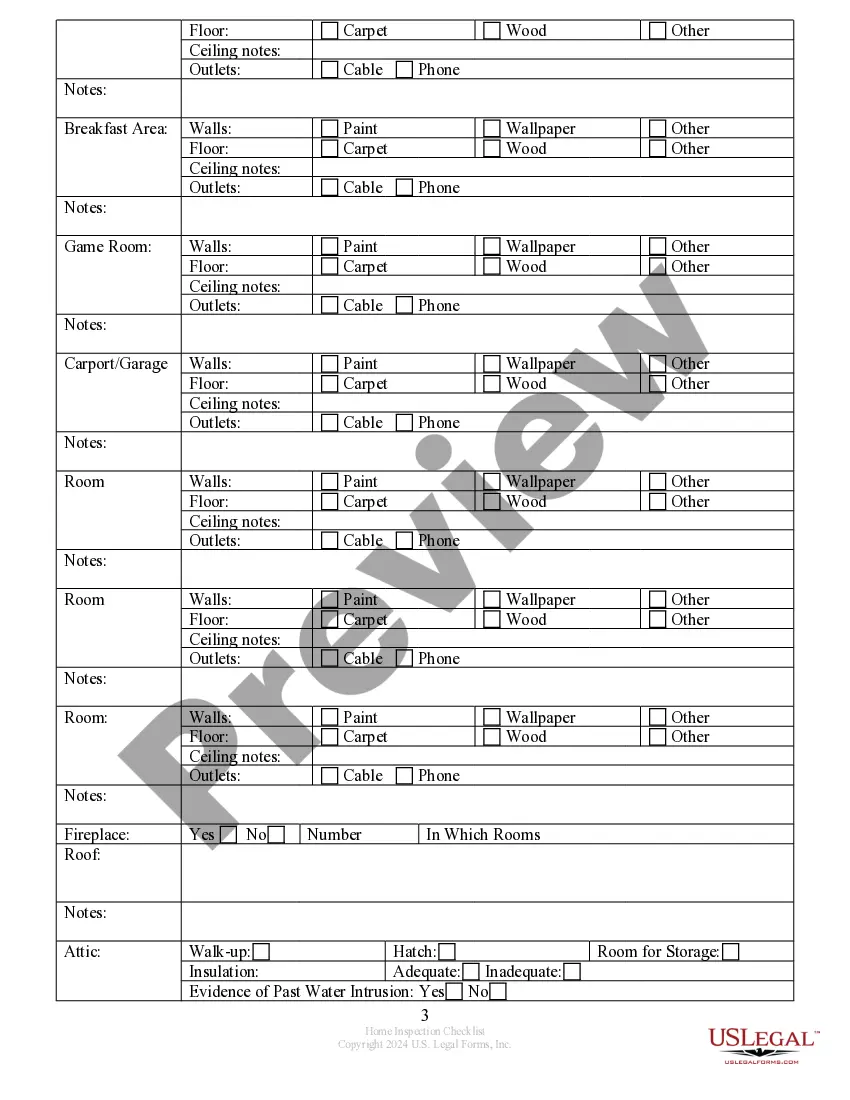

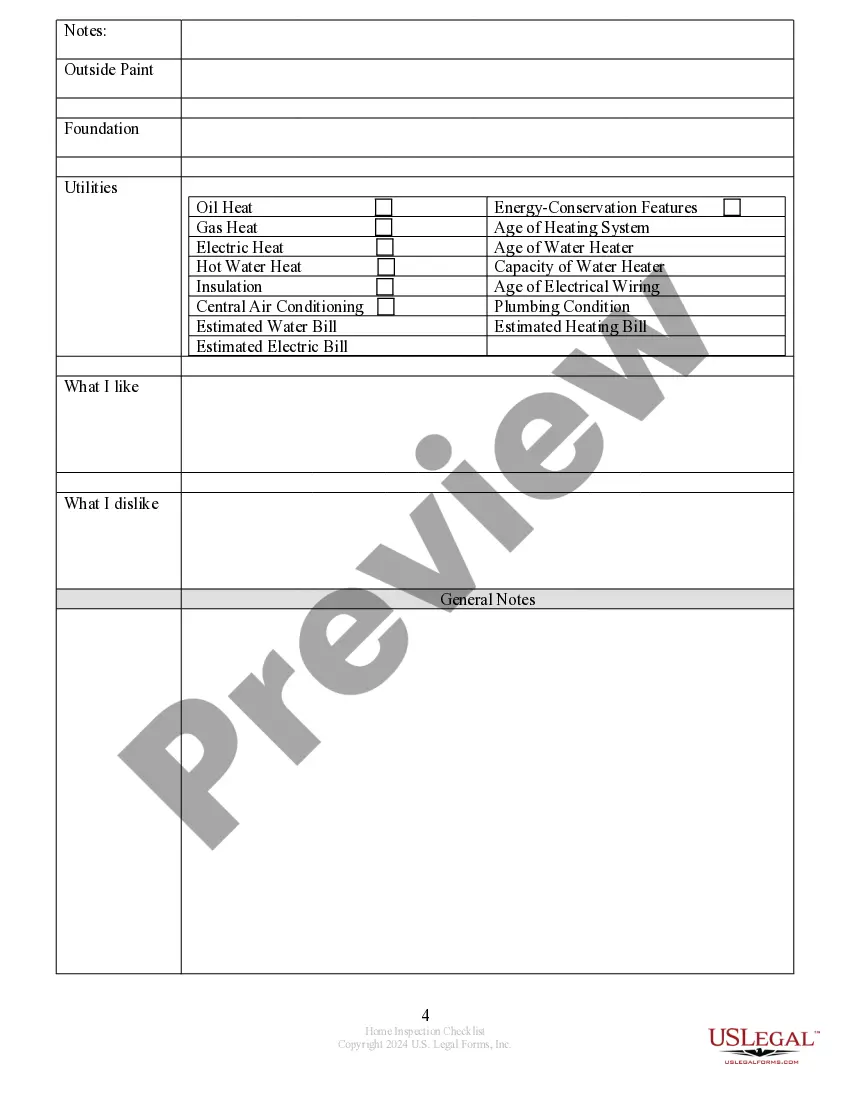

- Document compliance review. Prior to acquiring any template, ensure it meets your usage requirements and complies with your state or county regulations. Review the form description and use the Preview if it’s available.

Form popularity

FAQ

To afford a $400,000 house, your salary should generally be at least three times your mortgage payment. Factors such as down payment, credit score, and current interest rates also play a role. Using a home buyers checklist for buying a home can help you estimate additional costs like taxes and insurance to ensure you make a sound financial decision. Consulting with uslegalforms can provide you with further resources and tools to assess your financial readiness.

The buying process starts with setting your budget and getting pre-approved for financing. Then, use your home buyers checklist for buying a home to find the right property. After selecting a home, make an offer, conduct due diligence, secure financing, and finally close the deal. Remember, each step is crucial to ensuring a smooth transaction.

Begin with determining your budget and getting pre-approved for a mortgage. Next, start house hunting based on your home buyers checklist for buying a home, considering the features that fit your needs. After you find a suitable property, make an offer, negotiate terms, and schedule a home inspection before closing the deal.

Start by considering your lifestyle and priorities. Think about the number of bedrooms, proximity to schools or work, and outdoor space. Write down features that are non-negotiable, as well as those you'd like but can live without. This home buyers checklist for buying a home will guide you in narrowing down your choices.

The seven steps to buying a house typically include: determining your budget, finding a real estate agent, searching for homes, making an offer, getting a home inspection, securing financing, and closing the deal. By following the home buyers checklist for buying a home, you can move through these steps systematically and reduce stress throughout the process.

Deciding what you need for your house starts with considering your lifestyle and future plans. Create a list of must-haves versus nice-to-haves, and use the home buyers checklist for buying a home to rank these features based on your needs. This process can help you make a more informed decision when searching for your new home.

You can calculate what you need to buy a house by evaluating your budget, including your income, expenses, and savings. Use tools such as affordability calculators and the home buyers checklist for buying a home, which includes important factors like down payment and ongoing monthly costs. This careful calculation will help you set realistic expectations.

To determine what you need to buy a house, start by assessing your finances, including savings, income, and debt. Additionally, consult the home buyers checklist for buying a home, which details essential factors like closing costs, down payment, and mortgage options. This checklist will guide you through the steps to ensure you're fully prepared.

The 20-30-3 rule is a guideline to help you budget when buying a home. It suggests that you should aim for a 20% down payment, keep your monthly housing costs to no more than 30% of your gross monthly income, and limit your home search to a maximum of three times your annual income. Following this rule can make your home buying journey easier and more organized.

Yes, you can afford a $300k house on a $70k salary, but it depends on your overall financial situation. Typically, lenders recommend that your housing expenses should not exceed 28% of your gross monthly income. By following the home buyers checklist for buying a home, you can evaluate your other debts and expenses to determine if this is a sustainable option for you.