New York Contract Ny Withholding On Paycheck

Description

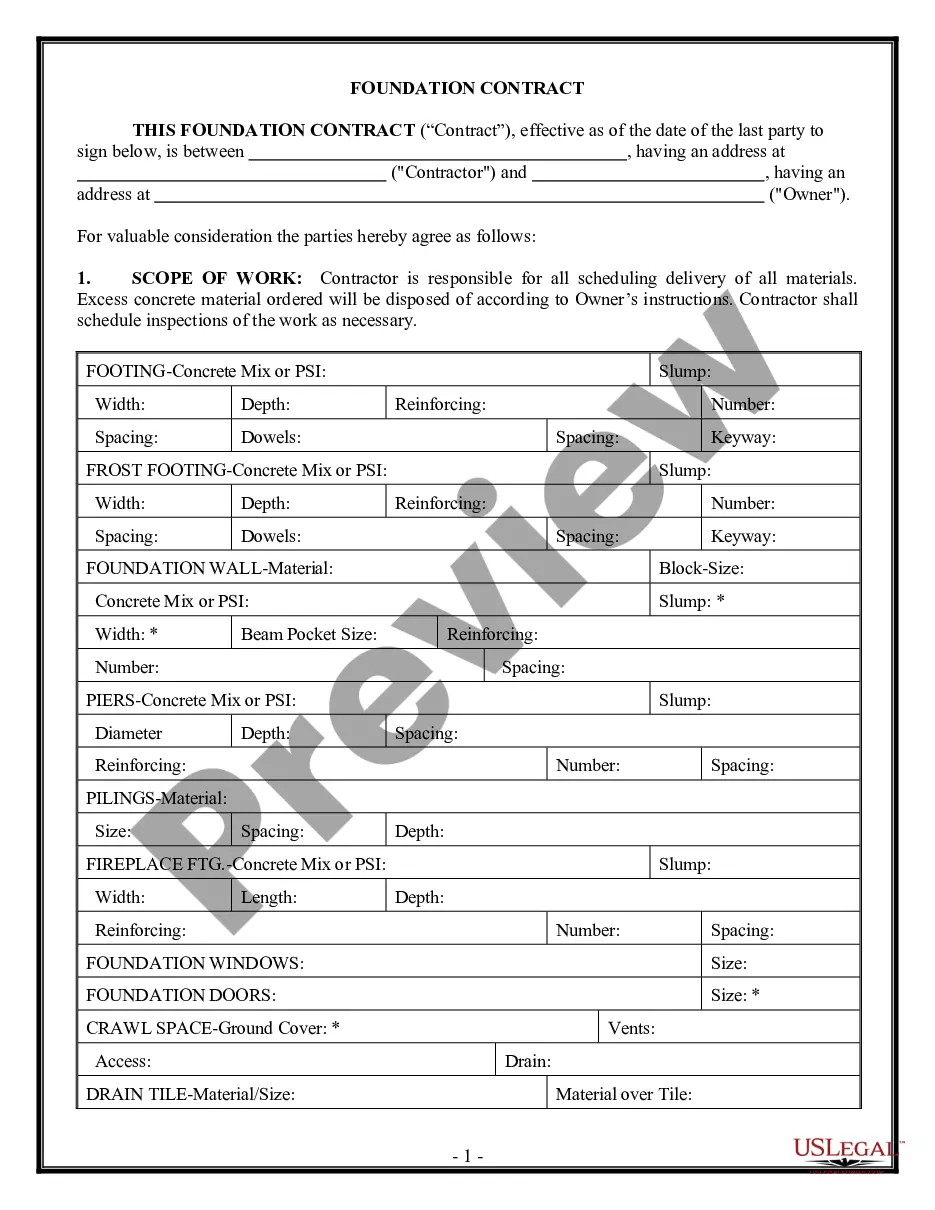

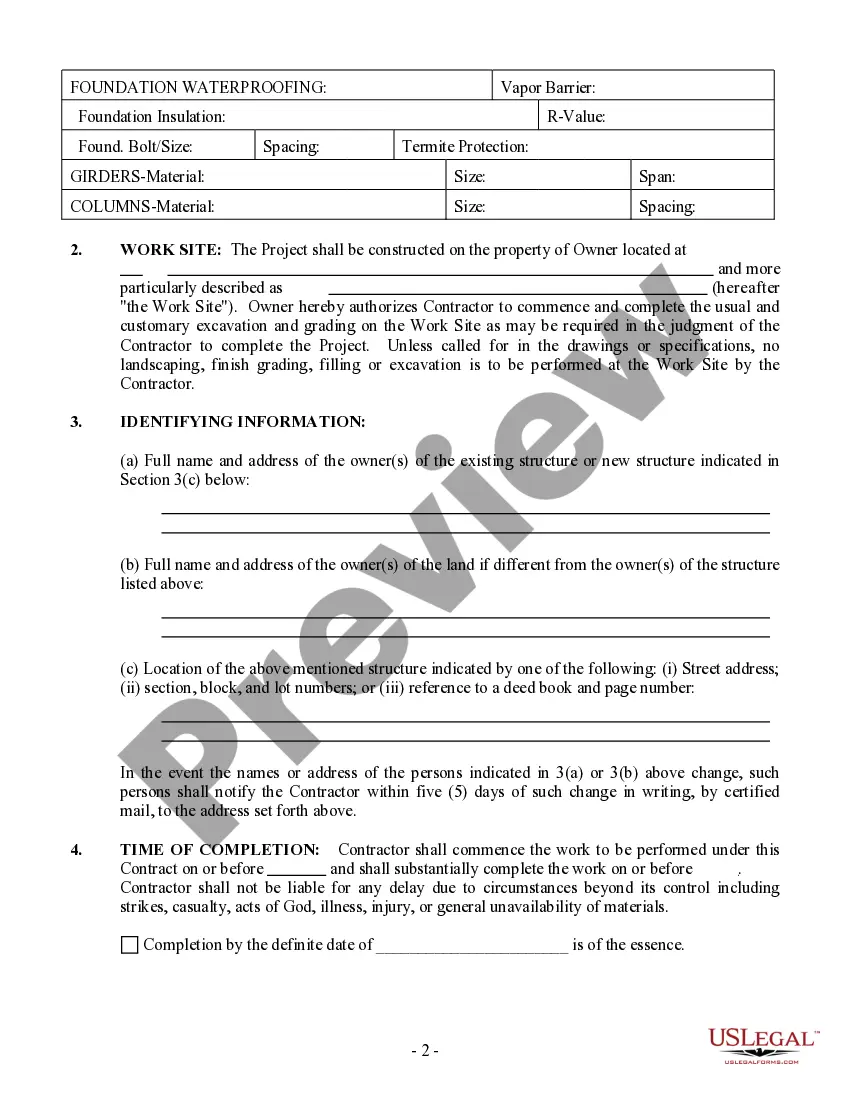

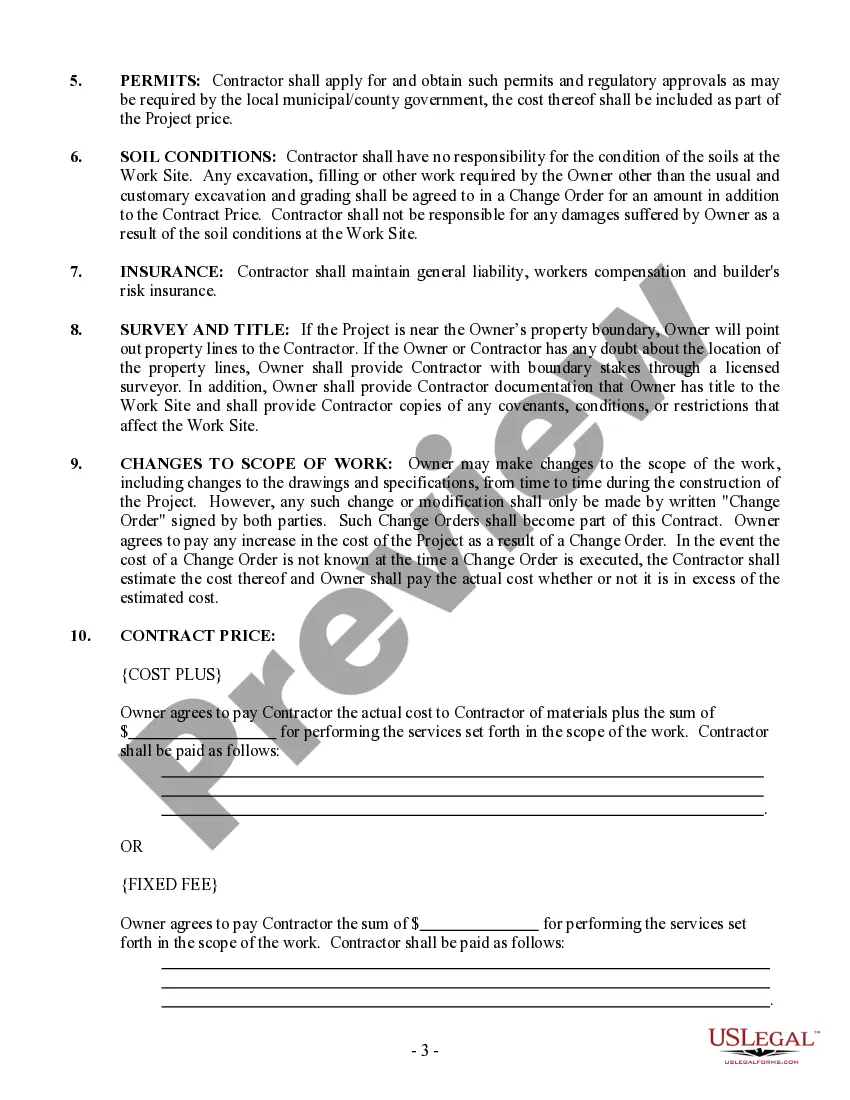

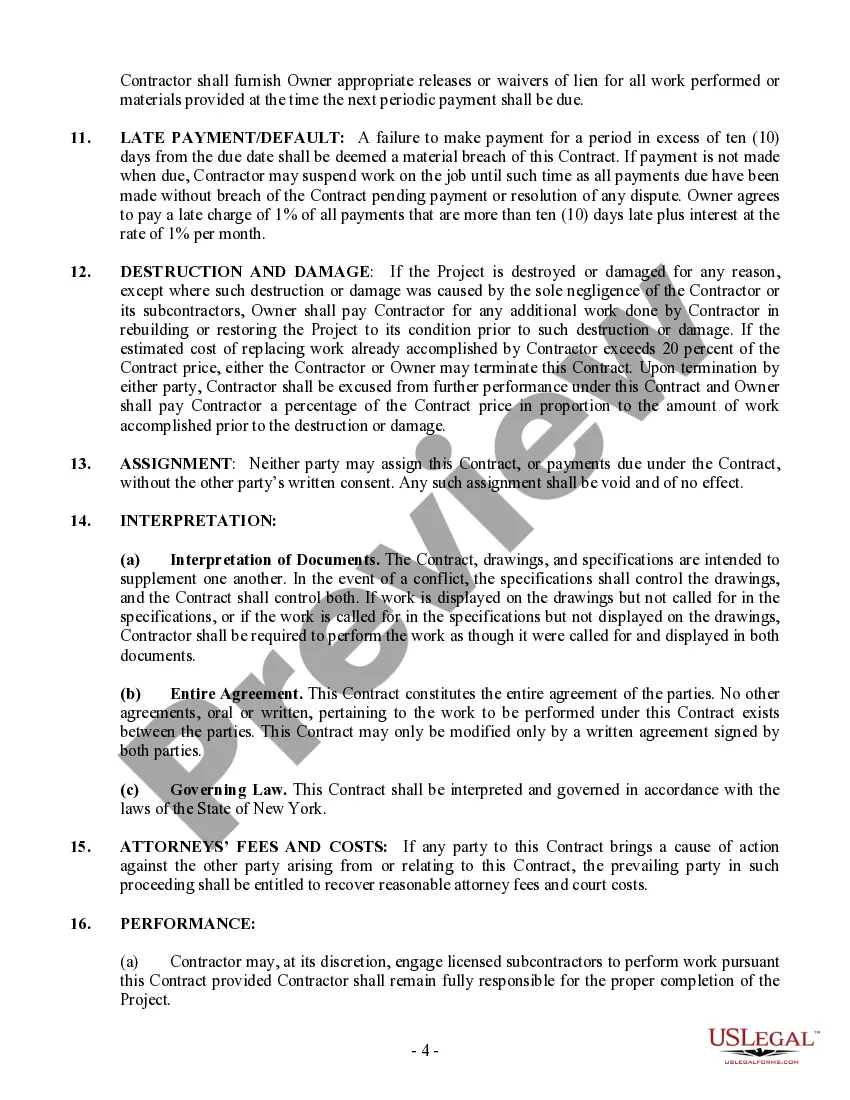

How to fill out New York Foundation Contract For Contractor?

Individuals frequently link legal documentation with intricacy that only an expert can handle.

In some respects, this is accurate, as composing New York Contract Ny Withholding On Paycheck necessitates considerable expertise in subject standards, including state and county laws.

However, with US Legal Forms, accessibility has improved: pre-made legal templates for various life and business circumstances specific to state regulations are gathered in one online directory and are now open to everyone.

Once obtained, all templates remain in your profile; you can access them anytime via the My documents section. Explore all the advantages of utilizing US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and area of application, making the search for New York Contract Ny Withholding On Paycheck or any other specific template a matter of minutes.

- Previously registered users with an active subscription must Log In to their accounts and click Download to obtain the form.

- New users to the platform must first register an account and subscribe before they are able to download any documentation.

- Here’s a detailed guide on how to obtain the New York Contract Ny Withholding On Paycheck.

- Review the page content thoroughly to confirm it satisfies your requirements.

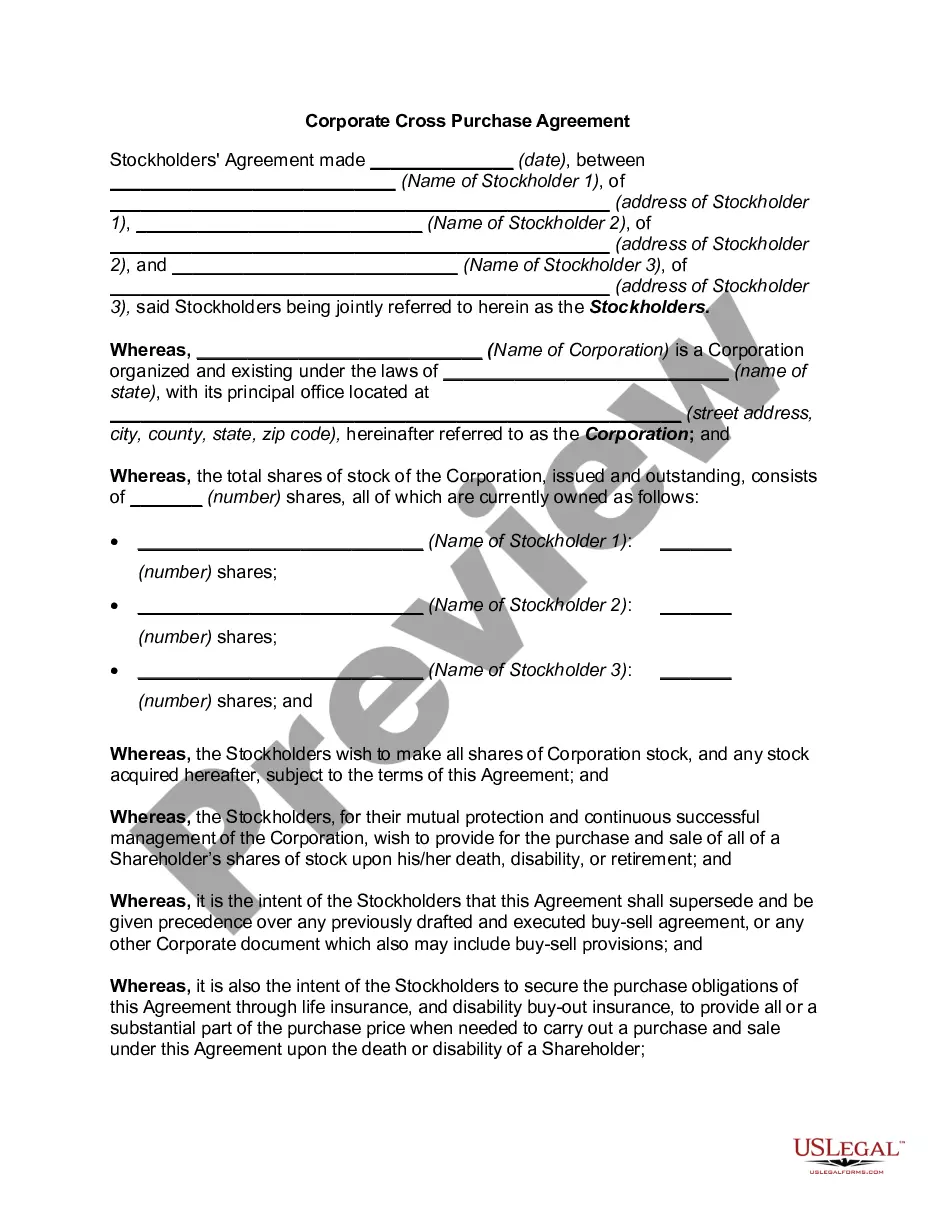

- Examine the form description or check it through the Preview feature.

- Search for another example using the Search bar above if the previous document does not meet your needs.

- Select Buy Now when you identify the correct New York Contract Ny Withholding On Paycheck.

- Pick a subscription plan that aligns with your necessities and financial constraints.

Form popularity

FAQ

Like the state's tax system, NYC's local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000.

NY Income tax is New York State tax. NY NYC Inc is New York City tax.

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

New York Payroll Taxes % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions. You can find detailed instructions on how to apply these local New York payroll taxes through the NY Department of Taxation.