New York Contract Ny Form Nys-45

Description

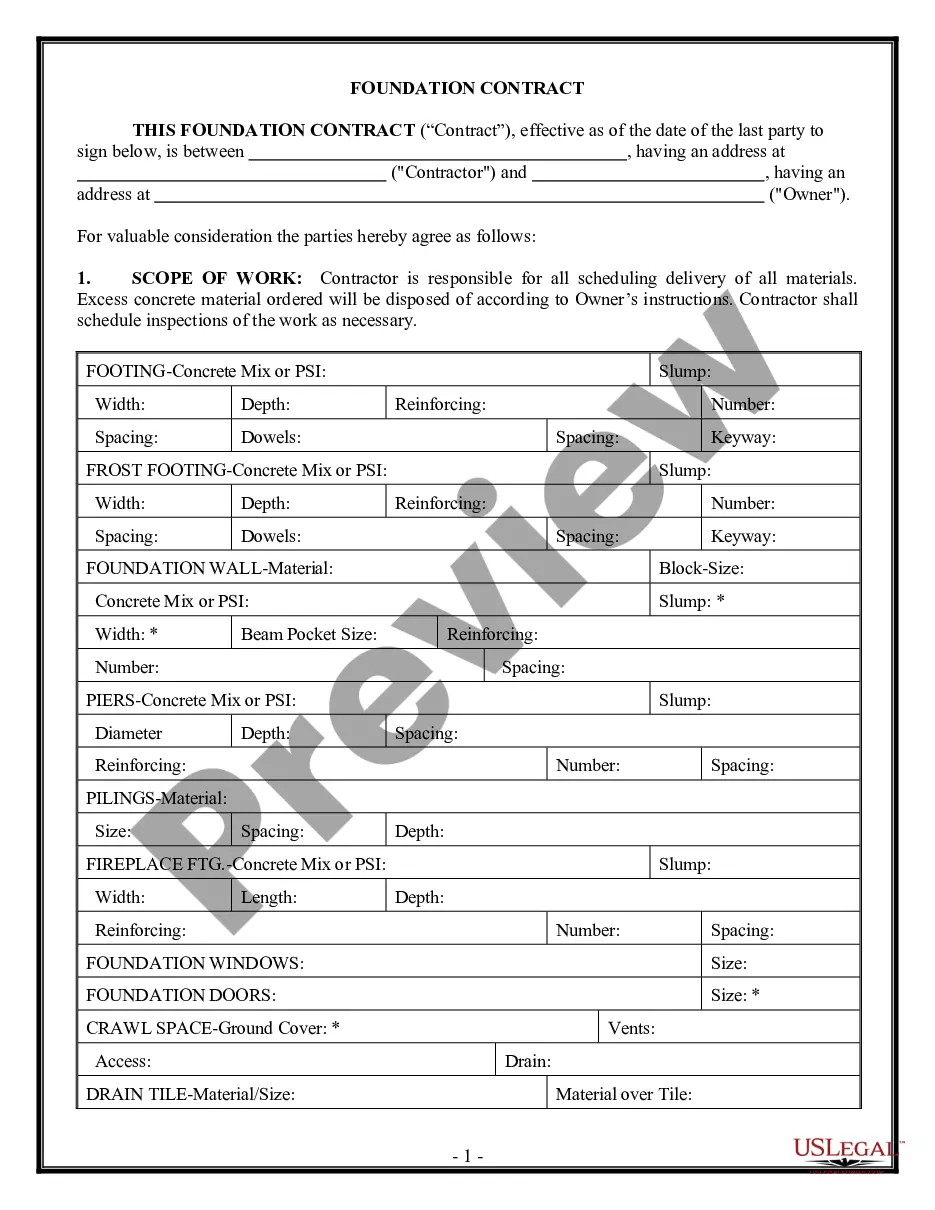

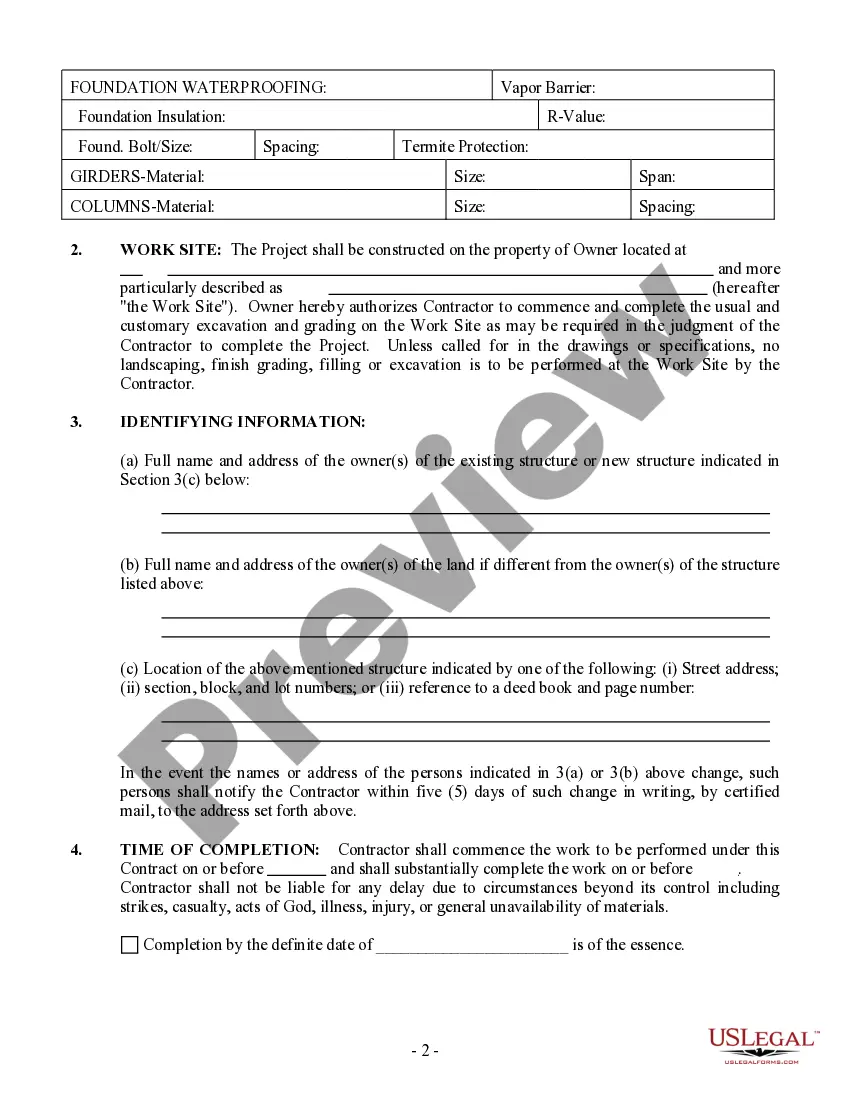

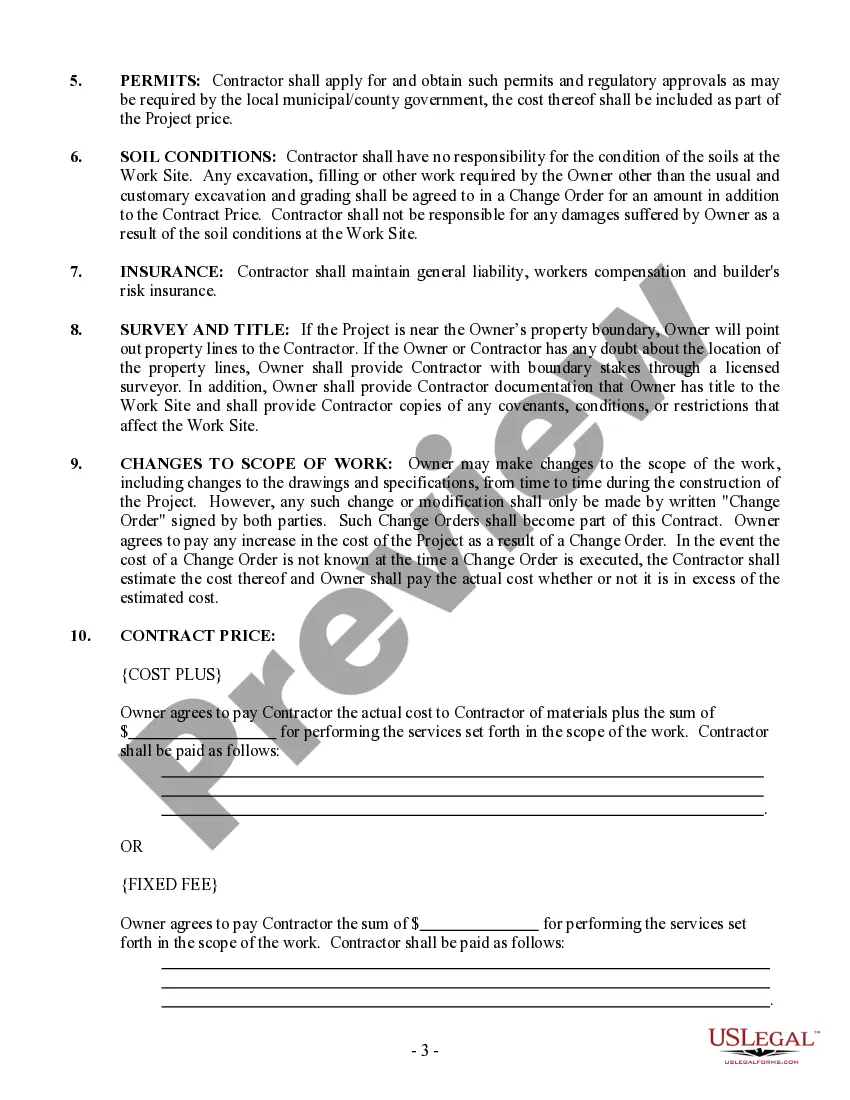

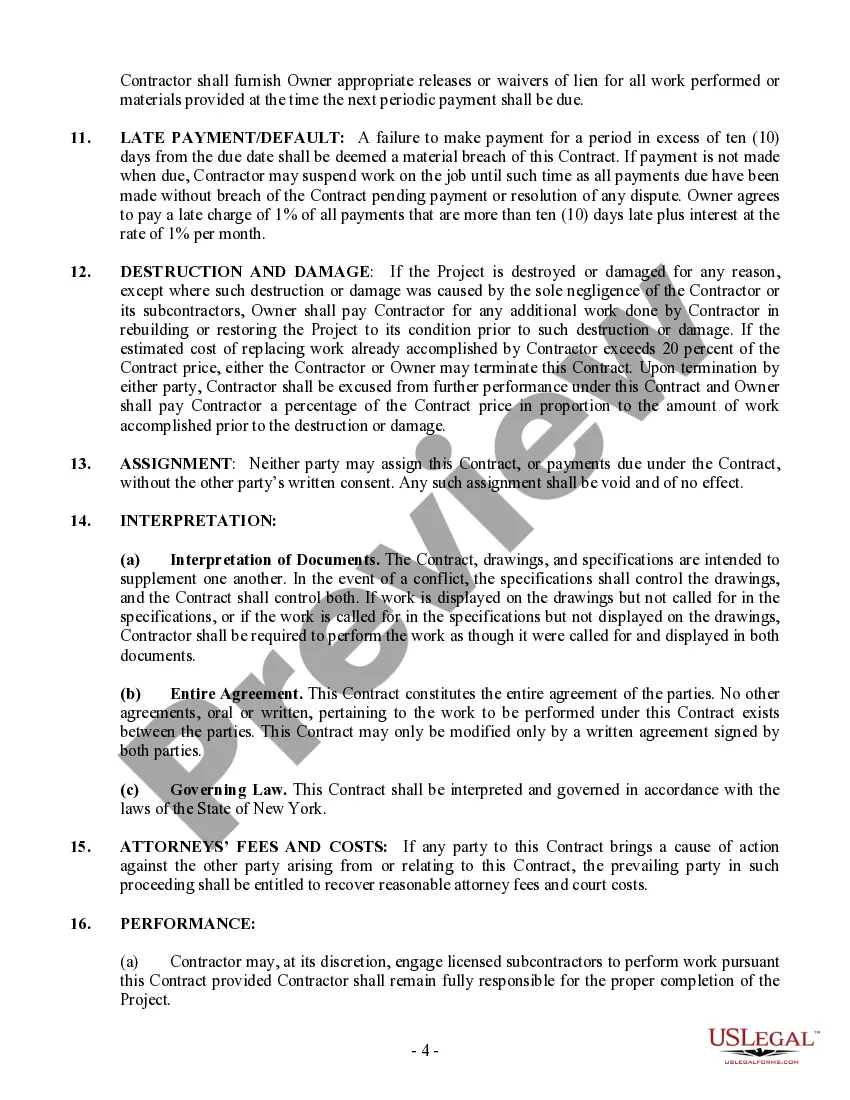

How to fill out New York Foundation Contract For Contractor?

There's no longer a necessity to squander time hunting for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our website provides over 85k templates for various business and personal legal situations categorized by state and purpose. All forms are professionally created and checked for accuracy, so you can be confident in obtaining the current New York Contract Ny Form Nys-45.

Select a preferred subscription plan and either register for an account or sign in. Process your subscription payment using a credit card or PayPal to proceed. Choose the file format for your New York Contract Ny Form Nys-45 and download it to your device. Print your form to fill it in by hand or upload the template if you wish to complete it in an online editor. Creating legal documents in accordance with federal and state laws and regulations is quick and straightforward using our platform. Try US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our service and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documentation at any time by accessing the My documents tab in your profile.

- If you have never utilized our service before, the process will require a few additional steps to finalize.

- Here’s how new users can access the New York Contract Ny Form Nys-45 from our collection.

- Examine the page content carefully to ensure it includes the sample you need.

- To facilitate this, make use of the form description and preview options whenever available.

- Employ the Search bar above to find another template if the prior one did not meet your needs.

- Click Buy Now next to the template title once you identify the appropriate one.

Form popularity

FAQ

All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter. If you withhold less than $700 during a calendar quarter, remit taxes withheld with your quarterly return, Form NYS-45.

Form NYS-1If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45. If you have more than one payroll within a week (Sunday through Saturday), you are not required to file until after the last payroll in the week.

Form NYS-45-ATT "(Instructions) Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return - Attachment" - New York.

Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return.

Form NYS-45-X, Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, is only available as a paper form.