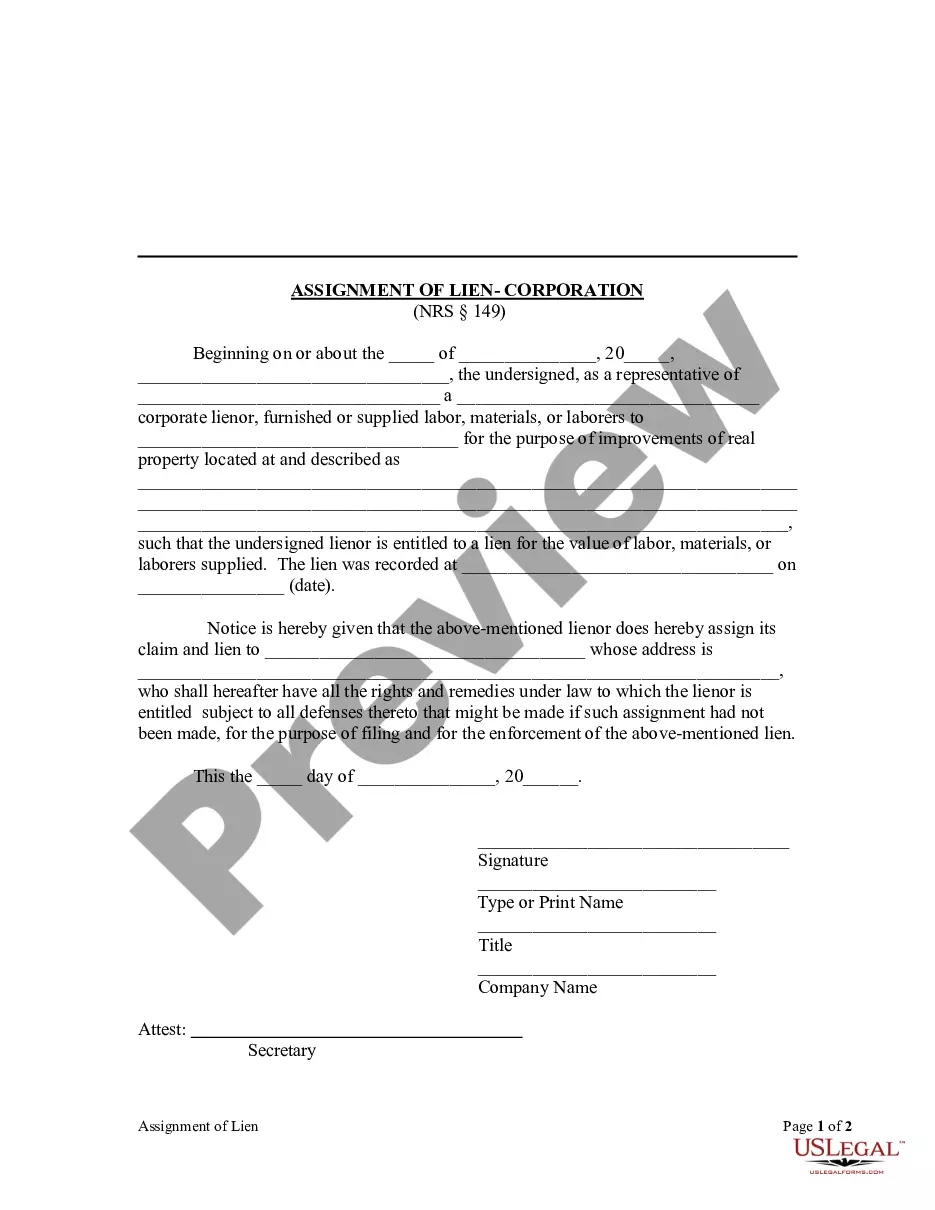

The Nevada UCC filing format refers to the specific guidelines and requirements for submitting Uniform Commercial Code (UCC) documents in the state of Nevada. The UCC filing is an integral part of documenting secured transactions, providing a standardized format to ensure public notice and priority of interests in personal property collateral. In Nevada, there are primarily two types of UCC filings: UCC-1 and UCC-3 Financing Statements. Let's explore each format in detail: 1. UCC-1 Financing Statement in Nevada: The UCC-1 filing format is used to create a public record of a creditor's security interest in collateral owned by a debtor. To properly file a UCC-1 in Nevada, the following information is required: — Name and address of the debtor and the secured party — Description of the collateral being used as collateral — Filing fee (varies by jurisdiction— - Properly completed UCC-1 form It is crucial to accurately describe the collateral while filing a UCC-1 to ensure the validity and enforceability of the security interest. Filing the UCC-1 with the Nevada Secretary of State's office is recommended to establish priority in case multiple parties have a claim on the same collateral. 2. UCC-3 Amendment Statement in Nevada: The UCC-3 filing format is used to make amendments, terminations, assignments, or continuation statements related to an existing UCC-1 filing. Common reasons for filing a UCC-3 in Nevada include changes in secured party information, amendments to the collateral description, or partial/full releases of the collateral. To properly file a UCC-3 in Nevada, the following information is required: — Identifying information of the initial financing statement to be amended, terminated, assigned, or continued — Specific details of the amendment/termination/continuation — Filing fee (varies by jurisdiction— - Properly completed UCC-3 form Submitting an accurate UCC-3 filing ensures that any changes or updates to an existing UCC-1 financing statement are officially recorded and recognized by interested parties. Understanding and adhering to the Nevada UCC filing format is crucial for both debtors and creditors engaging in secured transactions. Adhering to these guidelines helps establish legal clarity, protects the interests of both parties, and ensures the proper recording of collateral details for future reference or disputes.

Nevada Ucc Filing Format

Description

How to fill out Nevada UCC1 Financing Statement?

It’s no secret that you can’t become a legal expert immediately, nor can you grasp how to quickly draft Nevada Ucc Filing Format without having a specialized background. Putting together legal documents is a time-consuming venture requiring a particular training and skills. So why not leave the preparation of the Nevada Ucc Filing Format to the pros?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court documents to templates for internal corporate communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the document you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Nevada Ucc Filing Format is what you’re looking for.

- Begin your search again if you need any other template.

- Register for a free account and choose a subscription plan to purchase the template.

- Pick Buy now. As soon as the payment is through, you can get the Nevada Ucc Filing Format, complete it, print it, and send or send it by post to the necessary individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Individuals can find mugshots of recent arrests in Wisconsin by looking at arrest records through the local law enforcement agency, county sheriff's office, or state police department. Wisconsin Police Departments and the criminal courts both maintain current arrest records, mugshots, and warrants.

The public may view all nonconfidential portions of a circuit court record in person, at the office of the clerk of court for the county where the case was filed, or may view certain portions of the circuit court record online via the Director of State Courts' public internet website.

Wisconsin public records can include but are not limited to: Vital Records (birth, death, marriage, and divorce records) Property Records (deeds, mortgages, liens, etc.) Court Records. Inmate & Jail Records. Sex Offender Records. Wanted Person Records. Unclaimed Property Records.

This website provides public access to the records of the Wisconsin circuit courts for counties using the Consolidated Court Automation Programs (CCAP) Case Management system. These records are open to public view under Wisconsin's Open Records law, sections 19.31-19.39, Wisconsin Statutes.

State adult criminal history files are also pub- lic record and available to the public. The Legislature has established fees for obtaining criminal history information based on re- questor type. Requests for information may be made by mail or online for customers us- ing a credit card or having an account.

Consolidated Court Automation Programs (CCAP) Steering Committee. CCAP is responsible for supporting the IT needs of the entire Wisconsin Court System.

Access to criminal history information can be obtained on the Wisconsin Online Record Check System at . Adult criminal history information is public record in the State of Wisconsin. Anyone may obtain this information provided they pay the fee established by the Wisconsin Legislature.