Trust Account With Lawyer

Description

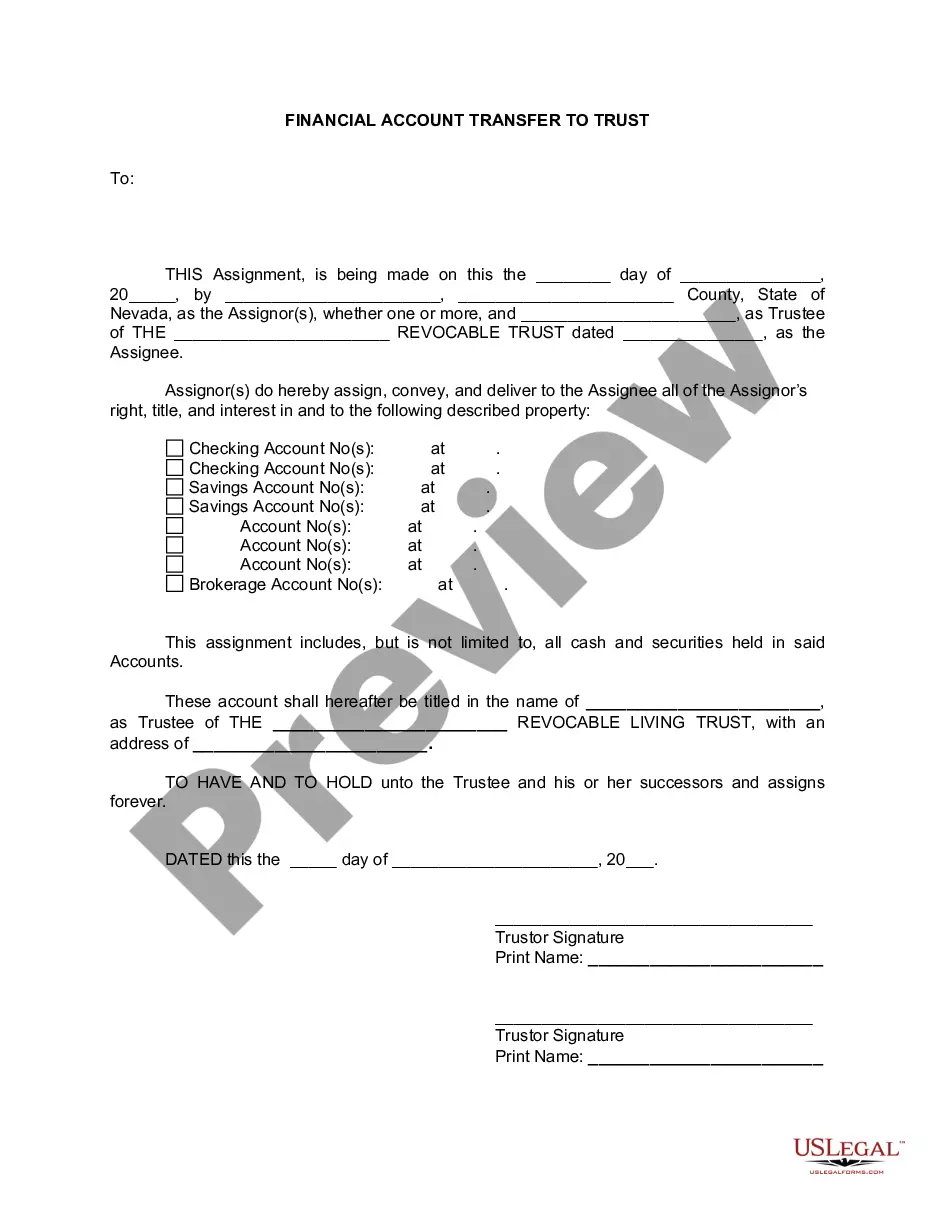

How to fill out Nevada Financial Account Transfer To Living Trust?

- If you have used US Legal Forms before, log in to your account and download your required form. Ensure your subscription is current; renew as needed.

- For first-time users, start by checking the Preview mode of the relevant form and ensure its description aligns with your jurisdiction's requirements.

- If you need a different form, use the Search tab to find one that meets your needs. Confirm it suits your purpose before proceeding.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to unlock all available resources.

- Complete your payment using a credit card or PayPal. Once your purchase is successful, you can download the required form.

- Access your downloaded document from the My Forms section in your account anytime.

In conclusion, using US Legal Forms enables you to efficiently access a wide range of legal documents, including those required for setting up a trust account with a lawyer. With a collection surpassing competitors, you'll find precisely what you need with ease.

Start your legal journey today by visiting US Legal Forms and discover the perfect templates for your requirements!

Form popularity

FAQ

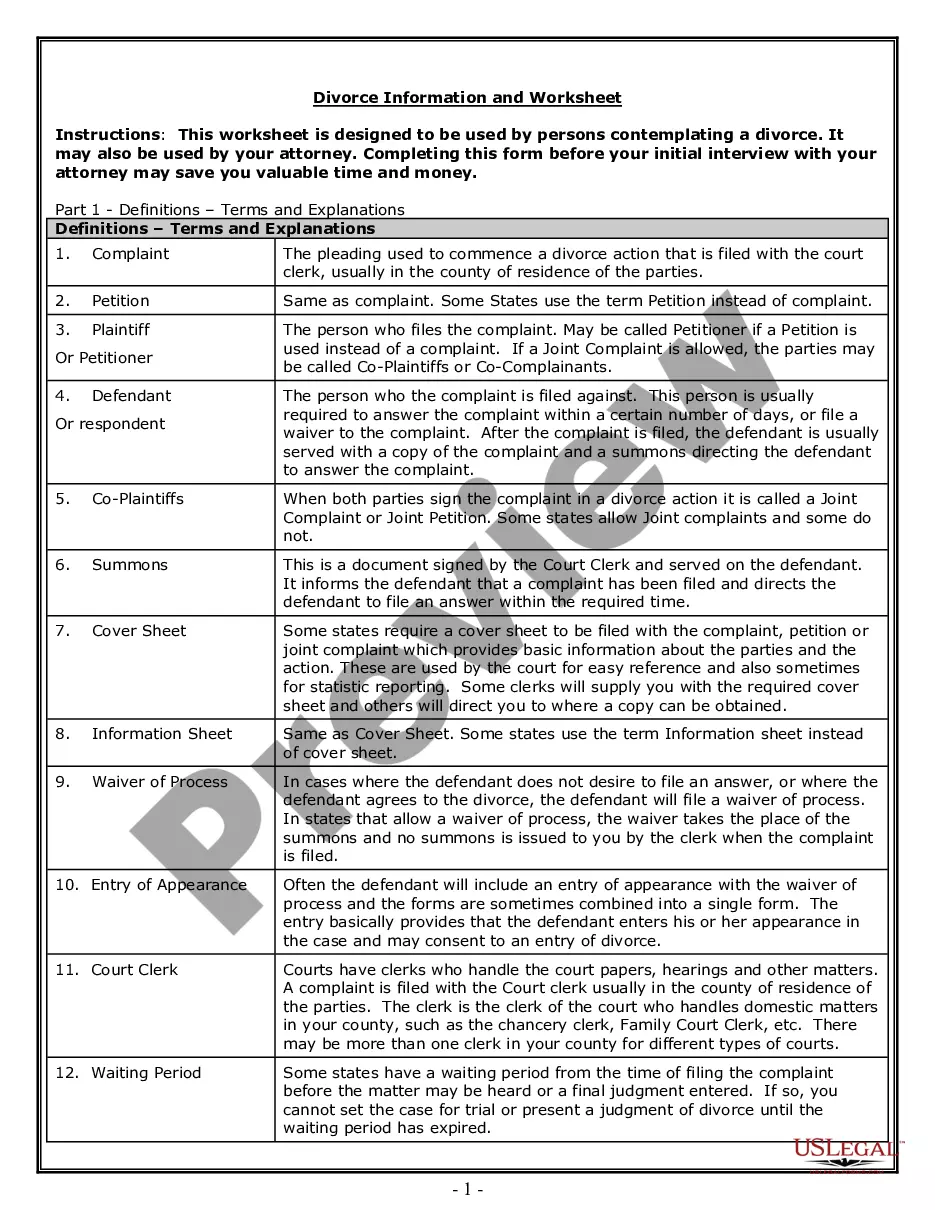

Opening a bank account for a trust involves a few key steps. Begin by gathering your trust document, tax identification number, and personal identification. Choose a bank that specializes in trust accounts with lawyers to streamline the process. Once you’ve selected a bank, fill out the application and submit your documentation as required. This ensures your trust funds are managed effectively and in accordance with the trust's terms.

Trust accounting for law firms involves tracking the funds held on behalf of clients in a trust account. This requires meticulous recordkeeping to ensure that every deposit, withdrawal, and transfer is accurately documented. With a trust account with a lawyer, firms can maintain transparency and ensure clients’ funds are secure. Additionally, regular reconciliation is essential to avoid any discrepancies and to comply with legal obligations.

To create a bank account for a trust, first gather necessary documents such as the trust agreement and identification for the trustee. Next, contact your bank to learn about their specific requirements for opening a trust account with a lawyer. This process usually involves filling out an application and providing documentation. Once opened, ensure you manage the account according to the terms outlined in the trust to maintain compliance.

The best bank for a trust account often depends on your specific needs and location. Many people find that local banks or credit unions offer competitive rates and personalized service, while large national banks may provide more features. Look for banks that specialize in trust accounts with lawyers, as they typically understand the nuances involved in managing trust funds. Always compare fees, interest rates, and services before making a decision.

Yes, you can open a bank account in the name of a trust. To do this effectively, you will need a copy of the trust document and any identification required by the bank. A trust account with a lawyer ensures that all funds are managed correctly and that the trust's terms are followed strictly. Your attorney will guide you through the process to ensure everything complies with the applicable laws.

The best type of bank account for a trust is usually a trust account with a lawyer. This account allows you to keep trust funds separate from your personal assets, providing security and clear documentation. It's important to choose an account that offers good interest rates and low fees, ensuring your trust funds grow over time. Consulting with your lawyer can help you determine the most suitable account based on your trust's needs.

The major disadvantage of a trust can be the complexity and costs involved in setting it up correctly. Depending on your situation, establishing a trust account with a lawyer might require considerable legal documentation and potential fees. It's essential to understand the implications before proceeding with a trust to avoid unexpected challenges.

Someone might use a trust to manage their assets effectively and protect their interests. Trusts can help with estate planning, ensuring that wealth is distributed according to your wishes. Additionally, a trust account with a lawyer can simplify the management of funds, making it easier to navigate complex legal situations.

The purpose of a client trust account is to provide a dedicated space for managing funds that belong to clients, which is essential in maintaining transparency and trust. When you work with a trust account with your lawyer, you can rest assured that your funds are safeguarded until they are needed for legal fees or other expenses. This creates an accountable system for all financial transactions related to your legal matters.

Depositing a check made out to an estate into a trust may be possible, but it often requires proper legal documentation. Consult your attorney, as they can help determine the best approach to managing estate funds with regard to the trust account with a lawyer. Clarifying these transactions ensures compliance with legal standards and protects the interests of all parties involved.