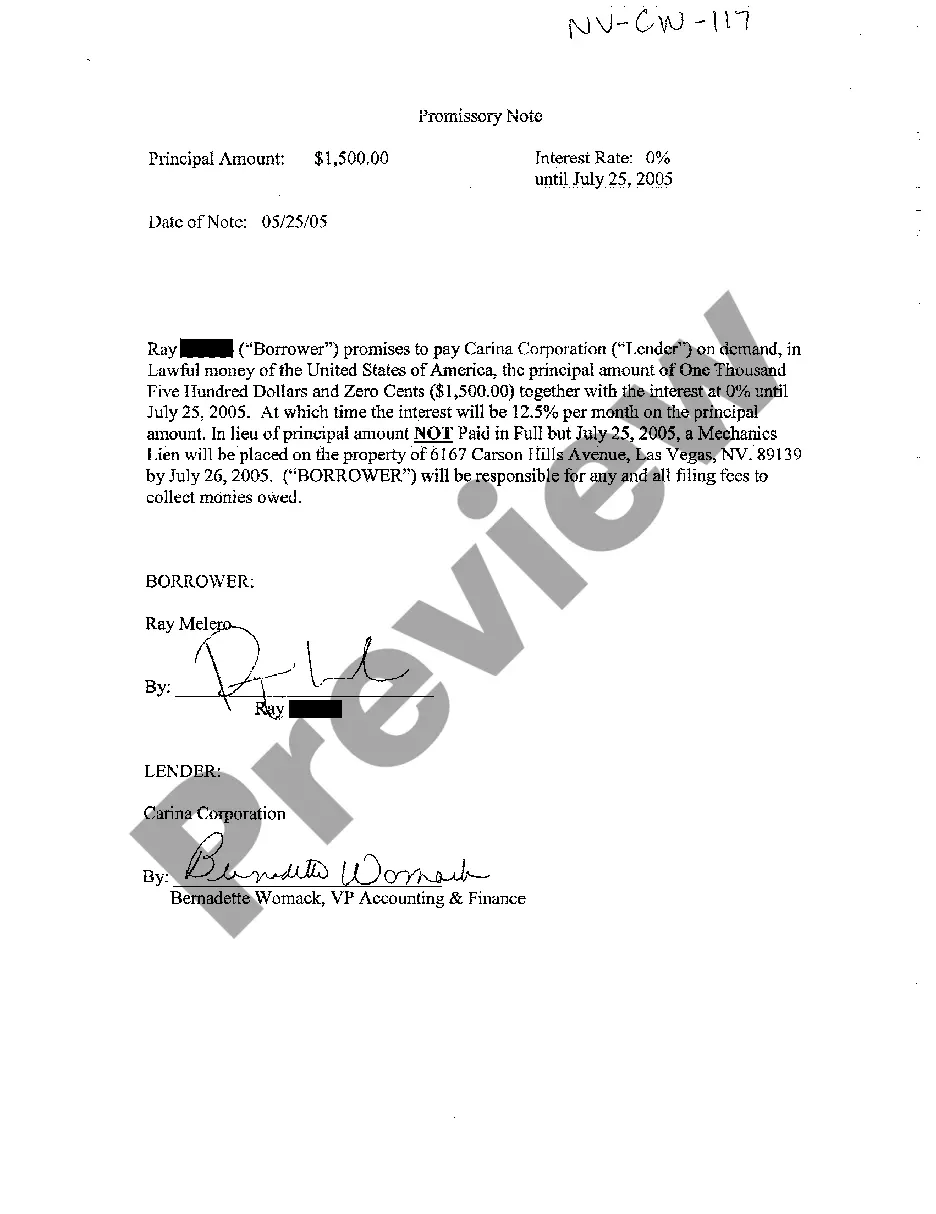

Nevada Promissory Note No Interest Template With Calculator

Description

How to fill out Nevada Promissory Note For Small Loan - No Interest?

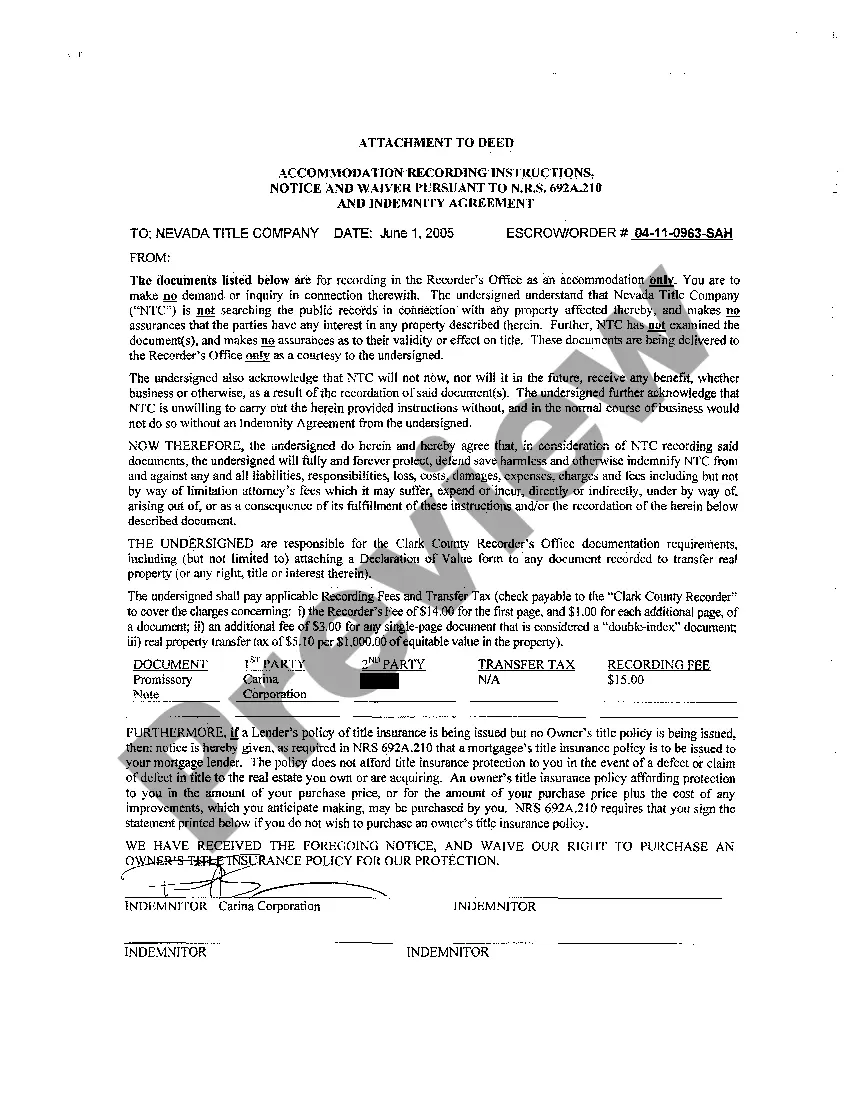

When you are required to finalize Nevada Promissory Note No Interest Template With Calculator in compliance with your local state laws and regulations, there are several alternatives to choose from.

There’s no need to examine every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Browse the suggested page and verify it meets your needs.

- US Legal Forms is the largest online directory with a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to adhere to each state's regulations.

- Therefore, when you download Nevada Promissory Note No Interest Template With Calculator from our site, you can be assured that you have a valid and current document.

- Obtaining the necessary template from our platform is very easy.

- If you already possess an account, simply Log In to the system, verify your subscription's validity, and save the chosen file.

- In the future, you can access the My documents section in your profile and retrieve the Nevada Promissory Note No Interest Template With Calculator at any time.

- If this is your first time using our library, please follow the steps below.

Form popularity

FAQ

Calculating Simple Interest If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

If our payments are monthly, then we divide our annual interest rate by 12. The P stands for the fixed monthly payment amount that we will have to pay. To find the total amount that we end up paying, we multiply this fixed monthly amount by the total number of payments.

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Based on discussions with professionals who buy and sell notes, the market rate of return for a privately held note typically ranges from 12% for a well collateralized note with a strong payment history to 25% for an uncollateralized note.