Trust Filing Evidence With The Vat

Description

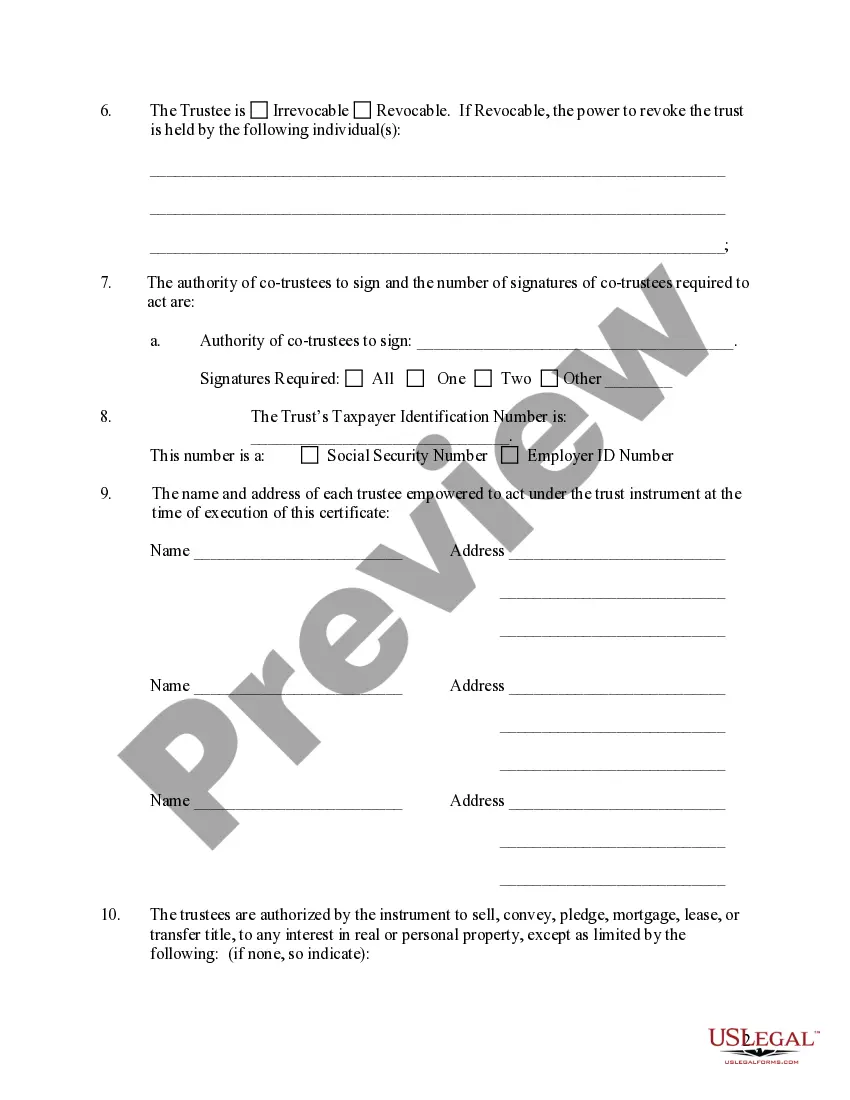

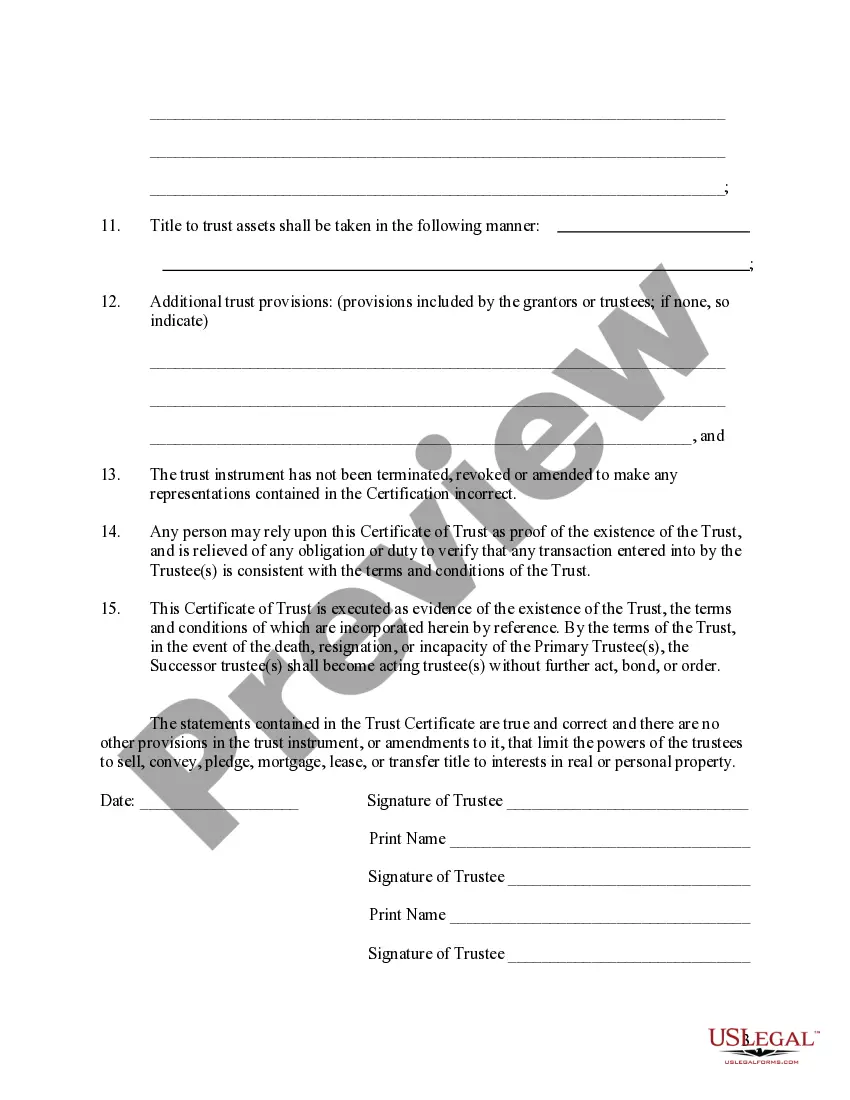

How to fill out Nevada Certificate Of Trust By Individual?

- If you're a returning user, log in to your account and download the required form by clicking the Download button. Verify that your subscription is current; if it's not, renew based on your payment plan.

- New to US Legal Forms? Start by reviewing the Preview mode and form description to ensure you choose a template that meets your needs and aligns with local jurisdiction.

- Search for additional templates if necessary. Use the Search tab if you find inconsistencies and locate the correct form.

- Once you identify the right document, purchase it by clicking on the Buy Now button and selecting your preferred subscription plan. Registration is required for access.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize your subscription.

- Download your form after purchase. Save it to your device to complete, and access it anytime via the My Forms menu in your profile.

US Legal Forms provides individuals and attorneys with the ability to swiftly manage legal documents through an extensive library of over 85,000 fillable forms. This ensures that your forms are not only accessible but compliant and precise.

With a remarkable collection of forms and expert assistance available, US Legal Forms stands out in empowering users to trust their filing evidence with the VAT. Get started today to simplify your legal documentation process!

Form popularity

FAQ

The responsibility for filing a trust tax return typically falls on the trustee. As the trustee, you oversee the trust's administration, which includes fulfilling tax obligations. In some cases, beneficiaries may also have responsibilities, especially if income is distributed. For clarity on roles and to gather the necessary trust filing evidence with the vat, consider using resources from uslegalforms.

A trust generally does not need to file a tax return if it has no income, which may seem straightforward. However, keep in mind that even with no income, the trust may still have filing requirements depending on its structure and state regulations. It's crucial to understand the trust's obligations to ensure compliance. Consulting with uslegalforms can help clarify your trust's specific filing needs and provide trust filing evidence with the vat.

Form 8453 is used to authenticate the electronic filing of a trust's tax return. This form ensures that all information is accurate and confirms that the fiduciary is responsible for the submitted return. Completing this form adds a layer of trust filing evidence with the VAT, establishing the legitimacy of the filing. To streamline this process, consider using US Legal Forms, which can provide clear instructions and templates.

Yes, if your trust generates income, you must file a 1041. The 1041 form reports the trust’s income, deductions, and any tax liability. Filing this form is critical for ensuring accurate trust filing evidence with the VAT. If you have questions about your specific situation, platforms like US Legal Forms offer resources and forms to assist you with compliance.

Filling out a 1041 estate tax return involves gathering detailed financial information about the estate. You need to report all income earned by the estate during the tax year, as well as deductions and credits applicable to the estate. This process helps in providing proper trust filing evidence with the VAT. Utilizing platforms like US Legal Forms can simplify this task with straightforward templates.

To complete Form 56, start by entering your identifying information, including the name and address of the trust. Next, indicate the type of authority you have over the trust, ensuring that all significant information is accurate. The goal is to ensure proper record-keeping for trust filing evidence with the VAT, making this form critical for compliance. If you encounter issues, consider using US Legal Forms for guidance.

In Illinois, anyone who is a fiduciary for a trust must file IL 1041, which reports income generated by the trust. This includes trustees managing assets that produce taxable income. Filing is essential to provide trust filing evidence with the VAT. If you are unsure about your filing responsibilities, consult resources or professionals who understand the trust regulations.

Yes, if a trust pays fees to a trustee, it may be required to issue a 1099 form to report these payments for tax purposes. This is essential for the trustee's tax obligations and ensures accurate income reporting. By keeping organized records as trust filing evidence with the vat, this process becomes seamless.

Not all trusts are required to file a tax return, but many must. For instance, a revocable trust typically doesn't need to file as long as the grantor is alive. However, for other trusts, proper documentation as trust filing evidence with the vat will clarify whether you need to file annually.

Yes, an irrevocable trust is typically required to file a tax return, usually Form 1041, depending on its income. The exact filing requirements may vary based on the trust's earnings and distribution of income to beneficiaries. Maintaining trust filing evidence with the vat can help simplify this process and ensure compliance.