Trust Filing Evidence With The Law

Description

How to fill out Nevada Certificate Of Trust By Individual?

- If you're a returning user, log into your account and navigate to the template you need. Confirm your subscription is active; renew if necessary.

- For first-time users, start by previewing the form descriptions. This ensures you select the correct document relevant to your needs and jurisdiction.

- If you don’t find the right form, use the search functionality to locate it. Verify that the template meets your requirements before proceeding.

- Select the document by clicking on the Buy Now button. Choose a subscription plan and create an account for full access to the library.

- Complete your purchase by entering your payment details or using your PayPal account.

- Finally, download the chosen template and save it to your device. You can access your documents later in the My Forms section of your profile.

By utilizing US Legal Forms, you ensure compliance with legal standards while efficiently managing your document needs. The platform empowers users to file trusted legal evidence with confidence.

Start simplifying your legal workflow today—visit US Legal Forms and explore the vast array of resources available!

Form popularity

FAQ

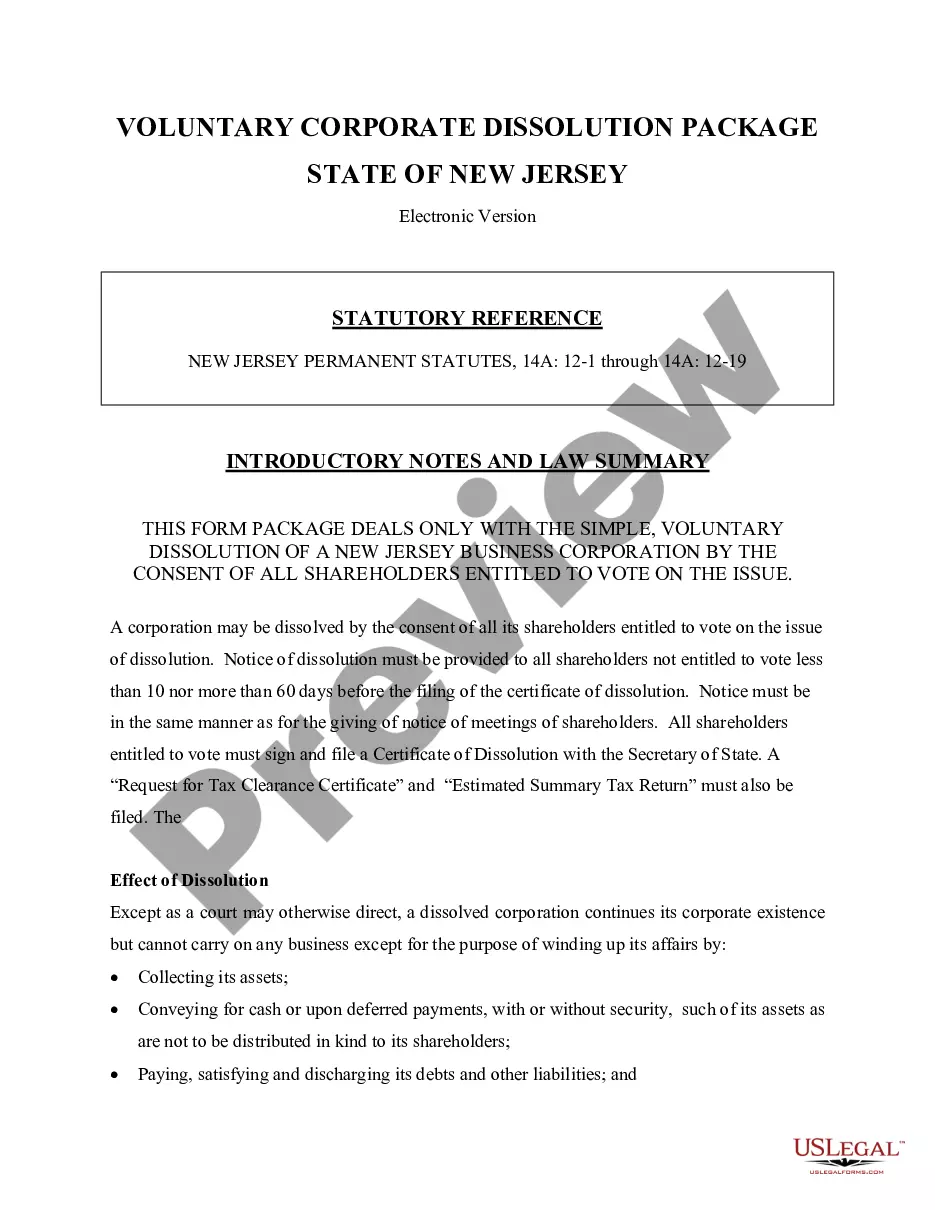

A trust becomes a legal document when it is executed in accordance with state laws governing trust creation. This involves signing the document in the presence of a witness, and in some cases, having it notarized. Trust filing evidence with the law confirms its legality and enforceability. Platforms like US Legal Forms can simplify this process, ensuring your trust is properly established.

A trust document becomes legal through its proper formation and adherence to state laws. Key factors include the clear expression of intent, the identification of trust property, and the rights of the beneficiaries. Trust filing evidence with the law solidifies the document's validity. For a straightforward process, many users turn to US Legal Forms to create compliant documents.

To determine if a trust is valid, you should review whether it meets the legal requirements set by state law. This includes checking for a proper trust document, the capacity of the creator, and the presence of the necessary elements like beneficiaries and a trustee. If you have any doubts, consider seeking professional help or using platforms like US Legal Forms for guidance on trust filing evidence with the law.

To create a valid trust, you need a clear intention to form one, a trust property, a specific beneficiary, a designated trustee, and a legal purpose. Each of these elements acts as trust filing evidence with the law. By ensuring each requirement is met, you establish a robust framework for managing assets. Using US Legal Forms can help you navigate these requirements efficiently.

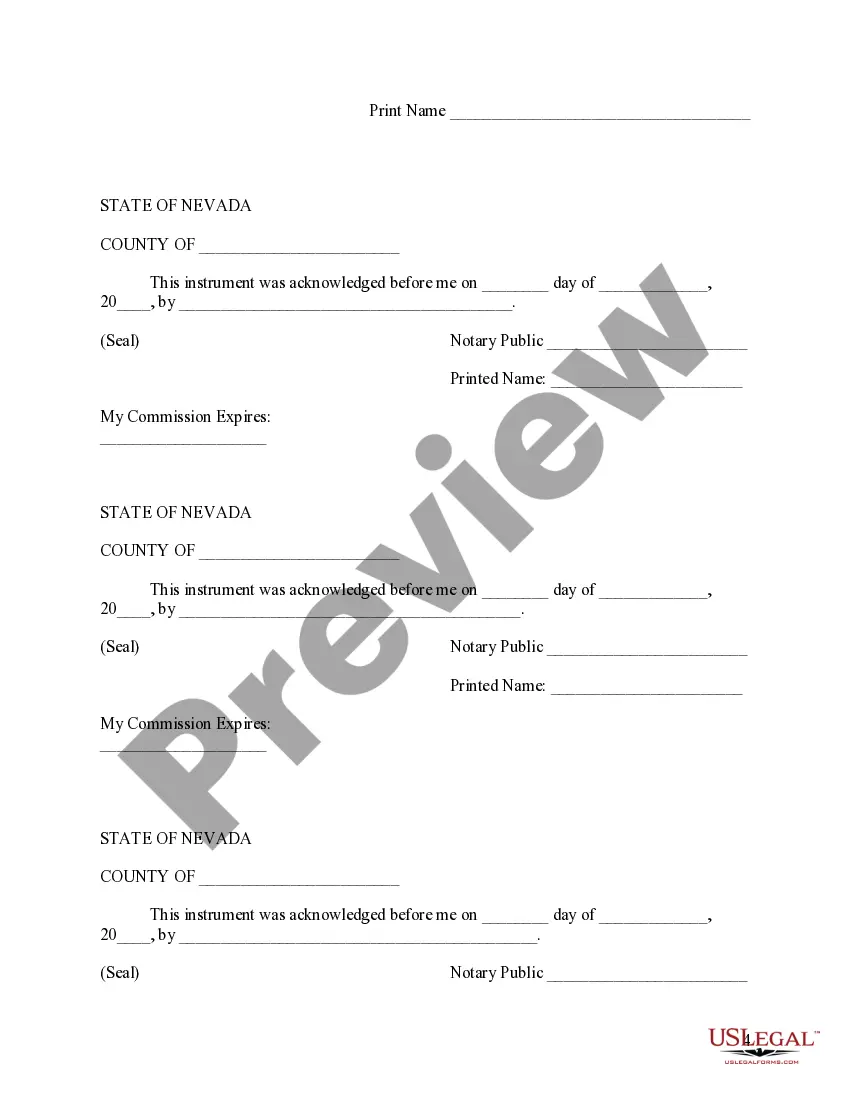

The best states to register a trust typically include Delaware, Nevada, and South Dakota, known for their advantageous trust laws. These states offer tax benefits and privacy protections for trusts. Trust filing evidence with the law confirms proper registration within these jurisdictions. Uslegalforms can assist in evaluating which state aligns best with your trust goals.

Determining the best state for your trust usually requires considering tax laws and regulations. States like Delaware, Nevada, and South Dakota often provide favorable conditions for trusts. Trust filing evidence with the law is important to ensure that you meet all legal standards. Consult uslegalforms for personalized advice to find the right state for your trust needs.

Yes, trusts that generate income must file forms with the IRS, including IRS Form 1041 for reporting income. However, not all trusts are required to file, particularly if they do not produce taxable income. Trust filing evidence with the law assures that all financial activities are reported correctly. For comprehensive assistance, uslegalforms can help you navigate these requirements.

To submit IRS Form 56, which notifies the IRS of the creation of a trust, you need to gather all necessary details about the trust. After completing the form, you can submit it by mailing it directly to the IRS or submitting it electronically, if applicable. Trust filing evidence with the law is shown with proper submission. Uslegalforms provides guidance on how to effectively complete and submit this form.

A trust should file its tax return in the state where it is considered a resident for tax purposes. The guidelines vary by state, and filing can also depend on where trust income is sourced. Trust filing evidence with the law ensures compliance with both federal and state regulations. Tools offered by uslegalforms can simplify determining your tax obligations.

The location of a trust is mainly determined by the residency of the trustor and where the assets are managed. Other factors include tax implications and legal requirements specific to states. Trust filing evidence with the law is crucial for clarifying these parameters. Solutions like uslegalforms can help clarify specifics regarding the best location for your trust.