Trust Filing Evidence With The Case

Description

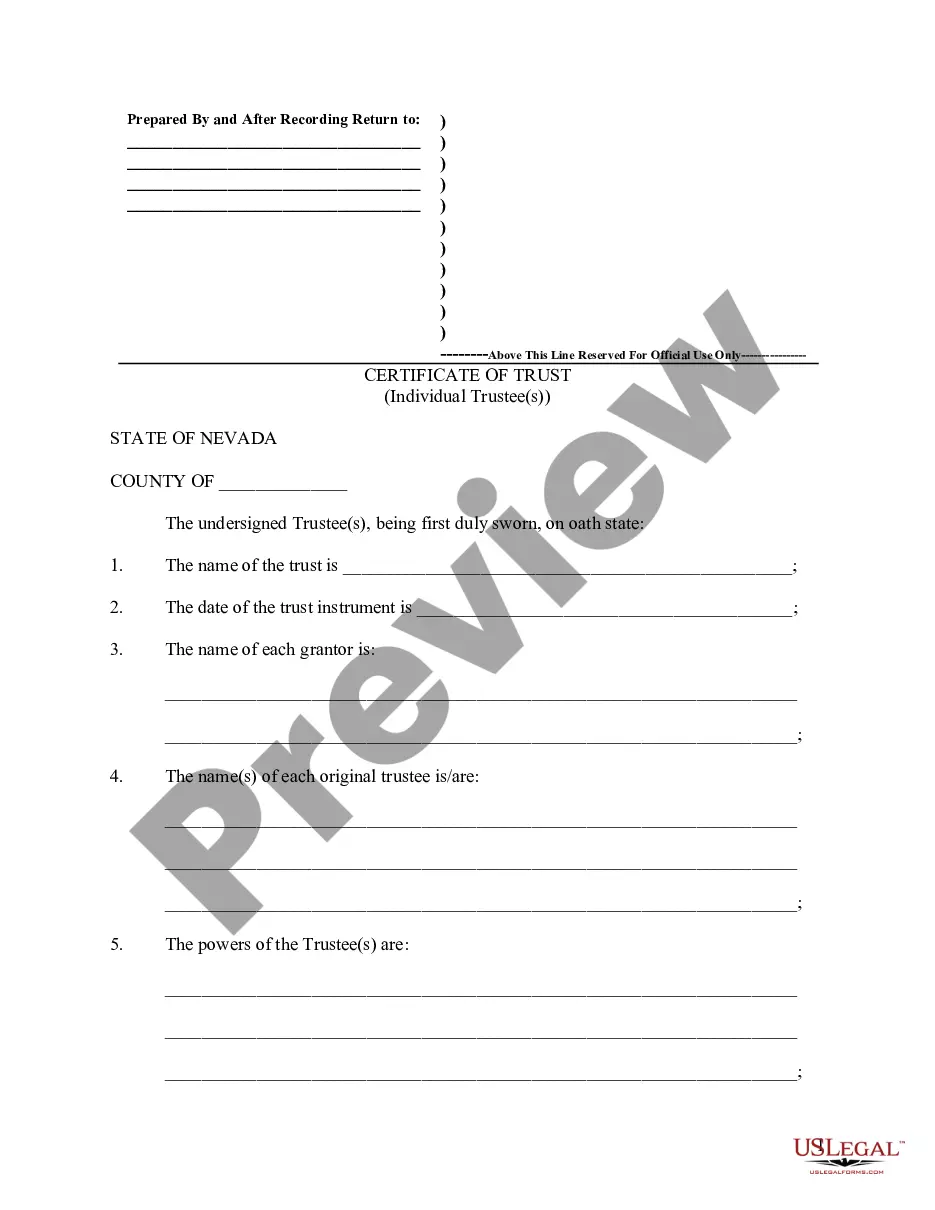

How to fill out Nevada Certificate Of Trust By Individual?

- Log in to your account if you are a returning user. Ensure your subscription is active.

- Preview the required form template to confirm it meets local jurisdiction requirements.

- If necessary, use the Search tab to locate additional templates if you don't find the right one at first glance.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan.

- Complete the payment using your credit card or PayPal account.

- Download the completed form to your device and access it anytime from the My Documents menu.

By following these steps, you can easily trust filing evidence with the case while benefiting from US Legal Forms' extensive library filled with over 85,000 legal documents. This service not only empowers you to create precise forms but also provides access to premium experts for assistance.

Get started today and ensure your legal documents are in order. Visit US Legal Forms to find the forms that best fit your needs!

Form popularity

FAQ

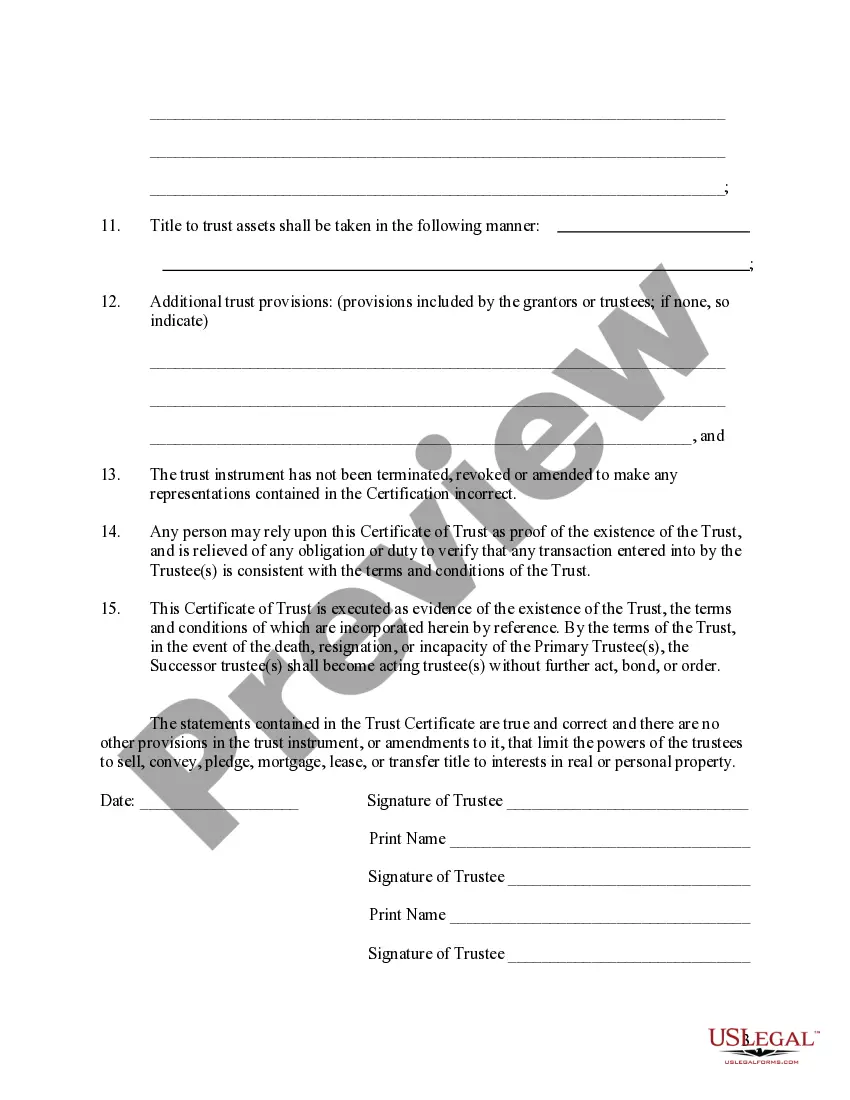

One of the biggest mistakes parents make is failing to fund the trust properly after its creation. This oversight can render the trust ineffective, hindering its intended purpose. To avoid this pitfall, consider using professional assistance, like uslegalforms, for guidance on proper funding and maintaining trust filing evidence with the case throughout the process.

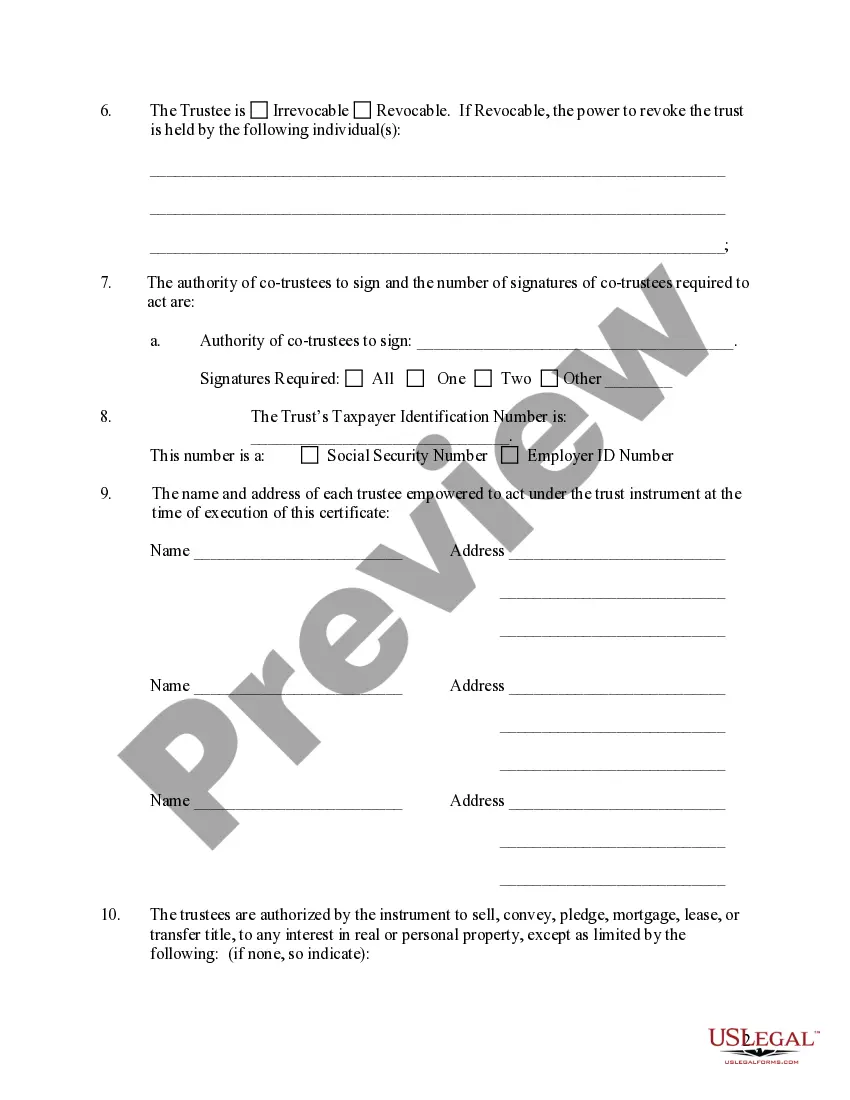

A trust must be clearly described in a legal document by stating its name, purpose, and the parties involved, including trustees and beneficiaries. Include specific terms that outline the trust's operational structure and its financial directives. Clarity in these descriptions is vital, as it helps establish trust filing evidence with the case, making the trust more enforceable.

Yes, you can write off certain expenses related to managing a trust. These can include administrative costs, legal fees, and some investment expenses. Utilizing proper bookkeeping practices can help maintain clear records, which serve as important trust filing evidence with the case if any inquiries arise.

Drafting a trust document involves outlining the trust’s purpose, naming the trustees, and detailing the beneficiaries. You must clearly define the trust's assets and the terms under which they will be managed and distributed. Using a reliable platform like uslegalforms can assist you in ensuring that every element adheres to legal standards, ultimately supporting trust filing evidence with the case.

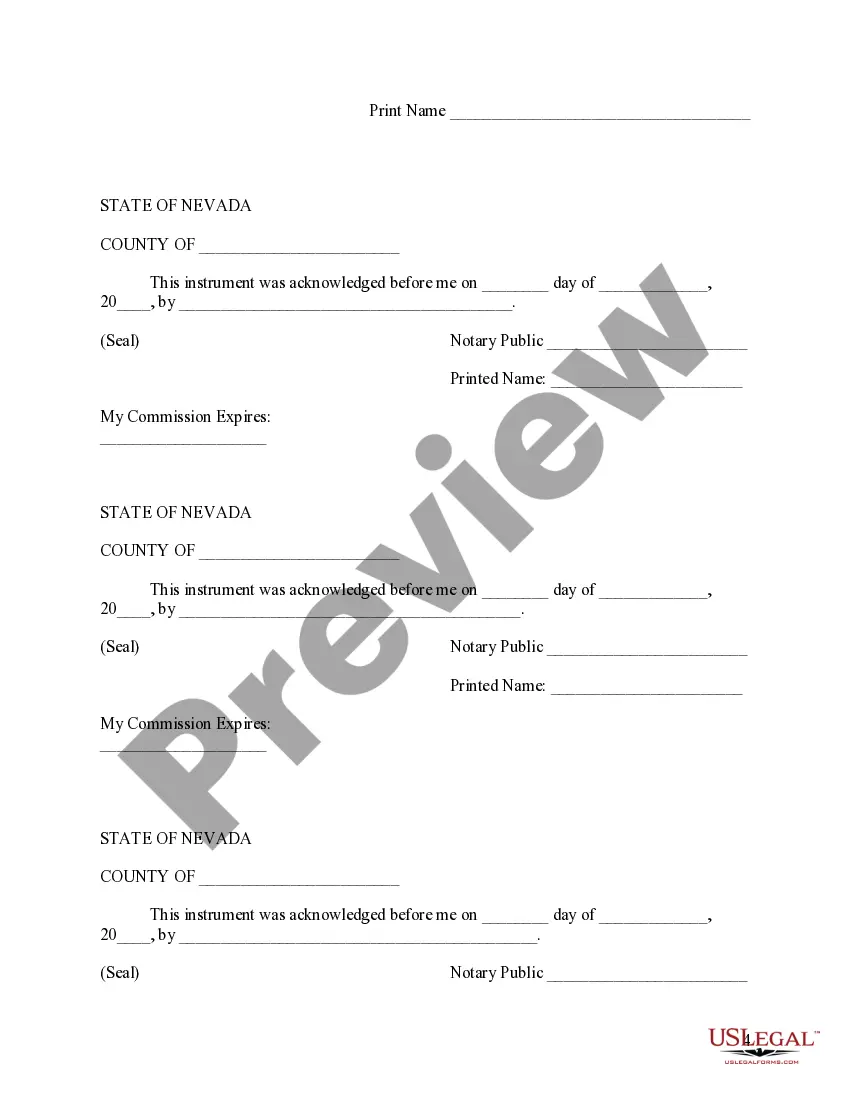

Yes, you can create your own certificate of trust, but it is crucial to follow state requirements accurately. Ensure that the document clearly states the trust's existence, its purpose, and the identities of the trustees. Consulting with a legal expert can provide necessary insights, especially to ensure your certificate serves as strong trust filing evidence with the case.

Some assets are not ideal for placing in a trust, such as retirement accounts, life insurance policies, and certain types of property. For example, you cannot transfer your IRA directly into a trust without incurring taxes. It's wise to seek guidance on this, as understanding trust filing evidence with the case will help protect your assets effectively.

Filling out form 1041 requires accurate information regarding the trust's income and deductions. Start by gathering all relevant documents that show income earned by the trust. Carefully include the trust's name, taxpayer identification number, and ensure the address is correct. Remember, proper documentation is essential as trust filing evidence with the case can simplify your tax reporting.

Yes, beneficiaries can request to see bank statements related to the trust. This transparency allows beneficiaries to understand how trust assets are managed and spent. If you face any obstacles, obtaining trust filing evidence with the case can reinforce your request and ensure you receive the necessary documentation.

Trust beneficiaries have several rights, including the right to receive trust distributions and information about the trust. They can also request a copy of the trust document and ask questions about the trust's administration. Understanding these rights is essential, and gathering trust filing evidence with the case can help clarify any disputes.

Yes, a beneficiary can certainly ask to see the trust documents. It is their right to understand the terms and verify their benefits. If you need help navigating this process, platforms like USLegalForms can assist in preparing your request effectively.