Trust Filing Evidence For Tax Return

Description

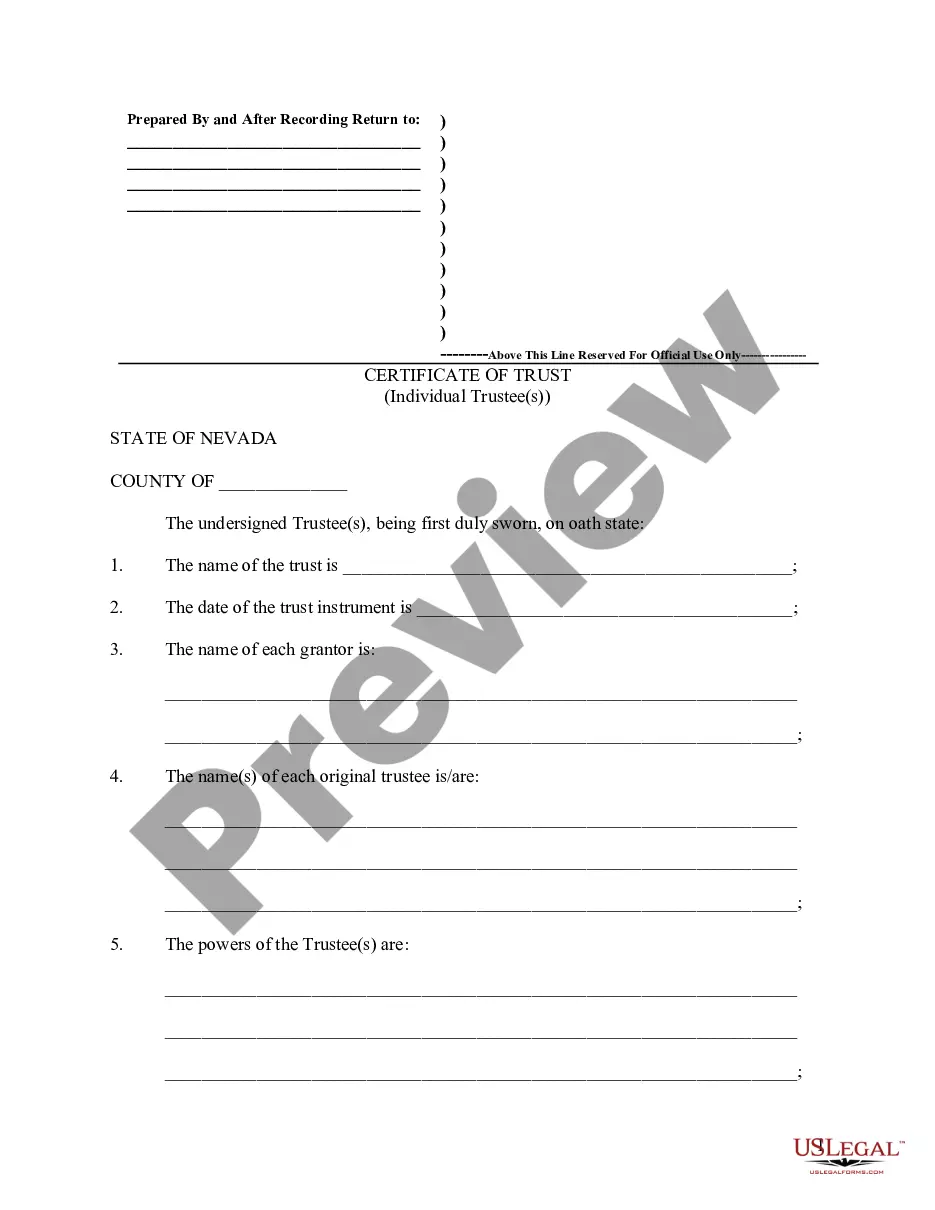

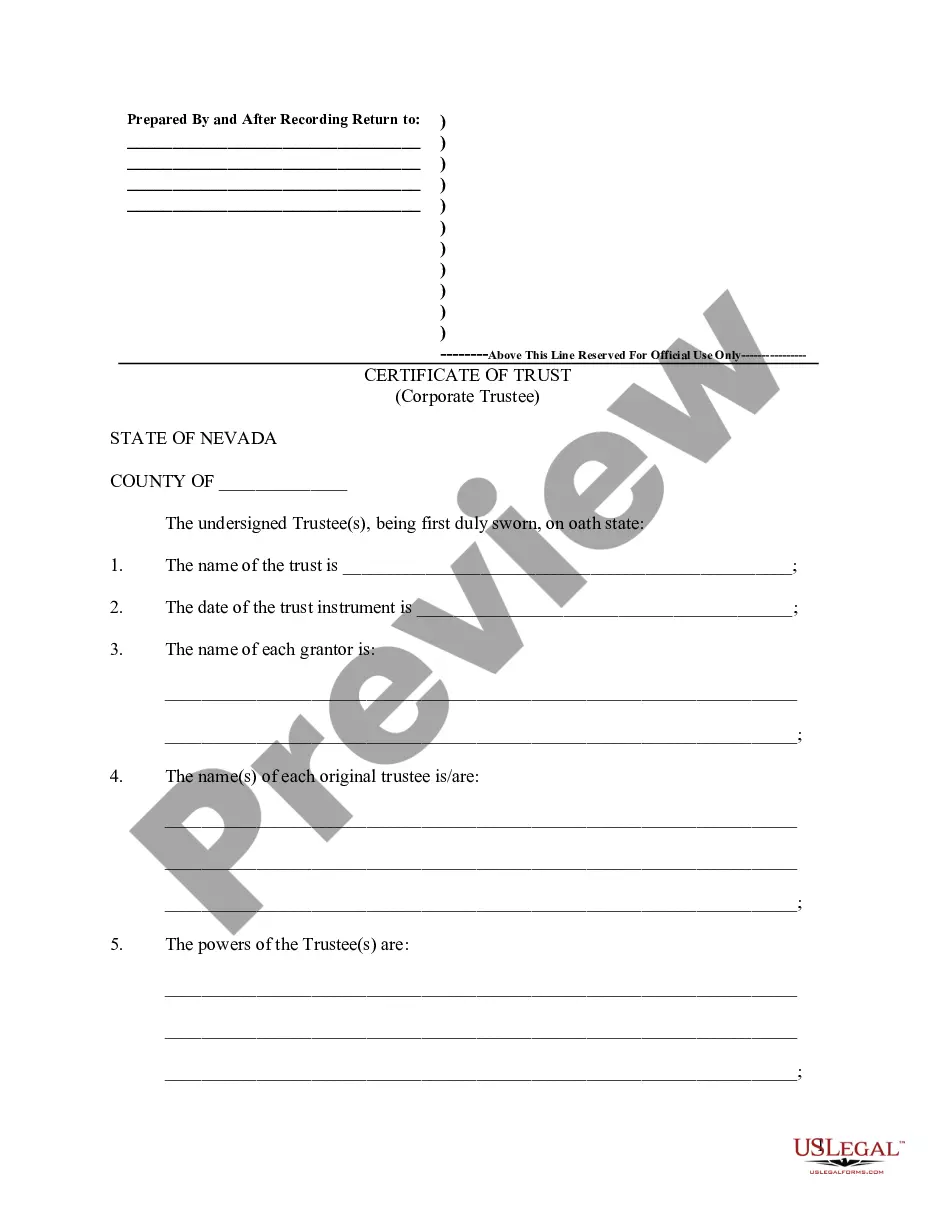

How to fill out Nevada Certificate Of Trust By Individual?

- Log in to your existing US Legal Forms account, ensuring your subscription is active. If necessary, renew your subscription.

- Explore the Preview mode and detailed descriptions of potential form templates to select the one that aligns perfectly with your requirements.

- Utilize the Search tab to find alternative templates if the initial choice doesn’t meet your needs.

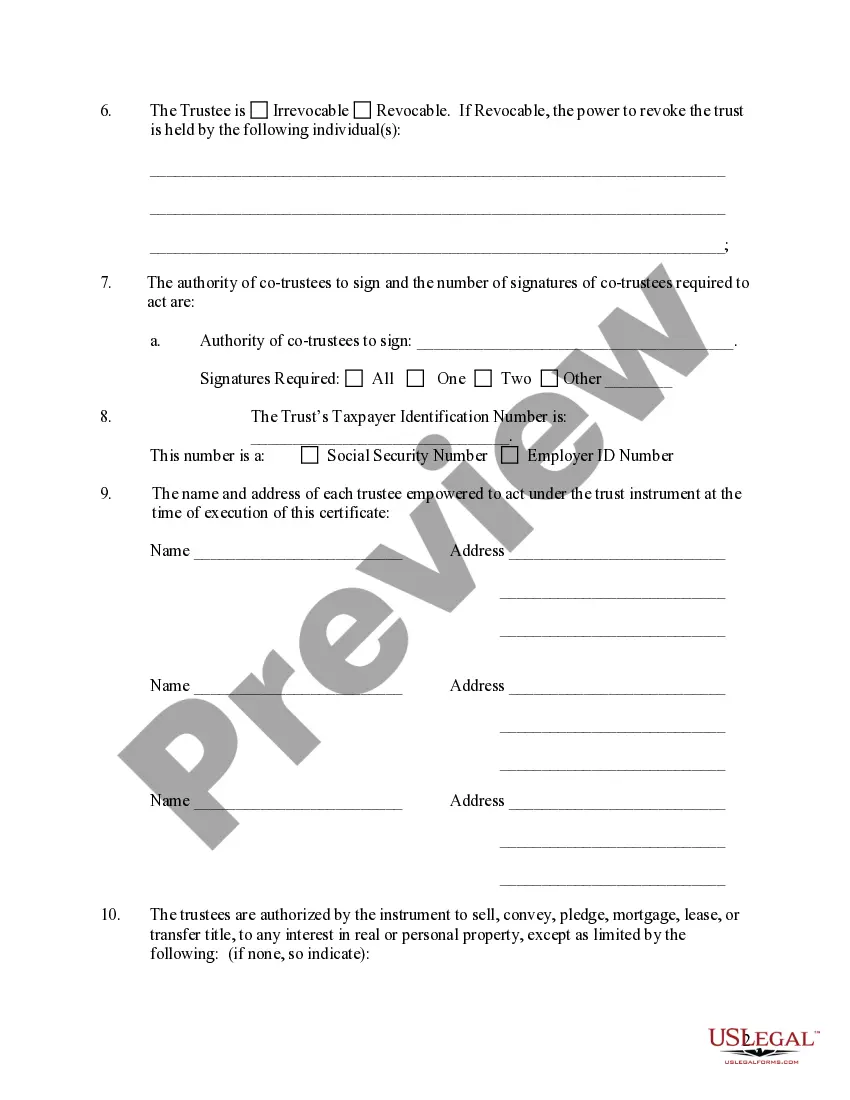

- Once you've selected the correct document, click on the Buy Now button to proceed with the purchase. Choose the subscription plan that suits you.

- Enter your payment details to complete the transaction securely.

- Download your form and save it to your device for easy access anytime. You can also find it in the My Forms section of your profile.

US Legal Forms provides a robust collection of over 85,000 legal forms, making it an invaluable resource for individuals and attorneys alike. With access to premium experts for assistance, you can ensure that your documents are completed accurately.

Start utilizing US Legal Forms today to streamline your tax filing process and access the legal templates you need effortlessly. Don't hesitate—get started now!

Form popularity

FAQ

To file taxes on behalf of a trust, you need to gather all relevant financial documents, including income statements and deductions. Next, complete Form 1041 and provide Schedule K-1 to beneficiaries. This process establishes trust filing evidence for tax return and ensures compliance with IRS regulations. Consider using uslegalforms to access helpful tools and templates that can streamline your filing process.

Yes, a trust must file a tax return with the IRS if it meets certain income thresholds or has taxable income. Filing helps maintain compliance with tax laws and provides trust filing evidence for tax return purposes. Irrevocable trusts generally have more stringent filing requirements compared to revocable trusts. Ensuring proper filing is crucial, and uslegalforms offers reliable resources to assist in this process.

To report trust income, complete Form 1041 for the trust and distribute Schedule K-1 to beneficiaries for their personal tax returns. This process ensures that all trust income is accurately reported, serving as vital trust filing evidence for tax return. It is essential to keep detailed records of all income and expenses related to the trust to facilitate accurate reporting. Consulting resources on uslegalforms can provide helpful insights and templates for this task.

The trustees are responsible for preparing a Schedule K-1 for beneficiaries of the trust. This document provides each beneficiary with details regarding their share of the trust's income, deductions, and credits. Accurate preparation of K-1 forms serves as critical trust filing evidence for tax return requirements. Utilizing tools available on platforms like uslegalforms can help streamline this process efficiently.

Recent IRS rules have introduced changes to how trusts must report their income and distributions. These updates aim to improve clarity and compliance within the tax system. Trusts are required to ensure that their reporting aligns with these new regulations, including providing accurate trust filing evidence for tax return. Staying informed about these rules can help avoid potential penalties for non-compliance.

To file a tax return, a trust must have taxable income or meet specific thresholds, outlined by the IRS. Factors such as the trust's income types and whether it is a revocable or irrevocable trust play key roles. Trust filing evidence for tax return includes providing the necessary documentation that confirms the income earned and any applicable deductions. You can find more detailed guidance through platforms like uslegalforms, which can simplify the trust filing process.

Trusts must report income, deductions, and credits to the IRS using Form 1041. This form acts as the primary trust filing evidence for tax return. Additionally, beneficiaries may receive a Schedule K-1 to report their share of income on their personal tax returns. Trusts that earn taxable income must adhere to these obligations to ensure compliance with tax laws.

Yes, trust tax returns can be filed electronically, making the process more efficient and convenient. Using e-filing allows trusts to maintain trust filing evidence for tax return purposes while ensuring secure submission. Many tax software programs and platforms, like USLegalForms, streamline this process by guiding you through necessary steps. Electronic filing often speeds up processing times and helps in managing tax obligations effectively.

To report trust income on a tax return, you typically use IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts. The trust needs to account for all income generated during the year, which will serve as trust filing evidence for tax return purposes. It's essential to categorize income correctly, including interest, dividends, and capital gains. Proper reporting helps prevent issues and ensures accurate taxation.

Yes, a trust may be required to file a gift tax return if it makes a gift exceeding the annual exclusion amount. This is important for establishing trust filing evidence for tax return purposes. The trust must report gifts made during the tax year, which can impact the grantor's tax obligations. Understanding these requirements ensures compliance and accurate reporting.