Trust Filing Evidence For Tax

Description

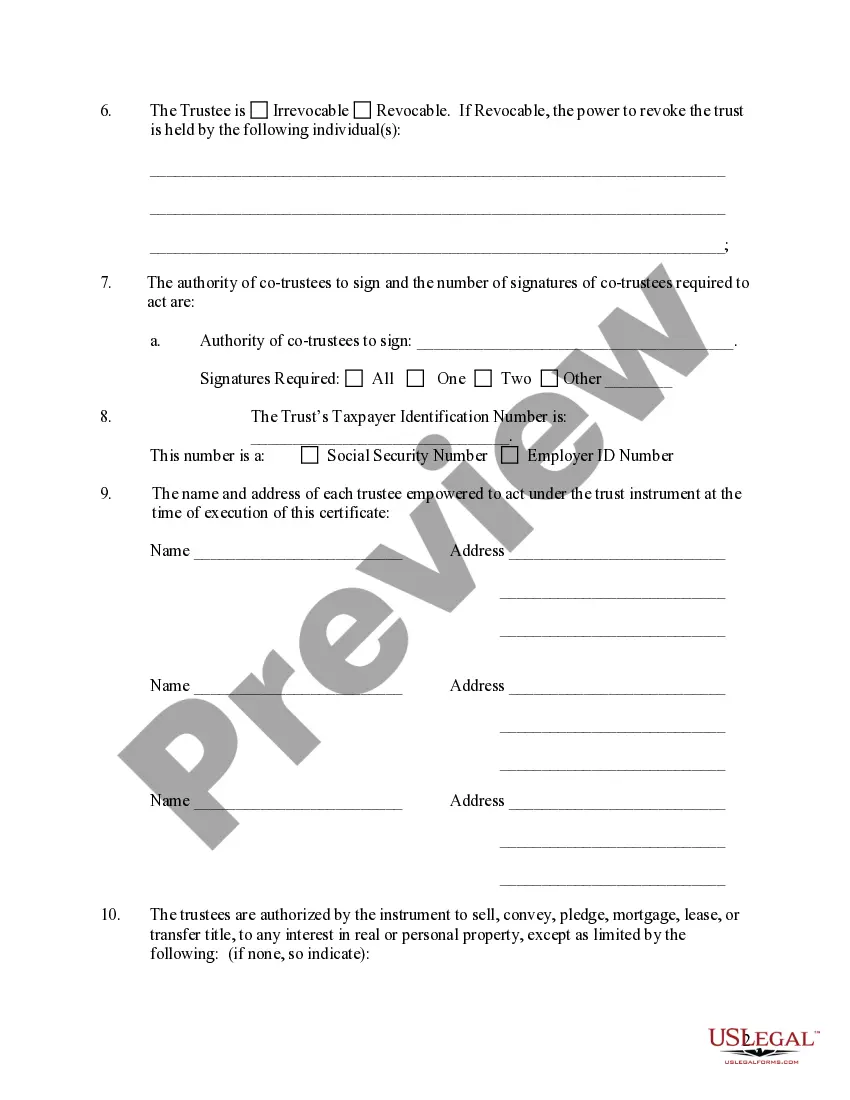

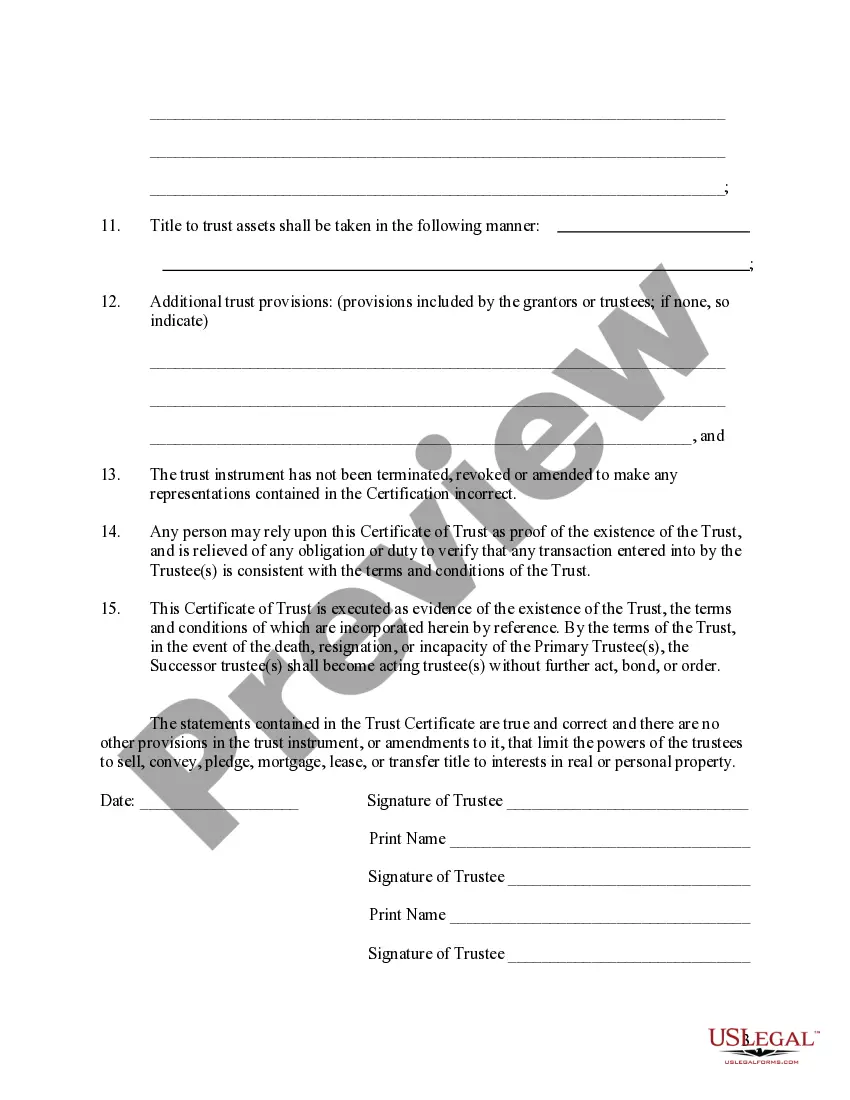

How to fill out Nevada Certificate Of Trust By Individual?

- If you're an existing user, log into your account and check if your subscription is active to download the required form template by clicking the Download button.

- For new users, begin by reviewing the Preview mode to select a template that suits your specific needs.

- If the chosen form doesn’t meet all your requirements, use the Search tab to locate a more suitable document.

- Once you find an appropriate form, proceed by clicking the Buy Now button and select from the available subscription plans.

- Complete your purchase by providing either your credit card details or logging in with your PayPal account.

- After payment confirmation, download the form to your device for filling out and accessing anytime from the My Forms section.

US Legal Forms is a powerful tool that brings efficiency to your legal documentation process. With a vast collection of over 85,000 forms, users can seamlessly navigate their legal needs.

Make the smart choice today—explore US Legal Forms for a simpler way to manage your legal documentation.

Form popularity

FAQ

To obtain an IRS transcript for a trust, you can request it online through the IRS website or by submitting Form 4506-T. The transcript provides a detailed record of the trust's tax filings and is essential for maintaining clear financial records. Having this transcript acts as an important piece of trust filing evidence for tax, ensuring all reported information is accurate. For streamlined processes, check out the resources available on uslegalforms.

Yes, trusts can receive Forms 1099, especially if they earn interest, dividends, or other reportable income. The trustee must ensure all 1099 forms are reviewed and accurately integrated into the trust's tax return. This serves as trustworthy evidence for tax filing, making compliance easier. It's beneficial to utilize tools on uslegalforms to manage these documents efficiently.

To report trustee income, you must include it in the trust's annual tax return using Form 1041. Ensure that all income generated by the trust is accounted for in the calculations. Clear record-keeping will strengthen your trust filing evidence for tax purposes and facilitate accurate reporting. Using uslegalforms can help streamline this process by providing the necessary documentation.

The IRS form used for reporting trust income is Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts. This form allows the trustee to report income, deductions, and credits associated with the trust. Properly filling out Form 1041 serves as trust filing evidence for tax and ensures compliance with federal tax laws. You can find guidance and resources on uslegalforms to assist you in this process.

Yes, trust income must be reported on tax returns. It's essential to include trust income on the appropriate tax forms to avoid penalties. Reporting trust income accurately provides solid trust filing evidence for tax purposes. When done correctly, this can also lead to beneficial tax outcomes for the beneficiaries.

Yes, IRS Form 1041 can be filed electronically, which enhances the accuracy and speed of your submission. Electronic filing is beneficial for documenting trust filing evidence for tax efficiently and securely. Additionally, platforms like USLegalForms make it easy to file these forms online, reducing the complexity involved in traditional paper filing.

To file a tax return for a trust, you must complete IRS Form 1041 and gather all relevant financial information. Ensure that you include all income and deductions associated with the trust to maintain accurate records. Trust filing evidence for tax requires careful attention to detail. Consider using resources from USLegalForms for easy access to the forms and instructions needed.

The trustee is responsible for filing the tax return for the trust. This includes ensuring that all necessary documentation is submitted in a timely manner. The responsibility for trust filing evidence for tax falls on the trustee, who must report income generated by the trust accurately. Using tools from USLegalForms can help simplify this task for trustees.

Yes, you can file the IL 1041 electronically. This process allows for a faster and more efficient submission of your trust tax return. It simplifies the documentation needed for trust filing evidence for tax purposes. By using reliable online platforms like USLegalForms, you can streamline your filing process.

The exemption amount for estates on Form 1041 can vary depending on the circumstances. Generally, estates may have an exemption amount based on the current tax regulations. Gathering trust filing evidence for tax will help you determine the correct exemption applicable to your situation.