Nevada Deed Of Trust Requirements

Description

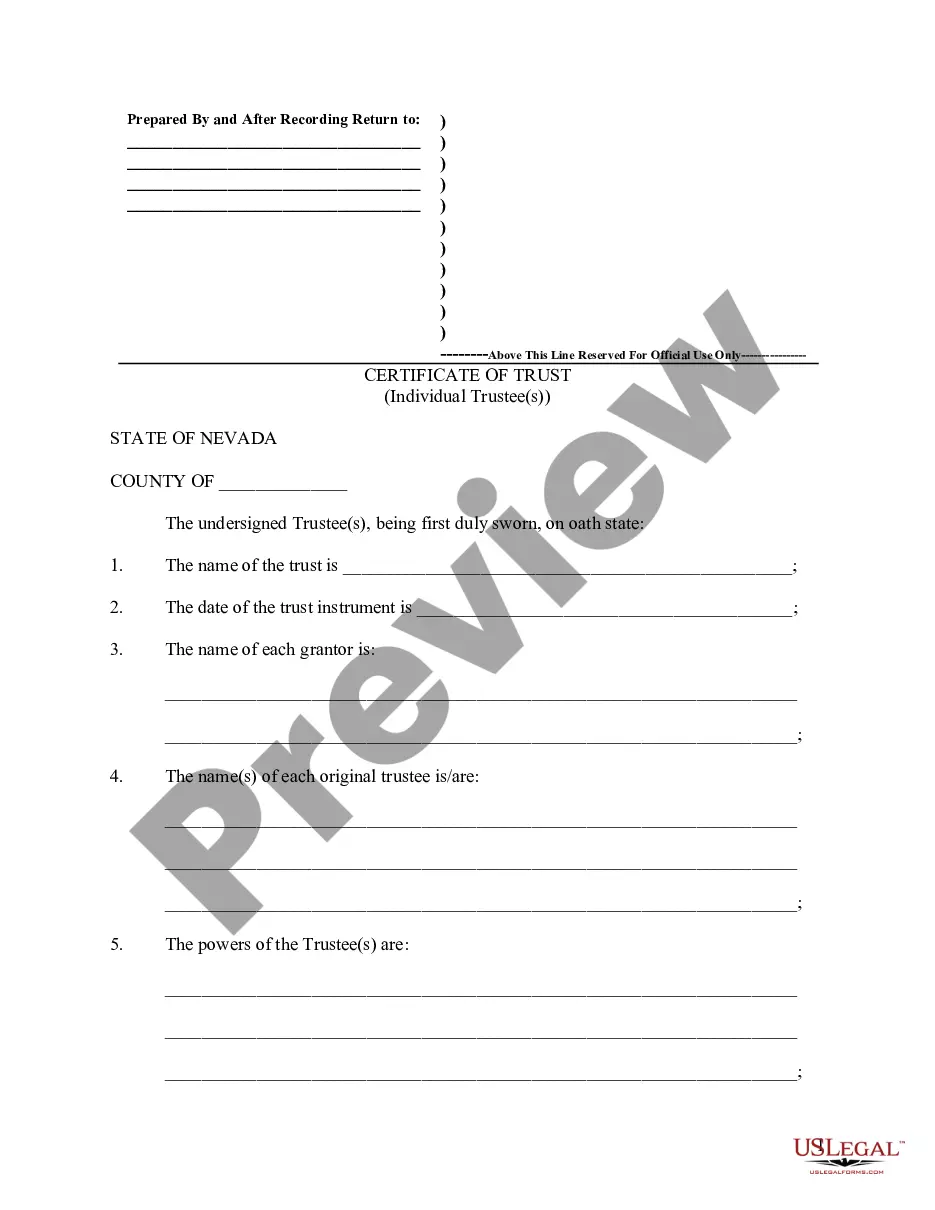

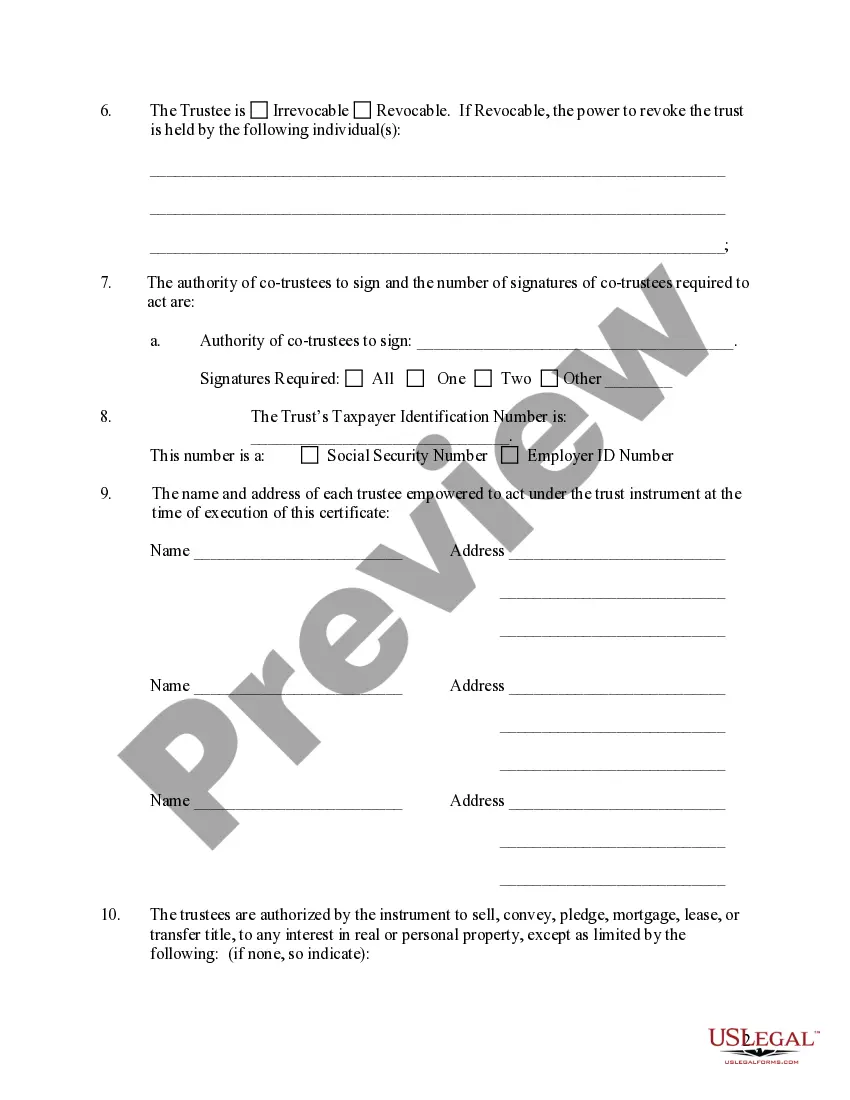

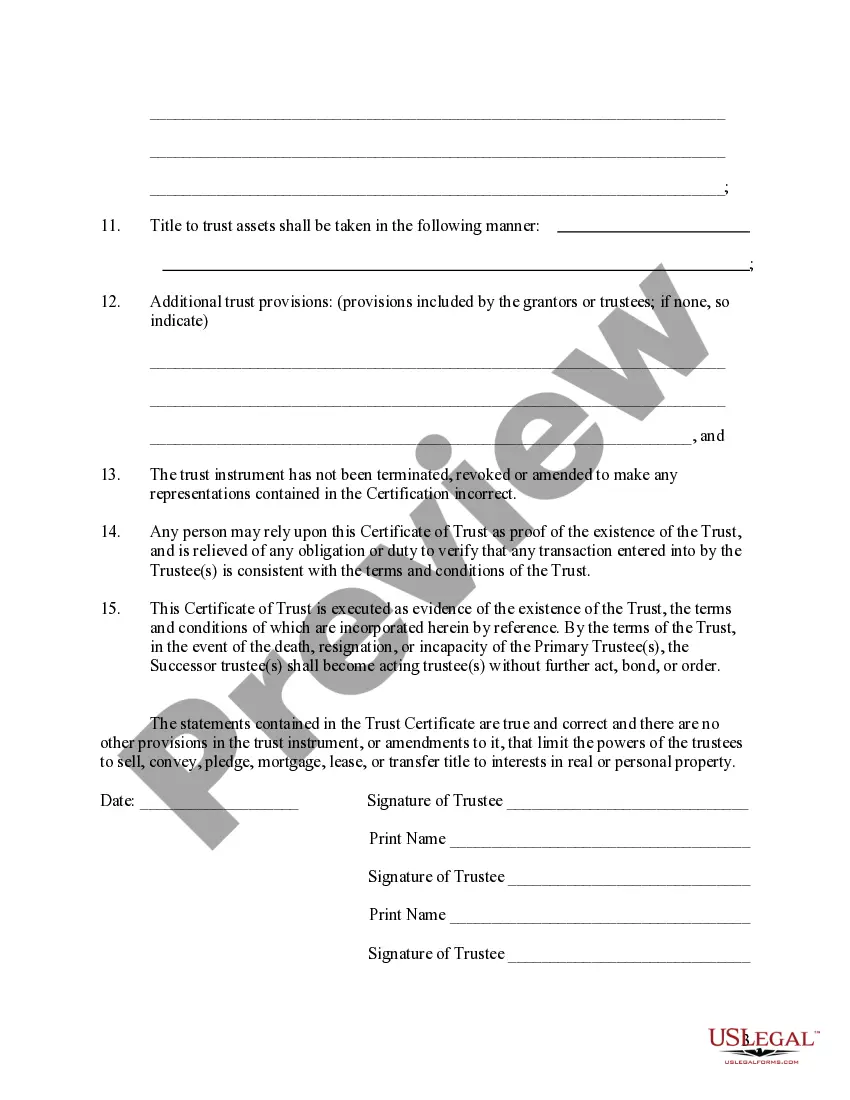

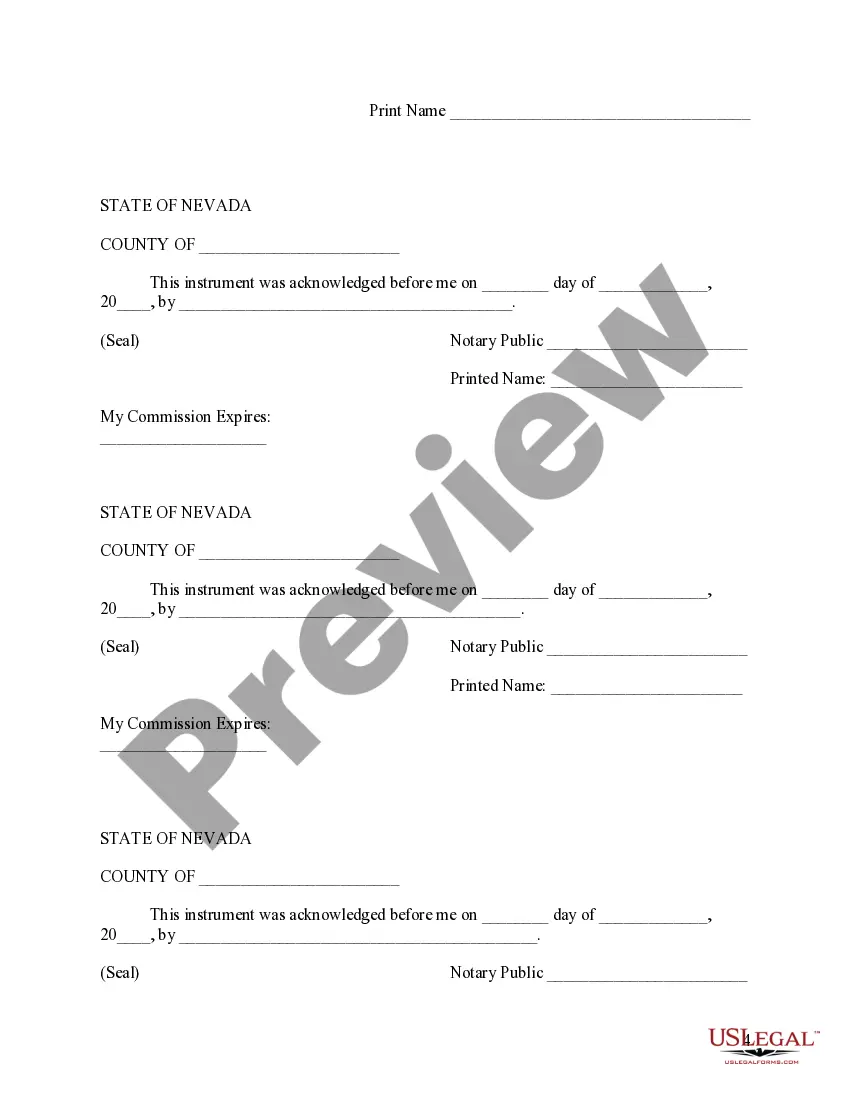

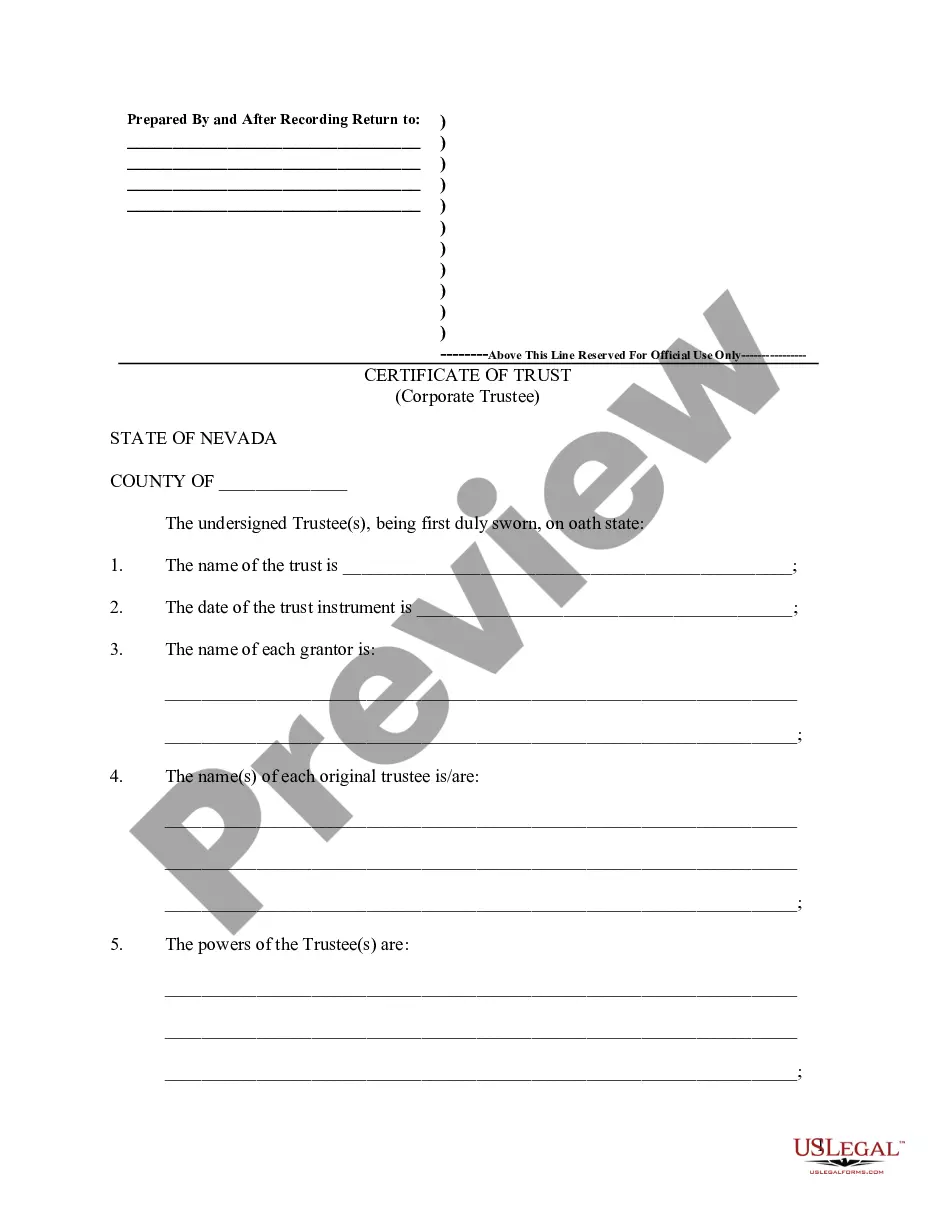

How to fill out Nevada Certificate Of Trust By Individual?

Legal administration can be perplexing, even for the most seasoned experts.

When you are seeking information on Nevada Deed Of Trust Requirements and lack the time to search for the correct and current version, the processes can be stressful.

Access a valuable collection of articles, guides, and resources related to your case and requirements.

Save time and energy searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Preview feature to find Nevada Deed Of Trust Requirements and obtain it.

Enjoy the US Legal Forms online repository, supported by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly task today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to view the documents you previously downloaded and organize your files as needed.

- If it’s your first experience with US Legal Forms, create an account and gain unrestricted access to all the platform's features.

- The steps to follow after finding the form you need are.

- Verify this is the correct form by previewing it and reviewing its description.

- Ensure that the template is recognized in your state or county.

- Select Buy Now when you are ready.

- Choose a monthly subscription plan.

- Select the format you desire and Download, complete, eSign, print, and send your document.

- Access state- or county-specific legal and business documentation.

- US Legal Forms addresses any needs you may have, from personal to corporate documents, all in a single location.

- Employ advanced tools to complete and manage your Nevada Deed Of Trust Requirements.

Form popularity

FAQ

Yes, Nevada does use a deed of trust instead of a traditional mortgage in real estate transactions. This instrument serves as a security agreement for the lender, allowing them to claim the property in case of default. Consequently, it's important for borrowers to familiarize themselves with Nevada deed of trust requirements to avoid pitfalls.

Yes, you can write your own deed of trust in Nevada, but it’s crucial to ensure that it meets all legal requirements. Creating a valid deed requires understanding state-specific laws and guidelines to avoid future disputes. If you feel uncertain, consider using ulegalforms for guidance and templates that align with Nevada deed of trust requirements.

While this primarily focuses on Nevada deed of trust requirements, it’s useful to know that to record a deed in Colorado, you need a completed deed, a legal property description, and signatures from the grantor. This process helps to validate claims regarding property ownership. Although regulations vary, ensuring proper documentation is key in both states.

Yes, a deed of trust must be filed in the county recorder's office where the property is located. Filing this document is crucial for establishing a legal claim to the property. By complying with these Nevada deed of trust requirements, you can protect your investment and secure your rights.

A deed of trust serves as a secure way to finance property transactions. It involves three parties: the borrower, the lender, and the trustee. This arrangement facilitates trust by clearly defining the roles and responsibilities, ultimately fulfilling the Nevada deed of trust requirements efficiently.

The requirements for a deed of trust in Nevada include a clear statement of the parties, a legal property description, and signatures from all grantors. Additionally, the deed should be notarized to ensure its validity. By adhering to these Nevada deed of trust requirements, you can prevent potential legal issues later on.

In Nevada, it is not necessary to record a trust; however, recording can provide protection against claims and disputes. If you are establishing a trust for property, consider along with the deed of trust requirements, how recording may benefit you. This proactive approach can safeguard your interests.

In Nevada, a deed must include the legal description of the property, names of the parties involved, and the signature of the grantor. The notary acknowledgment is also essential to validate the document. Understanding these Nevada deed of trust requirements can help ensure a smooth property transfer process.