Certificate Of Trust Nevada Withholding

Description

How to fill out Nevada Certificate Of Trust By Individual?

Legal documents handling can be perplexing, even for seasoned professionals.

When you are looking for a Certificate Of Trust Nevada Withholding and cannot dedicate time to find the correct and current version, the process can be overwhelming.

Access a valuable resource library of articles, tutorials, and guides related to your situation and needs.

Save time and effort searching for the documents you require by using US Legal Forms’ advanced search and Preview feature to find Certificate Of Trust Nevada Withholding and obtain it.

Ensure that the template is recognized in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the format you desire, and Download, complete, sign, print, and send your document. Enjoy the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Transform your daily document management into a straightforward and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to see the documents you have previously downloaded and manage your folders as needed.

- If this is your first visit to US Legal Forms, create a free account and gain unlimited access to all the benefits of the platform.

- Here are the steps to follow after accessing the form you need.

- Confirm this is the correct form by reviewing it and going through its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you may have, from personal to corporate paperwork, all in one place.

- Utilize advanced tools to complete and manage your Certificate Of Trust Nevada Withholding.

Form popularity

FAQ

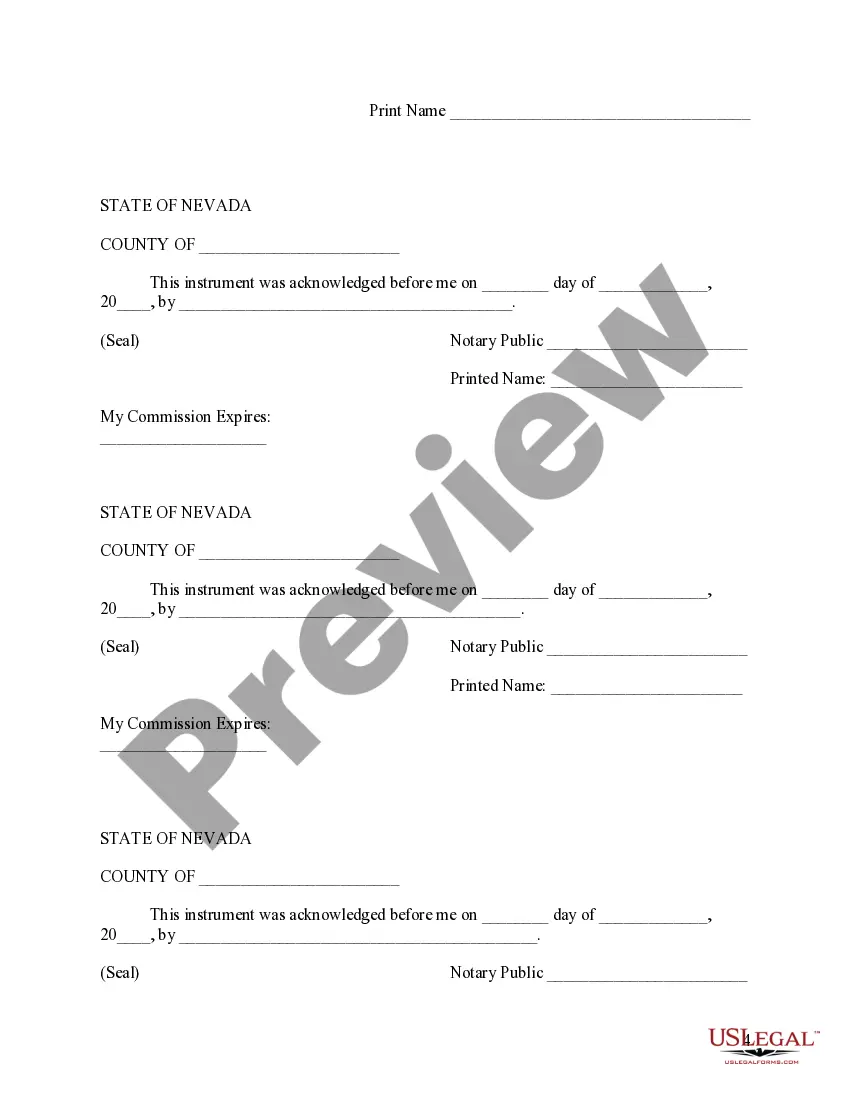

While a certification of trust does not always require notarization, having it notarized adds an extra layer of security. This step can help affirm the authenticity of your document and protect against disputes. Be sure to check local Nevada regulations, as they may have specific guidelines regarding certificate of trust Nevada withholding in your situation.

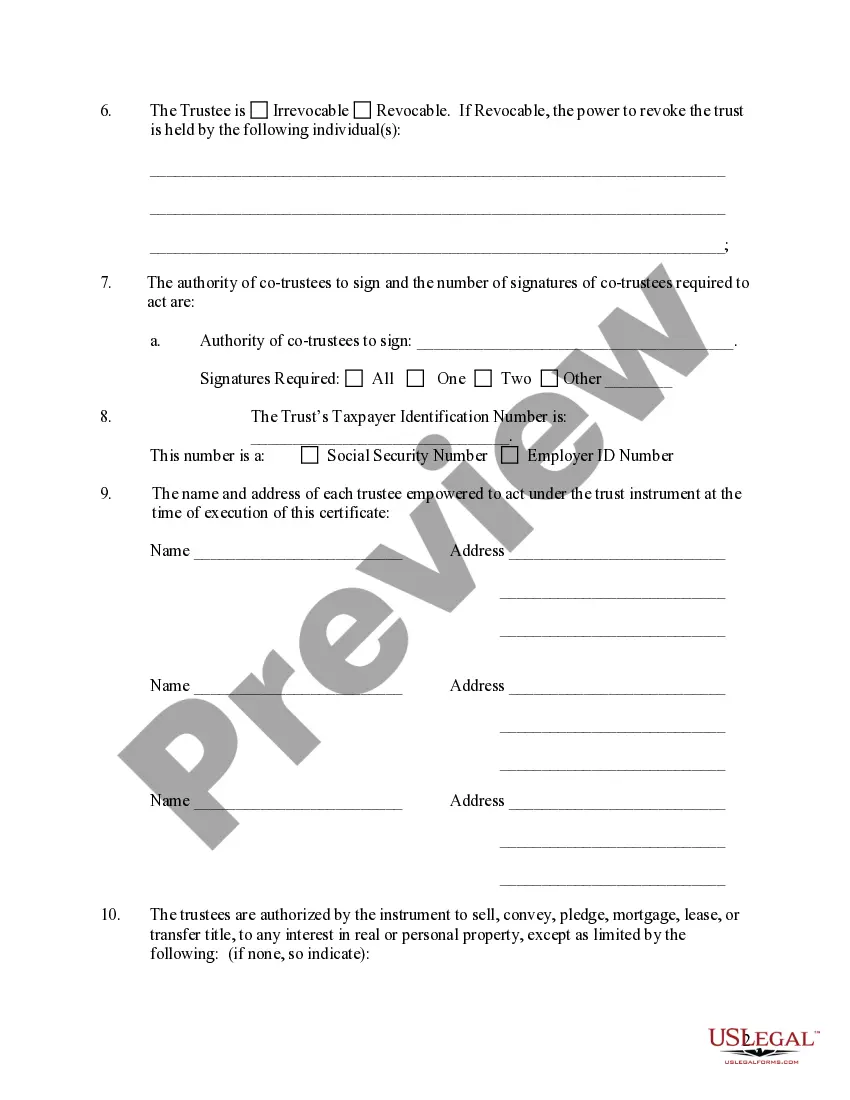

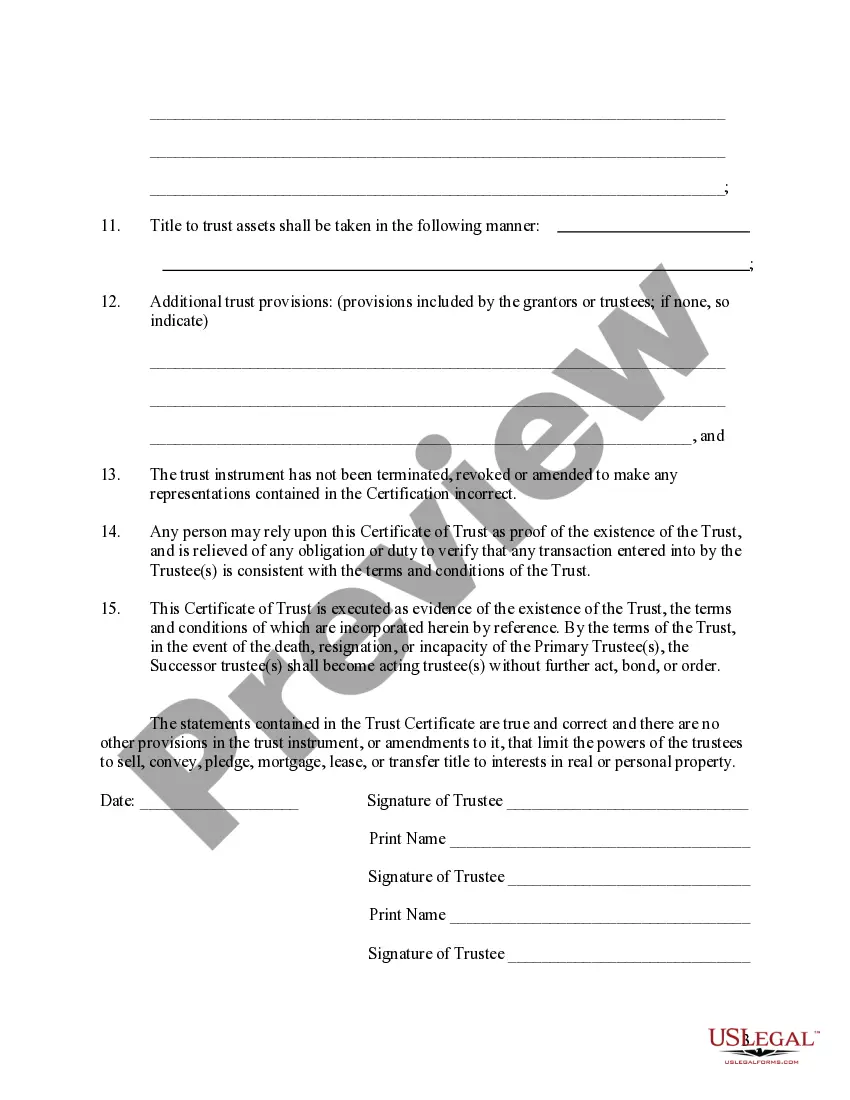

Filling out a certification of trust form involves providing information about the trust itself, including its creation date and the trustee's authority. You should also list the beneficiaries and the specific powers granted to the trustee. If you reference certificate of trust Nevada withholding, it can further authenticate your documentation for transactions.

To properly fill out a trust amendment form, start by identifying the specific parts of the trust that you wish to change. Clearly state the amendments, ensuring they align with your original trust agreement. Including a reference to the certificate of trust Nevada withholding can help clarify the purpose of the amendment to financial institutions.

Yes, you can create your own certificate of trust, but it's vital to follow Nevada's legal requirements. It should contain essential details like the trust's name, the trustee’s information, and the date of trust establishment. To ensure its validity, you may want to consult a legal professional, especially regarding certificate of trust Nevada withholding.

Filling out a W9 for a trust requires you to provide the trust's name, its employer identification number, and the type of entity. If the trust is revocable, indicate that on the form. Remember to use the certificate of trust Nevada withholding to clarify the trust's identity and authority, making it smoother for banks or other financial institutions.

To fill out a trust fund, start by gathering all necessary documentation related to the assets you intend to place in the trust. Next, clearly designate the beneficiaries and specify how the assets should be distributed. When it comes to the certificate of trust Nevada withholding, make sure to include relevant details about the trust and sign it appropriately to ensure it is legally binding.

The CEP tax, or Corporate Excise Tax, does not specifically apply to trusts in Nevada, as Nevada does not have a corporate income tax. As a result, this feature further confirms Nevada as a desirable location for trust establishment. Knowing the implications of CEP allows you to optimize your trust strategies. By leveraging the benefits of Certificate of trust nevada withholding, you can ensure maximum advantages from your financial planning.

The 2 year rule for trusts in Nevada states that if a trust is established and funded for at least two years, it can offer greater protection against creditors. This rule enhances the trust's resilience, as assets are shielded from claims that may arise during that initial period. This aspect is crucial for effective estate planning and asset protection. Understanding this rule can guide you in appropriately managing your Certificate of trust nevada withholding.

Trusts in Nevada are generally not subject to state income tax, allowing the income generated by the trust to grow without state-level taxation. This tax structure promotes long-term wealth accumulation and financial planning. Beneficiaries typically handle their own personal income taxes on distributions received from the trust. Therefore, the Certificate of trust nevada withholding is a pivotal consideration in your trust management strategy.

Nevada does not have a state withholding tax, which enhances its appeal for both individuals and businesses. This absence of withholding tax allows you to retain more of your earnings and assets. Moreover, if you are handling a trust, the absence of state withholding tax can simplify administrative processes. Keeping these factors in mind can help when planning for your Certificate of trust nevada withholding considerations.