Llc Limited Liability With Us

Description

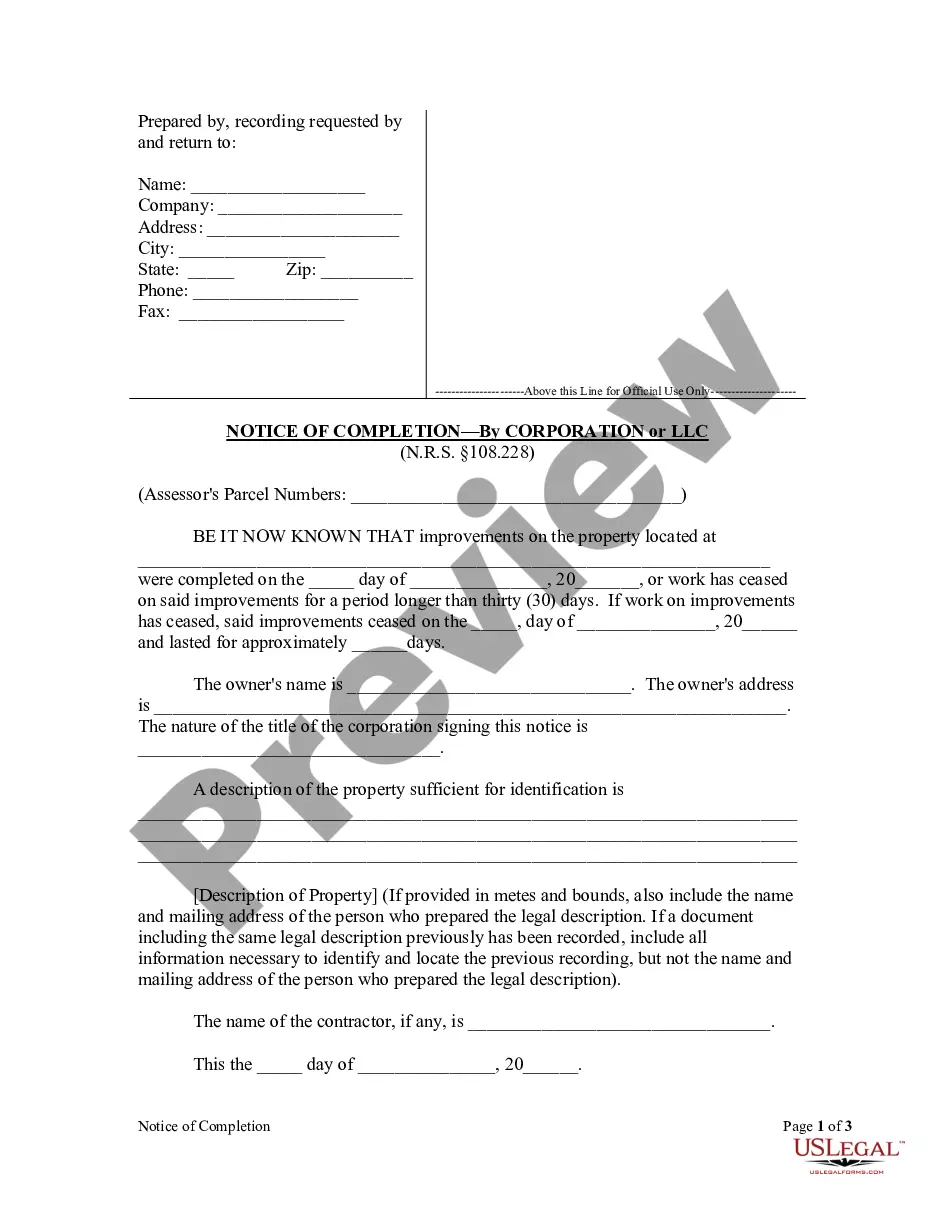

How to fill out Nevada Notice Of Completion - Corporation?

- If you are a returning user, log in to your account and select the desired form template for download. Verify that your subscription remains active.

- For newcomers to US Legal Forms, start by reviewing the Preview mode and form descriptions to select the form that aligns with your specific needs and jurisdiction requirements.

- Utilize the Search tab to explore alternative templates if necessary. Ensure that the selected form meets all criteria before proceeding.

- Once you’ve found the appropriate document, click on the Buy Now button and choose a subscription plan that suits you. You will need to register an account for full access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- After your payment is confirmed, download your document and save it on your device for easy access later through the My Forms section of your profile.

In conclusion, US Legal Forms equips users with a vast range of legal documents tailored for LLC formation. This ensures you can operate your business securely and efficiently. Don't hesitate to explore our resources today!

Start your journey to legal protection and convenience by visiting US Legal Forms now!

Form popularity

FAQ

Yes, while the LLC structure provides personal liability protection, owners can still be sued personally for activities outside the business or for personal guarantees. This means if you mix personal and business finances, you risk losing that protection. It's essential to maintain clear boundaries between personal and business assets. By forming your LLC limited liability with us, we ensure you understand how to protect your personal assets effectively.

Generally, an LLC does not file its own taxes if it's a single-member LLC; instead, its earnings are reported on the owner's personal tax return. This setup simplifies tax filing, allowing for greater efficiency. However, if you operate as a multi-member LLC, the business will file a partnership return, and members will still report their share of profits on their personal taxes. When you choose LLC limited liability with us, we can assist you in understanding the nuances of tax responsibilities.

A good example of a limited liability company, or LLC, is a small business operated by a single owner, such as a consultancy or a retail store. This individual benefits from the LLC structure because it protects personal assets from business liabilities. Many entrepreneurs choose this structure for its flexibility and ease of management. If you consider forming an LLC limited liability with us, we can guide you through the process.

Yes, a non-citizen can be a member of an LLC in the United States. There are no citizenship requirements for ownership, which makes LLCs an attractive option for foreign investors. If you are considering creating an LLC limited liability with us, you can have a diverse group of members from different backgrounds contributing to your business's growth.

An LLC is not considered a traditional person, but it is treated as a legal entity, which allows it to own property, enter contracts, and incur liabilities. This separate legal status provides the limited liability that protects members' personal assets. When you pursue an LLC limited liability with us, you benefit from this unique status that helps shield your personal finances.

One major disadvantage of an LLC limited liability with us is that it may involve more paperwork compared to sole proprietorships. Additionally, owners may face self-employment taxes on profits, depending on how the LLC is taxed. It's also worth noting that some states impose higher fees and regulations on LLCs, which can affect your overall business strategy.

While most individuals can become members of an LLC, certain restrictions apply. For example, individuals who are under the age of 18 or those declared mentally incompetent may not qualify. It's essential to understand these restrictions before setting up your LLC limited liability with us, as they can impact your business's composition.

A US Person for tax purposes typically includes citizens or residents of the United States and certain entities organized under US law, like LLCs. This classification is important when considering how income is taxed. If you form an LLC limited liability with us, you should be aware of your tax responsibilities to ensure compliance with the IRS.

An LLC, or limited liability company, is a business structure in the United States that combines the benefits of limited liability and pass-through taxation. When you create an LLC limited liability with us, your personal assets are generally protected from business debts and liabilities. This structure allows for flexibility in management and offers credibility to potential clients and partners.

When writing LLC, it should be capitalized as 'LLC' and placed after the name of the business, as in 'Company Name, LLC.' This format maintains clarity and ensures proper identification as a limited liability company. Using this method reinforces your commitment to limited liability with us.