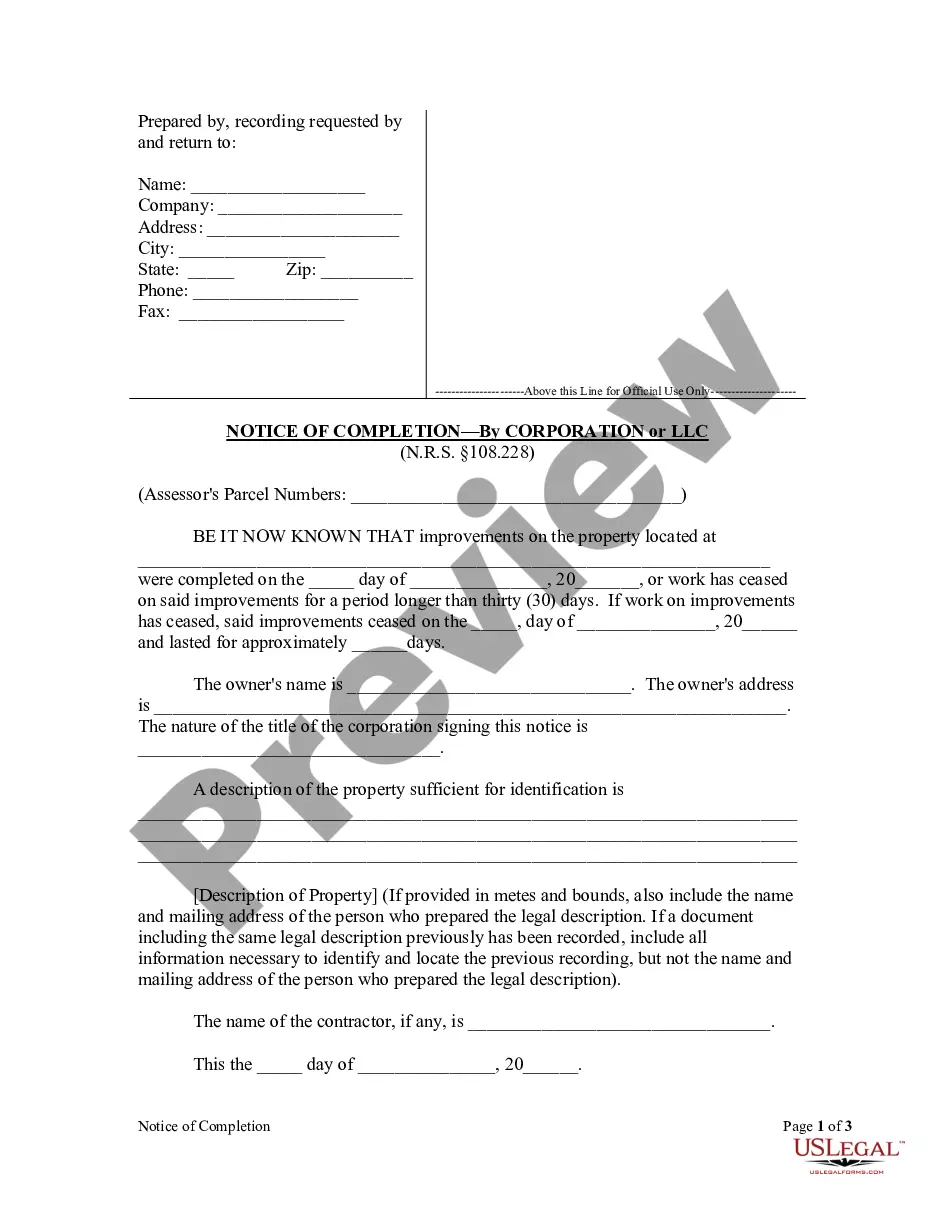

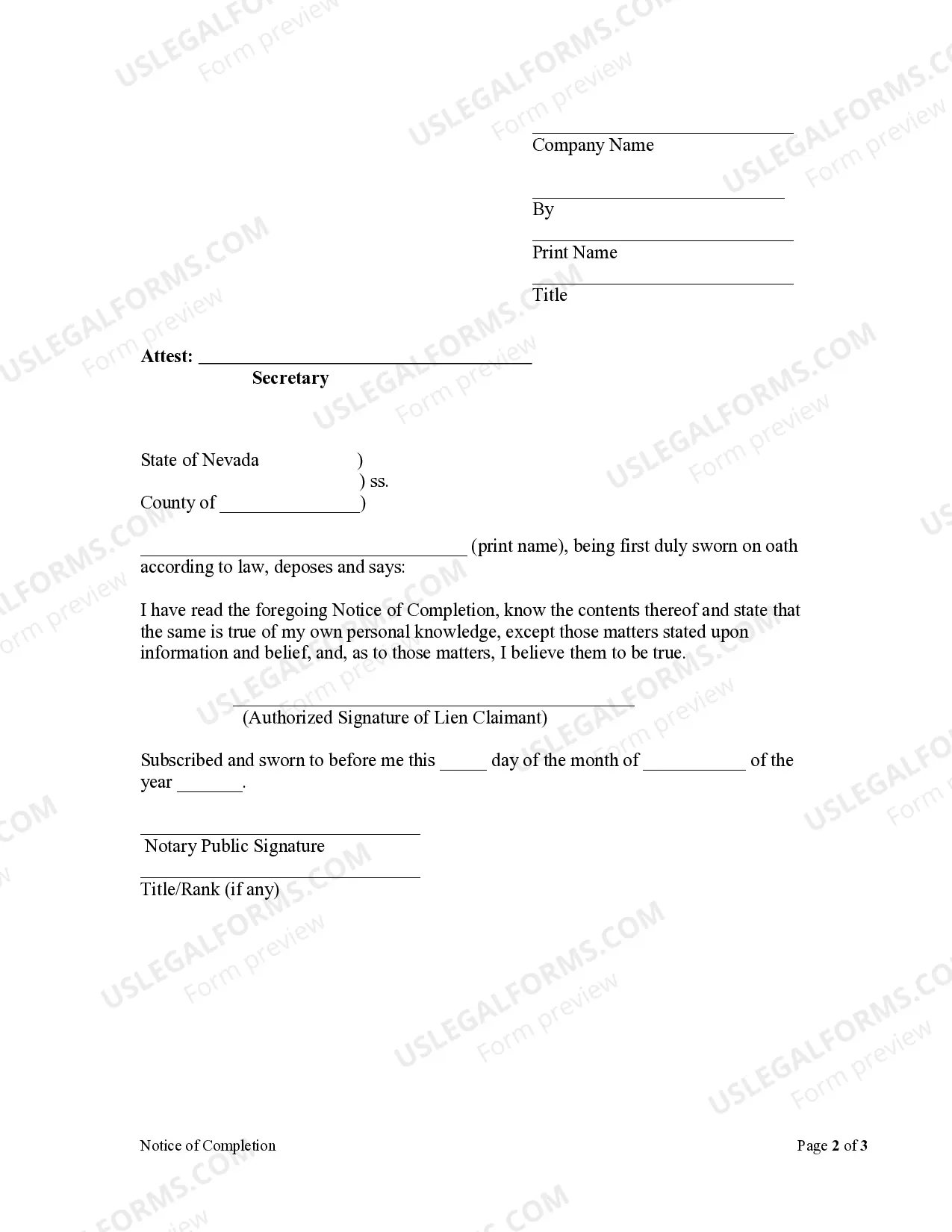

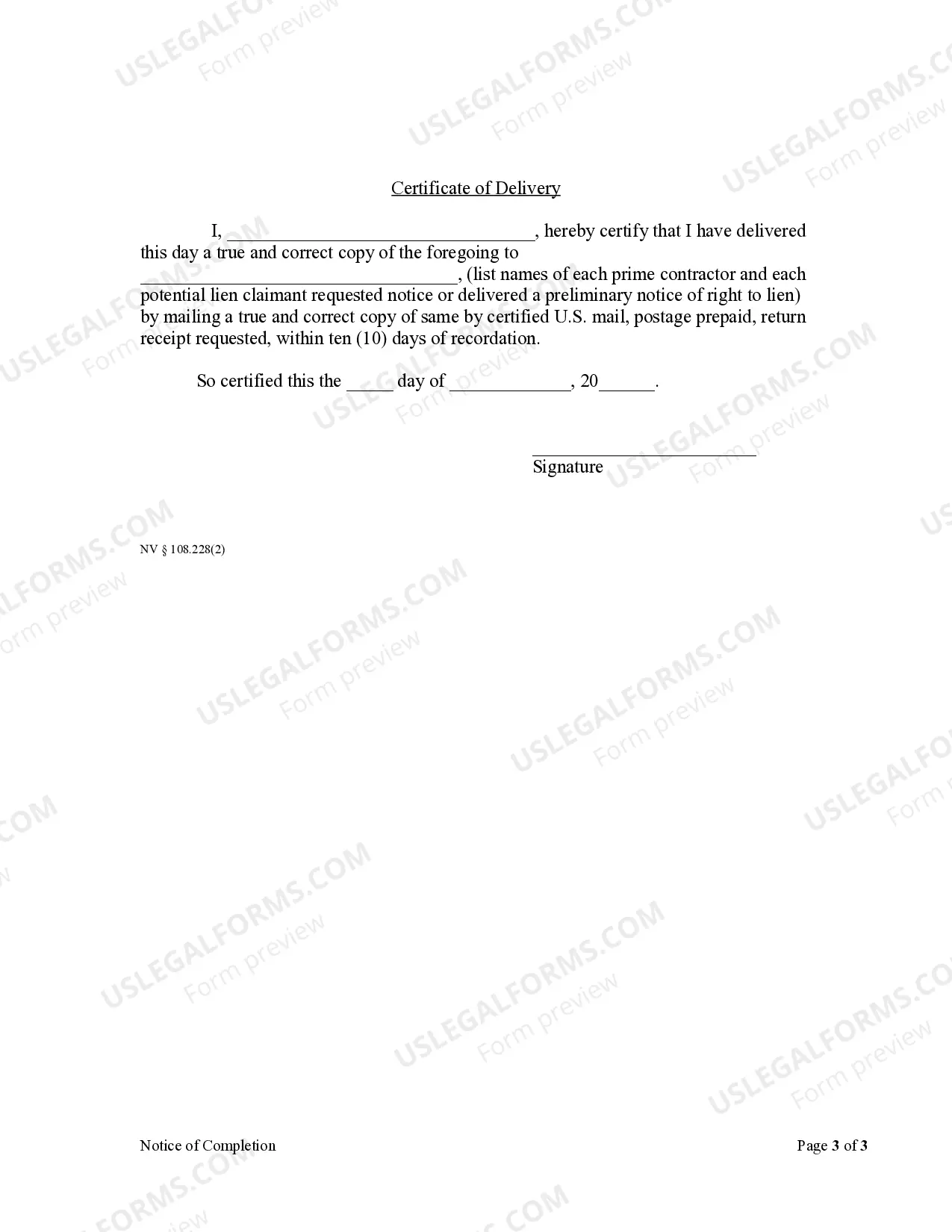

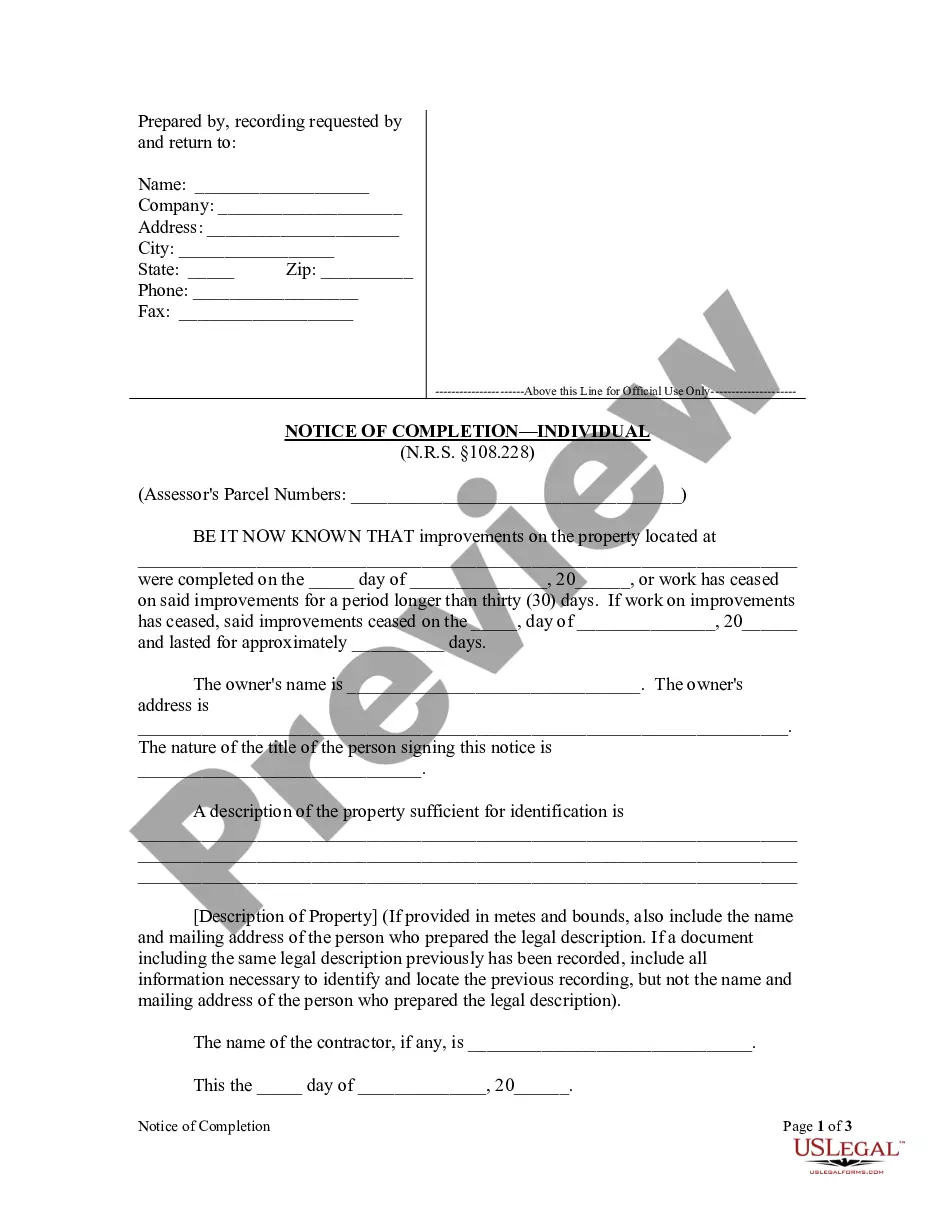

Nevada statutes require the filing of a mechanic's lien within ninety (90) days of the completion of work in most cases. A notice of completion, properly recorded, serves to put all parties with an interest in the property on notice that the time within which to file a lien is running. Nevada statutes require a property owner to provide a copy of this notice of completion, within ten days of the filing of the notice, to all contractors and to any other interested party who submitted a written request prior to the filing of the notice.

Limited Liability Company Form Of Ownership

Description

How to fill out Nevada Notice Of Completion - Corporation?

- Log in to your US Legal Forms account. If this is your first time, create an account to get started.

- Browse the library and select the Limited Liability Company form that fits your requirements. Use the Preview mode to verify it meets your local standards.

- If necessary, utilize the Search tab to find alternate templates that might be more suited to your needs.

- Choose a subscription plan that works for you and click on the Buy Now button to proceed.

- Enter your payment details securely via credit card or PayPal to finalize your purchase.

- Download your completed form onto your device. You can always access it later through the My Forms section of your profile.

By following these straightforward steps, you can swiftly secure the appropriate Limited Liability Company form of ownership. US Legal Forms not only offers a robust collection of templates but also provides users the ability to access expert assistance for any completion needs.

Start creating your LLC today with US Legal Forms – the go-to destination for all your legal document needs!

Form popularity

FAQ

Yes, an LLC is indeed a form of ownership. It combines characteristics of both a corporation and a partnership, offering limited liability protection to its members. This means that as a owner of a limited liability company form of ownership, your personal assets are generally protected from business debts. Understanding this structure can help you make informed decisions about your business's future.

As the owner of a Limited Liability Company (LLC), you are referred to as a member. Members may be individuals or other companies, allowing for flexibility in ownership. This member designation emphasizes the collaborative nature of a limited liability company form of ownership. Whether you have one member or many, each member enjoys protections and benefits unique to this structure.

Several documents can serve as proof of ownership for an LLC. The primary document is the operating agreement, which details members and their ownership stakes. Other supporting documents include member interest certificates, tax filings indicating the members, and the Certificate of Good Standing. Utilizing these documents can clarify the limited liability company form of ownership and ensure all members are recognized.

Ownership of an LLC can typically be demonstrated through the operating agreement, member agreements, and records of capital contributions. These documents outline who owns what percentage of the business and outline the rights and responsibilities of each member. Additionally, any meeting minutes that record member decisions can serve as supplementary proof. They all contribute to understanding your limited liability company form of ownership.

To prove ownership of an LLC, you should present the operating agreement and any amendments that specify member stakes. If needed, showing capital contribution documents can add further proof of ownership. Additionally, tax documents that identify members at the time of filing can help establish ownership. These elements reinforce your claim under the limited liability company form of ownership.

Determining ownership of an LLC involves reviewing the operating agreement and membership records. Your operating agreement usually outlines the members and their respective ownership percentages. Furthermore, many states require an initial filing that declares the members of the LLC, which can assist in confirming ownership. Understanding the limited liability company form of ownership clarifies how ownership is shared among members.

Proving that you have an LLC requires some essential documents. The most significant proof is your LLC formation documents, which you filed with your state. Additionally, obtaining a Certificate of Good Standing from your state’s Secretary of State can serve as evidence. This document clearly shows your limited liability company form of ownership is active and recognized by the state.

To determine whether your LLC is classified as an S corporation, C corporation, or partnership, you should review the tax setup of your business. An LLC typically defaults to a partnership structure if it has multiple members unless it opts for corporation status. Your entity’s classification affects how income is taxed and how assets are managed. Evaluating your structure can provide insights into the advantages of the limited liability company form of ownership, and platforms like uslegalforms can assist you in ensuring compliance with the necessary legal frameworks.

Determining whether your LLC is classified as an S corporation or C corporation primarily depends on the tax election you made when forming your business. An LLC can choose to be treated as an S corp or C corp through proper filings with the IRS, such as Form 2553 for S corp status. If your LLC meets specific requirements, the way it distributes profits and losses can affect tax liabilities. Therefore, it's beneficial to consult with a tax professional or legal advisor to navigate through these classifications.

Documenting ownership in an LLC is crucial for legal clarity and operational efficiency. Typically, this involves creating an operating agreement that outlines the ownership structure, the rights of members, and management procedures. Additionally, it is important to maintain accurate records of member contributions and ownership percentages. These documents not only help define the limited liability company form of ownership but also serve as important references in case of disputes.