Corporation With Limited Liability

Description

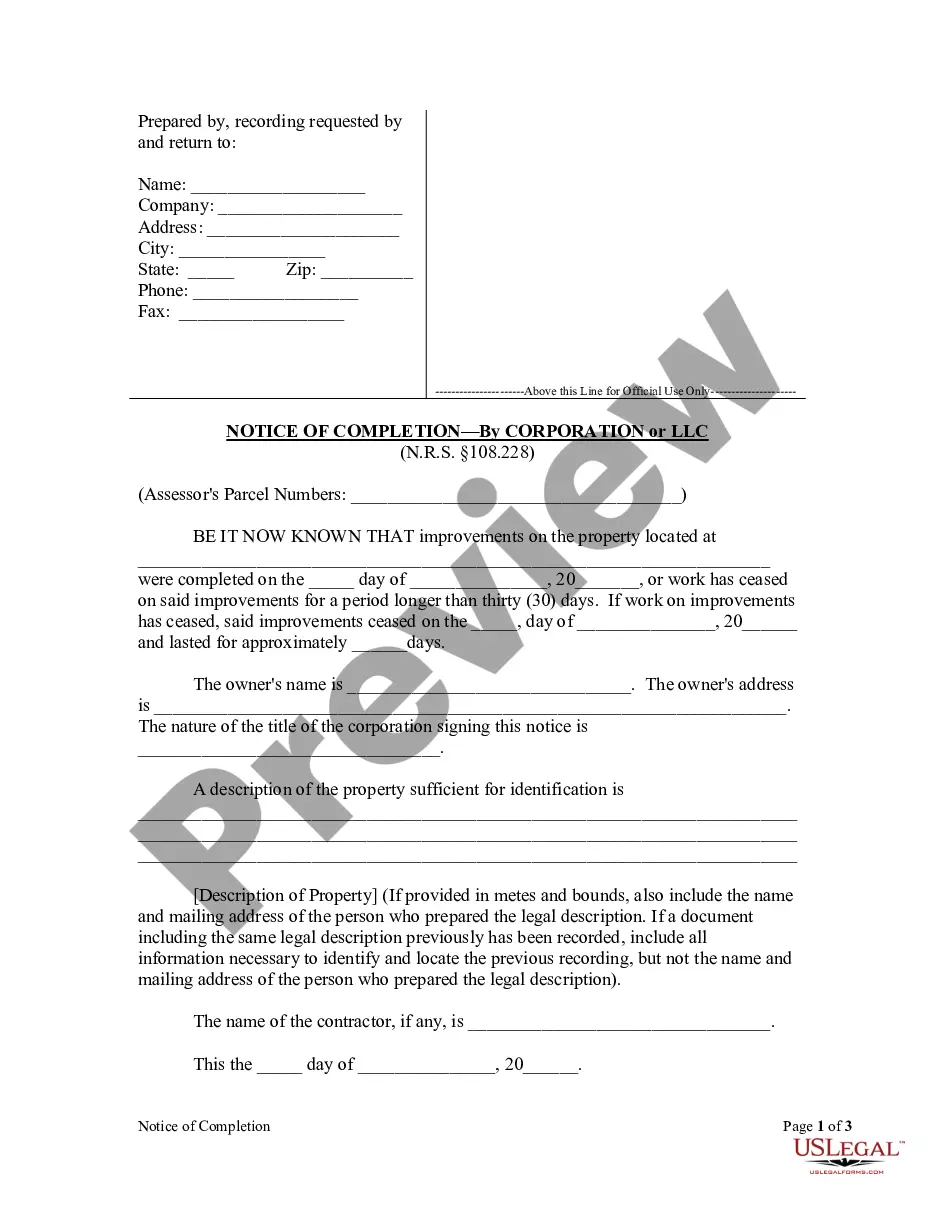

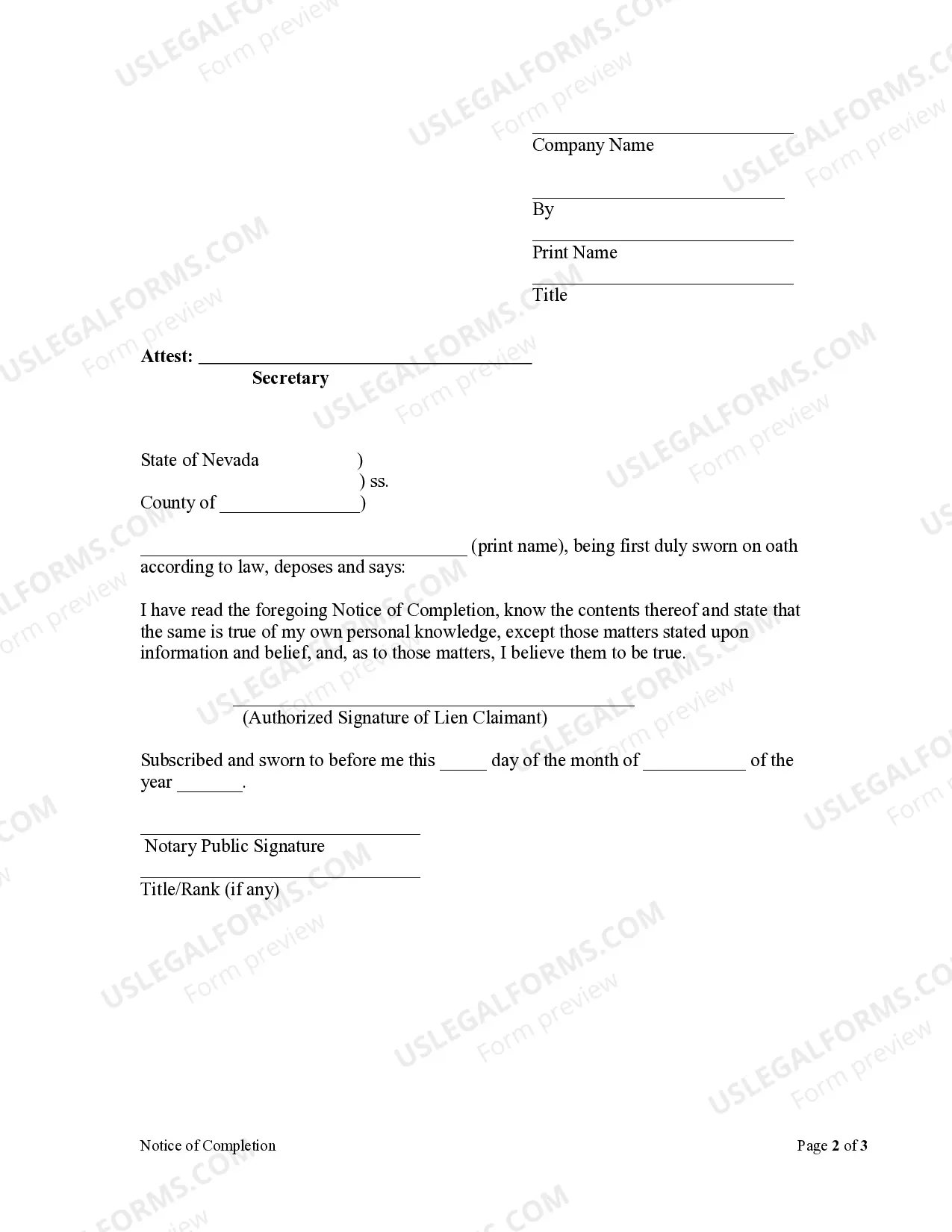

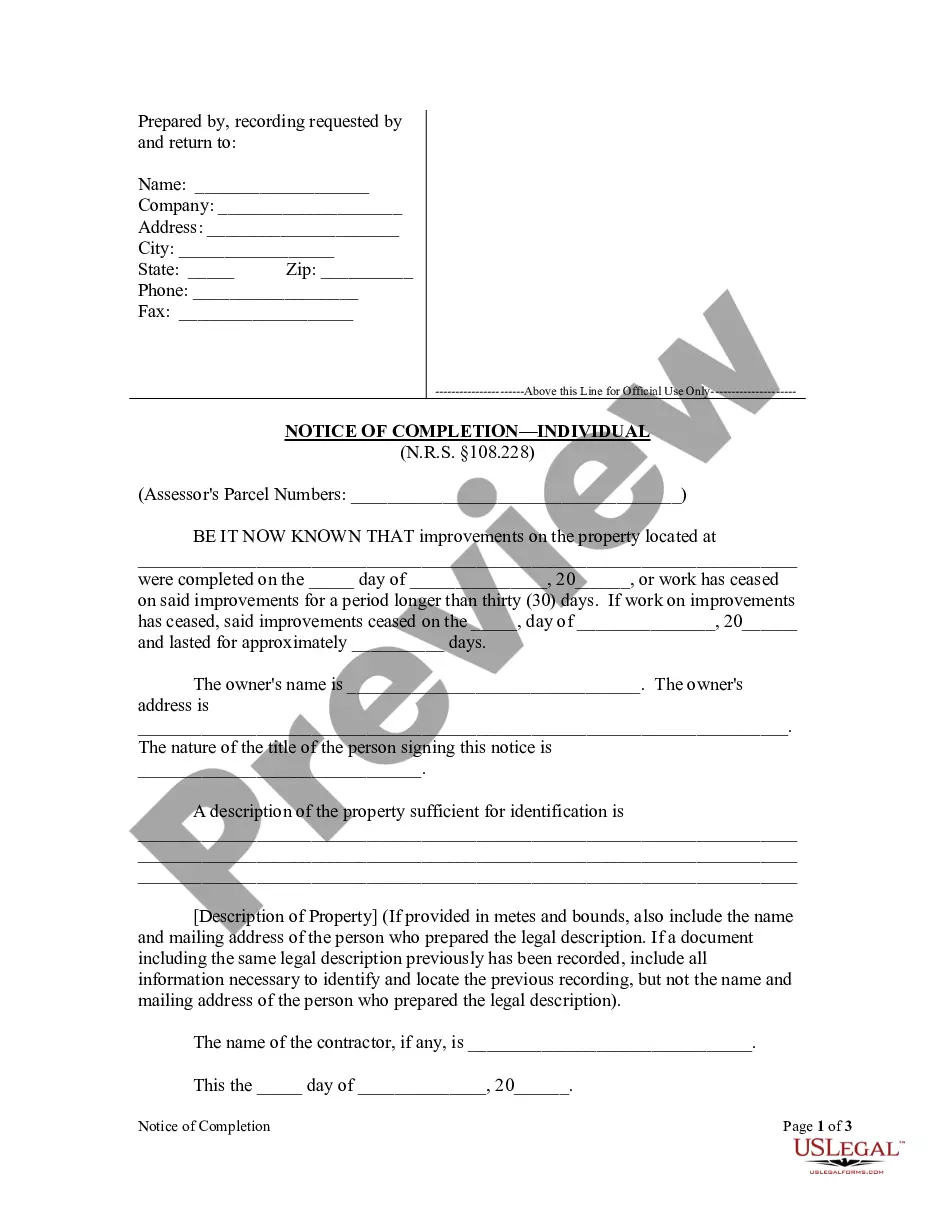

How to fill out Nevada Notice Of Completion - Corporation?

The Limited Liability Corporation you observe on this page is a versatile formal template crafted by skilled attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has delivered individuals, organizations, and lawyers with over 85,000 confirmed, state-specific documents for any business and personal circumstance. It’s the fastest, simplest, and most reliable method to acquire the forms you require, as the service promises bank-level data security and anti-malware safeguards.

Choose the format you desire for your Limited Liability Corporation (PDF, DOCX, RTF) and save the document on your device.

- Search for the document you require and examine it.

- Browse through the file you sought and preview it or review the form description to ensure it meets your requirements. If it does not, utilize the search feature to find the suitable one. Click Buy Now once you have located the template you need.

- Subscribe and Log In.

- Select the pricing plan that best fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already have an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

Both corporations and LLCs have owners, but in a limited liability company, the ?members? own the assets of the business because of the investments they've made. In contrast, a corporation's owners own stock shares, but they do not own corporate assets.

The owners of an LLC are called ?members.? A member can be an individual, partnership, corporation, trust, and any other legal or commercial entity. Generally, the liability of the members is limited to their investment and they may enjoy the pass-through tax treatment afforded to partners in a partnership.

Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship. While the limited liability feature is similar to that of a corporation, the availability of flow-through taxation to the members of an LLC is a feature of partnerships.

Limited liability ? What is limited liability? Limited liability is a form of legal protection for shareholders and owners that prevents individuals from being held personally responsible for their company's debts or financial losses.

LLCs and S corps have much in common: Limited liability protection. The owners of LLCs and S corporations are not personally responsible for business debts and liabilities. Instead, the LLC or the S corp, as the owner of the business, is responsible for its debts and liabilities.