Notice Construction Form Withholding

Description

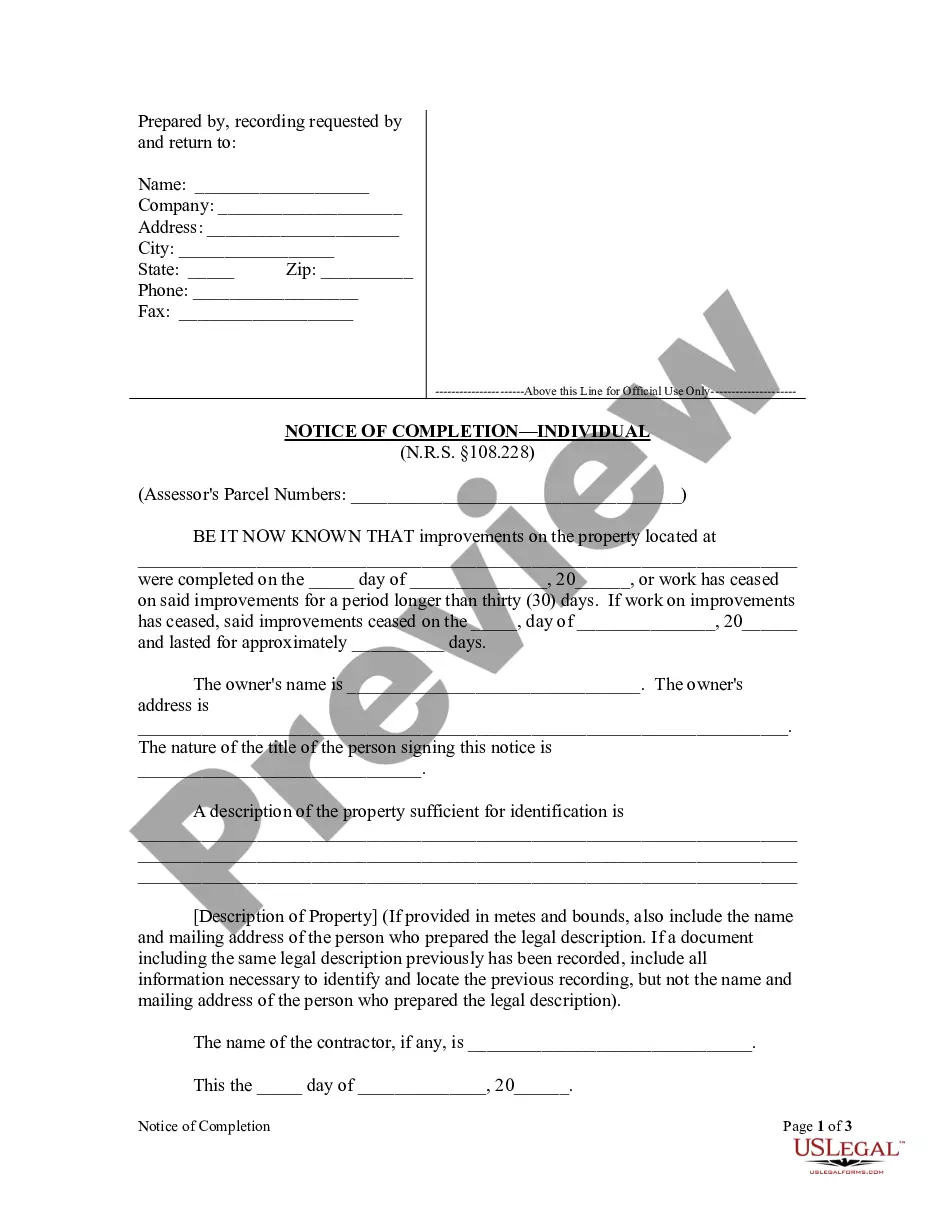

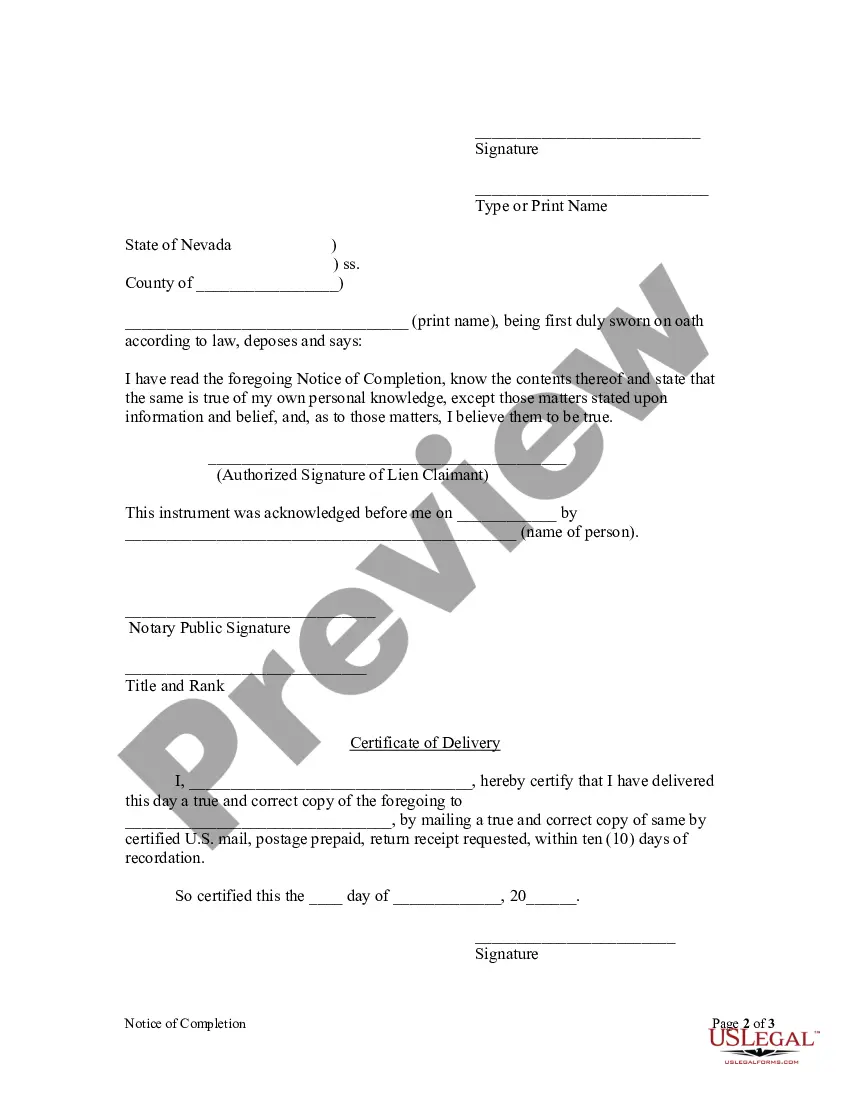

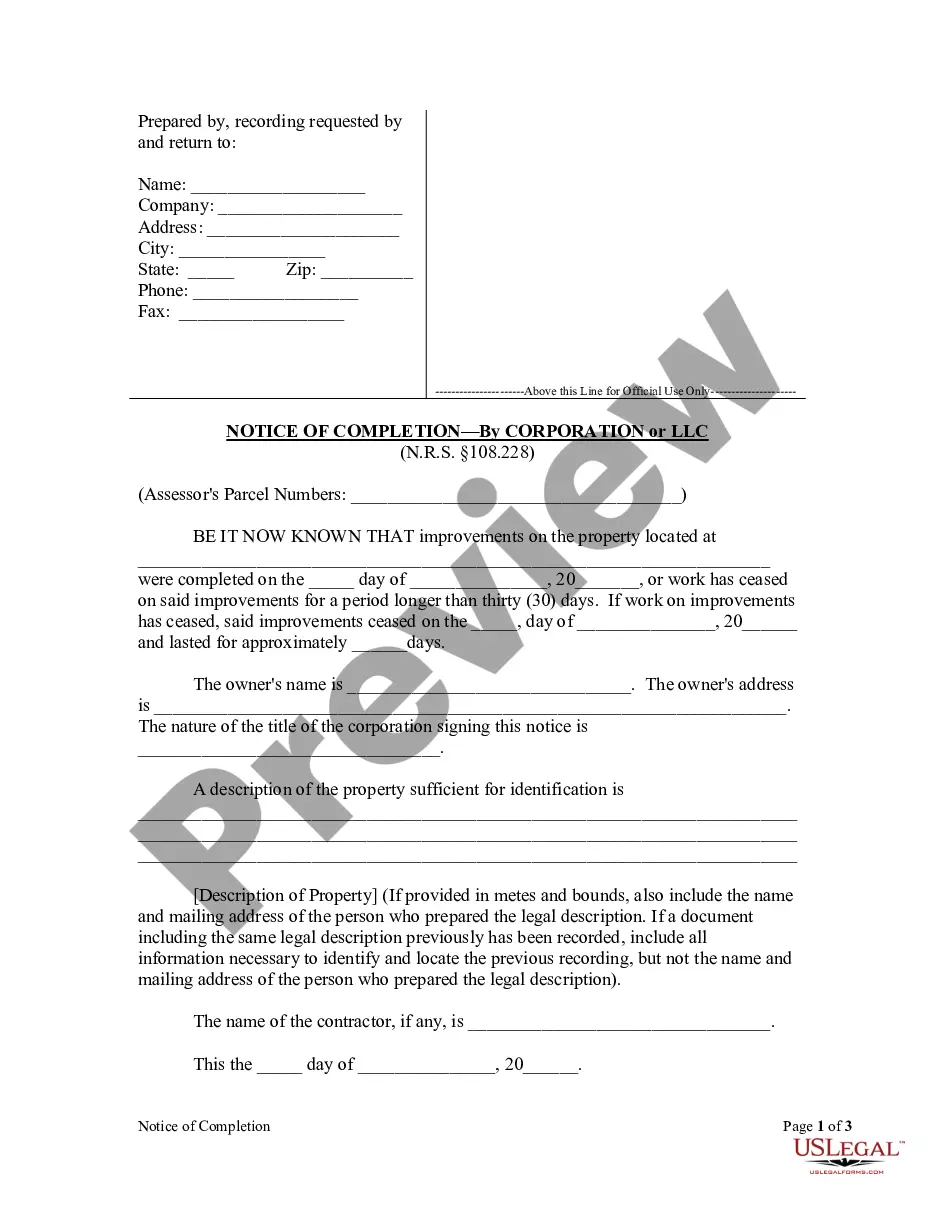

How to fill out Nevada Notice Of Completion - Individual?

There’s no further justification to squander hours searching for legal documents to adhere to your local state regulations.

US Legal Forms has consolidated all of them in one location and simplified their accessibility.

Our platform offers over 85,000 templates for any corporate and individual legal matters categorized by state and area of use.

Utilize the search field above to look for another sample if the previous one did not meet your needs. Click Buy Now next to the template name once you discover the suitable one. Choose your preferred pricing plan and create an account or Log In. Process the payment for your subscription using a credit card or via PayPal to proceed. Choose the file format for your Notice Construction Form Withholding and download it to your device. Print the document to fill it out by hand or upload the sample if you choose to utilize an online editor. Preparing legal paperwork under federal and state laws and regulations is quick and easy with our library. Try US Legal Forms today to keep your documentation organized!

- All documents are expertly crafted and confirmed for validity, ensuring you receive a current Notice Construction Form Withholding.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click on Download.

- You can also revisit all saved documents at any time by accessing the My documents tab in your profile.

- If you’ve never engaged with our platform before, the procedure will require a few additional steps to finalize.

- Here's how new users can find the Notice Construction Form Withholding in our catalog.

- Review the page content thoroughly to confirm it includes the sample you require.

- To achieve this, use the form description and preview options if available.

Form popularity

FAQ

Yes, you can fill out an AW-4 online, making the process smoother and more efficient. Many online platforms provide the necessary resources to complete this form accurately. When managing your Notice construction form withholding, these tools can significantly ease your workload.

The IT 2104 form is used in New York for claiming allowances for state income tax withholding. This form helps ensure accurate withholdings are made from your paychecks. Managing your Notices and construction forms withholding effectively with resources like US Legal Forms can help you navigate the completion of this form.

Yes, completing form W-4V online is possible, and it provides an efficient way to designate your tax withholding for Social Security benefits. Online platforms offer guided instructions for filling out this form correctly. With tools such as US Legal Forms, managing your Notice construction form withholding becomes much simpler.

To fill out an employee's withholding certificate, start by accurately completing the information section with the employee's details. Then, specify the number of allowances the employee is claiming, which influences the tax amount deducted from their wages. Make sure to consider the employee's personal circumstances, such as dependents and additional income. Utilizing tools like USLegalForms can help clarify this process and ensure compliance with regulations.

Filling out the Employee Withholding Certificate, or W-4 form, involves several key steps. First, provide your personal information, including your name, address, and Social Security number. Next, indicate your filing status and the number of allowances you wish to claim based on your specific situation. This ensures appropriate withholding. For a thorough understanding, you can leverage resources from platforms like USLegalForms, which offer step-by-step guidance.

The employee's withholding certificate is typically completed by the employee themselves. This document, known as the W-4 form, provides essential information used by employers to determine the right amount of tax to withhold from an employee’s paycheck. It is important for the employee to provide accurate details to avoid any discrepancies. You can find guidance on filling this out effectively on platforms like USLegalForms.

Filling out your withholding form requires careful attention to detail. Start by using the Notice construction form withholding, which guides you through the necessary information needed. Follow the instructions provided, and ensure that all fields are filled accurately. If you're unsure, consider utilizing resources or tools available on the uslegalforms platform for additional assistance.

If you need to correct a 1099-NEC after filing, you can do so by submitting a corrected form to the IRS. Use the Notice construction form withholding, ensuring that you provide the correct information. Remember to also notify the recipient of the correction to keep all records accurate. Timely corrections help you manage your tax responsibilities effectively.

To submit tax withholding correctly, you should complete the Notice construction form withholding. This form collects necessary information about your payment and withholding details. After filling it out, you can submit it electronically or by mail to the appropriate tax authority. Make sure to check the deadlines to avoid any penalties.

When a transaction is withheld, it indicates that payment for goods or services will not occur until certain conditions are satisfied. This could be due to contractual disputes, incomplete work, or other issues that need resolution. Using a Notice construction form withholding can formalize this action, providing clarity and legal backing for the decision to withhold payment.