Form Single Person With Child Tax Credit

Description

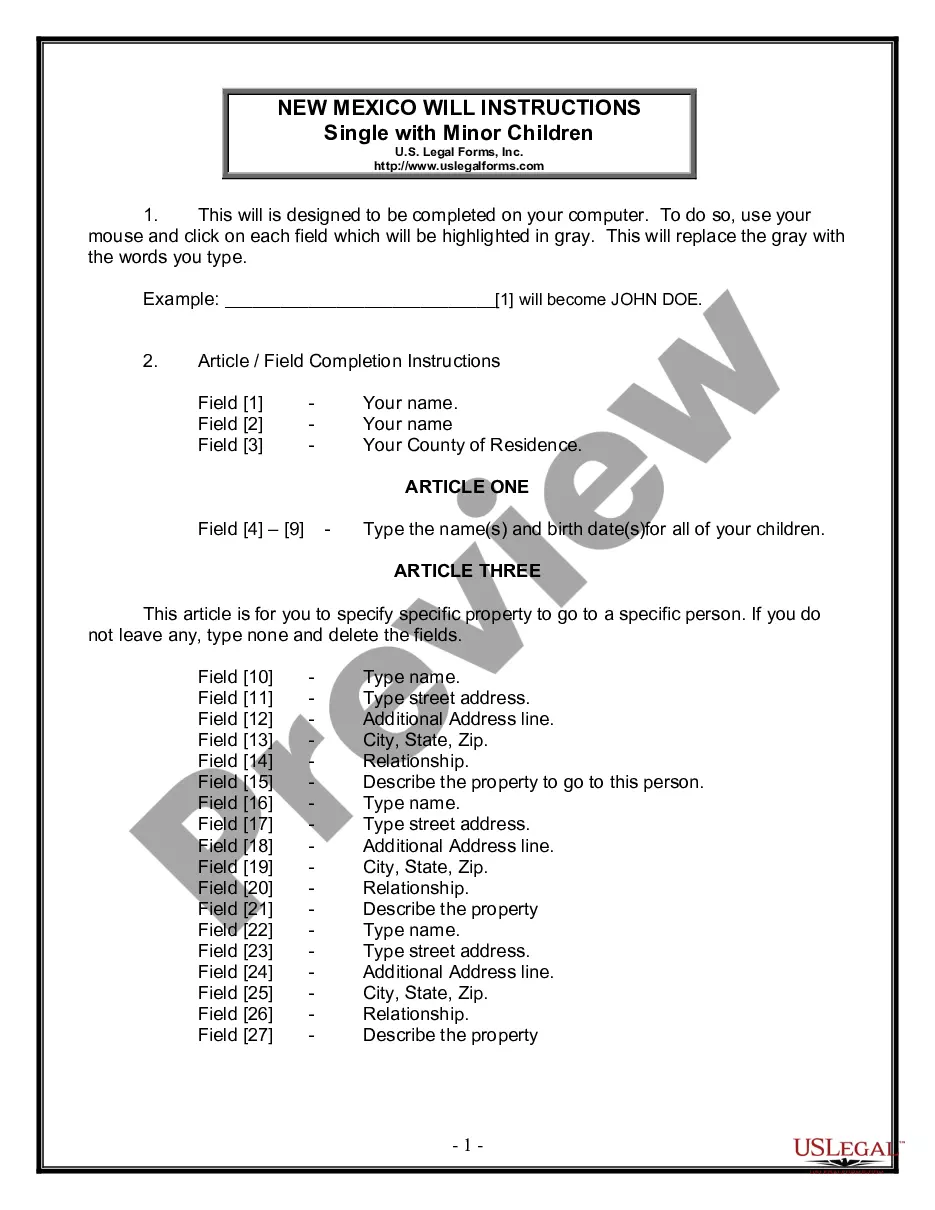

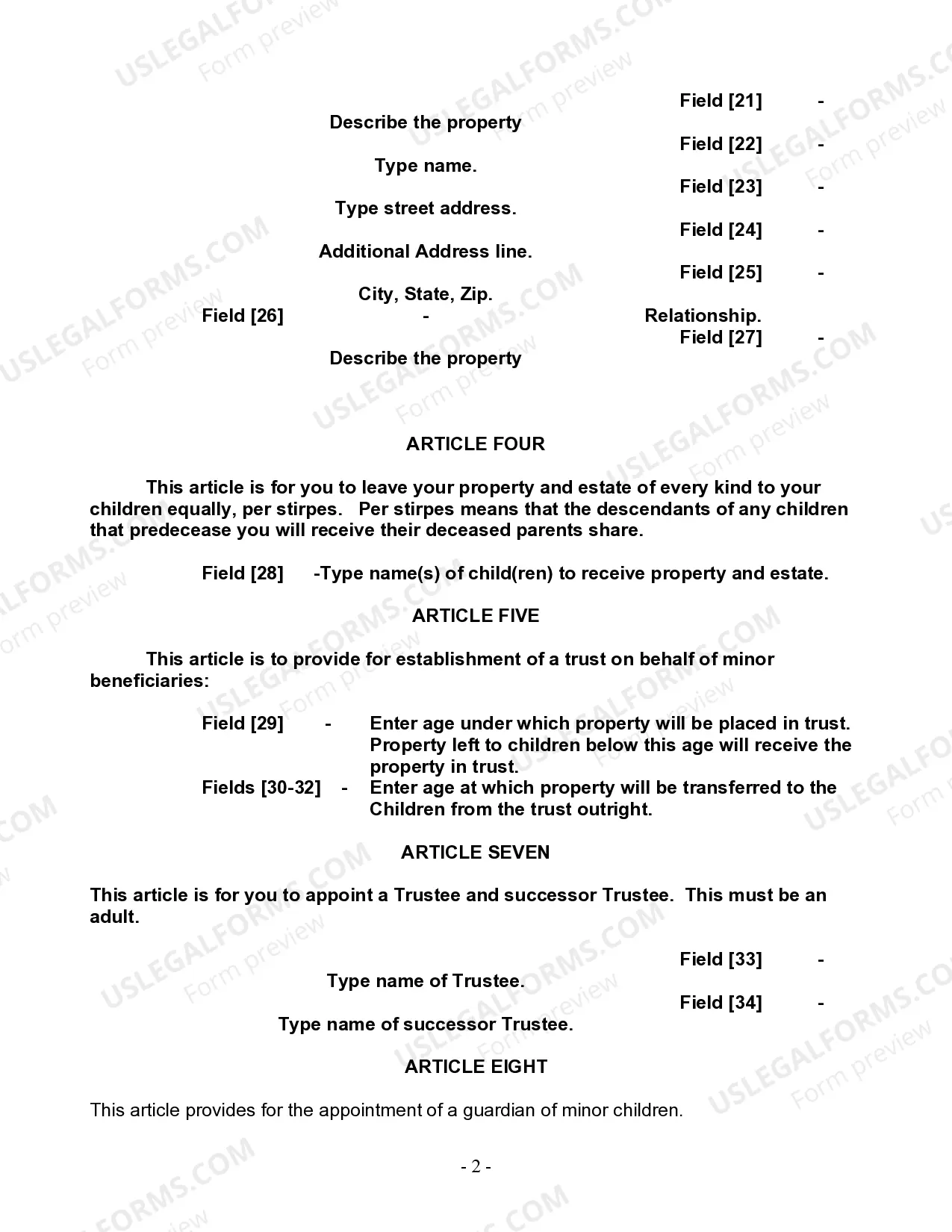

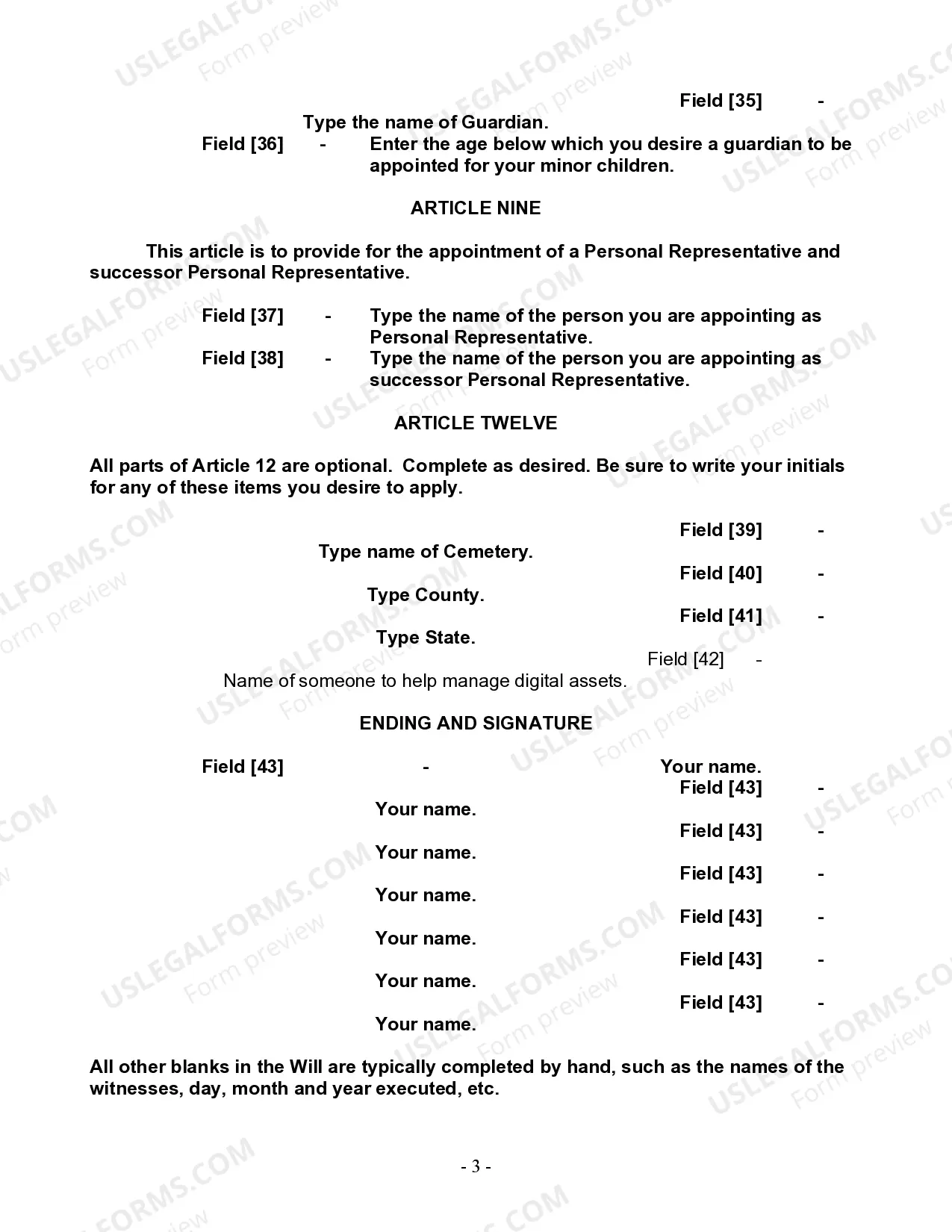

How to fill out New Mexico Last Will And Testament For A Single Person With Minor Children?

Bureaucracy necessitates accuracy and exactness.

Unless you engage in completing documents like Form Single Person With Child Tax Credit regularly, it may result in some misunderstandings.

Choosing the appropriate sample from the beginning will ensure that your document submission proceeds smoothly and avert any issues of resubmitting a file or repeating the same task from scratch.

If you are not a subscribed user, finding the necessary sample may require a couple of additional steps: Find the template using the search field. Ensure the Form Single Person With Child Tax Credit you’ve identified is applicable to your state or county. Check the preview or consult the description that contains details on the use of the sample. If the result meets your search, click the Buy Now button. Choose the suitable option among the suggested pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal payment option. Obtain the form in the file format of your preference. Locating the correct and updated samples for your documents takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your documentation process.

- You can always access the correct sample for your documents in US Legal Forms.

- US Legal Forms is the largest online repository of forms that houses over 85 thousand samples for various fields.

- You can discover the latest and most pertinent version of the Form Single Person With Child Tax Credit simply by searching it on the platform.

- Locate, save, and download templates in your profile or check the description to confirm you have the correct one at hand.

- With an account at US Legal Forms, it is simple to acquire, store in one location, and navigate the templates you keep to reach them in a few clicks.

- When on the webpage, click the Log In button to authorize.

- Then, go to the My documents page, where the record of your documents is stored.

- Browse through the description of the forms and download the ones you need at any time.

Form popularity

FAQ

Filing separately with your child usually involves confirming your status as a single person with child tax credit during the filing process. You will need to fill out the appropriate sections in your tax forms to indicate your dependents. Resources like USLegalForms can simplify this, helping you navigate the process with ease and accuracy.

Yes, if you file as a single person with child tax credit, you can still claim the credit provided you meet specific income and eligibility criteria. This credit is designed to support parents, allowing you to benefit financially. Be sure to properly document your claims and check the latest IRS guidelines to ensure compliance.

If you qualify as a single person with child tax credit, you could expect a substantial relief of either $3,000 or $3,600 per qualifying child, depending on their age. This amount can significantly lower your tax bill or boost your refund. It is essential to be well-informed about your qualifications and claimed amounts to maximize your benefits.

Typically, your tax refund will arrive within 21 days of filing your taxes electronically, especially if you claim the Child Tax Credit. However, factors such as your specific financial situation or filing method might affect this timeframe. For more accurate estimates, check with the IRS or use reliable tax platforms like USLegalForms for real-time updates.

Filing taxes with the Child Tax Credit requires you to indicate your eligibility for the credit correctly. When you file as a single person with child tax credit, make sure to include all necessary details about your qualifying child. Using tools from platforms like USLegalForms can simplify the filing process, ensuring you get the credit you're entitled to.

To claim the child tax credit as a single person with child tax credit, you will need to complete Form 1040 or 1040-SR. You should include your qualifying children’s information and calculate your total credit. If you use an online tax platform like USLegalForms, the process becomes even smoother, providing guidance every step of the way.

Yes, a single person with child tax credit can potentially receive $3,600 for each child under the age of six. For children aged six to 17, the amount is $3,000. The total amount you can claim depends on your income and filing status, ensuring a program that aims to help support your family needs.

Box 16 typically references a specific income adjustment calculation that includes various types of income and deductions. To accurately compute this, consolidate all relevant financial information and follow the IRS guidelines. This calculation is crucial for your overall tax return and can influence your eligibility for the Form single person with child tax credit. Seeking help from resources like uslegalforms can offer valuable assistance.

Filling out the Child Tax Credit involves determining your eligibility, counting your qualifying children, and completing the appropriate sections on your tax forms. Make sure to use the IRS guidelines to ensure your entries are correct. If you need assistance, uslegalforms can guide you in completing the Form single person with child tax credit accurately, ensuring you don’t miss out on this potential benefit.

Line 16 on Form 1040 is where you report certain types of income and adjustments. This includes taxable scholarships, certain business income, and more. Accurately reporting this line is vital, especially when considering the Form single person with child tax credit. Incorrect entries here could delay your refund or affect your eligibility.