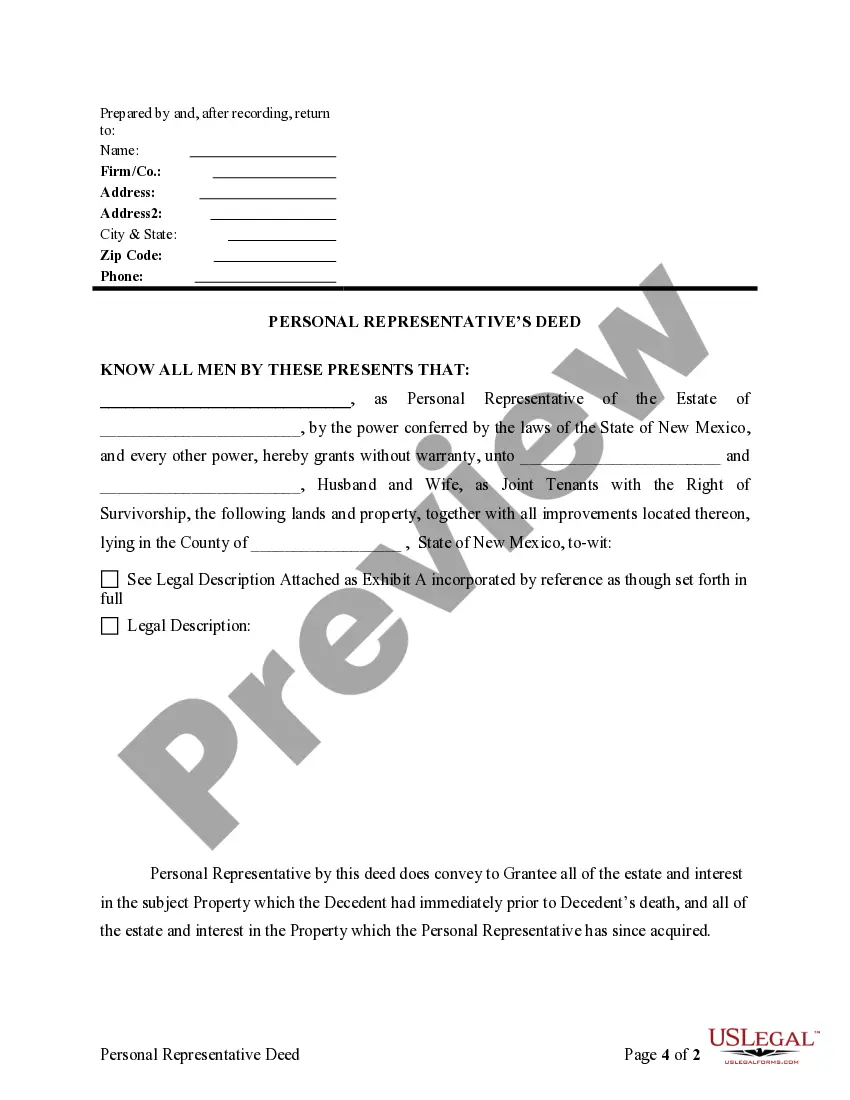

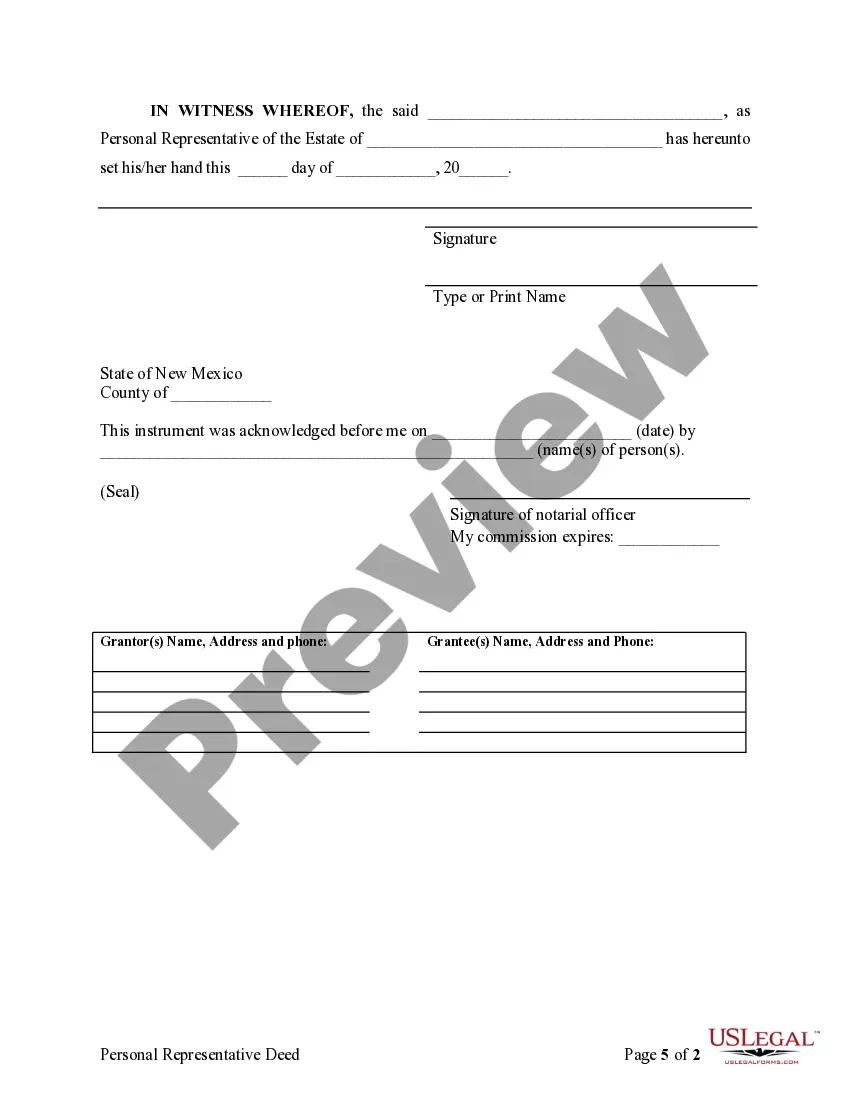

A personal representative deed form for California is a legal document that enables a personal representative, also known as an executor or administrator, to transfer property owned by a deceased individual to beneficiaries or heirs. This form is used when the deceased person has passed away with a valid will (testate) or without a will (intestate). In California, there are two main types of personal representative deed forms: 1. Personal Representative Deed with Independent Administration: This form is commonly used when the personal representative has been granted independent administration powers by the probate court. With independent administration, the personal representative has more flexibility and can handle the estate's affairs without requiring court approval for every action taken. This type of deed form allows the personal representative to sell, transfer, or distribute the decedent's property without seeking the court's authorization for each transaction. 2. Personal Representative Deed without Independent Administration: This form is employed when the personal representative has not been granted independent administration powers or the estate is subject to court supervision. In such cases, the personal representative must obtain court approval for any transactions or distributions involving the decedent's property. This type of deed form is often used when the estate is more complex or there are disputes among beneficiaries. The personal representative deed form for California typically includes the following information: 1. Decedent's information: Full legal name, date of death, and address of the deceased. 2. Personal representative's information: Full legal name, address, contact details, and their relationship to the deceased. 3. Property details: A detailed description of the property being transferred, including the address, legal description, and any associated parcel or lot numbers. 4. Beneficiary information: Names, addresses, and relationship to the deceased of all beneficiaries or heirs who will receive the property. 5. Probate case information: If applicable, the case number and court information should be included. 6. Legal language and signatures: The form will contain specific legal language and a section for signatures from the personal representative and witnesses. It is essential to consult with an attorney or obtain professional legal advice when preparing and executing a personal representative deed form in California. Each case may have unique circumstances, and it is crucial to ensure compliance with relevant laws and regulations to avoid potential issues or disputes in the future.

Personal Representative Deed Form For California

Description

How to fill out Personal Representative Deed Form For California?

Working with legal documents and procedures could be a time-consuming addition to the day. Personal Representative Deed Form For California and forms like it often need you to search for them and navigate the way to complete them effectively. Therefore, if you are taking care of economic, legal, or personal matters, having a comprehensive and practical online catalogue of forms at your fingertips will go a long way.

US Legal Forms is the top online platform of legal templates, offering more than 85,000 state-specific forms and numerous resources that will help you complete your documents easily. Explore the catalogue of pertinent papers open to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Shield your document management processes with a high quality service that allows you to put together any form in minutes without having additional or hidden cost. Simply log in in your profile, find Personal Representative Deed Form For California and acquire it immediately within the My Forms tab. You can also access previously saved forms.

Could it be your first time using US Legal Forms? Register and set up up an account in a few minutes and you will have access to the form catalogue and Personal Representative Deed Form For California. Then, stick to the steps listed below to complete your form:

- Ensure you have found the proper form by using the Review feature and looking at the form information.

- Pick Buy Now as soon as all set, and select the monthly subscription plan that is right for you.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience helping users control their legal documents. Obtain the form you require today and improve any process without having to break a sweat.

Form popularity

FAQ

Michigan LLC Cost. Forming an LLC in Michigan costs $50?the state fee to file the Michigan Articles of Organization. You'll also need to pay a $25 annual report fee every year to keep your LLC active.

Michigan does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

After you form a Michigan LLC, you may need to obtain a business license or permit. Your requirements are determined by the industry you are in and where your Michigan LLC is located.

You can get an LLC in Michigan in 2 weeks if you file online (or 4 weeks if you file by mail). If you need your Michigan LLC faster, you can pay for expedited processing.

Completing and filing your articles of organization form is the most important step when learning how to get an LLC in Michigan. You'll need to file this form with the Michigan Corporations Division. But before you do, review your proposed filing to confirm you've completed everything correctly.

Starting an LLC in Michigan is not free. Businesses must pay a $50 fee when registering their companies and an annual $25 fee to maintain the LLC. This is in addition to any taxes and fees for licenses or permits.

Here are the steps to starting an LLC in Michigan: Select a business name for your Michigan LLC. Choose your Registered Agent. File the LLC Articles of Organization with the state. Complete and sign an LLC Operating Agreement. Get a Tax ID Number (EIN) from the Internal Revenue Service (IRS) Open an LLC bank account.

The articles of organization is a document that officially establishes your LLC by laying out basic information about it. Prepare articles of organization and file them with the Michigan Corporation Division to register your Michigan LLC properly.