New Mexico Release Mortgage Withholding Form

Description

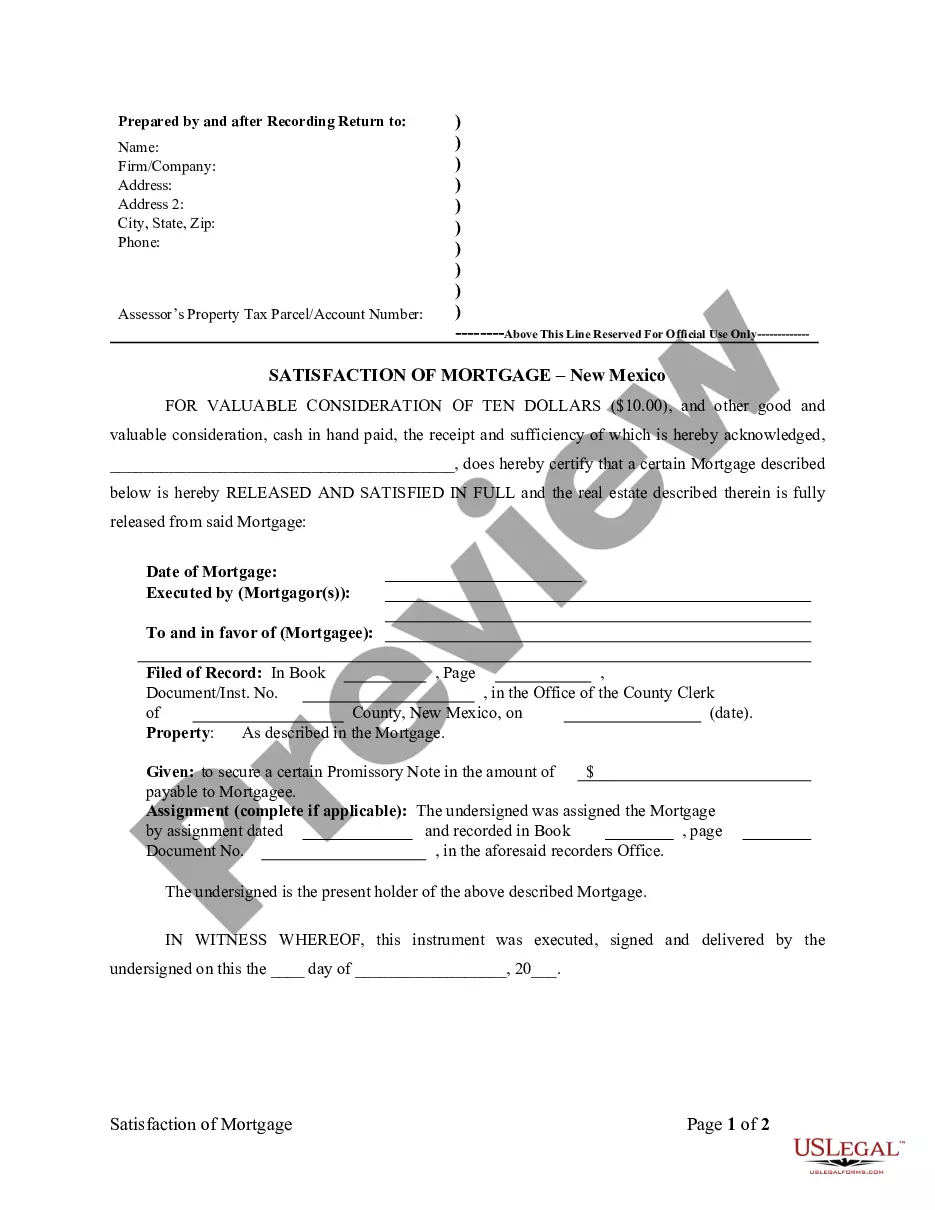

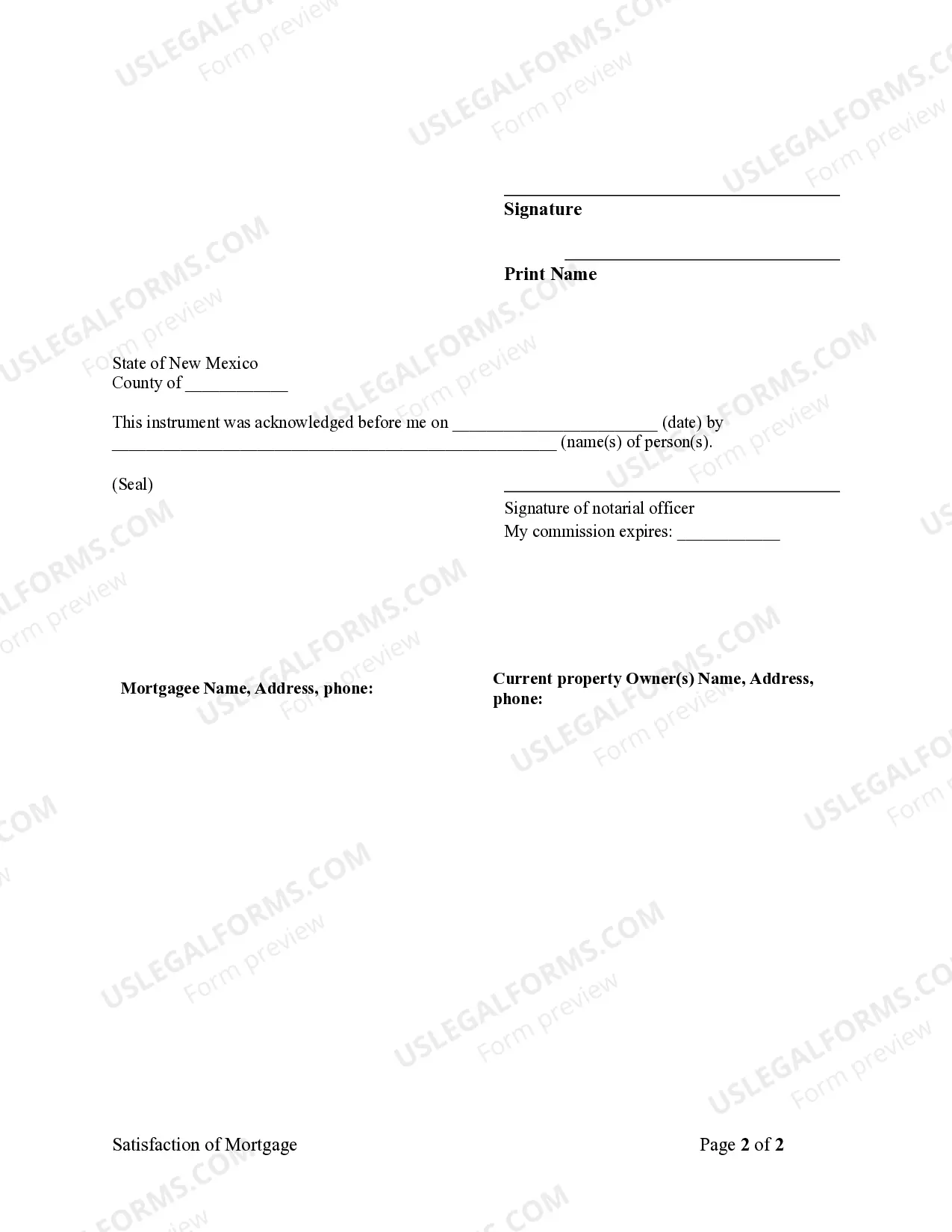

How to fill out New Mexico Satisfaction - Release Of Mortgage By Mortgagee - Individual Lender Or Holder?

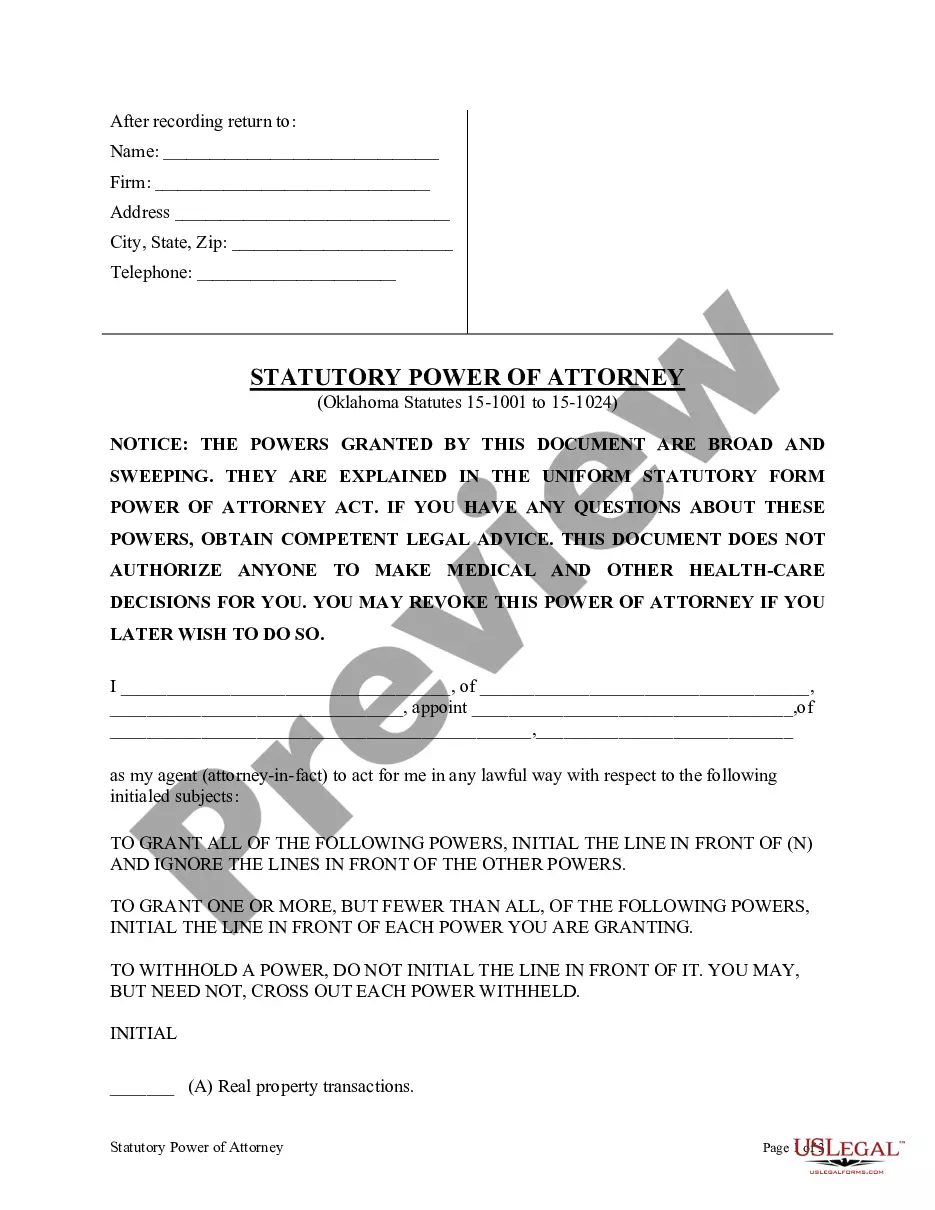

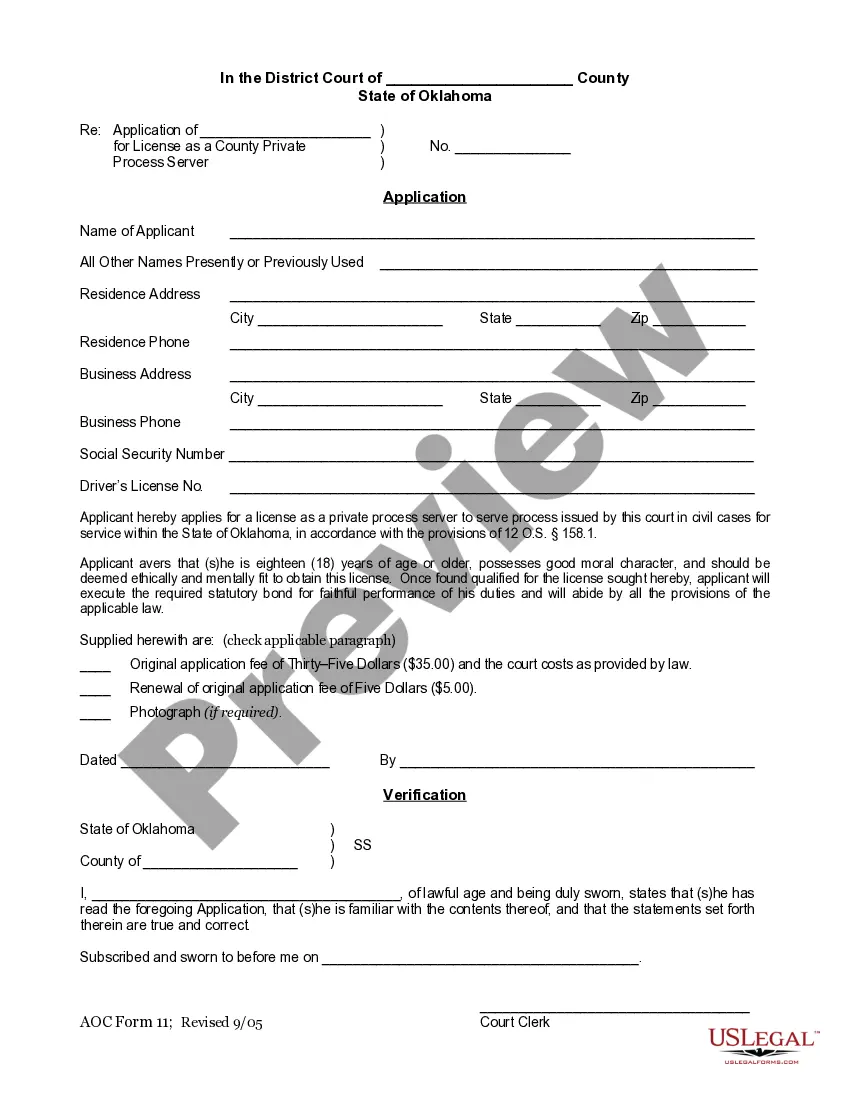

There's no longer any necessity to invest hours searching for legal documents to comply with your local state laws. US Legal Forms has compiled all of them in one location and streamlined their accessibility.

Our site offers over 85k templates for any business and personal legal situations categorized by state and area of application. All forms are professionally crafted and verified for accuracy, so you can be assured of obtaining an up-to-date New Mexico Release Mortgage Withholding Form.

If you are acquainted with our platform and already possess an account, you must verify that your subscription is active before acquiring any templates. Log In to your account, choose the document, and click Download. You can also access all previously obtained documents any time needed by opening the My documents tab in your profile.

Print your form to complete it by hand or upload the sample if you wish to do so in an online editor. Creating formal paperwork under federal and state regulations is fast and straightforward with our platform. Try US Legal Forms today to keep your documents organized!

- If you have never utilized our platform before, the procedure will require a few additional steps to finish.

- Here's how new users can locate the New Mexico Release Mortgage Withholding Form in our library.

- Review the page content attentively to ensure it includes the sample you seek.

- To assist, use the form description and preview options if available.

- Employ the Search bar above to search for another sample if the current one does not meet your needs.

- Click Buy Now next to the template name once you identify the correct one.

- Select the preferred subscription plan and either create an account or Log In.

- Complete your subscription purchase with a credit card or via PayPal to continue.

- Choose the file format for your New Mexico Release Mortgage Withholding Form and download it to your device.

Form popularity

FAQ

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.

Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days. This number is also used for NM Worker's Compensation payments and filing.Find an existing CRS ID Number: On Form CRS-1, Combined Report System. By contacting the Dept. of Taxation and Revenue.

Notify the Taxation and Revenue Department of your close-of-business date by logging in to your administrator account online profile in the TAP system. Click more account options under the BTIN you wish to close. Under the Manage my account cube, click close account.